Report Overview

Hazardous Location Air Conditioners Highlights

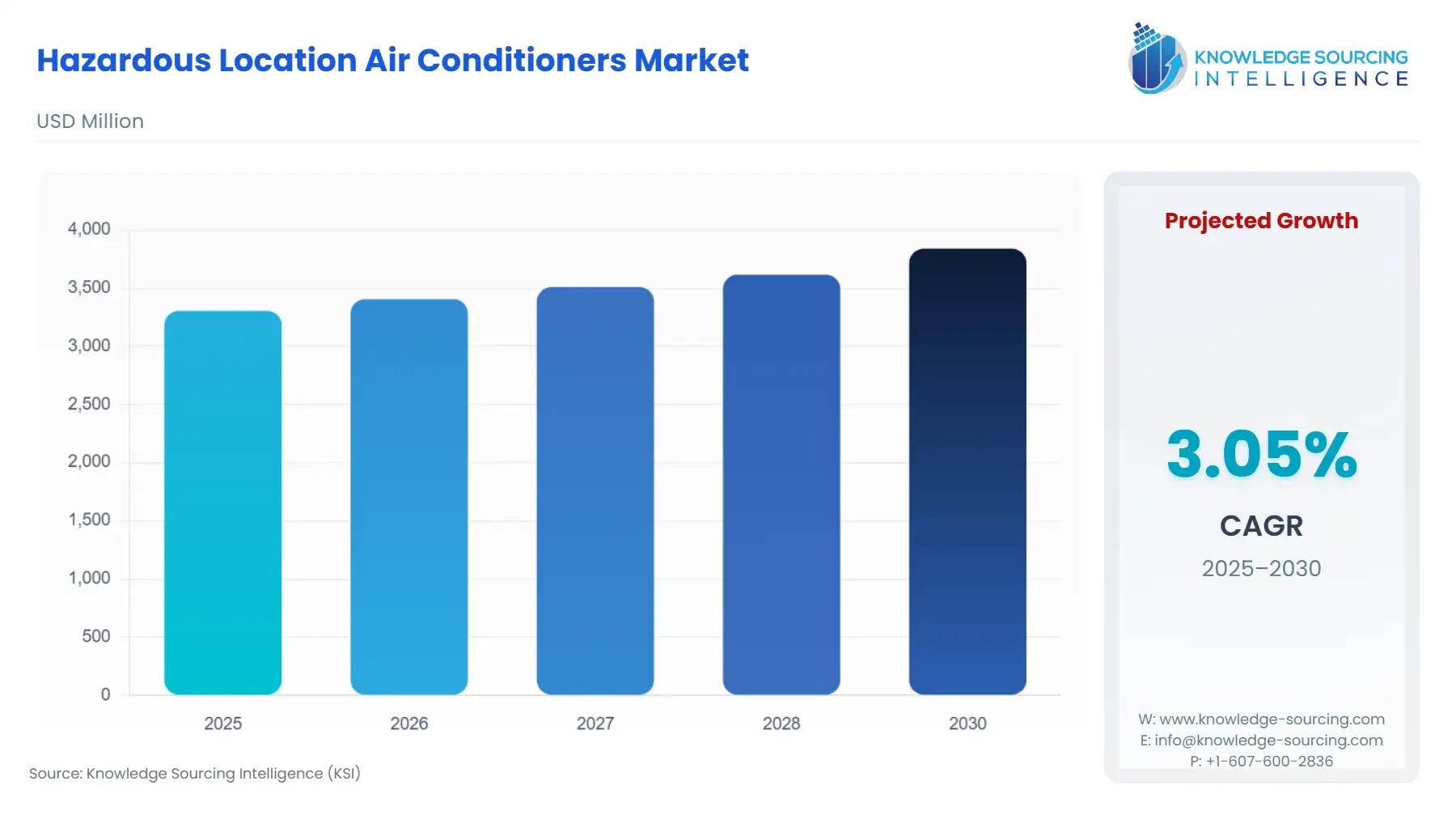

Hazardous Location Air Conditioners Market Size:

The Hazardous Location Air Conditioners Market will grow at a CAGR of 3.05% to be valued at US$3.841 billion in 2030 from US$3.306 billion in 2025.

