Report Overview

Health Information Exchange Technology Highlights

Health Information Exchange Technology Market Size:

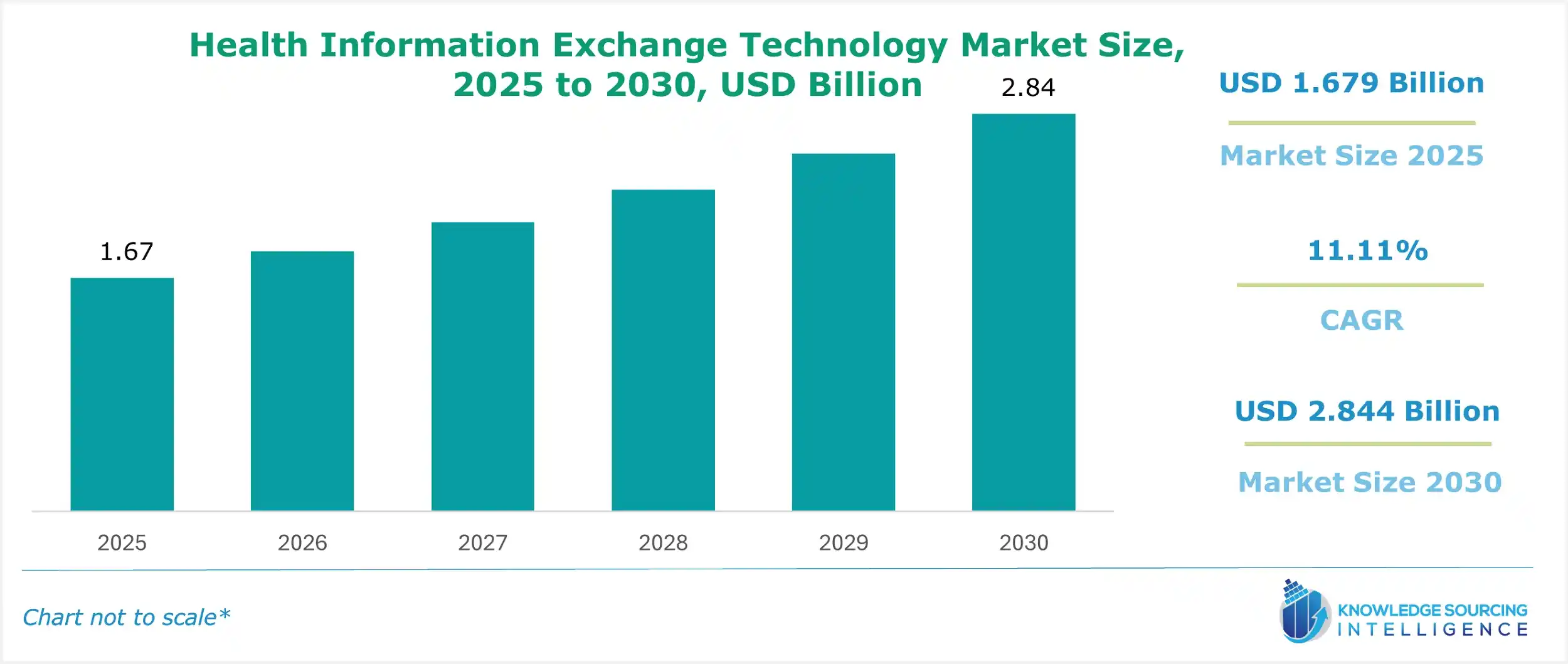

Health Information Exchange Technology Market is forecasted to grow at a 10.78% CAGR during the forecast period, attaining USD 3.103 billion in 2031 from USD 1.679 billion in 2025.

