Report Overview

Herbicide Market Size, Share, Highlights

Herbicide Market Size

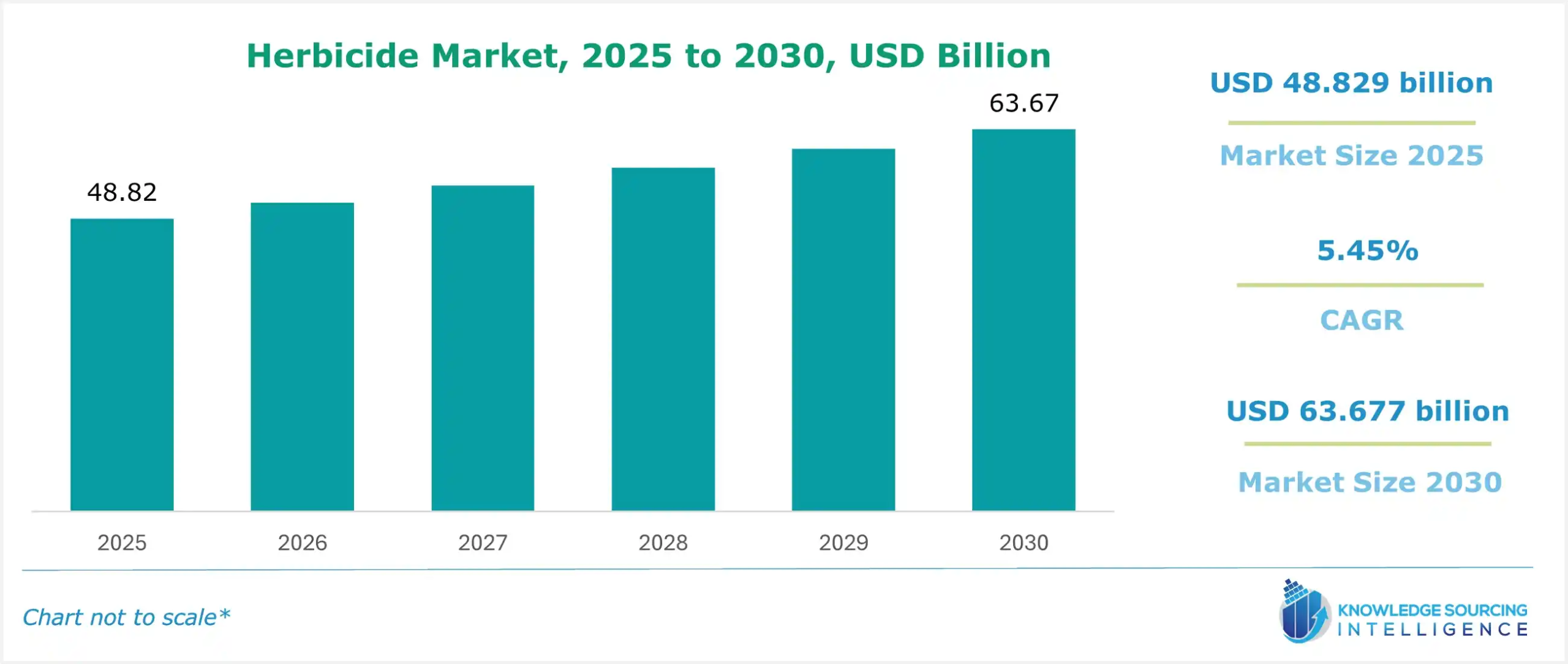

The herbicide market is expected to grow at a CAGR of 5.45%, reaching a market size of US$63.677 billion in 2030 from US$48.829 billion in 2025.

Herbicides are regarded as critical components in the modern agriculture industry, and they are expected to grow in the coming years owing to multiple factors. They are powerful agents meant to reduce or eliminate unwanted plant growth. They are imperative in agricultural landscapes or gardens since they enable the growth of desired plants and full utilization of farmland.

What are the drivers of the herbicide market?

- Rising demand for Herbicides by type

Herbicides can be divided into two broad categories: selective and non-selective herbicides. Selective herbicides target only certain species of plants whole, sparing others. These herbicides are often used in row-crop farming to manage weeds without damaging crops or desirable vegetation. Non-selective herbicides kill any plant material they come into contact with; hence, they are often used for clearing wastelands or industrial sites. Their methods of application include spraying onto foliage, applying to soils, or directly to aquatic systems, each with its own mode of action, such as inhibiting cell division, photosynthesis, amino acid production, or mimicking natural plant hormones.

There are a few reasons why herbicides are in demand. Among them is the need to produce more food for the ever-increasing world population and the availability of demanding standards for agricultural products. Herbicides are very important, especially in commercial farming practices like row crops, where they increase efficiency by preventing or remediating the growth of weeds. They also play a crucial role in forest management and urban landscaping, such as lawns and parks. The industry is witnessing an increasing trend towards eco-friendly organic herbicides that contain plant-derived concentrates like citric acid or vinegar, which are less hazardous to the environment.

