Report Overview

Global Pharmaceutical Blister Packaging Highlights

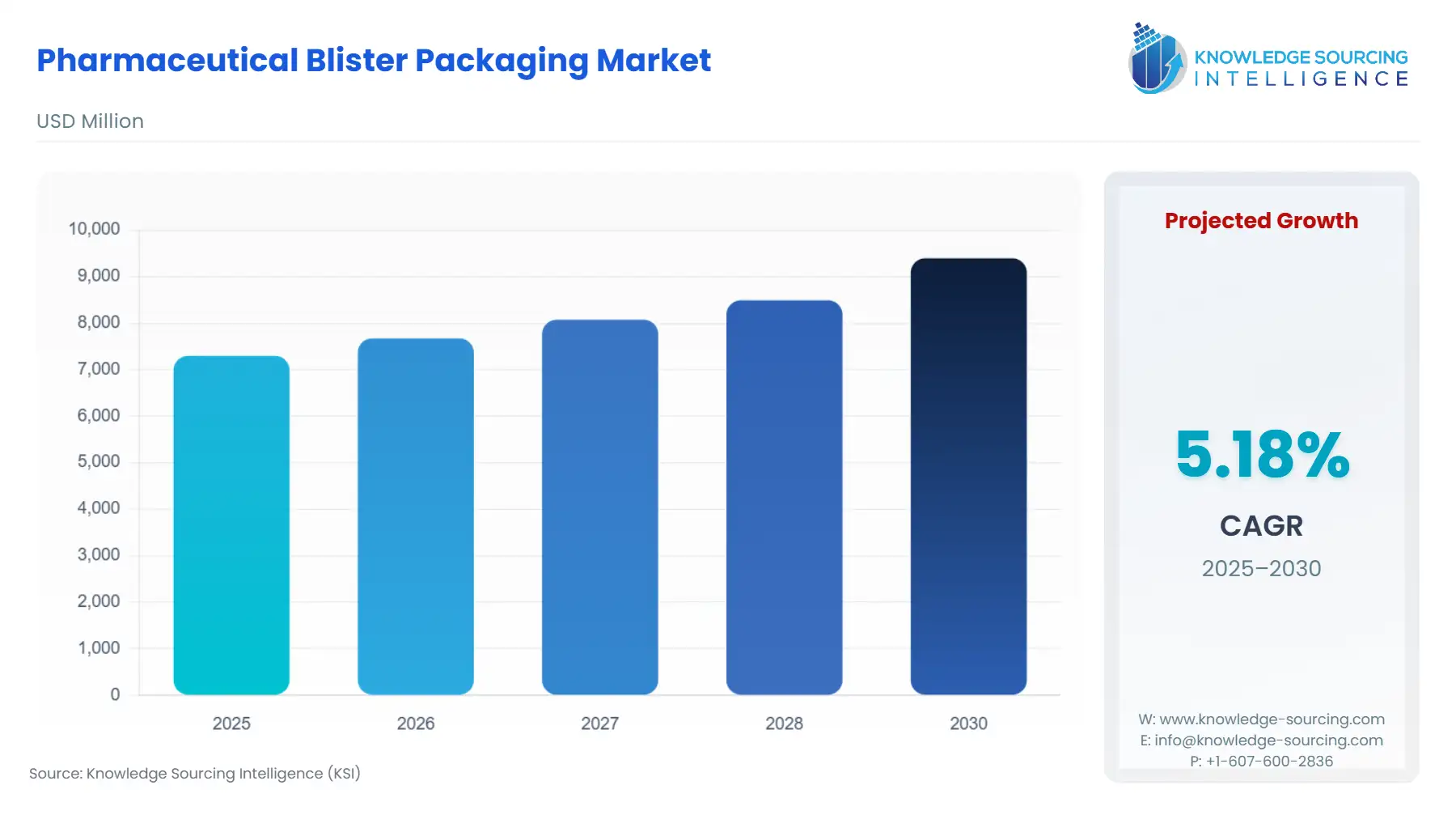

Pharmaceutical Blister Packaging Market Size:

The global pharmaceutical blister packaging market is estimated to grow at a CAGR of 5.18%, from US$7,297.836 million in 2025 to US$9,394.743 million in 2030.

