Report Overview

Global Power Transformer Market Highlights

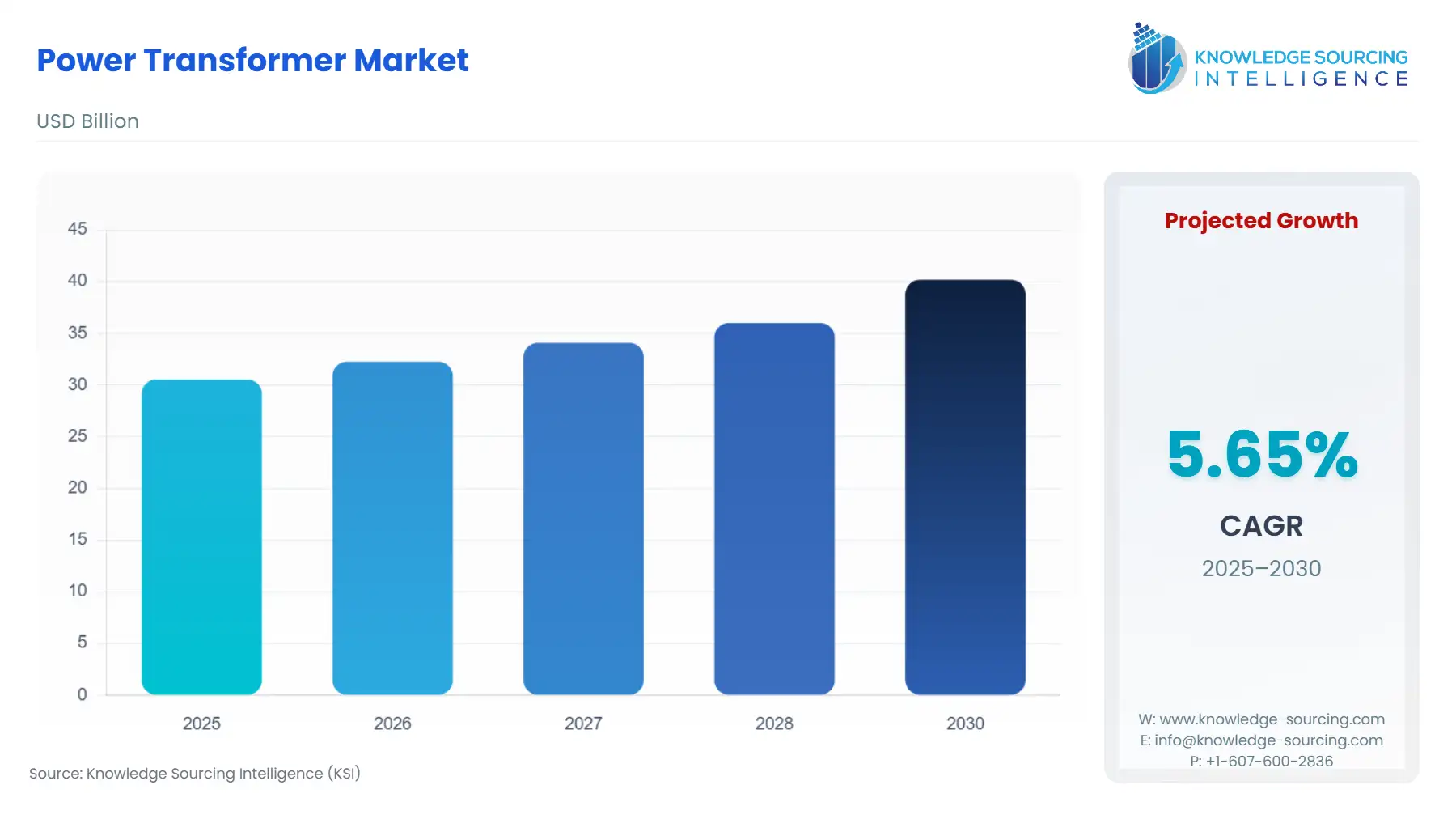

Power Transformer Market Size:

The global power transformer market is expected to grow from USD 30.548 billion in 2025 to USD 40.210 billion in 2030, at a CAGR of 5.65%.

