Report Overview

Global Tea Market - Highlights

Tea Market Size:

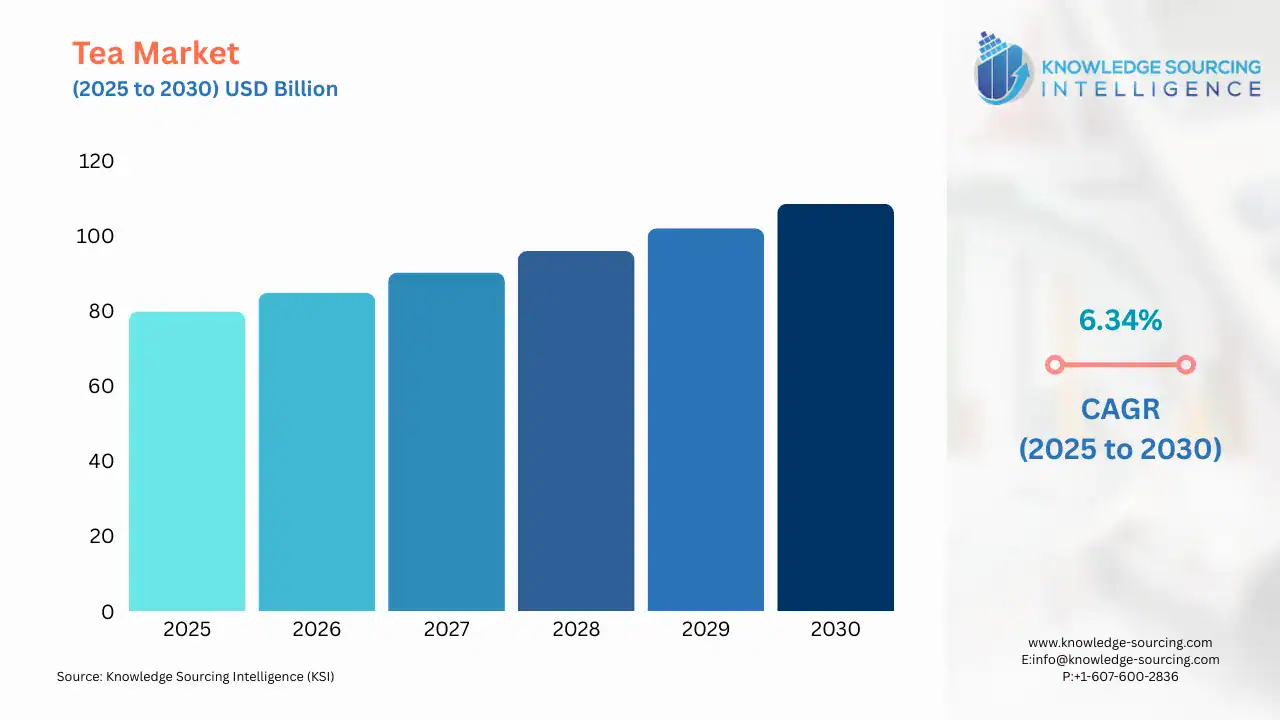

The global tea market is estimated to attain a market size of USD 108.457 billion by 2030, growing at a 6.34% CAGR from a valuation of USD 79.765 billion in 2025.

Tea has become one of the most popular beverages worldwide among people who prefer non-alcoholic beverages. It is expected to witness radical growth in the coming years because of the increasing tea culture in some parts of the world, such as China and India. It is also believed to have originated from there and spread worldwide in the last 2000 years. China's beverage, even today, has an essential place in Chinese society. The increase in the consumption of ready-to-consume products is linked to shifts in consumer behavior, particularly regarding iced teas, which are refreshing and popular among millennials. The above facts are fuelling market growth over the forecast period.

Another supporting factor is the growth in disposable income within the world's developing regions, which continues to promote tea consumption. It also makes it possible for continued demand, mainly in the Asia Pacific, where tea is forecast to grow consistently. High market growth prospects are predicted to develop due to the increasing awareness regarding the health benefits associated with tea. The diversifying range of tea products, from herbal tea and green tea to black tea, white tea, and many others, is very interesting for tea lovers and is a really enjoyable anticipation of market growth.