Hazardous Location Air Conditioners Market Introduction:

The hazardous location air conditioners market has emerged as a critical segment within the broader HVAC industry, addressing the unique cooling needs of high-risk industrial environments where flammable gases, vapors, or dusts pose significant safety challenges. These specialized systems, often referred to as explosion-proof air conditioners, flameproof air conditioners, or ATEX-certified air conditioners, are engineered to operate safely in areas classified as hazardous due to the presence of ignitable substances. Industries such as oil and gas, petrochemicals, pharmaceuticals, mining, and chemical processing rely on these systems to maintain safe working conditions, protect equipment, and ensure compliance with stringent safety regulations. The industrial air conditioning hazardous areas sector is driven by the need for reliable temperature control in environments where standard HVAC systems could ignite volatile substances, leading to catastrophic consequences.

The global demand for hazardous location air conditioners is propelled by the expansion of industries operating in explosive atmospheres, particularly in regions with significant oil and gas production, such as the Middle East, North America, and Asia-Pacific. These systems are designed to prevent ignition risks by incorporating sealed electrical components, non-sparking motors, and corrosion-resistant enclosures. The market is also shaped by advancements in IECEx HVAC technologies, which ensure compliance with international safety standards for equipment used in explosive environments. As industries prioritize worker safety, regulatory compliance, and operational efficiency, the explosion-proof air conditioners market is witnessing steady growth, supported by innovations in energy efficiency and system design.

Several key factors drive the growth of the hazardous location air conditioners market:

- Stringent Safety Regulations: Governments and regulatory bodies worldwide, such as the European Union's ATEX directives and the International Electrotechnical Commission's IECEx standards, mandate the use of certified equipment in hazardous areas. Compliance with these standards is non-negotiable for industries operating in explosive environments, driving demand for ATEX-certified air conditioners and IECEx HVAC systems.

- Industrial Expansion in High-Risk Sectors: The global energy demand, particularly in oil and gas exploration, has led to increased investments in refineries, offshore drilling platforms, and petrochemical plants. These facilities require robust industrial air conditioning in hazardous areas to maintain safe temperatures and protect sensitive equipment. For instance, BP Oman's adoption of Ex-Machinery's explosion-proof air conditioners for its operations highlights the critical role of these systems in the energy sector.

- Technological Advancements: Innovations such as IoT-enabled flameproof air conditioners with real-time monitoring capabilities and energy-efficient designs are enhancing market appeal. Recently, a leading manufacturer introduced a new line of ATEX-certified air conditioners with advanced IoT features, allowing remote management in hazardous environments, thereby improving operational efficiency and safety.

- Focus on Worker Safety and Environmental Sustainability: Growing awareness of workplace safety and environmental concerns is pushing companies to adopt explosion-proof air conditioners that minimize energy consumption while ensuring compliance with safety standards. These systems also help maintain sterile environments in industries like pharmaceuticals, where volatile solvents are prevalent.

Despite its growth potential, the hazardous location air conditioners market faces several challenges:

- High Costs of Certification and Installation: Obtaining ATEX and IECEx certifications involves rigorous testing and documentation, which increases manufacturing costs. Additionally, installation by certified professionals familiar with hazardous area classifications adds to the overall expense.

- Complex Maintenance Requirements: Explosion-proof air conditioners require regular inspections to ensure seal integrity and compliance with safety standards. Unauthorized repairs can void certifications, necessitating manufacturer-approved parts and specialized technicians, which can be costly and logistically challenging.

- Limited Awareness in Emerging Markets: While developed regions like North America and Europe have stringent regulations driving adoption, emerging markets in Asia-Pacific and Africa may lack awareness or infrastructure to support widespread use of IECEx HVAC systems, limiting market penetration.

Types of Hazardous Location Air Conditioners:

Hazardous location air conditioners are categorized based on their design and application; each tailored to specific hazardous environments. The primary types include:

- Central Air Conditioners: These systems are used in large-scale industrial facilities, such as oil refineries and chemical plants, where high cooling capacities are required. They are often water-cooled for enhanced performance in high heat-load environments.

