Report Overview

Global Service Delivery Automation Highlights

Service Delivery Automation Market Size:

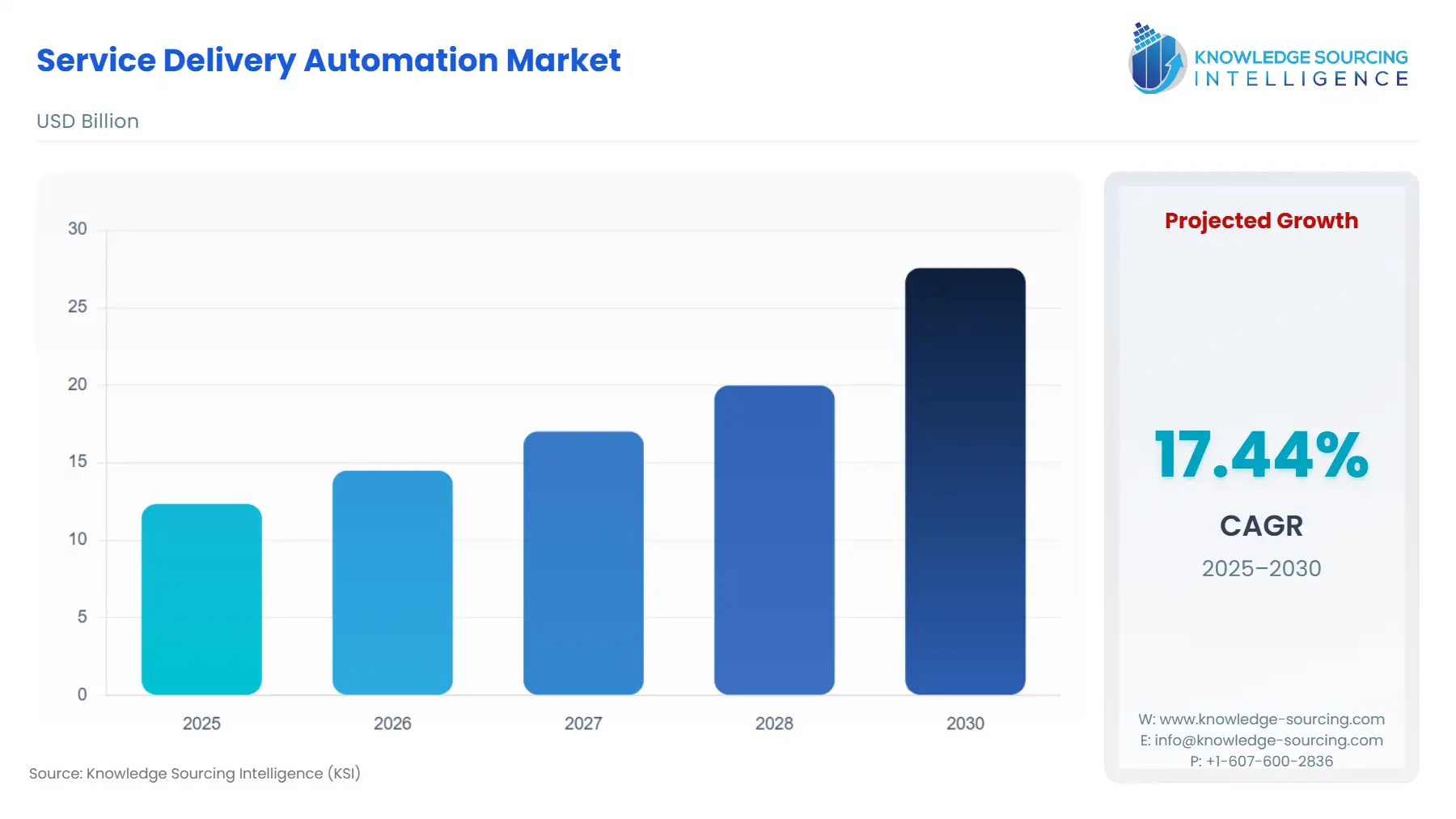

The Global Service Delivery Automation Market is expected to grow from US$12.335 billion in 2025 to US$27.559 billion in 2030, at a CAGR of 17.44%.

Service delivery automation encompasses technologies that streamline the provisioning, management, and optimization of IT and business services, encompassing tools like robotic process automation (RPA), AI-driven orchestration, and machine learning algorithms for predictive maintenance. Enterprises deploy these systems to orchestrate workflows across hybrid infrastructures, ensuring reliability in an era where service disruptions can erode competitive edges. The market emerges at the intersection of digital transformation imperatives and operational resilience needs, where organizations face mounting pressures from volatile supply chains and escalating customer expectations for instantaneous, error-free interactions.