Tea Market Overview & Scope:

The global tea market is segmented by:

- Type: By type, the market is segmented into green tea, black tea, white tea, herbal tea, and others. The black tea segment is expected to hold the largest share, while herbal tea archiving is the fastest-growing segment. The black tea is deeply embedded in culture and daily consumption practices in various countries like India and the UK.

- Distribution Channel: By distribution channel, the market is divided into online and offline. Offline channels dominate the current market, due to consumer preference for personalized purchases and trust in the physical inspection of the tea. Meanwhile, the online channel is growing faster due to the rise in online shopping for products, including tea, followed by improved internet infrastructure globally.

- Beverage Type: By beverage type, the global tea market is divided into hot tea and cold/ iced tea. The hot tea segment holds a major share in the beverage type associated with the cultural significance of hot tea in regions like Asia Pacific and Europe, followed by health benefits, especially green and black tea.

- End Use: By end-use application, the market is segmented into key verticals such as residential and commercial. The residential segment is the largest share in the market because major tea consumption is done in households as a daily staple, and cost-effective health benefits boost the steady demand of tea in households.

- Region: Geography-wise, Asia Pacific is expected to take the largest share of the global tea market because the region is the premium tea consumer, as they have a culture of drinking tea from a very young age, coupled with major production of tea in the region, are major attributes driving the regional market. As per the pilot study on domestic consumption of tea in India 2024, the country is the second largest producer of tea in the world, while it is the largest producer of black tea globally. Moreover, the country is the fourth largest exporter of tea, with 83 percent of tea consumed domestically.

Top Trends Shaping the Global Tea Market:

- Rising Widespread Culture of Drinking Tea

Tea is increasingly being adopted globally by individuals who are health-conscious and by people who prefer non-alcoholic beverages. According to the Tea Association of the USA Inc., tea is the most widely consumed beverage after water and is present in 80 percent of United States households and according to the data from Tea Fact Sheet 2022 stated that on any day, more than 159 million Americans consume tea which can be serviced hot or iced.

Tea Market Growth Drivers vs. Challenges:

Drivers:

- Increasing Sustainably Produced Tea Demand: The growing demand for sustainable tea production amid the increasing environmental awareness has increased the adoption of Voluntary Sustainability Standards (VSS) to address certain issues in the tea market and propagate market growth. These standards provide tea consumers with more sustainable options. The production of VSS-compliant tea is focused on meeting consumer preferences. It aims to maintain the tea sector's sustainability through agricultural practices that enable climate resilience and prevention of soil erosion, lower the use of pesticides, increase profitability for smallholders, and improve the workers' conditions that include the provision of rights to collective bargaining, sanitation, and clean drinking water. This was enabled through the development of certain VSS, and a consumer as an end-user can help produce sustainability by encouraging production standards related to voluntary steps taken in the supply chain.

This further created a virtuous circle whereby demand for sustainable tea improved tea growers' conditions. Eventually, the environmental conditions under which it is produced will create greater incentives for investment. In the beginning, the demand for sustainable tea was primarily North American and European. This was to be utilized to become VSS and a green card to access the potentially lucrative markets, continued in exports, and meet growing domestic demands for the tea producers to have access to resources. Increasing instant mixed drink use is propelling the tea market's growth in the forecast period.

- Rise in Health Awareness and Working Population: There is an increase in consumers' awareness of health benefits associated with tea, which is being aided by the shifting consumer lifestyle, adoption of modern living circumstances, and the abandonment of conventional methods for preparing food and beverages.

Particularly in developing nations and in regions where cooking at home was ingrained in the tradition, this transition has been significant. The demand for various kinds of beverages has increased as a result of growing urbanization, rising personal disposable income, and an increase in the workforce, particularly female participation, which is also promoting the market.

According to the World Bank data, there is a steady increase in the labor force globally from 3.65 billion in 2023 to 3.69 billion in 2024. Meanwhile, female participation in the workforce increased from 39.8 percent in 2022 to 40.2 percent in 2023. As more individuals move towards developed cities, the demand for beverage premix and ready-to-drink tea options is expanding continuously.

