Report Overview

High Barrier Packaging Films Highlights

High Barrier Packaging Films Market:

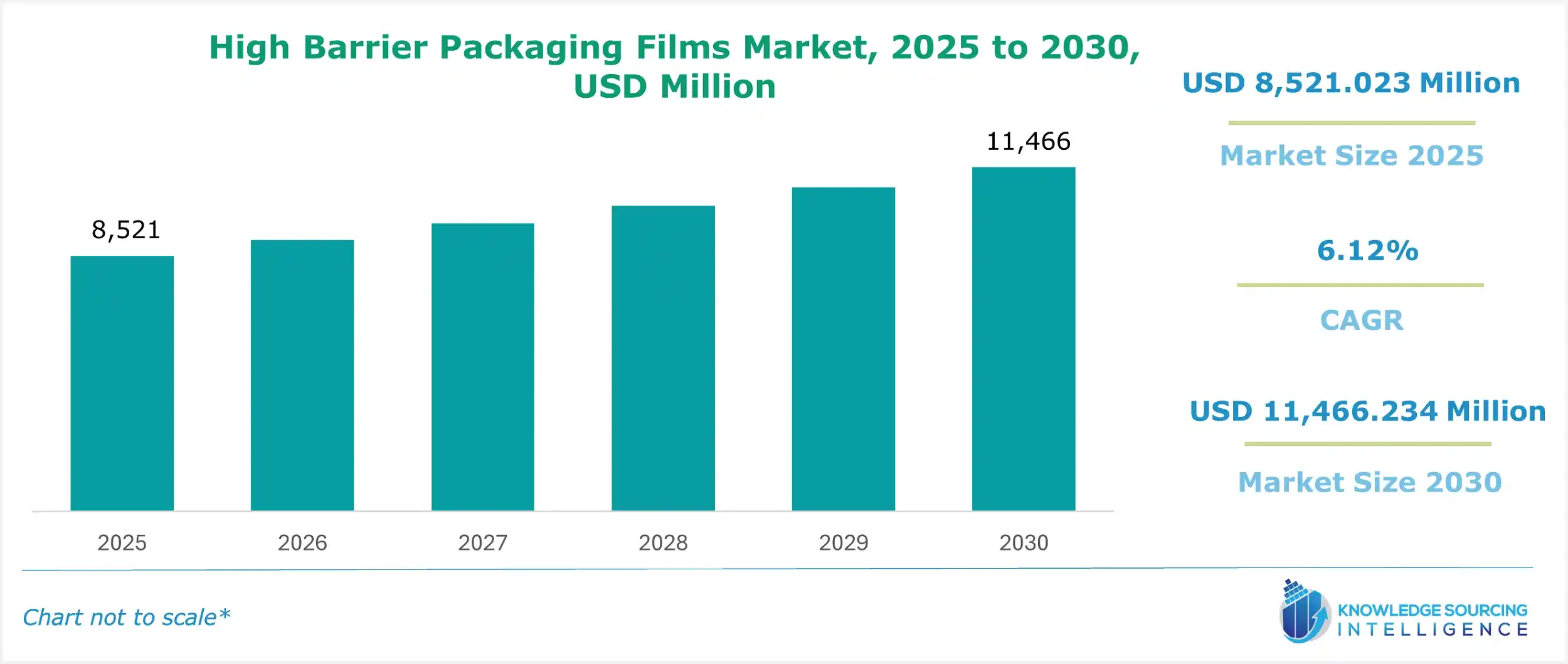

The High Barrier Packaging Films Market, valued at US$8521.023 million in 2025, is projected to grow at a CAGR of 6.12%, reaching a market size of US$11466.234 million by 2030.

The growing demand for food and beverage preservation is driving the market for high-barrier packaging films. Increasing demand for convenience and ready-to-eat foods is boosting the market growth. Alongside the growing e-commerce market, stringent government regulations for food and pharmaceutical safety and technological advancement in materials are also expanding the market.

High Barrier Packaging Films Market Overview & Scope:

The High Barrier Packaging Films market is segmented by:

- Material: The market is segmented into Polyethylene, Polypropylene, Organic coating, BOPET, Inorganic coating, Polyamide, and Others.

- Barrier Type: The high barrier packaging films market is segmented into moisture barriers, oxygen barriers, light & aroma barriers, and others.

- Packaging format: The market is segmented into flexible packaging, rigid packaging, and semi-rigid packaging.

- End-User: The market is segmented into Food and Beverage, industrial, Pharmaceuticals, and Others.

- Region: The high barrier packaging films market is segmented into North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Top Trends Shaping the High Barrier Packaging Films Market:

1. Demand for convenience food

- There is a growing trend for convenience food, such as ready-to-eat meals, due to rising urbanization and busy lifestyles, directly impacting the demand for high-barrier packaging films.

