Report Overview

Radar Sensor Market Report, Highlights

Radar Sensor Market Size:

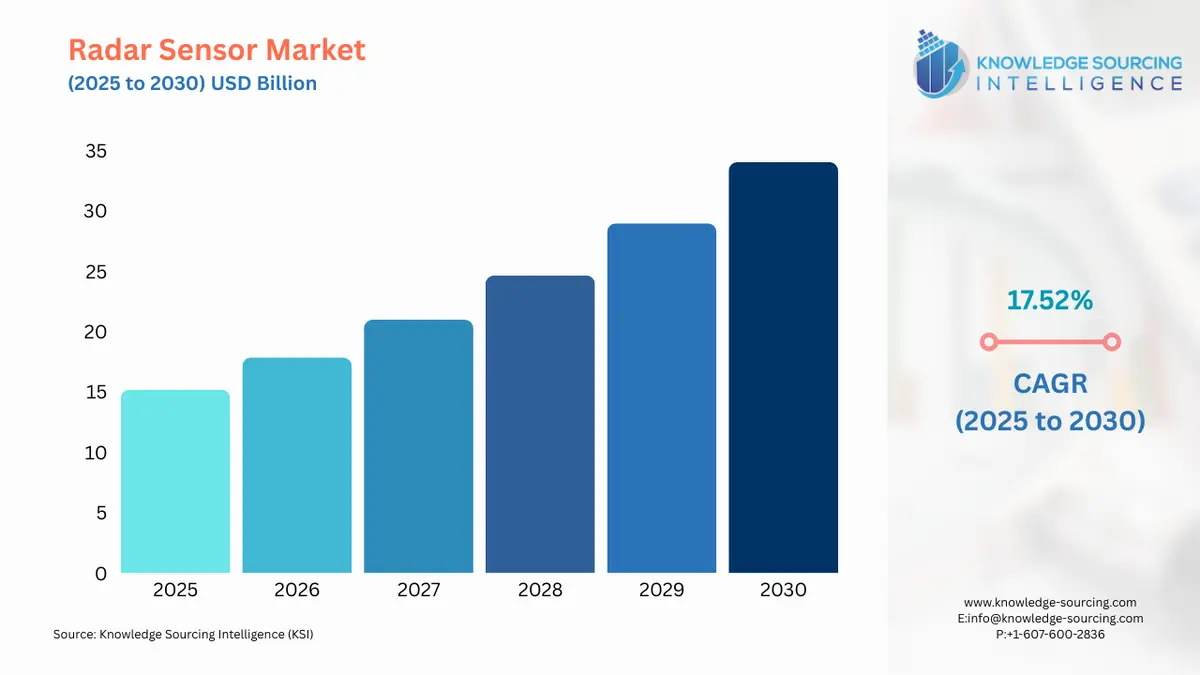

The global radar sensor market will grow at a CAGR of 17.52% from USD 15.189 billion in 2025 to USD 34.042 billion in 2030.

Radar Sensor Market Trends:

The radar sensor market is experiencing significant growth, driven by the widespread adoption of radar sensors across multiple industries, including automotive, aerospace and defense (A&D), and military applications. These sensors excel in detecting, locating, and tracking objects, making them essential for enhancing safety and efficiency in various systems.

A primary growth driver is the increasing integration of Advanced Driver Assistance Systems (ADAS) and autonomous vehicles in the automotive industry. Radar sensors enable critical safety features such as adaptive cruise control, collision avoidance, and guided parking assistance, improving vehicle safety and driver convenience. The rise of electric vehicles (EVs) and self-driving technology further amplifies demand for advanced radar technology to ensure precise object detection and navigation.

In the aerospace and defense sector, radar sensors are vital for applications like surveillance, target tracking, and navigation systems, supporting national security and military operations. The growing emphasis on smart defense systems and unmanned aerial vehicles (UAVs) drives market expansion. Additionally, industrial automation and smart infrastructure leverage radar sensors for motion detection and environmental monitoring.

