Report Overview

Hormonal Contraceptives Market Size

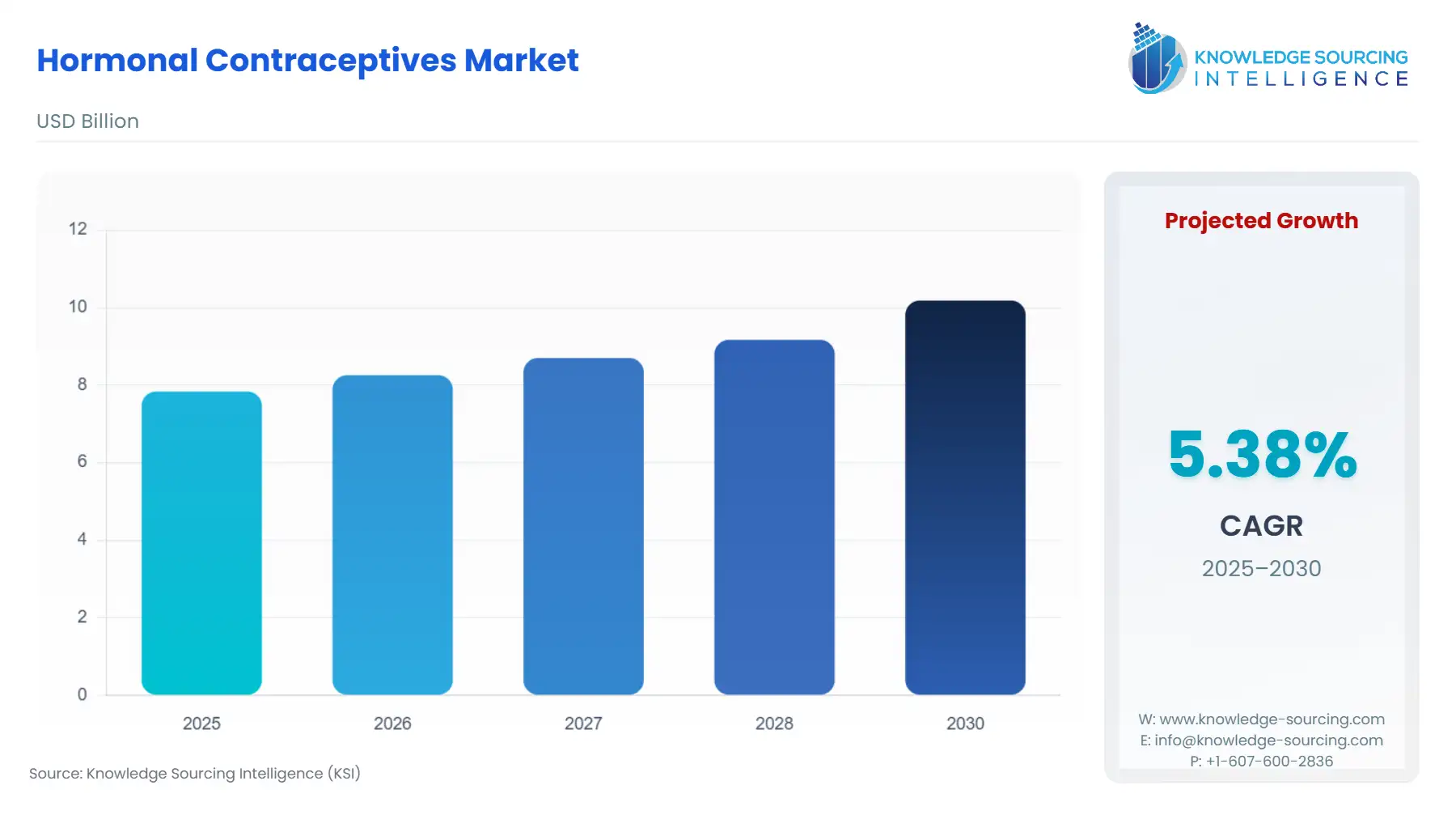

The hormonal contraceptives market is projected to grow at a CAGR of 5.38% over the forecast period, increasing from US$7.836 billion in 2025 to US$10.184 billion by 2030.

Hormonal contraception refers to pills that employ synthetic hormones to prevent pregnancy, thus preventing ovulation and thickening of cervical mucus and modifying the uterine lining. The quickening of global revenues in the realm of hormonal contraception will escalate with the surge in family planning and reproductive health counselling sectors, finally leading hormonal contraception to become the number one solution for family planning. It paves the way for developing impetus for women's health and empowerment, augmented the number of protective rules and government acts in favour of contraceptive access, and the incidence of disease transmission (STDs). These three factors also build up the pressure to conform to preventive measures.

Moreover, increased investments in major players in new contraceptive devices, various governmental initiatives to expand the contraceptive market, and increased awareness on the part of medical professionals are some of the market drivers. Awareness market drivers are projected to post strong growth in promptness from a very low base as women slowly discover the different alternatives available for them to avoid pregnancy.

