Report Overview

Home Decor Market Size, Highlights

Home Decor Market Size:

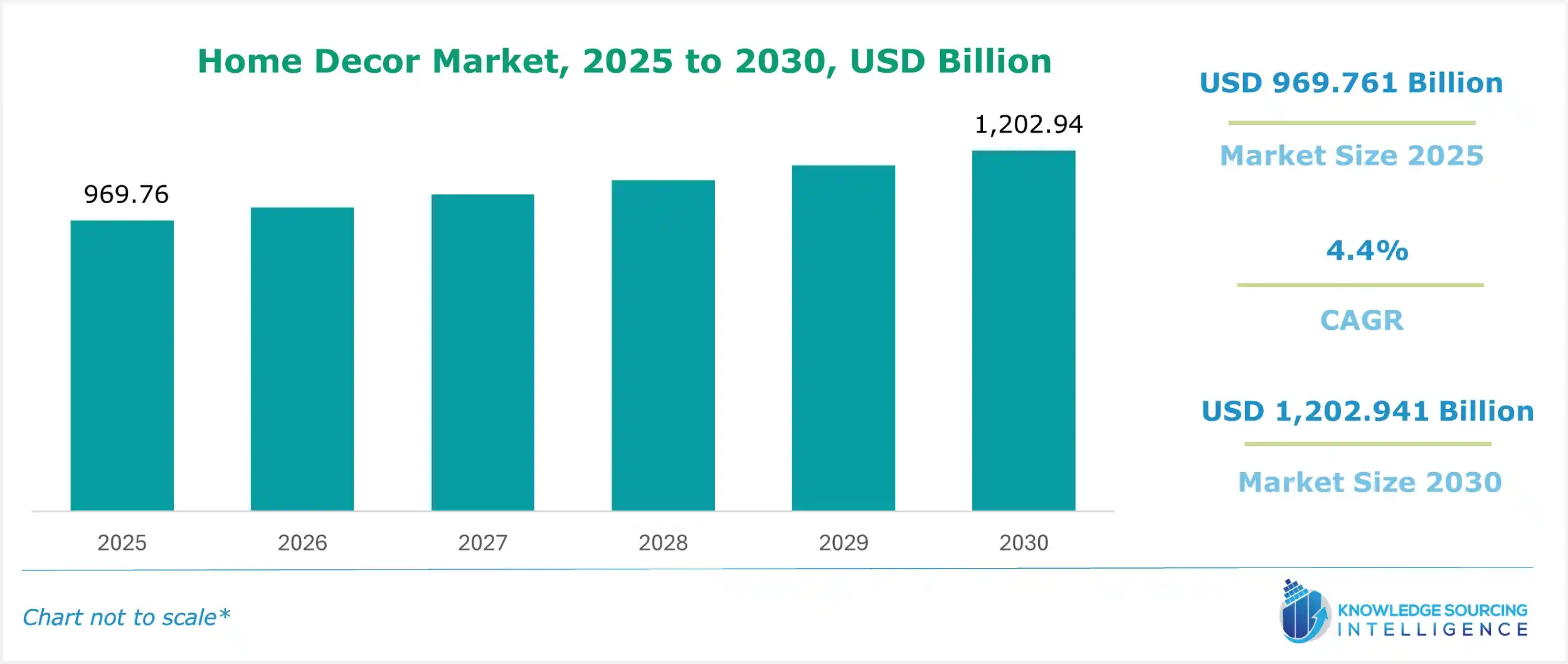

The home decor market is set to witness robust growth at a CAGR of 4.4% during the forecast period, reaching a value of US$1,202.941 billion in 2030 from US$969.761 billion in 2025.

Home Decor Market Trends:

Home décor is a form of artistic decoration of internal and external residential structure rooms, which must also be made fully functional. The categories of products covered in home décor range from carpets and accessories such as floor coverings, tracks, and mats to refrigerator and kitchen appliances, furniture, and other items available in a house.

One factor influencing home décor's growth is the rising demand for luxury interiors, particularly in regions with high disposable income. Moreover, the market is also anticipated to grow as consumers are demanding more eco-friendly goods.