- Ductless Split Systems: Popular for their flexibility, these systems consist of an indoor unit (evaporator) and an outdoor unit (condenser). They are ideal for applications where only one unit needs ATEX or IECEx certification, as the outdoor unit can be placed outside the hazardous zone, reducing costs.

- Portable Units: These compact units are designed for temporary or mobile applications, such as offshore drilling platforms or construction sites, offering ease of installation and mobility.

- Vertical Units: Surface-mounted vertical units, such as those offered by Ice Qube, provide closed-loop cooling for enclosures in hazardous areas, with capacities ranging from 1,000 to 20,000 BTU/h. They are certified for Class I Division 2 and Zone 2 environments.

- Monoblock Systems: These integrate the evaporator and condenser in a single housing, suitable for compact installations in Zone 2 environments. Artidor’s monoblock systems, based on Toshiba and Daikin platforms, are designed for robust industrial use.

Certifications for Hazardous Location Air Conditioners:

To ensure safety in explosive atmospheres, hazardous location air conditioners must comply with rigorous certifications:

- ATEX Certification (EU): The ATEX directive (Atmosphères Explosibles) is mandatory for equipment used in hazardous areas within Europe. It categorizes environments into zones (0, 1, 2 for gases; 20, 21, 22 for dusts) based on the likelihood of an explosive atmosphere. ATEX-certified air conditioners are assessed for ignition risks and marked with an ATEX certificate.

- IECEx Certification (International): The IECEx system provides a global standard for explosion-proof equipment, ensuring compliance across countries. IECEx HVAC systems are tested for safety in Zone 1 and Zone 2 environments, offering international interoperability.

- NEC 500/505 (USA): The National Electrical Code (NEC) defines hazardous location classifications in North America, with Class I (gases/vapors) and Class II (dusts) divisions. Units certified under NEC 500/505 are designed for specific hazardous conditions.

- UL Listed (USA): Underwriters Laboratories (UL) certification ensures compliance with U.S. safety standards, particularly for explosion-proof air conditioners used in Class I Division 1 and 2 environments.

Hazardous Location Air Conditioners Market Trends:

Hazardous location air conditioners are specifically made for and used in locations that are vulnerable to explosions or have a chance of catching fire, to reduce temperature and make the operating area safe from hazards. The rising demand for energy around the world is leading to the growth of the energy sector, which is expected to increase the demand for hazardous location air conditioners during the forecast period. Furthermore, the growth of the mining industry and the increasing concerns regarding the workers’ safety who work in hazardous locations are some of the prominent factors anticipated to augment the growth of hazardous location air conditioners in the coming years.

The hazardous location air conditioners market is experiencing significant advancements driven by technological innovation and stringent safety requirements in high-risk industries like oil and gas, petrochemicals, and pharmaceuticals. A key trend is the integration of smart monitoring hazardous location AC systems, which leverage IoT for industrial cooling to enable real-time diagnostics and remote management. For instance, Ex-Machinery’s launch of IoT-enabled explosion-proof ductless split systems allows operators to monitor performance and detect issues proactively, enhancing safety and efficiency in Zone 1 and Zone 2 environments.

Another prominent trend is the focus on energy-efficient explosion-proof AC units. Manufacturers are developing systems with advanced heat exchangers and eco-friendly refrigerants, reducing energy consumption while maintaining compliance with ATEX and IECEx standards. Corrosion-resistant AC designs are also gaining traction, particularly in offshore and chemical facilities, where units with stainless steel or coated enclosures withstand harsh conditions, as seen in Shield Air’s Birdwell product line.

Additionally, air filtration in hazardous areas is becoming critical, with units incorporating advanced filtration to remove contaminants and maintain air quality in volatile environments. Ice Qube’s Evolution Series, updated in 2024, integrates high-efficiency filters for Zone 2 applications, ensuring cleaner air and equipment longevity. These trends reflect the market’s shift toward smarter, safer, and more sustainable cooling solutions for hazardous environments.

The global hazardous location air conditioners market features key players such as ABB Ltd., Siemens AG, Johnson Controls International plc, Emerson Electric Co., Honeywell International Inc., Danfoss A/S, and Klinge Corporation.