North America leads the market, fueled by early adoption of technological advancements and substantial government investments in defense and automotive innovation. Asia-Pacific, particularly China and Japan, is also a key growth region due to rapid industrialization and automotive production. Manufacturers are investing in radar sensor technology and product innovation, developing high-performance, cost-effective solutions to meet evolving demands. The radar sensor market is poised for robust growth, driven by safety regulations, autonomous driving, and global technological advancements.

Radar Sensor Market Growth Drivers:

- Increasing utilization in the aerospace and defense sector is expected to fuel global requirements for radar sensors.

Radar sensors have become essential while performing surveillance, target tracking, and overall situational awareness in the aerospace and defense industry for many years. Furthermore, the rising importance of radar sensor technology in newer applications has led to significant changes across the global landscape designed for the radar sensor. Radar sensors are now becoming popular for aircraft navigation and collision avoidance systems in the aerospace field. They enable accurate altitude measurement, weather detection, and terrain mapping, ensuring safer and more proficient flights.

Moreover, the growth of unmanned aerial vehicles (UAVs) has amplified the need for radar sensors for various missions, including reconnaissance and surveillance, utilized by the defense sectors to detect, locate, and track any object. In addition, the Federal Budget Authority for the Department of the Air Force in the USA provides valuable insights into the growth of radar sensor usage within the aerospace and defense domain and its impact on the global market of radar sensors.

Further, the budget allocation request stood at $188.1 billion for 2025 by the U.S. Air Force, which is an increase of $3 billion from FY 2024. This consistent rise shows a renewed commitment to strengthening defense capabilities, which incorporates investments and advancement in radar sensor technology. This indicates a positive trajectory for global radar sensor market expansion as the aerospace and defense sectors continue to prioritize advanced radar systems to support security and surveillance capabilities.

- The expanding automotive industry is expected to bolster the radar sensor market.

The market potential for ADAS has been increased to mid-range automobiles because of the recent attention on safety globally, such as the issuance of new regulatory guidance and standards for automated vehicles - Automated Automobiles 3.0 by the NHTSA, which resulted in a rise in manufacturing volume. Hence, radar sensors are being employed by a large number of companies.

As per the data published by the Federal Highway Administration, vehicle registration increased in the nation, accounting for 99,946,870 automobile registrations, while all motor vehicle registrations were 283,400,986 in 2022. Furthermore, California has the highest number of all motor vehicle registrations, with 31,119,113 registrations in 2022. This significant increase in registration can be attributed to the rise in the use of radar sensors for consumer safety in automotive vehicles.

In addition, market players are collaborating to develop radar sensor technology in automotive, focused on introducing new advanced innovations and vehicle features utilizing this technology, leading to market expansion in the years to come. For instance, in September 2023, Mobileye and Valeo announced a collaboration to develop high-definition imaging radars for next-generation driver assistance and automated driving features. The association focuses on offering software-defined, best-in-class imaging radars for progressive hands-off ADAS systems and eyes-off automated driving features on interstate and urban roads.

Radar Sensor Market Geographical Outlook:

- The North America region would dominate the radar sensor market share.

North America is predicted to hold a major part of the market share for the projection period owing to the early adoption of emerging technologies and huge spending on R&D in multiple industries.

Additionally, Canada and the US are the leading countries that contribute huge spending on military and defense to support the expansion of the radar sensor market. The requirement for radar sensors in the United States is on the rise due to the rapid pace of automation, including the rise of Industry 4.0, and the fast growth of autonomous driving, which in turn creates a growing need for presence and motion detection for better safety and control.

The increasing 5G and IoT development, along with the growing R&D spending in radar technology, also drive the growth of the Indian Radar sensor market. For instance, in March 2024, Raytheon successfully demonstrated its Lower Tier Air and Missile Defense Sensor (LTAMDS) to the U.S. Army in a recently held live-fire event. Supporting the progress, 360-degree radar is used to find and close complex targets, with military commanders from seven countries present at its first trial. The fourth live-fire Radar Demo demonstrates LTAMDS execution and integration with the Integrated Battle Command System (IBCS). This growth in the aerospace and defense industry and radar sensor technology would positively impact the regional market.