Hormonal Contraceptives Market Growth Drivers:

- The introduction of effective hormonal contraceptives is increasing the market demand

Several significant companies are engaged in channelling investments directed at the development of novel and efficient technology for contraception. This shifts the whole paradigm due to the huge popularity that has always characterized the two products in their provision for industrialized countries like the United States. The vaginal ring - or Nuvaring - comes in an advantageous rank among hormonal contraceptive products for many women and is comparable in efficacy to contraceptive pills. This product is only effective for three weeks, after which it needs to be replaced. It is inserted without pain which is very user-friendly. This also increased the demand for the use in industrialized countries.

- Increasing reliability of hormonal contraceptives is anticipated to increase the market demand

Hormonal contraceptives are reported to have a slightly higher efficacy rate than the combs and the sponges/diaphragms. If hormonal manipulatives are used perfectly, one in every 1,000 will get pregnant, according to NCBI. The increased unmet need for contraceptives is a testament to the prevailing disparities in access to better supply in parts of the continent. Women aged between 15 and 45 years have been reported unable to access modern contraceptives by the WHO. About 24.2% of those women need the contraceptive for just the right or needed period in years. Levels of unmet needs are much higher in Asia Latin America and the Caribbean, where 10.2% and 10.7%, respectively, will be unmet. These disparities are expected to create a significant market for the forecast period.

- Shift to personalized and convenient contraceptive options is also increasing the market demand

Modern and more personalized hormonal contraception are changes in the market in a significant way. These solutions like patches, rings, and oral contraceptive combinations are increasingly being preferred for simplicity and adaptation to the users' tastes and lifestyles. These solutions offer their flexibility, and, improved user adherence, meeting a broad spectrum of demands and preferences. New technology exists for the formulation of new delivery technologies providing more efficacy and lesser side effects continuous improvement research implemented today would facilitate the treatment's alternative.

Moreover, this trend is indicative of an increasing demand across consumer sectors worldwide for specific and individualized healthcare, which happens to be more convenient and in line with the particular health goals of the person. When there are real changes in medical services and infrastructure and more defined economic growth policies being pursued by less developed nations, the modern approaches to family planning hormonal changes become more important in the landscapes.

Hormonal Contraceptives Market Key Segments

- By product type, oral contraceptive is expected to witness significant growth in the hormonal contraceptives market.

The birth control pill is an oral contraceptive that is generally referred to professionally. Hormones are contained in oral contraceptives, which usually stop eggs from being released from the ovaries to avoid the risk of pregnancy. Most of these pills hold estrogen and progesterone combined.

Further, adding convenience of use and availability, the pill, hormonal oral contraceptives, is expected to account for many market shares. Major companies, furthermore, are expected to see a positive category grow through new product launches and by expanding their palette of hormonal contraceptives. For instance, in July 2024, Perrigo Company Plc proposed one of the first over-the-counter (OTC) birth control tablets in the United States to be submitted to the US Food and Drug Administration. Conversion of an Rx-to-OTC procedure has been asked for an Opill pill, a progestin-based day-after pill. Increased innovative products in oral contraceptives are expected to drive market growth.

Hormonal Contraceptives Market Geographical Outlook

- The North American region is expected to witness significant growth in the hormonal contraceptives market.

North America dominates the global hormonal contraception market, owing to its modern healthcare infrastructure, high awareness of family planning, and widespread availability of contraceptive choices. The U.S. and Canada specifically control a considerable chunk of the market with heavy investments in a stronger healthcare system, huge research and development scope, and satisfactory spending of mundane individuals on health items. Furthermore, government programs and excellent coverage of health insurance are offered universally to increase access and utilization of hormonal contraceptives The growth of this segment is also very well backed up by a strong network of institutions of delivery and continuous exploitation towards contraceptive technology. It turns into the North American leadership in advocating growth and development in the hormone contraception market.

Hormonal Contraceptives Market Key Developments:

- In June 2024, a new male contraceptive gel was studied that combines two hormones, progesterone acetate (Nestorone) and testosterone, lowering sperm production more quickly than similar experimental hormone-based treatments for male birth control. The results of an ongoing multicenter phase 2b clinical trial were reported at ENDO 2024, the Endocrine Society's annual meeting in Boston.

- In March 2024, the first daily over-the-counter oral contraceptive pill was made accessible in the United States. The distribution process and availability in shops and online will be continuing, so initial availability may be restricted. On July 13, 2023, the United States Food and Drug Administration (FDA) authorized Opill, a progestin-only tablet (0.075 mg norgestrel). This progestin-only pill (POP) has been approved without a prescription for adolescents and adults to prevent pregnancy

Hormonal Contraceptives Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Hormonal Contraceptives Market Size in 2025 | US$7.836 billion |

| Hormonal Contraceptives Market Size in 2030 | US$10.184 billion |

| Growth Rate | CAGR of 5.38% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Hormonal Contraceptives Market |

|

| Customization Scope | Free report customization with purchase |

The Hormonal contraceptives Market is analyzed into the following segments:

- By Product Type

- Oral Contraceptives

- Injectable Contraceptive

- Skin Patches

- Intrauterine Devices (IUDs)

- Vaginal Rings

- Emergency Contraceptive Pills

- By Hormone Type

- Progestin-Only Contraceptives

- Combined Hormonal Contraceptives

- By Distribution Channel

- Hospital

- Retail

- Online

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific Region

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Taiwan

- Others

- North America