Report Overview

Global Polyester Fiber Market Highlights

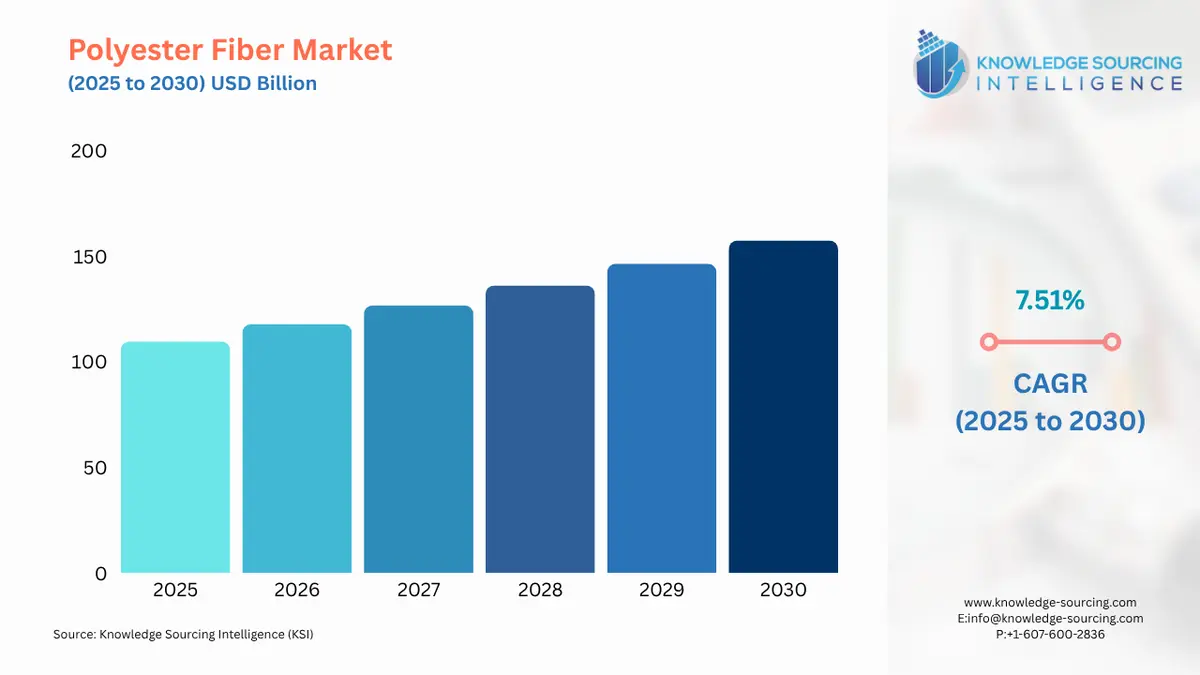

Polyester Fiber Market Size:

The global polyester fiber market is estimated to attain US$157.375 billion by 2030, growing at a CAGR of 7.51% from US$109.567 billion in 2025.

Polyester fiber is a synthetic fiber with polyester as a main component. The polyester fiber offers various features, and characteristics, including strong material and soft hand feel. It also offers resistance to stretching and shrinking. Polyester fiber is widely used in home furnishing, apparel, textile, and automotive industries. With the growing construction sector, the number of buildings and houses has been increasing, leading to an increased demand for home furnishing.

The polyester fiber offers a wide range of advantages over other types of material. This fiber is durable and lightweight and offers resistance to shrinking and wrinkling. The polyester fiber material is also easy to clean and can be dried quickly.

Polyester Fiber Market Drivers:

- Growing textile and apparel industries

The increasing demand for textile and apparel industries worldwide is a major factor estimated to boost the global polyester fiber market. This market is expected to surge in the coming years due to an increased demand for polyester fibers from the textile and apparel industries, as these industries have been growing at a steady pace. Governments of several countries' increasing investments in the textile industry have been a major factor in its boom.

For instance, the textile industry in India witnessed a significant surge in the past few years. The Invest India portal, in its report, stated that in 2023, the domestic apparel and textile industry contributed about 2.3% to the nation's GDP, about 13% to industrial production, and 12% to the nation's exports. The portal further stated that India has about 4.6% of the global textile and apparel trade market share. The report also noted that in 2023, India's textile and apparel industry was recorded at about US$ 160 billion. In the total fabric production in the fiscal year 2024, India produced about 952 million square meters of cotton yarn, whereas about 432 million square meters and 450 million square meters of blended 100% non-cotton yarn and man-made filament yarn, respectively. The nation also produced about 511 million square meters of man-made fiber during fiscal year 2024.