Health Information Exchange Technology Market Overview:

The Health Information Exchange (HIE) market is revolutionizing healthcare interoperability by enabling secure patient data sharing across disparate systems. Electronic health records (EHR) interoperability ensures seamless access to comprehensive patient information, enhancing coordinated care. Health data exchange platforms facilitate standardized, real-time data exchange in healthcare, improving clinical decision-making and patient outcomes. These technologies address challenges in fragmented healthcare systems, allowing providers to access critical data for diagnostics, treatment, and population health management. Market players leverage HIE solutions to streamline workflows, reduce redundancies, and ensure compliance with regulatory standards, driving efficiency and quality in modern healthcare ecosystems.

The Health Information Exchange (HIE) market is advancing through digital health transformation, prioritizing patient-centric care by enabling seamless data sharing across healthcare systems. Interoperability standards adoption, such as FHIR, enhances data exchange efficiency and compatibility. Cybersecurity in healthcare IT is critical, with advanced encryption and authentication protocols protecting sensitive patient data from breaches. These trends support real-time access to comprehensive health records, improving care coordination and outcomes. Hence, HIE platforms are increasingly being adopted to meet regulatory requirements, reduce costs, and empower patients with greater control over their health data, driving the evolution of integrated, secure, and efficient healthcare ecosystems.

Health Information Exchange Technology Market Trends:

The health information exchange (HIE) is revolutionizing healthcare data sharing and utilization. Stakeholders can securely share electronic health records (EHRs) with HIEs, which helps improve patient outcomes and care coordination. Utilizing HIE solutions facilitates seamless interoperability between healthcare systems, ensuring the swift transfer of accurate patient data. The market includes strict privacy and regulatory compliance procedures in addition to technology like health information networks and data integration platforms. Continuous innovation and breakthroughs in data-sharing protocols fuel competition. The Health Information Exchange market growth is moving forward, revolutionizing healthcare delivery, and is driven by a growing desire for more seamless data sharing and care coordination.

The HIE industry includes application interfaces, data integration platforms, and health information networks. Modern security measures must also be implemented to safeguard patient privacy and ensure compliance with regulatory requirements like the Health Insurance Portability and Accountability Act (HIPAA). In response to the growing use of electronic medical records and the requirement for interoperability between various healthcare systems, there has been a significant rise in the demand for HIE solutions. These arrangements permit medical care associations to productively convey patient information, guaranteeing that approved partners have access to the right and modern data.

The health information exchange (HIE) market size is rapidly expanding owing to the potential of HIE to make it possible for patients, payers, healthcare providers, and other parties to transfer electronic health records (EHRs) and other types of medical data safely and seamlessly. HIEs are essential for reducing healthcare costs, increasing patient outcomes, and improving care coordination.

Health Information Exchange Technology Market Key Players:

Cerner Corporation: Healthcare organizations can share patient data through Cerner's HIE systems, enhancing care coordination and interoperability.

Epic System Corporation: Epic provides HIE solutions that make it possible for healthcare providers to safely share electronic health records (EHRs), allowing for seamless data exchange and care coordination.

Allscripts Healthcare Solutions: Allscripts offers HIE systems that combine data from multiple sources, including electronic health records (EHRs), to provide complete patient information and enable stakeholders in the healthcare industry to exchange data in real time.

InterSystem Corporation: Safe data transmission and interoperability between healthcare systems are made possible by InterSystems' HealthShare technology, which also makes it possible to manage population health.

Orion Health: Orion Health offers HIE systems that make it possible to safely transfer patient data like electronic health records (EHRs), diagnostic images, and lab results. This helps patients get better treatment together and improves their outcomes.

Health Information Exchange Technology Market Growth Drivers:

Educating about the benefits of HIE for enhancing healthcare delivery:

More and more people are realizing that health information exchange (HIE) can improve healthcare delivery. HIE makes it possible for healthcare stakeholders to effectively share patient information, which improves patient outcomes, improves care coordination, and enables more information.

Personalized medication and patient-centered care are prioritized:

Patient-centered care and individualized treatment are becoming increasingly important in healthcare. Each patient's uniqueness is taken into consideration in this approach, and therapy is tailored accordingly. The safe exchange of patient data, the support of individualized treatment plans, and an increase in patient participation are all reasons why health information exchange (HIE) is so important.