Segment analysis of the herbicide market:

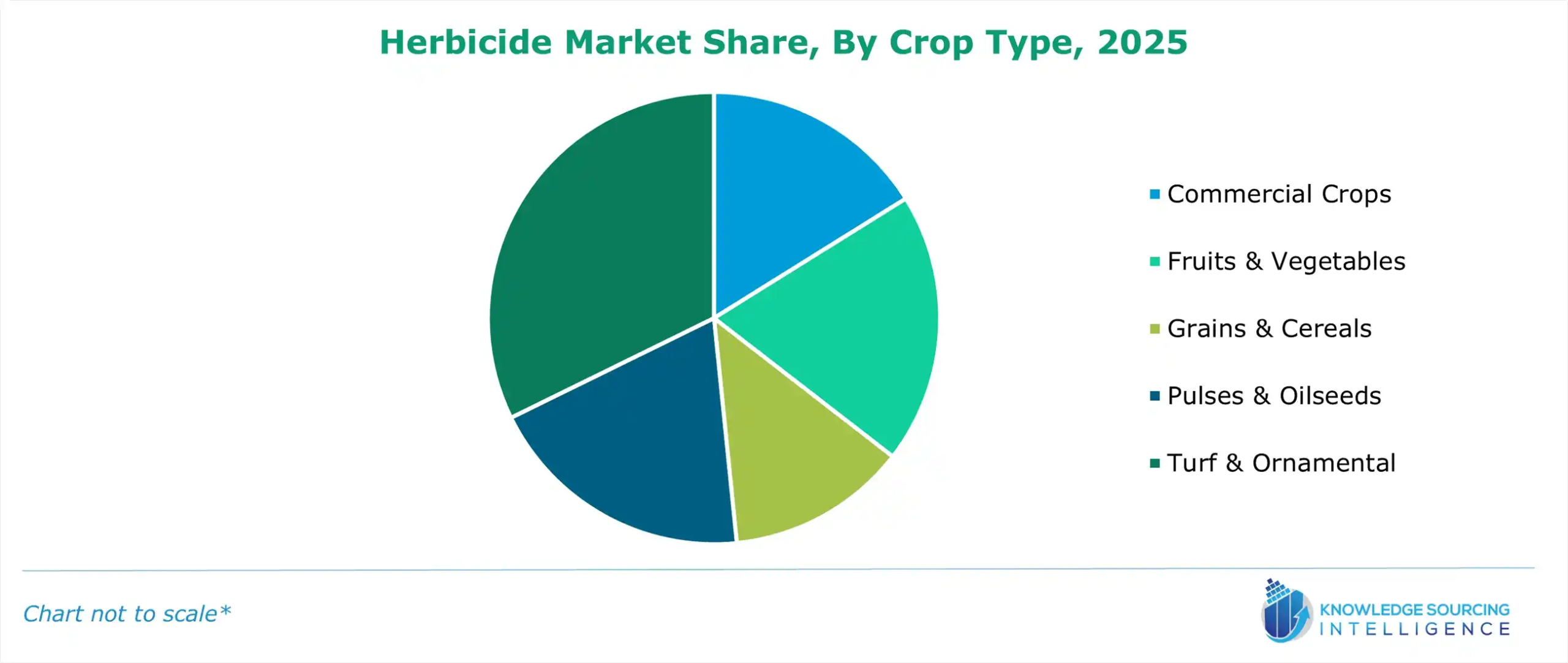

- The herbicide market by crop type is segmented into commercial crops, fruits & vegetables, grains & cereals, pulses & oilseeds, and turf & ornamentals.

The herbicides by crop type used are broadly applied in commercial crops and fruits & vegetables. With the growing economies of Asia and Africa, the demand for herbicide in other application areas will drive the market's expansion, such as in the application of grains & cereals, pulses & oilseed, as well as turf & ornamentals.