The evolution of this domain traces back to foundational IT service management practices, but recent accelerations stem from the convergence of cloud-native architectures and edge computing, which demand automated governance to handle distributed workloads. In practice, automation mitigates the silos that plague traditional service desks, fostering a unified layer for incident resolution and resource allocation. This not only curtails downtime but also reallocates human capital toward strategic innovation, a shift particularly acute in knowledge-intensive industries.

Global adoption reflects a broader reconfiguration of value chains, where service delivery automation serves as a linchpin for agility. For instance, in logistics-heavy sectors, automation tools synchronize real-time data flows, pre-empting bottlenecks that could cascade into revenue losses. As enterprises scale, the imperative to embed intelligence into service pipelines intensifies, transforming static processes into adaptive ecosystems capable of self-healing and continuous improvement.

Global Service Delivery Automation Market Analysis

- Growth Drivers

Technological maturation in artificial intelligence propels demand for service delivery automation by empowering systems to execute nuanced, context-aware tasks that previously required human intervention. Enterprises increasingly integrate AI to automate anomaly detection in service pipelines, where algorithms analyze vast datasets from network logs and user interactions to forecast disruptions before they manifest. This capability directly escalates adoption, as organizations in high-stakes environments like telecommunications report reductions in mean time to resolution through AI-orchestrated workflows. The result manifests in heightened procurement of AI-infused platforms, as firms seek to sustain service level agreements amid escalating transaction volumes driven by e-commerce proliferation.

Growing machine learning algorithms further catalyse market expansion by enabling predictive scaling of service resources, addressing the volatility inherent in cloud-hybrid deployments. In scenarios where demand surges unpredictably, such as during peak retail seasons, ML models dynamically allocate compute and storage, preventing over-provisioning that inflates costs. This driver intensifies the need for automation suites that embed ML for continuous optimization, particularly among large enterprises managing global footprints. Consequently, the demand curve steepens as businesses prioritize ML-enabled automation to mitigate risks from resource underutilization, fostering a virtuous cycle of efficiency and investment.

Labor market frictions, including acute shortages in skilled IT roles, compel organizations to automate routine service functions, thereby amplifying uptake of RPA and orchestration tools. Aging workforces in North America and Europe erode manual oversight capacities, prompting a pivot toward bots that handle ticket triage and configuration management. This shift directly boosts demand, as evidenced by sector reports indicating that automation adoption correlates with a decline in unfilled positions for service desk analysts in automated firms. Enterprises, facing high recruitment costs, turn to these technologies to bridge gaps, ensuring uninterrupted service flows without proportional headcount growth. In manufacturing, for example, RPA deployment automates compliance checks in production scheduling, freeing engineers for value-added diagnostics and sustaining output amid talent constraints.

The inexorable transition to service-dominant logics in global economies underscores the demand for automation that unifies disparate service silos into cohesive delivery engines. As businesses evolve from product-centric models to ecosystems where services constitute majorly in GDP in OECD nations, per economic outlooks from the European Commission, the pressure mounts for tools that govern end-to-end lifecycles, from provisioning to decommissioning. This paradigm demands automation platforms that enforce standardization across multi-vendor environments, curbing integration overheads that can exceed a certain percentage of IT budgets. Demand surges particularly in BFSI, where regulatory scrutiny on transaction integrity necessitates automated audit trails, driving procurement of solutions that embed traceability without compromising velocity.

- Challenges and Opportunities

Integration hurdles with legacy infrastructures pose significant constraints on service delivery automation demand, as enterprises contend with interoperability gaps that inflate deployment timelines and costs. Many organizations harbour siloed systems predating cloud eras, where retrofitting automation layers risks operational disruptions, deterring adoption among risk-averse sectors like manufacturing. This friction dampens demand amid compatibility issues, thereby compelling firms to defer investments in favour of incremental upgrades. Consequently, smaller entities face amplified barriers, as customization expenses erode ROI projections, constraining market penetration in resource-limited markets.

Skill shortages in automation governance exacerbate these challenges, limiting the effective scaling of service delivery tools and curbing broader demand uptake. With demand for certified RPA architects outpacing supply, especially in OECD regions, the enterprises struggle to operationalize advanced features like ML tuning. This talent vacuum not only prolongs time-to-value but also heightens error rates in automated workflows, fostering hesitancy among executives wary of reliability shortfalls. In turn, demand contracts in high-precision domains such as healthcare, where untrained oversight could precipitate compliance lapses, underscore the need for ecosystem-wide upskilling to unlock latent potential.