Home Decor Market Growth Drivers:

- Growing Disposable Income and Urbanization: The rising disposable income in developing nations has increased the demand for home décor products such as furniture and flooring. Moreover, people have started using top-quality products in their lifestyles, leading to a rising demand for home decor market growth. Further, changing lifestyles have also necessitated an escalation in the requirement for premium quality goods, positively impacting the market expansion.

- Increasing Demand for Smart Homes: Continuous growth in smart home offerings, such as smart decorative lighting, speakers, and aesthetic home appliances, is driving product consumption growth rates in many countries worldwide. Furthermore, market growth is higher due to increased buying of connected technology-based décor items that bring next-generation entertainment, home security, and personalized health management to homes. Real estate is changing, and the expanding residential and commercial infrastructure is adding to the sector's growth. For instance, the Government of the United Kingdom Land Registry Office Survey states that a quarter of prospective home movers in the United Kingdom think smart technology is a "must have" feature in their homes.

Home Decor Market Segmentation Analysis by Product Type:

- Furniture: The furniture segment is projected to hold a substantial market share due to the rising demand for wooden furniture due to high and premium quality, which is a key factor shaping the growth of this segment during the forecast period.

- Textile: The global market for textile home décor has been growing in emerging economies as a result of an increase in the number of wealthy consumers.

- Flooring: The demand for fashionable yet affordable eco-friendly floor coverings is fuelling this segment’s growth.

- Others: The home textile segment is growing due to rising fashion consciousness and households' preference for high-end bedding and window coverings

Home Decor Market Segmentation Analysis by Application:

- Indoor: This segment is also projected to maintain its dominance throughout the forecast period. The rising consumer preference for stylish interiors is one of the prime factors bolstering its growth.

- Outdoor: The outdoor segment is projected to grow substantially due to the shifting consumer preferences towards adopting stylish flooring and furniture owing to the increasing influence of Western culture on lifestyle.

Home Decor Market Segmentation Analysis by Distribution Channel:

- Online: The online segment is anticipated to grow at a decent rate due to the expansion of distribution channels in both developed and developing economies of the globe.

- Offline: The offline segment is projected to hold a substantial share due to the presence of many retailers in many countries and domestic manufacturers in countries like India and China, among others.

Home Decor Market Geographical Outlook:

The Home decor market report analyses growth factors across the following five regions:

- North America: The region is dominating the home décor market due to the abundance of options available and consumers' adherence to dynamic trends.

- Europe: The demand for materials sourced ethically is increasing, and consumers in the area are quickly moving toward sustainable home décor.

- Asia Pacific: The demand for contemporary kitchen and living room furniture in China and Southeast Asia is driven by the expanding residential and commercial infrastructure.

- South America & MEA: The South American, Middle East and African regions are anticipated to grow significantly due to the expanding urbanization.

Home Decor Market – Competitive Landscape:

- Inter IKEA Systems B.V.- IKEA Systems B.V. is a values-based business passionate about providing the greatest home furnishings and living at home. They offer a large selection of well-made, useful home furnishings at affordable prices that as many people as possible can afford.

- Herman Miller, Inc.- Herman Miller, Inc. is an American-based company that designs and manufactures office equipment and home furnishings. They are known for their innovative interior designs.

- Godrej Interio- Godrej Interio is a furnishings business providing services and goods for home décor. It is the biggest furniture brand in India and a member of the Godrej Group.

The following companies are among the global leaders in the home decor industry's research, development, and advancement.

Home Decor Market Latest Developments:

- In January 2024, IKEA introduced a modern smart lighting line emphasizing usability and sustainability. This action aligns with customer demands for energy-efficient solutions and reflects the rising demand for smart home technologies.

Home Decor Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Home Decor Market Size in 2025 | US$969.761 billion |

| Home Decor Market Size in 2030 | US$1,202.941 billion |

| Growth Rate | CAGR of 4.4% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Home Decor Market | |

| Customization Scope | Free report customization with purchase |

Home Decor Market is analyzed into the following segments:

By Product Type

- Furniture

- Textiles

- Flooring

- Others

By Application

By Distribution Channel

- Online

- Offline

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Others