Hazardous Location Air Conditioners Market Drivers:

- Stringent Regulatory Compliance for Safety: The hazardous location air conditioners market is propelled by rigorous safety regulations mandating certified equipment in high-risk environments. Industries like oil and gas rig AC, petrochemical plant cooling, and chemical processing air conditioning must comply with standards such as ATEX and IECEx to prevent ignition risks in explosive atmospheres. These regulations ensure that offshore platform HVAC systems and units in hazardous waste management facilities use explosion-proof designs with sealed components. For example, the European Union’s ATEX directive requires certified mining ventilation and cooling systems to protect workers in Zone 1 and Zone 2 environments. Non-compliance can lead to severe penalties and operational shutdowns, driving demand for certified air conditioners. For instance, Ex-Machinery reported increased adoption of ATEX-compliant units in European petrochemical plant cooling applications, reflecting the regulatory push for safety. This trend ensures sustained market growth as industries prioritize compliance to safeguard operations and personnel.

- Expansion of High-Risk Industrial Sectors: The growth of industries operating in explosive environments, such as oil and gas rig AC, petrochemical plant cooling, and mining ventilation and cooling, significantly drives the market. Global energy demands have spurred investments in offshore platform HVAC systems, particularly in regions like the Middle East and North America. For instance, Ex-Machinery’s adoption of explosion-proof chemical processing air conditioning units underscores the need for reliable cooling in volatile settings. Similarly, hazardous waste management facilities require specialized air conditioners to maintain safe temperatures and prevent equipment failure. The rise in mining ventilation and cooling applications, especially in Australia and Africa, further fuels demand for robust systems that withstand dust and gas hazards. As these sectors expand, the need for certified, durable air conditioners grows, with manufacturers like Ice Qube developing high-capacity units for such environments.

- Technological Advancements in System Design: Innovations in hazardous location air conditioners are a key driver, with advancements enhancing safety and efficiency in oil and gas rig AC, petrochemical plant cooling, and offshore platform HVAC applications. IoT-enabled systems allow real-time monitoring, improving operational reliability in air conditioning in chemical processing, and ventilation and cooling in mining. Energy-efficient designs with eco-friendly refrigerants are also gaining traction, reducing operational costs while meeting ATEX and IECEx standards. Shield Air’s launch of corrosion-resistant units for offshore platform HVAC highlights the focus on durability in harsh conditions. These advancements cater to industries’ need for safer, smarter, and sustainable cooling solutions, driving market adoption across high-risk sectors.

Hazardous Location Air Conditioners Market Restraints:

- High Certification and Installation Costs: The hazardous location air conditioners market faces significant challenges due to the high costs associated with obtaining certifications like ATEX and IECEx. These certifications require extensive testing to ensure oil and gas rig AC and petrochemical plant cooling systems are explosion-proof, increasing manufacturing expenses. Installation also demands certified professionals familiar with hazardous area classifications, adding to costs. For instance, Artidor’s offshore platform HVAC units require specialized installation to maintain compliance, which can be prohibitively expensive for smaller facilities. Unauthorized modifications can void certifications, necessitating costly manufacturer-approved parts. This financial burden can deter adoption, particularly in cost-sensitive regions or smaller hazardous waste management facilities, limiting market growth despite the critical need for these systems.

- Complex Maintenance and Service Requirements: Maintaining hazardous location air conditioners is complex due to their specialized design for environments like air conditioning in chemical processing and ventilation and cooling in mining. Regular inspections are required to ensure seal integrity and compliance with safety standards, often involving certified technicians. For example, offshore platform HVAC systems must undergo rigorous checks to prevent ignition risks, using manufacturer-approved components to avoid voiding certifications. Unauthorized repairs can lead to safety violations, increasing downtime and costs. This complexity poses a challenge for industries with limited access to trained personnel, particularly in remote oil and gas rig AC or hazardous waste management facilities, restraining market expansion as companies grapple with logistical and financial hurdles to maintain compliance and operational safety.