Regulatory ambiguities surrounding data sovereignty further impede automation diffusion, as varying jurisdictional mandates complicate cross-border service orchestration. Enterprises navigating fragmented rules on data localization face elevated compliance overheads, with non-adherence risks amplifying to fines exceeding a certain portion of global revenues under emerging AI directives. This uncertainty suppresses demand, particularly in multinational deployments, where harmonization efforts lag behind technological pace, as highlighted in EU policy briefings on digital transformation. Sectors like retail, reliant on seamless global service chains, witness deferred procurements, tempering growth trajectories until clearer guidelines emerge.

Advancements in open-source automation frameworks present opportunities to democratize access, spurring demand among SMEs previously side-lined by proprietary lock-ins. These platforms lower entry barriers, thereby enabling cost-effective integrations that align with modular service architectures. By fostering collaborative ecosystems, they catalyse adoption in emerging verticals like travel and hospitality, where agile automation enhances personalized service routing, potentially expanding the market in underserved segments.

Edge computing synergies offer another avenue to invigorate demand by enabling low-latency automation at distributed nodes, ideal for latency-sensitive applications in logistics. This convergence allows real-time service adjustments without central bottlenecks, addressing deployment delays in remote operations. Likewise, ethical AI integrations unlock prospects for differentiated offerings, as enterprises prioritize transparent automation to navigate bias risks in decision engines. By embedding auditability, providers can command premium pricing in regulated sectors like BFSI, where trust deficits erode a certain percentage of potential revenues, as per European Commission assessments. This focus not only mitigates reputational hazards but also aligns with sustainability mandates, positioning automation as a vector for green service delivery and broadening demand in eco-conscious markets.

- Raw Material and Pricing Analysis

Pricing and availability are influenced by global supply chains, with hardware costs comprising a major share of total automation system expenses. The recent U.S.-China export restrictions on rare earths and critical minerals will spike the price, followed by logistical frictions from talent mobility restrictions and data sovereignty rules, complicating cross-border code merges.

- Supply Chain Analysis

Service delivery automation's supply chain centers on intangible dependencies: global software development talent, cloud infrastructure, and open-source libraries. Key hubs cluster in North America for innovation (Silicon Valley) and Asia-Pacific for scaling (India's engineering pools). Recent U.S. tariffs on imported tech components targeting semiconductors underpinning AI accelerators elevate hardware costs indirectly, pressuring cloud pricing and thus automation deployment fees. Providers mitigate via domestic sourcing, but this fragments ecosystems, heightening integration overheads for end-users.

Service Delivery Automation Market: Government Regulations & Programs

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

European Union |

AI Act / European Commission |

Elevates demand for transparent, low-risk automation in BFSI by requiring bias audits, reducing adoption friction for certified platforms but delaying non-compliant pilots by months, thereby fostering growth in ethical AI integrations. |

|

United States |

NIST AI Risk Management Framework / National Institute of Standards and Technology |

Bolsters enterprise confidence in automation scalability, driving an uptake in federal-adjacent sectors like healthcare through voluntary guidelines that prioritize resilience; minimal barriers but incentivize U.S.-centric supply chains amid export controls. |

Service Delivery Automation Market Segment Analysis

- By Type: IT Process Automation

Based on type, IT process automation is expected to grow at a considerable rate, thereby accounting for a considerable market share. IT process automation commands a pivotal role in the service delivery ecosystem, driven by imperatives to orchestrate complex, multi-step workflows in dynamic environments. Core demand stems from the proliferation of hybrid IT infrastructures, where disparate tools fragment oversight, compelling enterprises to automate provisioning and remediation to avert outages attributable to manual errors. In large-scale deployments, such as those managed by global technology services providers, automation tools enforce policy-driven configurations across virtual and physical assets, directly addressing scalability bottlenecks that plague most IT leaders.

This segment's traction intensifies through integration with monitoring stacks, enabling proactive incident deflection that slashes resolution times. For instance, in transport and logistics, IT process automation synchronizes network services with fleet telemetry, pre-empting downtime in just-in-time operations and fuelling annual demand surge in export hubs like Mexico. Enterprises prioritize vendors offering extensible APIs, as these facilitate seamless chaining with legacy systems, mitigating integration costs that average a certain portion of total ownership. Moreover, the push for zero-touch deployments, automating patch cycles, and compliance validations aligns with regulatory escalations, embedding demand in sectors facing audit pressures, where non-automated processes risk penalties exceeding operational budgets.

