Report Overview

Helium Market - Strategic Highlights

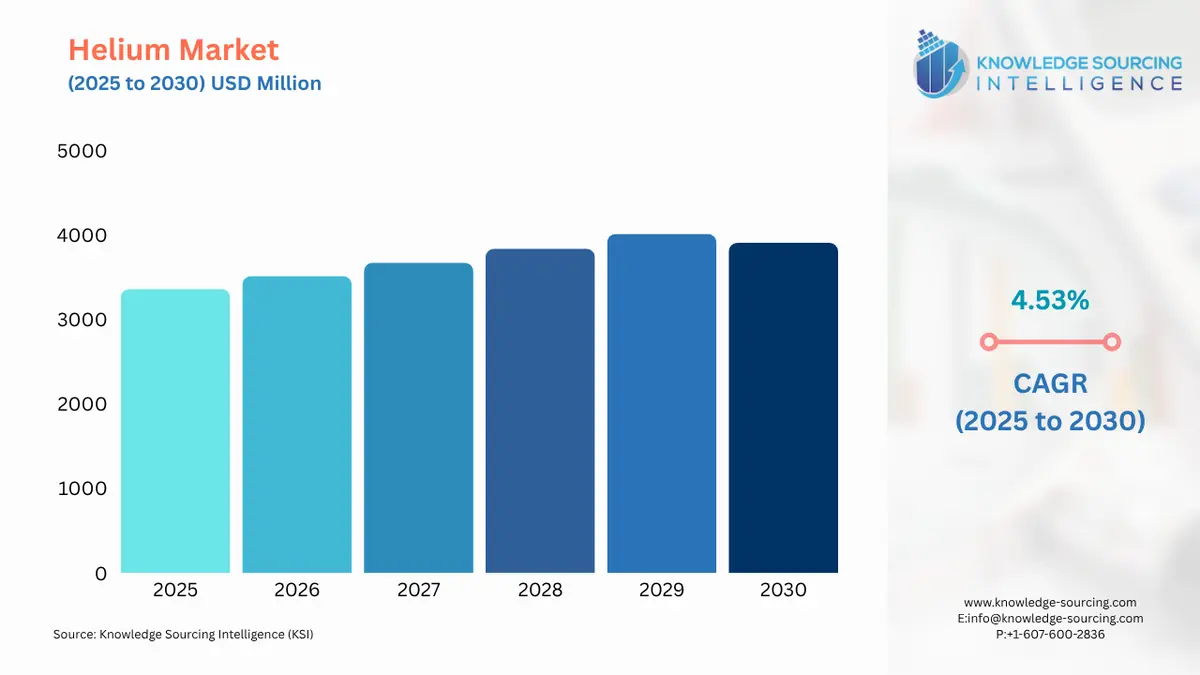

Helium Market Size:

The helium market is valued at US$3,361.234 million in 2025 and is projected to expand at a CAGR of 4.53% over the forecast period, reaching US$3,906.645 million by 2030.

Helium Market Introduction

Helium, a noble gas with unique properties such as low density, high thermal conductivity, and inertness, plays a pivotal role in modern industries. As the second most abundant element in the universe, helium is paradoxically scarce on Earth, primarily extracted as a byproduct of natural gas processing. Its applications span critical sectors, including healthcare, electronics, aerospace, and scientific research, making the helium market a focal point for industry experts tracking its trends. The market is characterized by a delicate balance of supply and demand, with challenges in the helium supply chain and its demand drivers shaping its trajectory. Helium’s irreplaceable role in cooling superconducting magnets for MRI machines, enabling semiconductor manufacturing, and supporting space exploration underscores its strategic importance. However, limited global reserves and geopolitical factors create volatility, impacting helium price volatility and market stability.