Pharmaceutical Blister Packaging Market Overview:

Blister packaging is a type of pre-formed cavity that ensures the safety of the products. In the pharmaceutical industry, blister packaging is generally used to pack pharmaceutical drugs, which helps to maintain the integrity of the drugs. It offers a cost-effective method and technique of packaging, while also offering visibility and temperature resistance to the drugs. The blister packaging also provides easy access to the consumer of the doses, as it holds each tablet separately.

Blister packing is a specialized material used in the pharmaceutical industry to safeguard single-dose units such as tablets or capsules. It is made with a type of thermoformed plastic material whose primary constituent is the cup-shaped polyethylene housed in an outer shell made of paper or aluminum foil. This packing ensures that the pharmaceuticals are free from moisture and harmful contaminants, thus ensuring the medicine is safe and effective for a longer period.

Blister packs are employed in unit doses, allowing patients to easily track their medication intake and reinforce adherence to prescribed regimens. Additionally, the transparency of packaging allows buyers to examine and inspect the medication while purchasing, which in turn enhances buyers' trust in the drug’s quality.

One of the major driving factors for pharmaceutical blister packaging materials is the growing global packaging industry. The Australian Packaging Covenant Organization (APCO) report of April 2024 stated that in 2021-22, the Australian packaging placed on the market was estimated at 6.98 million tons. This includes about 52.3% of paper and paperboard, followed by about 18.3% of plastic packaging and about 16.4% of glass packaging. Furthermore, according to the data from the Government of India of August 2024, the country’s pharmaceutical sector was estimated to reach $100 billion by 2025, which is expected to grow at a rate of 10-12 percent.

The extensive cost-effectiveness and simple production have made it the ultimate choice in most pharmaceutical products due to its temperature resistance. This has encouraged sustainability even with stringent requirements without impacting the shelf life of fragile drugs. Additionally, the ongoing improvements in blister packaging, the emergence of eco-friendly materials, and child-resistant inception cater to its commercial demand. This will solve the challenges in consumer safety and drug delivery confronting the pharmaceutical sector and offer novel tools for effective packaging.

The trend of using unit doses is a primary factor driving the pharmaceutical blister packaging market, indicating that the industry is continually evolving with changing patient demands and safety requirements. This method of dose packaging is designed to increase dosing accuracy and reduce pharmacy errors. They are especially helpful for patients with more complicated medication regimens, as they limit overdosing or underdosing. The pharmaceuticals in a unit dose are packaged individually to prevent contamination of that precious single use.

Pharmaceutical Blister Packaging Market Growth Drivers:

- Surging Drug Production Across the Globe

One of the key factors driving the pharmaceutical blister packaging market is a rapid increase in the global production of pharmaceuticals. Blister packaging helps to maintain the integrity of the drugs while helping consumers to read the doses. The growing production of pharmaceuticals in the global market will expand its demand, as it is among the most cost-effective packaging solutions for the pharmaceutical industry. Due to the growing prevalence of diseases, the demand for drugs is increasing, leading to an escalation in manufacturing capabilities. For example, pharmaceutical companies are increasing their production capacities due to the aging population and the rising number of sick older people whose needs cannot be satisfied. According to information published by the European Federation of Pharmaceutical Industries and Associations (EFPIA), pharmaceutical output is increasing globally. This surge represents significant contributions from the industry in research, technological advancements, and expansion to meet the burgeoning demand for healthcare. The following data show the global growth in pharma activity and confirm that it is aligned to fill nearly half of healthcare demands worldwide through domestic manufacturing.

India and China have almost regularly been leading Asia Pacific in pharma manufacturing. According to the data put together by the GoI (Government of India), it is evident that the Indian pharmaceutical business will reach the $100 billion mark in 2025, growing annually at a rate close to anywhere between 10-12% on average. This growth is powered by its robust manufacturing base footing within domestic boundaries and solid support from various government programs aimed towards enhancing manufacturing capabilities with an aggressive inclination as far as exports are concerned. It underscores the critical nature of blister material for a burgeoning amount of medicinal production worldwide.

Globally, Europe is one of the biggest producers and suppliers of pharmaceutical drugs. The European Federation of Pharmaceutical Industries and Associations (EFPIA), in its 2023 report, stated that the total production of the region's pharmaceutical industry was expected to account for Euro 390,000 million in 2023 from Euro 363,300 million in 2022.