Polyester Fiber Market Restraints:

- Increasing demand for sustainable fiber material

The increasing consumer demand for bio-based and sustainable fiber material. In the global textile and apparel industry, polyester fiber material includes multiple sustainable fiber alternatives, which include hemp fiber, linen, lyocell, recycled polyester, and bamboo, among many others. With the increasing global demand for sustainable fiber materials, various global fiber producers are increasing their research and development of alternative materials, hindering the polyester fiber market growth.

Polyester Fiber Market Geographical Outlook:

- Asia Pacific is forecasted to hold a major share of the Global Polyester Fiber Market.

The Asia Pacific region is forecasted to attain a greater market share in the global polyester fiber market. The region is among the biggest fiber producers, and it is used across multiple industries.

The region is also among the biggest producers of textile and apparel industries. Countries like India, Bangladesh, Japan, China, and Vietnam are the leading global textile and apparel producers. The governments of various Asian Pacific countries, like India, Bangladesh, Vietnam, and Malaysia, also introduced key policies and investment schemes to further propel the regional textile and apparel industries, increasing the demand for polyester fibers. For instance, in June 2023, the Ministry of Textiles of the Government of India amended the Operational Guidelines for Production Linked Incentive (PLI). This is aimed at promoting MMF (man-made fibers) and technical textiles segments, including synthetic and cellulose fibers.

Polyester Fiber Market Products Offered by Key Companies:

- Reliance Industries Limited is among the leading global corporations based in India and offers a wide range of products and solutions for multiple industries, including energy, petrochemicals, retail, digital services, media & entertainment, and new energy & new materials. The company offers textiles, polymers, polyesters, fiber intermediates, aromatics, elastomers, and reliance composite solutions in the petrochemical industries. It is among the largest producers of polyester fiber and yarns globally, with an annual production capacity of about 2.5 million tonnes. In the polyester staple fiber category, the company provides Recron Staple fiber & tow, Recron Fiberfill, Recron Fiber for reinforcements, and Recron certification.

- Huvis Corp., created by SK Chemicals and Samyang Corporation in 2000, is among the biggest Korean fiber companies. The company offers a wide range of products and solutions, including staple fiber, filament yarns, PET resins, super fiber, industrial materials, and daily life materials. In the staple fiber category, the company offers solutions for multiple industries, which include automotives, hygiene products, paper making/interior design, bedding/furniture, clothing, and eco-friendly products.

- Hyosung Japan Co. Ltd is among the biggest producers of products and solutions for the textile industry. The company offers solutions for textile, industrial materials, chemicals, power & industrial systems, trading, food service, and elderly care businesses. In the global textile industry, the company offers spandex, nylon polyester fiber, and fabric dying. In the global polyester fiber market, it provides a wide range of products, including regen, aerocool, aerosilver, firex, m2, Xanadu, cotna, and aeroheat, among others.

Polyester Fiber Market Key Developments:

- In April 2024, Neste, a global science and innovative technology leader, launched the world's first supply shin for sustainable polyester fiber based on CO2-derived material and renewable and bio-based materials. The company offers Neste RE, one of the required ingredients for polyester production. It also stated that the polyester fiber produced in the project is targeted to be used for a part of The North Face products by Goldwin. The planned products include sports uniforms, which were launched in July 2024.

- In November 2023, the LYCRA Company, a global leader that innovates and produces fiber and technology solutions for personal and apparel industries, launched the new LYCRA FIT400 fiber, one of the company's EcoMade offerings. The new fiber is a unique biocomponent fiber engineered to optimize performance and comfortable knits. The company also stated that the new fiber can be recycled back into polyester fibers under a controlled environment.

Polyester Fiber Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Polyester Fiber Market Size in 2025 | US$109.567 billion |

| Polyester Fiber Market Size in 2030 | US$157.375 billion |

| Growth Rate | CAGR of 7.51% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Polyester Fiber Market |

|

| Customization Scope | Free report customization with purchase |

Polyester Fiber Market Segmentation:

- By Grade

- PET

- PCDT

- By Product

- Filament

- Staple

- Others

- By Form

- Solid

- Hollow

- By Applications

- Automotive

- Home Furniture

- Apparel

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- UK

- Spain

- Others

- Middle East and Africa

- South Africa

- Saudi Arabia

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Thailand

- Indonesia

- Taiwan

- Others

- North America