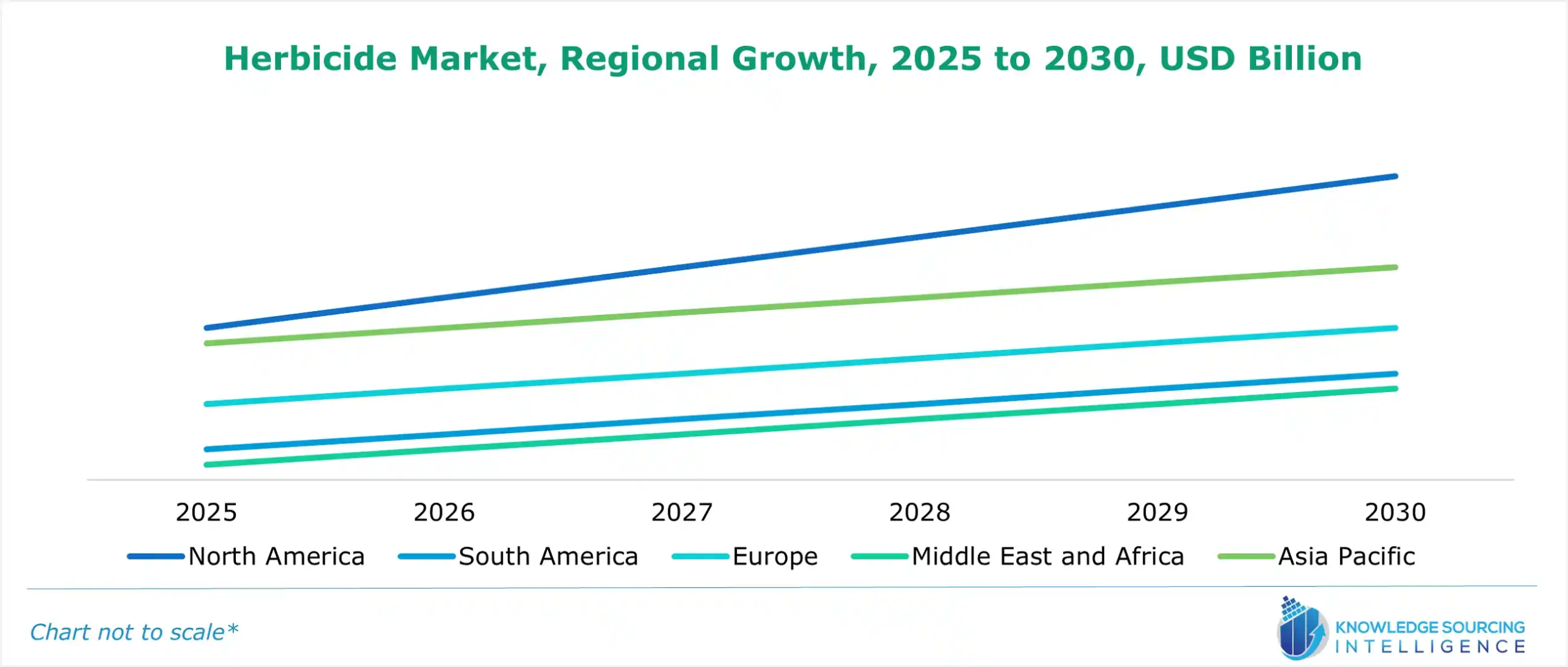

- Asia Pacific region to dominate the herbicide market during the forecast period.

The major economies like China, Japan, India, and South Korea dominate the Asia-Pacific region. Some of the fastest-growing emerging economies are from this region, such as ASEAN countries.

These countries are equipped with vast areas of agricultural land with growing populations that demand higher food production. In China, the plantation of genetically modified (GM) crops resistant to some herbicides has reassessed the market situation. From this, the farmers can take the help of herbicides more efficiently without damaging their crops. This is evident in India, wherein effective weed management in high-value cash crops like sugarcane is crucial, and improper weed control can lead to significant yield loss.

Consumer awareness and environmental issues have been the primary drivers for the adoption of bioherbicides and sustainable agriculture practices. Organic farming methods, which further stimulate bioherbicides with minimal damage to ecosystems, are gaining popularity at an increasing rate. Finally, precision agriculture advancements, including AI detection of herbs and the consequent precisely targeted application of herbicides, help increase efficiency in applying herbicides while minimizing these negative impacts and waste in the environment.

So far, soil application is the leading method in the Asia-Pacific herbicide market. The method has proven efficient for early-season weed control purposes and remains critical for the healthy establishment of crops. However, farmers are becoming more aware of herbicides in crop yield improvement and effective management of resistance so that demand will continue to increase further.

Major restraints of the herbicide market:

- Stringent health and environmental concerns are factors that will restrain the market's growth. Additionally, a few regulatory frameworks governing the use of herbicides are also becoming increasingly stringent, particularly in developed regions. These regulations often require extensive testing and approval processes, which can delay product launches and increase costs for manufacturers. This regulatory burden can stifle innovation, making it challenging for new products to enter the market

Key developments in the herbicide market:

- In February 2023, ADAMA Canada introduced a new crop protection product, a herbicide solution known as DAVAI A Plus, for the 2023 crop year. The introduction of this new crop protection is known to be a part of ADAMA’s ongoing strategy to meet the demand and the needs of Canadian growers while adapting to global supply chain issues.

- In February 2022, ADAMA Ltd., which is known to be the world’s leading crop protection company, launched its Timeline FX. It is considered the most advanced cross-spectrum, spring foliar herbicide for cereals.

Herbicide market scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Herbicide Market Size in 2025 | US$48.829 billion |

| Herbicide Market Size in 2030 | US$63.677 billion |

| Growth Rate | CAGR of 5.45% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Herbicide Market | |

| Customization Scope | Free report customization with purchase |

The herbicide market is segmented and analyzed as follows:

- By Type

- Selective Herbicides

- Non-Selection Herbicides

- By Application

- Chemigation

- Foliar

- Fumigation

- Soil Treatment

- By Crop Type

- Commercial Crops

- Fruits & Vegetables

- Grains & Cereals

- Pulses & Oilseeds

- Turf & Ornamental

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- UAE

- Rest of the Middle East and Africa

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America