The helium market growth is driven by several key factors. The rising demand for helium in healthcare, particularly for MRI systems, is fueled by the global increase in chronic diseases and diagnostic imaging needs. In electronics, helium’s role in semiconductor manufacturing and fiber optics production is critical as industries embrace 5G, IoT, and electric vehicles. The aerospace sector, with expanding space exploration programs by agencies like NASA and private companies like SpaceX, relies on helium for rocket propulsion and satellite systems. Additionally, advancements in helium recycling technologies offer opportunities to mitigate supply constraints, enhancing market resilience. The helium market forecast anticipates continued growth as these industries expand, with helium’s unique properties ensuring its indispensability.

However, the market faces significant restraints. The finite nature of helium reserves, concentrated in a few regions like the United States, Qatar, and Algeria, poses supply risks. Helium shortage impact has been a recurring issue, exacerbated by geopolitical tensions and production disruptions in key regions. For instance, the closure of the U.S. Federal Helium Reserve in 2024 tightened global supply, contributing to price spikes. Furthermore, helium’s dependency on natural gas extraction limits scalability, as declining fossil fuel production threatens availability. These challenges necessitate innovation in extraction and conservation to sustain the market.

Recent helium market opportunities include the discovery of new reserves in regions like Tanzania and Canada, driven by advanced geological surveys. These developments reduce reliance on traditional producers and enhance market stability. Additionally, investments in helium recycling technologies are gaining traction, particularly in high-tech industries, to address supply shortages. The market trends also highlight the growing role of helium in energy storage systems, supporting renewable energy initiatives. As industries increasingly prioritize sustainability, helium’s applications in cutting-edge technologies like quantum computing further elevate its demand.

Helium Market Overview

Helium is a form of colorless and odorless gas that is non-toxic in nature. Helium gas offers key applications across multiple industries, including cryogenic, medical imaging, aerospace, and electronic manufacturing. In medical imaging, the gas is used as a cooling agent for various types of equipment, such as MRI machines. Similarly, in the aerospace sector, the gas is commonly utilized as a lifting gas and propulsion fuel for rockets and weather balloons. Helium gas exhibits chemical inertness, making it safer for use across multiple industries. It features lower density and high thermal conductivity.

Helium Market Trends:

Rising Semiconductor Demand: The global surge in semiconductor production and demand is a primary driver of the helium market during the forecast period. Helium is essential in semiconductor manufacturing, acting as a cooling agent and carrier gas during fabrication.

Healthcare Sector Growth: Advancements in the healthcare industry are projected fuel the expansion of the global helium market. Helium is widely utilized as a cooling agent in medical imaging equipment, such as MRI machines and other diagnostic technologies, supporting market growth.

North America: North America is anticipated to secure a significant portion of the global helium market. This growth is propelled by the region’s increasing semiconductor and electronics production, alongside expansion in the aerospace and defense sectors. Additionally, developments in healthcare and transportation are expected to further heighten helium demand in the region.

Some of the major players covered in this report include Qatargas, Praxair (Linde Gas and Equipment), Air Liquide, Iwatani Corporation of America, Messer Group, Buzwair Industrial Gases Factory, Matheson Tri-Gas, SOL India Private Limited, Air Products and Chemicals, Inc., Helium One Global, GB Gases Ltd, and 45-8 Energy, among others.

Helium Market Drivers

Drivers:

Growing Demand in Healthcare for MRI and Cryogenic Applications

The healthcare sector is a primary driver of the helium market, with helium’s irreplaceable role in cooling superconducting magnets for MRI systems. The global rise in chronic diseases, such as cancer and neurological disorders, has increased the demand for diagnostic imaging, with over 10 million MRI procedures conducted annually. Helium’s low boiling point makes it essential for maintaining the ultracold temperatures required for MRI magnets, as well as for cryogenic storage of biological samples. Developing nations, particularly in the Asia-Pacific, are investing heavily in healthcare infrastructure, further boosting helium consumption. For instance, India’s healthcare expansion includes new MRI installations, driving demand. Additionally, helium is used in respiratory treatments for conditions like asthma, enhancing its medical applications. As medical research advances, particularly in cryogenic therapies, helium’s role remains critical, ensuring sustained market growth.

