Report Overview

Global Power Rental Market Highlights

Power Rental Market Size:

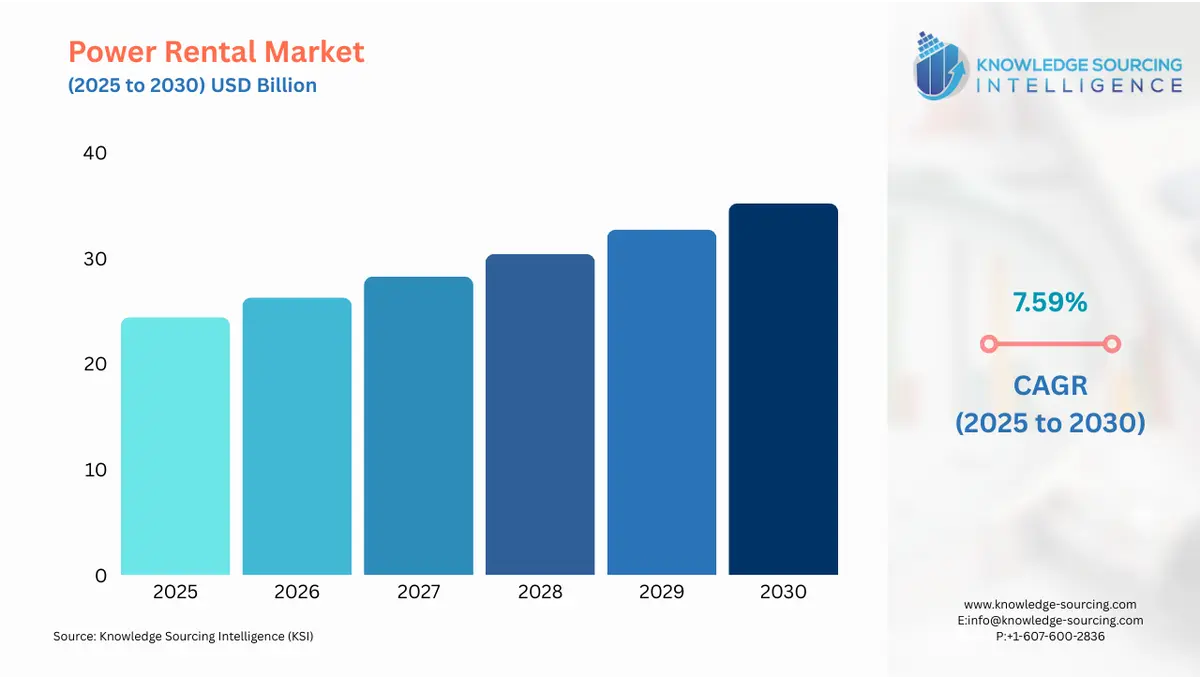

The global power rental market is expected to grow at a CAGR of 7.59%, reaching a market size of US$35.188 billion in 2030 from US$24.408 billion in 2025.

Power Rental Market Trends:

The increasing power consumption in various parts of the world is one of the most important factors driving the market for power rental during the analysis period.

Notably, the oil and gas industry is the most prominent user of rented power generators, which serve its exploration and production activities and for building infrastructure. This is also complemented by awareness of the benefits of outsourcing power equipment. Another emerging demand is for scalable rental equipment to cope with outages and voltage sags and swells.

Moreover, the construction of hotels and malls, besides government initiatives promoting the expansion of metro and airport networks, is also driving power rental demand in developed and developing countries. The market will register faster growth due to other factors, such as the increasing use of renewable energy resources in place of fossil fuels in an attempt to cut down carbon emissions.

What are the Power Rental Market Drivers?

- Urbanization and the development of infrastructure are contributing to the global power rental market growth

The growing urbanization propelled by ongoing urban and infrastructure development remains one of the major factors pushing the power rental market in developing economies. As cities grow, the demands for visible and reliable power sources increase as more infrastructure projects arise. Examples of construction activities that consume enormous amounts of power for machinery and equipment are commercial and residential buildings where public infrastructure, intended mainly for roads and bridges, is built. Most firms are more inclined to rent power equipment than purchase and maintain it; power equipment is usually required for short-term use. Such developments thus scaled the demand for becoming mainstream in contemporary urban development initiatives for power rental.

- Event-driven and seasonal needs are anticipated for the global power rental market growth.

The need for extra power during specific seasons and events is another important factor. A major booster to this industry is growing agricultural business power needs, especially in harvest seasons or through big events, such as music concerts or sporting competitions, which require significant electrical needs. These requirements often characterize the need for temporary and very specialized power demand, making renting power more economical and practical than setting it up for permanent generation in locations. The flexibility of rental agreements helps companies and event planners adjust their requirements whenever that need arises, thereby taking advantage of savings and guaranteeing a steady supply. Increasing resorts to this sector are also evident in the growing number of peak-load seasons and mega events that now underscore the renting of power.

Power Rental Market Restraints:

- Strict regulations are anticipated to hamper the market growth

Strict laws have been passed in Asia Pacific, Europe, and North America to limit carbon emissions from power generation. These laws generally accommodate acceptable noise levels for power generators with a view to reducing noise pollution associated with their operation. Rules concerning power generators are strictly governed by several environmental institutions, such as the United States Environmental Protection Agency (EPA) and the European Environment Agency of the European Union (EU).

Another salient element affecting the market of power generators is the change from using power generators to greener alternatives by Energy Service Providers (ESCOs). Noise levels emitted by power-generating plants are higher than those produced by other types of generators. Hence, various laws and regulations on noise control have been instituted by different government agencies.

Geographical Outlook of the Power Rental Market:

- North America is witnessing exponential growth during the forecast period.

The increasing frequency of extreme weather events like hurricanes, wildfires, and storms is driving significant growth in the North American power rental market. This frequently results in power outages that call for short-term power fixes. Furthermore, a steady and dependable power supply is required for the region's industrial and infrastructure advancements, which makes rental power services crucial for manufacturing facilities, temporary buildings, and construction sites. In addition, the North American market gains from technological developments in generator equipment, such as more ecologically friendly and energy-efficient models that companies are embracing to satisfy strict regulations.

Key Launches in the Power Rental Market:

- In January 2024, RenEnergy Group, which manufactures solar and energy storage systems for commercial and industrial clients in the UK and South Africa, was purchased by Aggreko. RenEnergy was established in the UK in 2006 by Damian and Lori Baker, and it has since grown. To South Africa in 2012. installs energy storage and charging devices, specialized car solar panels, and ground and rooftop solar panels.

- In October 2023, Shenton Group, a reputable energy and power solutions supplier, expanded its fleet of rental generators to include 500 kVA units. These high-capacity generators are available from Shenton Group, which is well-known for providing effective customer service and meeting the increasing demand across various industries.

Power Rental Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Power Rental Market Size in 2025 | US$24.408 billion |

| Power Rental Market Size in 2030 | US$35.188 billion |

| Growth Rate | CAGR of 7.59% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Power Rental Market |

|

| Customization Scope | Free report customization with purchase |

The Global power rental market is segmented and analyzed as follows:

- By Fuel

- Diesel

- Gas

- By Application

- Standby

- Peak Shaving

- Baseload

- By End-user

- Oil & gas

- Construction

- Mining

- Events

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Others

- North America

Our Best-Performing Industry Reports:

Navigation:

- Power Rental Market Size:

- Power Rental Market Key Highlights:

- Power Rental Market Trends:

- What are the Power Rental Market Drivers?

- Power Rental Market Restraints:

- Geographical Outlook of the Power Rental Market:

- Key Launches in the Power Rental Market:

- Power Rental Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 23, 2025