- Growing Propensity for Premixed Instant Beverages: Increased preference for convenience food and beverage consumption has prompted increased demand for instant beverages such as instant tea, thus further propagating the market growth in the forecast period. The shift in lifestyle, particularly in developing countries and regions where home cooking was once common, reflects a growing trend away from traditional methods of preparing food and beverages. This change is indicative of broader cultural transformations. The growing urbanization and increased personal disposable and family income have increased the demand for such beverages. Women have also begun to earn equally as men in families and hence prefer instant beverage premix over time-consuming tea preparation.

Moreover, most of the developed regions are moving toward an individualistic lifestyle. In regions with higher disposable income, such as North America, consumers dislike spending time preparing food and strongly prefer recreational activities over home cooking. This promotes the demand for ready-to-make food and beverage products, thus accelerating market growth in the forecast period. Additionally, different types of instant tea premixes in demand, including instant masala tea, eliachi tea, ginger tea, and lemon tea, support robust market growth beyond the forecast period in satisfying diverse customers worldwide.

Challenges:

- Presence of Alternative Beverage Options: The fast-growing phenomenon of taking coffee worldwide could hinder market growth during the forecast period.

Tea Market Regional Analysis:

- North America: Tea demand is expected to see significant growth in North America. The growing culture of ready-to-drink beverages that offer higher convenience, followed by improved demand for varied flavors based on ethical & sustainable sourcing, has further impacted the overall tea imports in the USA. According to the International Tea Committee, in the first six months of 2024, tea imports for consumption stood at 10,034 metric tons, which marked a 5% growth over the import volume in 2024 for the same period. Likewise, the same source also specified that total black tea imports for the same duration reached 8,769 metric tons, showing 5.1% growth, and green tea imports stood at 1,265 metric tons, which showed 1.1% growth.

The cultural & social trends in the USA, especially among Gen-Z and millennials, are experiencing positive growth, which has propelled the market demand for tea among them. And with the ongoing establishment of cafes and snack points, the demand is projected to show further progression in the coming years.

Apart from the adoption of modern lifestyle and improvement in disposable income, ongoing product developments by US-based tea players and investment in new product launches have further paved the way for future market expansion. For instance, in October 2024, Bigelow Tea launched its new brand “Bigelow Butterfly Pea Flower,” which offers two unique herbal flavors, namely “Vanilla Midnight” and “Sapphire Bay”.

Tea Market Competitive Landscape:

The market is fragmented, with many notable players, including Tata Consumer Products Ltd, Associated British Foods plc, Nestlé, ITO EN, LTD, Barry’s Tea, Dilmah Ceylon Tea Company PLC, The Hain Celestial Group, Inc., Harney & Sons Fine Teas, Full Leaf Tea Company, Ohio Tea Company, and Unilever, among others.

- Product Launch: In September 2024, Twinings announced the launch of its new ready-to-drink Twinings Sparkling Tea. It is a refreshing beverage which is fortified with vitamins and minerals, including Vitamin C, to support individual wellbeing. It is developed by combining tea and botanicals with sparkling water and fruit juice, providing a refreshing taste for the consumers.

- Product Launch: In May 2024, the new green tea product portfolio was launched by Lipton teas and infusions. It consists of five newly reformulated blends along with fresh fruit flavors and supports consumer health with the presence of flavonoids.

Tea Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Tea Market Size in 2025 | US$79.765 billion |

| Tea Market Size in 2030 | US$108.457 billion |

| Growth Rate | CAGR of 6.34% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Tea Market |

|

| Customization Scope | Free report customization with purchase |

The Global Tea Market is analyzed into the following segments:

- By Type

- Green Tea

- Black Tea

- White Tea

- Herbal Tea

- Others

- By Distribution Channel

- Online

- Offline

- By End-Use Application

- Residential

- Commercial

- By Beverage Type

- Hot Tea

- Cold/Iced Tea

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Spain

- Others

- Middle East and Africa

- UAE

- Israel

- Saudi Arabia

- Others

- Asia Pacific

- Japan

- China

- India

- Indonesia

- Thailand

- Taiwan

- Others

- North America

Our Best-Performing Industry Reports:

Navigation

- Tea Market Size:

- Tea Market Key Highlights:

- Tea Market Overview & Scope:

- Top Trends Shaping the Global Tea Market:

- Tea Market Growth Drivers vs. Challenges:

- Tea Market Regional Analysis:

- Tea Market Competitive Landscape:

- Tea Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 15, 2025