Expanding Use in Semiconductor and Fiber Optics Production

The electronics industry, particularly semiconductor manufacturing, is a key driver of the helium market growth. Helium’s inert properties and thermal conductivity make it vital for cooling wafers, plasma etching, and leak detection in semiconductor production. The global push for 5G, IoT, and electric vehicles has spurred investments, with the U.S. CHIPS Act allocating $280 billion to enhance domestic chip production. Helium is also critical in fiber optics manufacturing, ensuring contamination-free environments for high-quality optical cables used in 5G networks and data centers. The rapid expansion of high-speed internet infrastructure globally amplifies this demand. As helium market trends indicate, the electronics sector’s reliance on helium for precision manufacturing underscores its indispensability, driving market expansion despite supply challenges.

Growth in Space Exploration Programs

The helium market is propelled by the rapid expansion of space exploration, where helium is essential for rocket propulsion and satellite systems. Its inert nature and low boiling point make it ideal for pressurizing fuel tanks and cooling rocket components. NASA, ESA, and private companies like SpaceX and Blue Origin are increasing satellite launches and lunar missions, with helium playing a critical role. For example, SpaceX’s Starship program relies on helium for cryogenic propellant management. The global space economy is projected to grow significantly, with increased investments in satellite constellations for communication and navigation. This surge in helium market opportunities in aerospace underscores helium’s strategic importance, driving demand as space agencies and private players compete to advance exploration.

Helium Market Restraints

Challenges:

Limited Global Helium Reserves

The helium market faces significant constraints due to the scarcity of helium reserves, primarily extracted as a byproduct of natural gas processing. Key production regions, including the U.S., Qatar, and Algeria, account for most global supply, but reserves are finite and concentrated. The U.S. Geological Survey estimates that helium-bearing gas fields are limited, with regions like Texas and Oklahoma holding high concentrations (0.3–2.7%). The closure of the U.S. Federal Helium Reserve in 2024 exacerbated supply shortages, contributing to helium price volatility. As natural gas production declines in favor of renewable energy, helium availability is further threatened, impacting the helium supply chain. This scarcity drives up costs and creates uncertainty for industries reliant on helium, necessitating innovative extraction and recycling solutions.

Geopolitical Tensions Impacting Supply

Geopolitical instability in helium-producing regions poses a significant restraint on the helium market. The U.S., Qatar, and Russia dominate global production, but political unrest or export restrictions can disrupt supply chains. For instance, Qatar’s helium production faced challenges during past regional blockades, tightening the global supply. Similarly, Russia’s geopolitical tensions have raised concerns about export reliability. These disruptions contribute to the helium shortage impact, driving price volatility and affecting industries like healthcare and electronics. The helium market analysis highlights the risk of over-reliance on a few producers, prompting efforts to diversify supply through new reserves in regions like Tanzania. Mitigating these risks requires strategic investments in alternative sources and helium recycling technologies to stabilize the market.

Helium Market Segmentation Analysis

Helium Market is analyzed in the following segments:

By Form

Gaseous Helium is the most common type in the market. Gaseous helium dominates the helium market due to its extensive applications across industries. Its inert nature and low density make it ideal for leak detection, welding, and creating controlled atmospheres in semiconductor manufacturing. In electronics, gaseous helium is used for plasma etching and cooling during wafer production, supporting the global demand for 5G and IoT devices. The aerospace sector relies on it for pressurizing fuel tanks and purging systems, as seen in SpaceX’s Starship launches. Additionally, gaseous helium is critical in scientific research, serving as a carrier gas in gas chromatography and supporting experiments in physics and chemistry. Its dominance is driven by its versatility and safety, as it does not support combustion, making it suitable for applications where safety is paramount. The helium market trends indicate sustained demand for gaseous helium as industries prioritize precision and safety, with ongoing advancements in recycling technologies enhancing its availability.

