Report Overview

Global Single Malt Whiskey Highlights

Single Malt Whiskey Market Size:

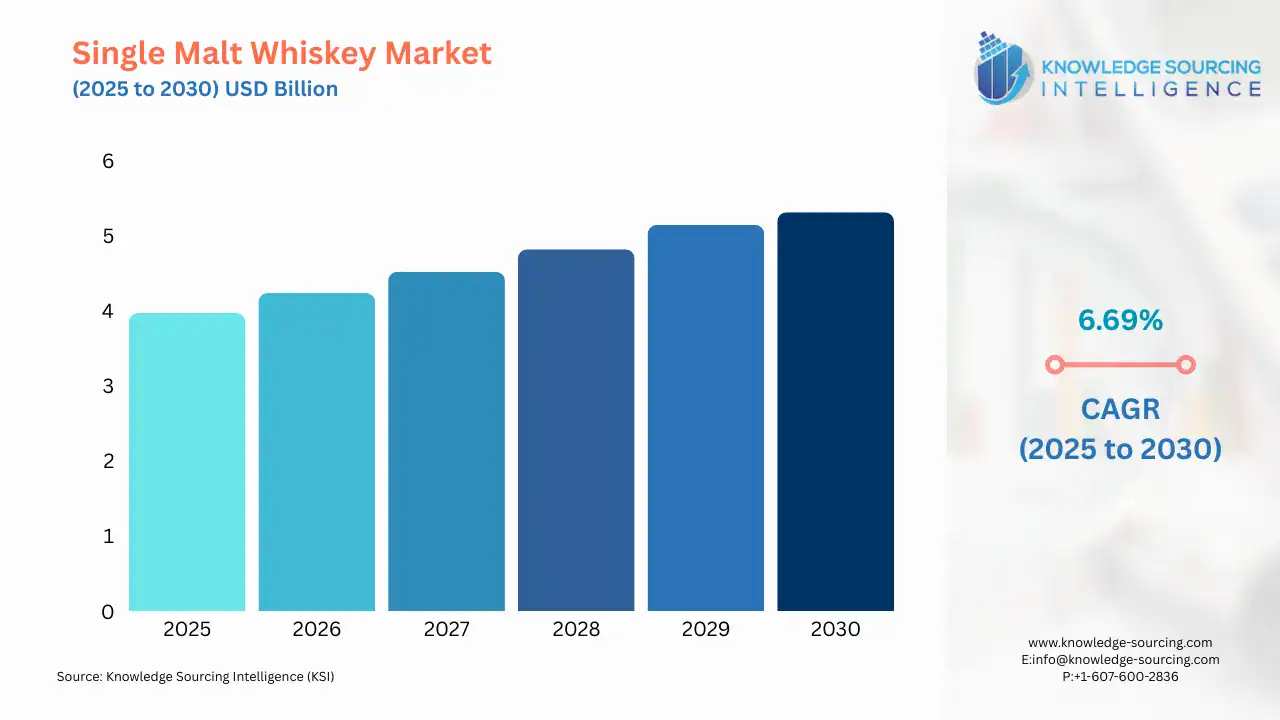

The global single malt whiskey market is projected to grow at a CAGR of 6.69% over the forecast period, increasing from US$3.969 billion in 2025 to US$5.311 billion by 2030.

Single malt whiskey, crafted primarily from malted barley and occasionally supplemented with unmalted grains like cornmeal or wheat, is renowned for its distinctive characteristics. When originating from a specific distillery, it earns the designation of single malt whiskey, often synonymous with the identity of that distillery. The rising trade of alcoholic beverages in the global market is among the key factors propelling the growth of single-malt whiskey during the forecasted timeline. For instance, the Scotch Whisky Association, in its report, stated that in 2023, the total Scotch whiskey export was recorded at GBP 5.6 billion, which is estimated at 74% of the total Scottish food and drinks exports in the year.

Moreover, the growing consumption of whiskey, especially for the premium category across the globe, is among the major factors propelling the growth of the single malt whiskey market. Additionally, the increasing global trade of whiskey and alcoholic beverages is also expected to boost the market during the forecasted timeline.

Single Malt Whiskey Market Growth Drivers:

- Growing global whiskey consumption is accelerating the market growth

The major factor propelling the demand for single malt whiskey during the forecasted timeline is the increasing global whiskey consumption, and as the beverages offer key benefits over other types of alcohol hence it also adds a sense of higher quality to the consumers. The global consumption of whiskey witnessed significant growth, majorly with the rising global disposable income and the rising demand for the food service sector in the market. Further, the Whiskey Magazine, in its article, stated that the production of whiskey in the Indian market witnessed a major growth during the recent few years. The magazine stated that in India, the sales of domestically produced single malt witnessed an increase of 25% in 2023.

Similarly, as per the Distilled Spirits Council of the United States, the sales whiskey market in the US stated that in 2023, a total of 31,110 thousand 9-litre cases of American whiskey were sold, with 6,554 thousand 9-litre cases of premium and 15,032 thousand 9-litre cases of high-end premium whiskey sold in the nation.