- By End-User: BFSI

Based on end-user, the BFSI sector is projected to constitute a considerable market share. The segment exemplifies how service delivery automation addresses precision demands in high-volume, regulated transactions, with core drivers rooted in the need for frictionless compliance amid exploding data volumes. Automation platforms automate KYC validations and fraud detection, processing terabytes in real-time to counter threats. This capability directly escalates procurement, as banks integrate RPA for end-to-end loan origination, reducing cycle times from days to hours and unlocking capital for reinvestment.

Demand surges from digital banking accelerations, where AI-embedded automation personalizes service routing, enhancing customer retention through predictive engagement. In emerging markets like Brazil, regulatory pushes for ethical AI under Bill 2338/2023 amplify needs for transparent bots in credit scoring, fostering localized adaptations that boost adoption. Large enterprises, handling the majority of global transactions, favour scalable solutions that embed ML for anomaly hunting, curtailing false positives that erode trust and inflate operational drags.

Service Delivery Automation Market Geographical Analysis

The global service delivery automation market analyzes growth factors across the following regions

- North America: The growing technological advancements, followed by the establishment of AI-centric strategies, and investment to bolster digital automation, have played an integral role in driving the service delivery automation in major regional economies, namely the United States and Canada. Moreover, ongoing efforts to improve cybersecurity infrastructure to prevent data theft have also impacted the overall usage in such nations. According to the “2025 H1 Data Breach Report” by Identity Theft Resource Center, the number of cyberattacks in the first half of 2025 stood at 1,348, which affected nearly 114,582,621 victims.

- Europe: Major European economies, namely Germany, the United Kingdom, France, and Spain, are investing to bolster the “Industry 4.0” concept, which has provided a framework for integration of technological options such as Artificial Intelligence (AI) in business operations, thereby accelerating the level of automation. Such efforts have stimulated the regional market expansion.

- Asia Pacific: Automation trend has gained traction in the Asia Pacific region, with regional nations such as China outlining policies under their “14th Five-Year Plan” to improve automation synchronization. Likewise, other major economies such as India are experiencing a considerable growth in AI-adoption, which has provided new growth prospects for service delivery automation in the country’s major sectors such as BFSI, manufacturing, and retail.

- South America & MEA: The strategic investment undertaken to bridge infrastructure gaps, followed by the implementation of industrial digital transformation programs, is driving the market for service delivery automation in South America, while the growing transition towards Artificial Intelligence (AI) has positively impacted the market in the MEA region.

Service Delivery Automation Market Competitive Environment and Analysis

The competitive arena for service delivery automation features intense rivalry among incumbents leveraging proprietary ecosystems to dominate integration layers.

- IBM positions itself as a full-stack orchestrator, including the company’s “Automation Decision Service,” emphasizing hybrid service governance in enterprises. Its strategic alliances with Red Hat fortify open-hybrid capabilities, capturing a considerable share in IT process segments through resilient, API-first architectures.

- UiPath excels in RPA-centric agility, with press overviews detailing agentic bots that automate the majority of rule-based tasks. Its marketplace model fosters extensibility, securing BFSI traction via low-code interfaces that reduce deployment, thereby underscoring a pivot toward composable automation.

Service Delivery Automation Market Developments

- April 2025: UiPath launched its next-generation “UiPath Platform” that integrates AI-agents, robots, and people in a single platform, thereby providing unmatched scalability, flexibility, and security compliance in enterprises for agentic automation. The platform is accessible through uipath.com

- June 2024: Automation Anywhere, Inc announced the launch of its “AI+ Automation Enterprise System,” which features the company’s second-generation GenAI process model that further accelerates the development and deployment of AI process automation in an organization, thereby driving efficiency in its business workflows, including customer service operations.

Service Delivery Automation Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Service Delivery Automation Market Size in 2025 | US$12.335 billion |

| Service Delivery Automation Market Size in 2030 | US$27.559 billion |

| Growth Rate | CAGR of 17.44% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Service Delivery Automation Market |

|

| Customization Scope | Free report customization with purchase |

Service Delivery Automation Market Segmentation:

- By Type

- IT Process Automation

- Business Process Automation

- By End-User

- Large Enterprise

- Small & Medium Enterprise

- By Industry Vertical

- Healthcare

- BFSI

- Travel & Hospitality

- IT & Telecommunication

- Transport & Logistic

- Retail

- Others

- By Geography

- North America

- USA

- Mexico

- Canada

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- India

- China

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

- North America