By Application

The use of Cryogenics is growing exponentially. Cryogenics is the leading application segment in the helium market, driven by helium’s ability to achieve ultralow temperatures near absolute zero. Liquid helium is critical for cooling superconducting magnets in MRI machines, a cornerstone of modern healthcare diagnostics. It is also used in scientific research, such as particle accelerators like CERN’s Large Hadron Collider, where helium maintains temperatures of -271.3°C. The helium market growth in cryogenics is fueled by the global rise in MRI installations and advancements in quantum computing, which rely on helium-cooled superconducting components. In space exploration, cryogenics supports infrared detectors and scientific instruments on spacecraft, as seen in NASA’s James Webb Space Telescope. The helium market forecast anticipates continued growth in this segment as healthcare and research expand, though supply constraints pose challenges. Innovations in helium recycling technologies are critical to sustaining this segment’s growth.

By Industry Vertical

The Healthcare industry is expected to dominate the market share. The healthcare sector is the dominant industry vertical in the helium market, driven by helium’s critical role in MRI systems and cryogenic medical applications. Liquid helium cools superconducting magnets in MRI machines, enabling precise diagnostic imaging for millions of patients annually. The global rise in chronic diseases and healthcare infrastructure investments, particularly in the Asia-Pacific, drives demand. For example, China’s healthcare modernization includes increased MRI installations. Helium is also used in respiratory treatments for conditions like asthma and in cryogenic storage of biological samples, supporting medical research. The helium demand drivers in healthcare are amplified by innovations in diagnostic technologies and the growing prevalence of non-invasive procedures. However, the helium shortage impact threatens supply reliability, necessitating recycling and conservation efforts. The helium market opportunities in healthcare lie in expanding applications in emerging therapies, ensuring helium’s pivotal role in advancing medical technology.

Helium Market Key Developments

Acquisition: In November 2024, Reliance Industries’ U.S. unit acquired a 21% stake in Wavetech Helium for $12 million, targeting the growing helium market. This strategic investment aims to capitalize on the U.S. helium supply gap, supporting helium market growth in healthcare and electronics. Wavetech’s focus on helium exploration aligns with helium market opportunities in low-carbon energy and high-tech applications. The move addresses the helium shortage impact by boosting domestic production, reducing reliance on foreign supply. This development strengthens the helium supply chain for critical industries.

Product Launch: In July 2024, U.S. Energy Corp. announced a transformative acquisition to enter the helium market, targeting production to meet rising demand in semiconductor manufacturing and aerospace. The acquisition focuses on helium-rich reserves, addressing the helium shortage following the Federal Helium Reserve’s closure. This move supports helium market growth by enhancing domestic supply, reducing helium price volatility. The project aligns with helium market trends toward diversifying production sources, ensuring stability for industries reliant on helium. U.S. Energy Corp.’s entry strengthens the helium supply chain for high-tech applications.

Product Launch: In October 2023, QatarEnergy LNG announced its helium plant is on track to be operational by 2027, with plans for a second Helium 5 plant to follow. This expansion aims to bolster Qatar’s position as a leading helium producer, addressing the global helium shortage impact. The project enhances the helium supply chain, supporting industries like healthcare and electronics. By increasing production capacity, QatarEnergy aims to stabilize helium price volatility, providing a reliable supply for global markets. This development is critical as demand grows in semiconductor manufacturing and space exploration.

Helium Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 3,361.234 million |

| Total Market Size in 2030 | USD 3,906.645 million |

| Forecast Unit | Million |

| Growth Rate | 4.53% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Form, Type, Application, Region |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Helium Market Segmentation:

By Form

Gas

Liquid

By Type

On-site

Merchant

Packaged

By Application

Cryogenics

Leak Detection

Breathing Mixes

Others

By Industry Vertical

Aerospace and Defense

Electronics and Semiconductors

Healthcare

Energy

Manufacturing

Others

By Region

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

United Kingdom

Germany

France

Spain

Others

Middle East & Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

Japan

India

South Korea

Taiwan

Others