2. Shift in demand for sustainable packaging solutions

- There is a gradual shift in demand for sustainable packaging solutions due to growing concerns over the harmful impact of high-barrier packaging films on the environment and rising governmental regulations to reduce the impact.

- Manufacturers are focusing on developing recyclable and biodegradable high-barrier packaging films to strategize according to the trend. For example, in August 2023, Amcor plc launched high-barrier performance paper packaging in North America. AmFiber Performance Paper packaging is based on laminated paper structure, offering high performance compared to plastics, and is qualified for curbside recyclability.

3. Advancement in high-barrier packaging materials

- There is growing technological advancement in the materials used for manufacturing high-barrier packaging films, including advancement in multilayer films, mono-material solutions with barrier properties, ethylene-vinyl alcohol copolymer (EVOH), and post-consumer recycled (PCR) materials, among others.

- Manufacturers are strategizing their high-barrier packaging manufacturing into this growing advancement to maintain a competitive edge in the market. For example, allvac Folien GmbH “allflex E” is a co-extruded 11-layer film with a special design made of polyamide (PA) and polyethylene (PE) with an EVOH high barrier. This ensures high puncture resistance and protects foods from drying out and preventing them from oxygen and moisture exposure.

High Barrier Packaging Films Market Growth Drivers vs. Challenges:

Opportunities:

- Rising demand from end-user industries: There is a growing demand for high-barrier packaging films due to their capacity to preserve product quality and freshness from various end-user industries such as food & beverage, pharmaceutical, personal care, and cosmetics. For instance, the sharp increase in demand for packaged meals and beverages will aid market expansion. As per the data by the Australian Bureau of Statistics, in 2022-23 FY, 14.8 million tonnes of food and non-alcoholic beverages were sold, greater than 14.1 million tonnes in 2018-19, highlighting the increasing trend in demand for packaged food and non-alcoholic beverages driving demand for high-barrier packaging films.

- Growing dominance of large retail chains: The market of large retail chains in developing developed countries are growing rapidly. It is leading to demand for extending the shelf life of food & beverage products, driving the market demand for high-barrier packaging films.

Challenges:

- Sustainability Concern: There is a huge environmental cost of high-barrier packaging films as many manufacturers and price-sensitive consumers are still relying on plastic-based high-barrier packaging. The growing environmental and sustainability concerns pose a significant challenge to the market. However, the market is shifting towards sustainable or recyclable high-barrier packaging, but it comes with a performance trade-off as recycled materials have compatibility issues. Alongside this, there is a lack of recycling infrastructure in some regions.

High Barrier Packaging Films Market Regional Analysis:

- Asia-Pacific: The Asia-Pacific region is projected to grow rapidly during the forecast period due to increasing demand for high-barrier packaging films from emerging economies such as India, China, and other Southeast Asian countries. India is projected to grow considerably due to the growing end-use industries such as food & beverage, e-commerce, and pharmaceutical. China will dominate the market due to high demand from end-use industries.

- North America: North America is projected to hold a significant market share due to the high demand for convenience and ready-to-eat meals, along with food preservation for vegetables and meat and poultry products. There is a high demand from various end-user industries such as pharma, personal care, and cosmetics, among others, leading to a significant market expansion. The increasing technological advancement and presence of key market players are encouraging the demand for sustainable and technologically advanced materials for high-barrier packaging film manufacturing.

High Barrier Packaging Films Market Competitive Landscape:

The market is highly fragmented due to the presence of various global and regional players. However, there are some key notable players with wide operations, such as Amcor plc, Berry Global Inc., and Sealed Air Corporation. Regional players such as Jindal Films, Uflex, and others cater to specific geographies. The recent developments in the market are:

- Geographic Expansion: In March 2024, TOPPAN Inc. and India-based TOPPAN Speciality Films Private Limited developed a GL-SP. This barrier film uses biaxially oriented polypropylene (BOPP) and will be produced in India.

- Production Launch: In July 2024, ProAmpac launched recyclable high-barrier fiber technology- Proactive Recyclable FibreSculpt. This solution is engineered for thermoforming applications, including?chilled cooked meats,?cold cuts,?sliced cheese, and fish, offering several benefits such as lightweight, better shelf appeal, and kerbside recyclability.

High Barrier Packaging Films Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| High Barrier Packaging Films Market Size in 2025 | US$8521.023 million |

| High Barrier Packaging Films Market Size in 2030 | US$11466.234 million |

| Growth Rate | CAGR of 6.12% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the High Barrier Packaging Films Market | |

| Customization Scope | Free report customization with purchase |

High Barrier Packaging Films Market Segmentation:

By Material

- Polyethylene

- Polypropylene

- Organic coating

- BOPET

- Inorganic coating

- Polyamide

- Others

By Barrier Type

- Moisture Barrier

- Oxygen Barrier

- Others

By Packaging Format

- Flexible Packaging

- Rigid Packaging

- Semi-Rigid Packaging

By End-User

- Food and Beverage

- Industrial

- Pharmaceuticals

- Others

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa