Report Overview

Power Distribution Component Market Highlights

Power Distribution Component Market Size:

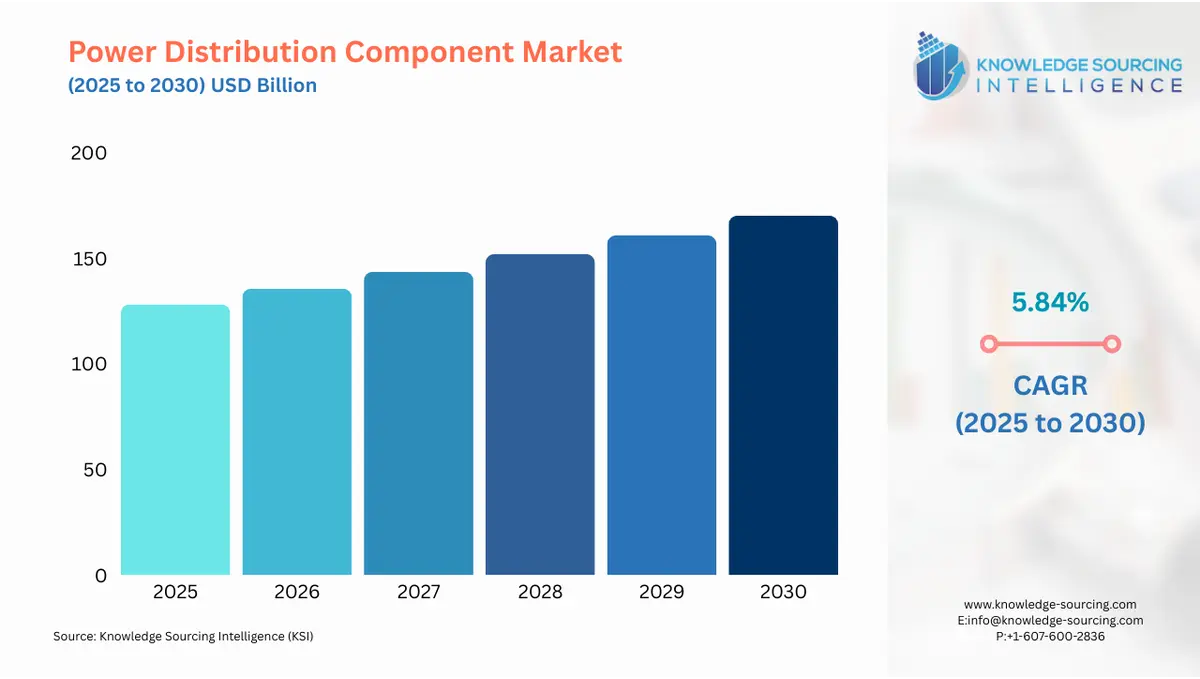

The global power distribution component market is expected to grow at a CAGR of 5.84%, reaching a market size of US$170.134 billion in 2030 from US$128.108 billion in 2025.

The rising demand for effective transmission and distribution (T&D) control systems drives the power distribution component market’s growth. In addition, certain factors, such as expansion in the refurbishment market of the existing electrical systems and regulated and economic restructuring within the industry aims, are expected to propel the market's growth. Because most underdeveloped and developing nations have no fixed, reliable electricity supply, people have focused on a better power distribution setup. Furthermore, the market also grows due to government policies and huge funding towards building a sustainable energy distribution system.

Moreover, the market will also grow due to rapid urbanization and industrialization in developing countries like India and China. The construction sector is also estimated to drive market expansion with the increasing population. Due to the rising electric vehicle market, there is a demand for more energy infrastructure, which will support the power distribution component market growth.

What are the global power distribution component market drivers?

- Rising demand for efficient transmission and distribution is contributing to the global power distribution component market growth

The growing preference for modernizing existing transmission and distribution control systems is among the major factors fueling market growth. National energy transmission & distribution losses stand at around 6% of the total US electricity generated annually. The use of material enhancements and inventive designs can enhance these technologies. To avoid increasing the cost of the technology, these enhancements will also have to focus on manufacturability.

Furthermore, the increasing demand for upgrades to electrical systems and the necessity for organizational and economic restructuring of other infrastructure will further enhance economic viability. The unavailability of a sound, reliable electricity infrastructure in many of the developing countries, coupled with the current push to install new systems in the developing countries, has also resulted in a conducive business environment. The factors driving the expansion of the enterprise include low prices, a non-hazardous operation, and a compact item.