Radar Sensor Market Key Developments:

- January 2024- Texas Instruments (TI) introduced a new series of automotive chips at the 2024 Consumer Electronics Show to progress automotive intelligence and safety. The AWR2544 77GHz mm-wave radar sensor chip is the first to be developed for automotive satellite radar designs, enabling better sensor fusion and enhanced ADAS decision-making. TI DRV3946-Q1 and DRV3901-Q1 driver chips are software programmable contactor coordinators for squib pyro fuse drivers with diagnostics in addition to the active safety of operational reliability required in battery management and powertrain systems.

- October 2023- The 80GHz Radar Level Sensor, HR2000, released by Holykell Sensor Inc., offers accurate and durable level measurement solutions for challenging industrial environments! The technology features state-of-the-art 80GHz mmWave radar, enabling targeted and accurate measurements of up to ±2mm. The sensor is characterized by a bubble-level shape, a low dead region, and good penetration with antijamming resistance.

- November 2023- NXP Semiconductors N.V., with the cooperation of radar solutions provider Zendar Inc., developed high-resolution radar for automotive powertrains and advanced driver assistance (ADAS) applications. The company's Distributed Aperture Radar system increases radar aperture, advancing target resolution and enabling lidar-like performance. The initiative highlights simplifying system solutions, reducing the size and radar footprint that complements NXP's scalable portfolio of radars.

- December 2022- Continental announced exclusive sponsorship of 4D radar sensors for the Indy Autonomous Challenge (IAC) community effort, including public-private industry partners and academic institutions. In the process, said 4D imaging radar sensors will be handed over to IAC by the company for implementation into a fast self-driving racecar from Dallara known as AV-21 which is used at levels of automation. IAC will use these advanced sensors to enable its autonomous racecars to tackle some of the most challenging high-speed racing circuits without human drivers.

Radar Sensor Market: A Deep Dive into Company Products:

- BGT60ATR24C- The XENSIV™ BGT60ATR24C is a product by Infineon Technologies AG is a compact 60 GHz radar sensor developed for ultra-wideband FMCW operation. These consist of a sensor configuration and data acquisition digital interface, an autonomous operation coordinate state machine, as well as optimal power modes to minimize energy utilization. The sensor, which is AEC-Q100/101 certified, guarantees precise processing capabilities, enhanced thermal management, and a compact system dimension.

- LX-80 10 Hz- It is a product from Geolux and is an Oceanographic Radar Sensor for measuring water levels and wave parameters at as high a sampling rate as 10 samples/s. It has various communication interfaces and is easy to deploy over the water surface. Applications include tide gauge monitoring, coastal wave energy analysis, wave locating and guidance of beach services, and harbor or mariculture observation until hurricane-wave increased detection.

List of Top Radar Sensor Companies:

- Geolux d.o.o.

- Baumer Holding AG

- ASTYX GmbH

- ZF Friedrichshafen AG

- Hans Turck GmbH & Co. KG

Radar Sensor Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

|

Radar Sensor Market Size in 2025 |

USD 15.189 billion |

|

Radar Sensor Market Size in 2030 |

USD 34.042 billion |

| Growth Rate | CAGR of 17.52% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

|

List of Major Companies in Radar Sensor Market |

|

| Customization Scope | Free report customization with purchase |

The global radar sensor market is analyzed into the following segments:

- By Type of Radar System

- Bistatic Radar

- Continuous Wave Radar

- Instrumentation Radar

- Weather Radar

- Others

- By Application

- Automotive

- Aerospace & Defense

- Security & Surveillance

- Industrial

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Others

- Middle East and Africa

- UAE

- Israel

- Saudi Arabia

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Thailand

- Taiwan

- Indonesia

- Others

- North America