Hazardous Location Air Conditioners Market Segmentation Analysis:

- The need for Explosion-Proof Air Conditioners is rising significantly: Explosion-Proof Air Conditioners dominate the hazardous location air conditioners market due to their critical role in ensuring safety in environments with flammable gases, vapors, or dusts. These units are engineered with sealed electrical components, non-sparking motors, and robust enclosures to prevent ignition in hazardous areas, such as Zone 1 and Zone 2 classifications. They are widely used in industries like oil and gas, petrochemicals, and pharmaceuticals, where volatile substances are prevalent. For instance, Ex-Machinery’s explosion-proof units, compliant with ATEX and IECEx standards, are designed for offshore platforms and chemical plants, offering high reliability in extreme conditions. Recent advancements include IoT-enabled monitoring for real-time diagnostics, enhancing operational safety. These systems are favored for their versatility, available in ductless split, portable, and monoblock configurations, catering to diverse applications. Their dominance is driven by stringent safety regulations and the need for certified equipment in high-risk settings.

- The Oil & Gas industry is predicted to hold a large market share: The Oil & Gas industry is the largest end-use segment for hazardous location air conditioners, driven by the sector’s extensive operations in explosive environments, such as drilling rigs, refineries, and offshore platforms. These facilities require robust cooling systems to maintain safe temperatures for equipment and personnel while preventing ignition risks. Explosion-proof and corrosion-resistant air conditioners are essential for oil and gas rig AC, ensuring compliance with NEC, ATEX, and IECEx standards. For example, Shield Air Solutions provides tailored HVAC systems for offshore oil platforms, designed to withstand harsh marine conditions. The segment’s growth is fueled by global energy demand, particularly in regions like the Middle East and North America. The oil and gas industry’s reliance on certified HVAC systems solidifies its position as the leading end-use market.

- North America is expected to lead the market expansion: North America, particularly the United States, Canada, and Mexico, leads the hazardous location air conditioners market due to its robust industrial base and stringent safety regulations. The U.S. oil and gas sector, a major consumer of explosion-proof air conditioners, drives demand, with facilities like refineries and offshore platforms requiring NEC-compliant systems. Specific Systems’ UL-listed units cater to Class I Division 1 and 2 environments, widely used in North American petrochemical plants. Canada’s mining and chemical industries also contribute, with Ice Qube’s Zone 2-certified units gaining traction for their compact design. Mexico’s expanding energy sector further boosts demand for ATEX and IECEx-certified systems. North America’s leadership is supported by advanced infrastructure, high regulatory compliance, and significant investments in hazardous area equipment, ensuring safety and operational efficiency across industries.

Hazardous Location Air Conditioners Market Key Developments:

- In November 2024, in a strategic move to enhance its presence in the hazardous location market, Red Sky Lighting, a harsh and hazardous lighting solution provider, entered into a partnership with Supra Desarrollos. While this is not a direct air conditioner launch or acquisition, the collaboration is a significant development in the broader hazardous location equipment market. It expands Red Sky Lighting's manufacturing and market reach in Mexico, which can directly influence the supply chain.

- In January 2024, Daikin, a global leader in HVAC, continued its strong focus on environmental sustainability by investing heavily in the transition to low-global warming potential (GWP) refrigerants, particularly R-32. This initiative affects its entire product portfolio, including units that can be converted for hazardous locations. Although there has been no single product launch for the hazardous market, this company-wide strategic shift is a significant development that impacts the entire industry by setting a new standard for eco-friendly and energy-efficient cooling technology.

Hazardous Location Air Conditioners Market Segmentation:

- By Product Type

- Explosion-Proof Air Conditioners

- Air-Cooled Hazardous Location AC Units

- Water-Cooled Hazardous Location AC Units

- Packaged HVAC Systems for Hazardous Areas

- By Cooling Capacity

- Below 5 Tons

- 5 to 10 Tons

- 10 to 20 Tons

- Above 20 Tons

- By End-User Industry

- Oil & Gas

- Chemical & Petrochemical

- Pharmaceutical & Healthcare

- Mining & Metals

- Power Generation & Utilities

- Marine & Offshore

- Food & Beverage

- By Regions

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- UK

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Indonesia

- Others

- North America