A Power transformer is one type of transformer that is used to transmit electrical energy in any component of the electronic or electrical circuit between the distribution primary circuits and the generator. In other words, it is a static device used for transforming power from one circuit to another without varying the frequency.

The power transformer ecosystem comprises tendering (T&D), contracting, installation & commissioning, and maintenance. As global energy production increases, it has led to the increasing need for expanding T&D networks; need new T&D infrastructure. This includes substations, power lines, and associated equipment, and new technology.

Electricity demand is expected to increase by 4.5% in 2021, as forecasted by International Energy Agency (IEA). With a projected 2021 GDP growth globally, electricity demand is expected to grow compared to the 2020 levels. This is also likely to fuel the transformers markets. Another market driver is the usage of clean energy. Power transformers are a critical part of the energy distribution process. It is anticipated that increase in the utilization of renewable and non-conventional energy resources will push the global power transformer market.

Power Transformer Market Growth Factors:

- Growing Electricity Demand.

Electricity is one of the prime sources of energy that powers industrial, commercial and domestic machinery and appliances. It is derived from several sources like fossil fuel, coal, thermal, nuclear, etc. Fossil fuel-based electricity generation is set to cover 45% of additional demand in 2021 and 40% in 2022; coal-fired electricity generation is set to increase by almost 5% this year and by a further 3% in 2022 with nuclear power accounting for the rest, according to IEA. To meet, the growing needs of electricity consumption, new power plants are being set up worldwide. Apart from the growing consumption of electricity, deployment of smart grids and smart transformers, replacement of existing aged power transformers are some other factors responsible for the global power transformer market growth.

- Renewable and Sustainable power generation.

As the world focuses more on renewable sources of energy, countries are increasing their investment to strengthen their power infrastructure and meet the growing electricity demand. It includes new power grid projects that integrate electric power generated through renewable sources to the main power grid. An increase in renewable power generation such as hydro, wind, and solar are prominent drivers for the global market of power transformers. According to IEA, based on current policy settings and economic trends, electricity generation from renewables – including hydropower, wind, and solar PV – is on track to grow strongly around the world over the next two years – by 8% in 2021 and by more than 6% in 2022.

Power Transformer Market Restraint:

Price is a significant factor that affects the power system market. Manufacturing of power transformers requires time, huge capital investment, high-quality electrical grade steel, and expert supervision. Along with it, constructing the supporting infrastructures needed for stable and life-long transformer operation is expensive. This makes power transformers manufacturing limited to large companies with high investment potential. The transformers are also unaffordable for smaller businesses. These aspects limit the market size.

Power Transformer Market Geographical Outlook:

Geographically, North America and Asia-Pacific account for a major share. Asia-Pacific is expected to account for the largest revenue share in the global power transformer market, owing to upcoming power grid expansion projects and an upsurge in renewable power generation. By type, oil-cooled transformers will hold a larger market share because they are more commercially viable and efficient in nature.

Power Transformer Market Competitive Insights:

The market leaders for the Global Power Transformer Market are Alstom[1], China XD Group, TBEA Kirloskar Electric Company, EMCO Limited, Bharat Bijlee Limited, Voltamp, Global Transformers & Switchgears Fzco., JSHP Transformers, Emirates Transformer & Switchgear Ltd. (ETS), Siemens AG. The key players in the market implement growth strategies such as product launches, mergers, acquisitions, etc. to gain a competitive advantage over their competitors. For instance,

- Alstom signed a Memorandum of Understanding with Bombardier Inc. and Caisse de dépôt et placement du Québec given the acquisition of Bombardier Transportation in 2020.

- China XD Group in 2020 received approval for eight new transformers which were part of major projects.

- JSHP Transformers in 2019 also launched a new product line JStrongTM Rupture/Arcing - Resistant transformer line. Siemens AG supplied power solutions to projects in Saudi Arabia and Germany in 2021.

Power Transformer Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 30.548 billion |

| Total Market Size in 2031 | USD 40.210 billion |

| Growth Rate | 5.65% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Cooling Type, Product, End-User, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Power Transformer Market Segmentation:

- By Cooling Type

- Oil-Cooled Power Transformers

- Air-Cooled Power Transformers

- By Product

- Distribution Transformers

- Power Transformers

- Instrument Transformers

- Specialty Transformers

- By End-User

- Utilities

- Industrial

- Commercial

- Residential

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

- North America