Growing demand from stakeholders in the healthcare industry for seamless information sharing:

The growing demand for seamless information exchange among healthcare stakeholders is driven by the requirements for improved patient safety, care coordination, and healthcare delivery. The safe and quick transmission of patient data throughout the healthcare ecosystem is made possible by health information exchange, or HIE, which enables collaboration and well-informed decision-making.

Data exchange and interoperability are becoming increasingly significant:

The increasing complexity of healthcare organizations and the desire to incorporate data from multiple sources are the driving forces behind the rising demand for interoperability and data interchange. Health information exchange (HIE) fulfills this requirement by facilitating seamless data sharing, encouraging efficient communication, and supporting improved clinical decision-making.

The health information exchange market is growing at a steady rate in the forecast period.

The market for health information exchange is segmented by set-up type, implementation model, solution, type, application, end-user, and geography. Set-up types are further segmented into public HIEs, private HIEs, and hybrid HIEs. The solutions are further segmented into portal-centric solutions, platform-centric solutions, and messaging-centric solutions.

Health Information Exchange Technology Market Geographical Outlook:

North America has the largest share of the health information exchange (HIE) market.

North America is set to dominate the Health information exchange (HIE) market. The region's prominence can be attributed to some factors. First and foremost, North America has a robust healthcare infrastructure that includes robust electronic health record (EHR) systems and cutting-edge IT capabilities for the healthcare industry. Second, interoperability and data-sharing standards are given a lot of attention in this area thanks to programs like the Consolidated Clinical Document Architecture (CCDA) and the Health Information Technology for Economic and Clinical Health (HITECH) Act. Furthermore, market expansion in North America has been aided by favorable government regulations and policies that encourage the use of HIE solutions.

Health Information Exchange Technology Market Developments:

November 2025: InterSystems launched the HealthShare AI Assistant, a generative AI capability within HealthShare Unified Care Record, enabling clinicians to conversationally query longitudinal patient data for faster, intuitive interoperability insights.

November 2025: Oracle Health Information Network was designated a Qualified Health Information Network (QHIN) under the U.S. Trusted Exchange Framework and Common Agreement (TEFCA), enhancing secure national health data exchange among providers, payers, and agencies.

October 2025: InterSystems and Google Cloud partnered to integrate HealthShare with Google Cloud’s Healthcare API, strengthening data harmonization, real-time interoperability, and clean, actionable data foundations for AI-enabled health information exchange.

July 2025: eHealth Exchange announced support for the CMS Digital Health Ecosystem at a White House interoperability event, reinforcing nationwide HIE adoption and collaboration to share patient records across providers and networks.

May 2025: Oracle Health Information Network achieved candidate QHIN status as part of the TEFCA onboarding process, marking an important step toward full participation in standardized nationwide health information exchange.

Health Information Exchange Technology Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Health Information Exchange Technology Market Size in 2025 | USD 1.679 billion |

Health Information Exchange Technology Market Size in 2030 | USD 2.844 billion |

Growth Rate | CAGR of 11.11% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Health Information Exchange Technology Market |

|

Customization Scope | Free report customization with purchase |

Health Information Exchange Technology Market Segmentation:

BY SET-UP TYPE

Public HIEs

Private HIEs

Hybrid HIEs

BY IMPLEMENTATION MODEL

Centralized HIEs

Decentralized HIEs

Federated/Consolidated HIEs

BY SOLUTION

Portal-Centric Solutions

Platform-Centric Solutions

Messaging-Centric Solutions

BY TYPE

Teleconsultation

Directed Exchange

Query-Based Exchange

Consumer Mediated Exchange

BY APPLICATION

Web Portal Development

Secure Messaging

Interfacing & Connectivity

Patient Care Management

Workflow Management

Others

BY END-USER

Healthcare Providers

Healthcare Payers

Pharmacies

Research Organizations

Others

BY GEOGRAPHY

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others