- The growing demand for luxury spirits is anticipated to increase the market demand

The rising popularity of luxury spirits as customer preferences change is a primary driver of the global Single Malt Whiskey Market's growth. The new trend of 'drinking less but better' would mean higher consumption of pure alcohols, according to Vinexpo, the global brand producing and promoting key features in the wine and spirits industry. According to sources, it would be a shift from wine or beer types of drinking to whisky. Moreover, the pure flavour associated with Single Malt Whiskey contributes massively to its popularity with younger customers, fuelling the market. Launching new products and a rise in demand for luxury single malt whiskey drive the growth of the market.

- Rising technological advancement is further propelling the market growth

The purchase of alcoholic products from e-commerce has become a popular trend among consumers and is expected to continue in this direction for many years into the forecast. Online shopping brings numerous advantages for customers: obtaining one's supplies right on time at home, a very quick shopping experience for the consumer, and the accessibility of various deals. This is indeed an important online channel in the larger economies. For instance, the government statistics state that online sales of alcohol are expected to grow by around 15% on an annual basis in the developed regions of North America and Europe. Therefore, manufacturers concentrate on creating new channels in e-commerce along with strategic partnerships. Rest assured, the market will certainly go a notch higher with advancing technology and improvement in distribution networks within e-commerce.

Single Malt Whiskey Market Segment Analysis:

- By type, scotch whiskey is anticipated to grow during the forecast period

Scotch whisky is a world-renowned distilled alcohol produced in Scotland using cereals, water, and yeast. The whisky has a characteristic smoky flavour because of the raw materials and the distillation procedure. With the increasing demand from consumers for luxury products, the market will grow significantly. For instance, the Scotch Whiskey Association reported that exports of scotch whiskey to the world amounted to £2.1 billion in H1 2024. Diverse tastes are already stimulating the industry, including combinations such as malt and honey, dry fruit and nut, elegant and floral notes, fresh fruit and vanilla. This range of flavours attracts new customers year after year.

Moreover, single malt scotch whisky beverages associated with rich and extravagant lifestyles are a very crucial factor as the reason driving the growth of this market. Consumers from mature developed markets are highly attracted to acquiring premium alcoholic beverages. This has pushed the manufacturers to work more on flavour-appealing products because the emerging category of consumers in developed markets today are 'whisky aficionados' , becoming taste inspectors.

- By distribution channel, the specialised retailers’ segment is anticipated to grow during the forecast period

Specialist retailers have played an important role in this market expansion, meeting the increased demand for distinctive and quality single malt options. They provide access to a broad selection, including exclusive and limited editions, to improve customer experience. Moreover, the growing interest in whiskey tourism has facilitated further growth in the market, with enthusiasts travelling to distilleries and speciality stores to seek out and acquire single malt whiskeys.

Further, these retailers have gained dominance based on two-fold: offering a tailored shopping experience for whiskey connoisseurs. Usually, they employ trained professionals who help in selecting consumers based on their needs and preferences. This makes consumers very loyal and repeat customers

Single Malt Whiskey Market Geographical Outlook:

- Asia Pacific is witnessing exponential growth during the forecast period

Single malt whiskey has formed one of the major premium alcohols valued for its flavour depth and complexity, and due to this, they are mainly used in parties, social gatherings, and other functions. Being one of the major economies, the demand for premium alcoholic beverages is witnessing positive growth in the United States, and with the growing party culture in the economy, demand is further expected to show an upward trajectory. Additionally, improvement in consumer purchasing power, followed by the rapid progress in living standards, has increased overall alcohol consumption in the economy. Further, commercial activities and social gatherings have provided a major boost to alcoholic beverage consumption and with the ongoing increase in demand for varied distilled spirits flavours, inclusive of wines and whiskey, the market is further anticipated to expand at an exponential rate.

Moreover, major market players have well-established their businesses in the United States and are aiming to optimize the growing demand for drinks that outperform the traditional concepts of alcoholic beverages. According to the annual report of Brown Forman, the company generated US$1,968 million in revenue sales from the United States, which showcased an increase of 2.66% over the 2022 revenue. The company in fiscal year 2024 also launched its Jack Daniel’s American Single Malt Whiskey in travel retail.

Single Malt Whiskey Market Key Launches:

- In November 2024, Bacardi India launched a new variant of its Irish spirit, Teeling Whiskey – Small Batch, specifically in the Indian market. Tapping into the growing demand for whiskey in Indian segment, which has become increasingly popular in the country over the years, new variants have been crafted especially for the Indian market.

- In November 2024, Bacardi revealed a significant investment in its Scotch whisky production infrastructure across Scotland, including the finalization of various improvement projects on its distilleries, among them the three new ageing warehouses added at the Poniel blending and maturation centre, boosting capacity by over 15%.

List of Top Single Malt Whiskey Companies:

- Bacardi

- Beam Suntory (Suntory Holdings Limited)

- Brown- Forman

- Diageo

- Pernod Ricard

Single Malt Whiskey Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Single Malt Whiskey Market Size in 2025 | US$3.969 billion |

| Single Malt Whiskey Market Size in 2030 | US$5.311 billion |

| Growth Rate | CAGR of 6.69% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Single Malt Whiskey Market |

|

| Customization Scope | Free report customization with purchase |

Single Malt Whiskey Market Segmentation:

- By Type

- Scotch Whiskey

- American Whiskey

- Irish Whiskey

- Others

- By Distribution Channel

- Supermarkets and Hypermarkets

- On-Trade

- Specialist Retailers

- Online

- Convenience Stores

- By Geography