Report Overview

Global Sand Control Solutions Highlights

Sand Control Solutions Market Size

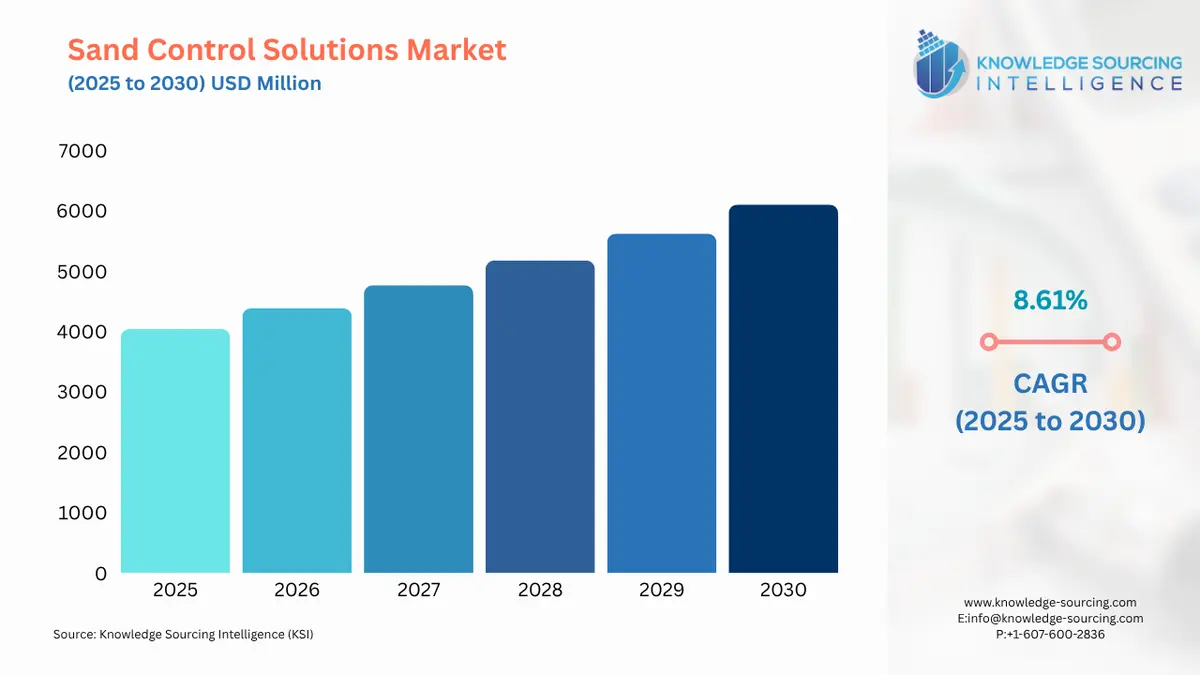

The Global Sand Control Solutions Market is expected to grow at a CAGR of 8.61%, reaching a market size of US$6,106.05 million in 2030 from US$4040.25 million in 2025.

Sand Control Solutions refer to using those equipment and techniques that help prevent the flow of sand towards a wellbore or its vicinity. It is used to maintain the structural integrity of the reservoir around the wellbore. These solutions are essential in hydrocarbon extraction as they minimize sand production, which could otherwise lead to equipment damage, increasing operational costs.

The sand control solutions market is growing steadily, driven by rising investments in the oil and gas sector. The push toward sustainable energy, backed by significant funding for low-carbon technologies, is also creating market opportunities. Additionally, the need to improve the reserve-to-production ratio in both existing and aging wells is increasing demand for efficient sand control solutions as operators focus on enhancing well productivity and longevity. Further, operators are aiming for safer, more efficient, and sustainable oil & gas extraction processes, prioritizing cost optimization. Thus, all the factors combined are driving the market growth of global sand control solutions.

The sand control solutions market consists of various equipment and solutions like gravel packs, sand screens, chemical treatments, frac packs, and many more. These are designed to control the sand particles from entering the wellbore during oil and gas production. The market is segmented into open holes and cased holes based on the type of wellbore. Based on deployment, it is segmented into offshore and onshore.

What are the Global Sand Control Solutions Market Drivers?

- Increasing oil and gas production is leading the market growth of global sand control solutions

The global energy demand is rising continuously with the increasing population and industrialization. This has led to increasing demand for hydrocarbon extraction methods for more oil & gas production. As per the U.S. Energy Information Administration, the United States of America's crude oil production has surged from 5484 thousand barrels per day in 2010 to 12.935 thousand barrels in 2023. As the demand for oil and gas is continuously rising, the need for sand control solutions is also growing.

- Focus on cost optimization by operators of wellbore is leading to a steady increase in the sand control solutions market

Wellbore operators are aiming for a safer, more sustainable, and more efficient oil and gas extraction process. They want to minimize their production and extraction cost by preventing the sand produced during the hydrocarbon extraction process. Sand control solutions and equipment help prevent equipment damage, thus reducing sand-related issues. The increased focus on cost optimization by the operator of wellbores, more specifically for mature wellbores, is leading to a steady growth of global sand control solutions.

Segment Analysis of the Global Sand Control Solutions Market:

- The offshore segment is anticipated to hold the dominant market share in the forecast period

The offshore segment refers to managing oil and gas production processes in offshore environments such as deepwater. Compared to onshore deployment, these sand control segments face unique challenges, such as high pressure, complex geological conditions, etc. According to the International Energy Agency, the production of energy through offshore winds is expected to rise in the coming years as the potential of offshore winds is greater than it is being utilized today. With high-quality resources available in the market, offshore winds have the potential to generate 420,000 TWh worldwide, which is almost 18 times the demand for electricity today. Moreover, the operational cost of an offshore plant has declined noticeably over the years, pushing approximately 90 major offshore projects into establishment in the coming years, further driving the market of sand control solutions during the forecast period.

- Middle East & Africa (MEA region) is anticipated to grow at a significant rate.

The Middle East & Africa (MEA) region is anticipated to grow at a significant market rate during the forecast period. This considerable growth in the MEA region is due to rapid development in the oil & gas sector in several countries, such as Kuwait, UAE, Saudi Arabia, Iran, etc. At the same time, the oil and gas sector has been the traditional backbone of the MEA countries, resulting in the prevalence of many mature wellbores that need more sand control solutions. With rapid oil & gas market development, the demand for sand control solutions is also increasing.

Major Challenges in the Global Sand Control Solutions Market:

- Huge investment in infrastructure building is posing a challenge for market growth.

Development and deployment of sand control solutions require a lot of investment. Thus, a high capital cost is associated with deploying these solutions. At the same time, the deployment of sand control solutions also requires time, leading to delays in operations in the oil and gas industry and increasing the cost associated with production. Thus, huge investments in sand control solutions are limiting the operators from adopting sand control solutions, restraining the sand control solutions market expansion.

Key Developments in the Global Sand Control Solutions Market:

Sand Control Solutions Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Sand Control Solutions Market Size in 2025 | US$4040.25 million |

| Sand Control Solutions Market Size in 2030 | US$6,106.05 million |

| Growth Rate | CAGR of 8.61% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Sand Control Solutions Market |

|

| Customization Scope | Free report customization with purchase |

The Global Sand Control Solutions market is segmented and analyzed as given below:

- By Well Type

- Open hole

- Cased hole

- By Deployment

- Offshore

- Onshore

- By Type

- Gravel Pack

- Frac Pack

- Sand Screens

- Inflow Control Devices

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

- North America