- Growing demand for efficient transmission is anticipated to boost the market expansion

The existing electrical infrastructure development and the demand for efficient transmission and distribution management systems will contribute to the sector’s growth. Additionally, the increasing implementation of smart grid technologies and the continuous upgrade of transmission and distribution systems are expected to increase the market expansion of power distribution apparatus components. Sustained urban and industrial growth is expected to create a broader range of market opportunities. Additionally, the rapid expansion of low-voltage distribution networks in homes and businesses is likely to boost the global power distribution components market.

- Growing adoption of renewable energy resources

With the increasing demand for renewable energy resources, developing energy-efficient and intelligent grid systems is becoming of utmost importance. Several applications of power distribution elements across different industries, such as power, transport, and telecommunication, are differentiated from one another in many aspects. These elements are also required for other industries since they help ensure a constant supply of electric power to drive different equipment and appliances.

Major restraints in the power distribution component market:

- High installation cost is anticipated to hamper the market growth

The high installation prices of power distribution equipment, such as switchgear, might discourage some organizations and individual customers, consequently limiting market growth. These components may be unsuitable for mass consumption because of their large volumes, which may hinder market growth. These significant elements eliminate and regulate power flow within the system and protect the exclusive system; however, they are expensive due to intricate fabrication processes and the use of high-quality, durable materials.

Additionally, copper and aluminium conductors are expensive, especially where long distances are involved or the capacity required is much higher. On the other hand, underground cables are more expensive: they are heavier gauged because the insulation and armor must be tougher and more robust.

Geographical outlook of the power distribution component market:

- North America is witnessing exponential growth during the forecast period

The development of regional industries will be supported by the growing focus on the expansion of long-distance distribution networks, as well as large-scale projects aimed at upgrading the local grid systems. There is an increasing focus on the need to modernize and rehabilitate the existing grid networks to cope with power outages and peak load scenarios. Urbanization and industrialization trends in the US and Canada are also anticipated to raise the electricity cravings of the region; hence, the necessity of quality power distribution components increases.

Key launches in the power distribution component market:

- In October 2024, Hitachi Energy unveiled the Relion REF650, a multipurpose protection and control relay in India. Compared to earlier iterations, this product, which is intended for the medium voltage power distribution grid, provides more flexibility, modularity, and strong security. Because of its innately simple interface, the product is in a unique position to meet the changing power quality needs of industrial and utility facilities nationwide.

- In March 2024, Eaton, an intelligent power management company, launched a cutting-edge new modular data center solution for businesses looking to quickly satisfy the expanding demands of AI, machine learning, and edge computing in North America. Eaton's SmartRack® modular data centers can be set up in warehouses, manufacturing facilities, and enterprise or colocation data centers.

Power Distribution Component Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Power Distribution Component Market Size in 2025 | US$128.108 billion |

| Power Distribution Component Market Size in 2030 | US$170.134 billion |

| Growth Rate | CAGR of 5.84% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Power Distribution Component Market |

|

| Customization Scope | Free report customization with purchase |

The Power Distribution Component Market is segmented and analyzed as follows:

- By Product

- Switchgear

- Switchboard

- Distribution Panel

- Motor control Panel

- Others

- By Configuration

- Fixed Mounting

- Plug-in

- Withdrawable Unit

- By Voltage Rating

- <11kV

- 11 to 33kV

- 33 to 66kV

- 66 to 132 kV

- By Insulation

- Air

- Gas

- Oil

- Vacuum

- Others

- By Installation

- Indoor

- Outdoor

- By Current

- AC

- DC

- By Application

- Residential

- Commercial

- Industrial

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- UK

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Taiwan

- Others

- North America

Our Best-Performing Industry Reports:

- Power And Control Cable Market

- Electrically Conductive Adhesives Market

- Electromechanical Relay Market

Navigation:

- Power Distribution Component Market Size:

- Power Distribution Component Market Key Highlights:

- What are the global power distribution component market drivers?

- Major restraints in the power distribution component market:

- Geographical outlook of the power distribution component market:

- Key launches in the power distribution component market:

- Power Distribution Component Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 23, 2025