Additionally, in 2022, Switzerland was the largest producer with Euro 56,641 million pharmaceutical production 2022, followed by Italy and Belgium produced total pharmaceuticals of Euro 49,000 million and Euro 40,959 million, respectively. Further, Germany and France reported production spending on pharmaceuticals at Euro 37,405 million and Euro 32,773 million, respectively.

Similarly, according to the Press Information Bureau of India, the country’s drug and pharmaceutical export reportedly increased to $2.31 billion in July 2024 from $2.13 billion in July 2023, an 8.36 percent increase. Further, the country's drug and pharmaceutical exports accounted for $27.85 billion in 2023-24, rising from $15.07 billion in 2013-14.

Additionally, the rise in pharmaceutical production is expected to promote advanced blister packaging solutions with high barrier technologies, which are increasing in demand. The pharmaceutical production boom, therefore, is increasing the need for reliable material solutions that can maintain their integrity and ensure safety. High acceptance of blister material is mainly due to its higher efficacy in contamination prospects and tampering cost, which is requisite for the success of constituent functionality-sensitive medicines. In addition, developments in blister material technology, such as intelligent material solutions that promote medication compliance, are creating new opportunities for the market.

- Shift Towards Unit Dose Material

Increasing demand for unit dose material by the industry in response to evolving patient needs and a shift towards safety standards are other factors driving this market’s growth.

This material is optimal for increasing dosing accuracy and eliminating medication errors. This is especially ideal for patients on many medications as it aids in the delivery and adherence to complex drug schedules, preventing overdose/underdose.

With the progress in healthcare, increasingly effective use of unit dose systems is required to enhance medication safety and its related part, medication administration across different settings. In addition, technological upgrades such as automation in the packaging and serialization processes can streamline production practices, rendering unit-dose systems more effective than vials while making them less expensive. The focus on medicine safety with regulations became more stringent by reinforcing the shift towards unit dose formats.

Technological developments are another major factor that increases the demand for unit dosage systems. Machine-driven packaging processes have helped unit-dose packaging evolve to be more labor- and cost-effective. Through serialization and track-and-trace technologies, manufacturers can solve the need for compliance data on time with all regulations while enhancing product security from the factory to end users. Furthermore, these advances contribute to operating efficiency, inventory management improvements, and waste reduction. Regulatory bodies are increasingly focusing on ensuring the safety of medicines and moving more quickly to unit dose formats.

Pharmaceutical Blister Packaging Market Restraints:

- The Risk of Damaged Drugs: The Material Challenge during Transportation

Drug damage during transit is a serious concern for any company in the pharmaceutical business, and it's one of the most significant hurdles that they face. According to Loss and Damage Analysis in International Transport of Pharmaceutical Products, a report that was backed by IMS Health (2015-2020), each year, pharmaceutical companies lose an average income of $16 billion due to transportation issues, with total losses for industry surging well over double figures ($35 bn) within one single 12 months — In 2020. The International Air Transport Association (IATA) notes that temperature excursions impact 20% of temperature-sensitive pharmaceuticals during transport and a great deal more, more than half, in airline and airport custody. This is unacceptable – according to some estimates, annual product losses amount to 2.5 to 12.5 billion USD from a market size of $300 billion.

Although blister material is the perfect solution, many companies cannot overcome these challenges. One major restraint is the development of new materials to account for how shifts in transportation conditions, such as changes in temperature and humidity, can negatively impact these drugs. Environmental changes can affect some drugs, and the use of improper materials may cause deterioration or loss of potency. The sector is struggling to incorporate more sustainable material solutions that lighten environmental impacts without sacrificing performance. These challenges must be met for blister material to remain an effective part of the safe transport puzzle for pharmaceuticals.

Regulation compliance is, as always, a cornerstone of pharmaceutical packaging—it may even be more significant when considering novel materials or technologies. The need for extensive testing ensures that any new ability of packaging blisters will not present an unacceptable risk of compromised patient safety and product quality. Regulatory agencies require robust documentation before novel materials can be approved for use to show that they adhere to established safety standards. In other words, using a blister pack solution to facilitate enhanced machine performance does not mean one has the right or ability to lay aside compliance.

Pharmaceutical Blister Packaging Market Segment Analysis:

- Type Insights

Based on type, the pharmaceutical blister packaging market is segmented into compartments, slides, and wallets. The blister wallet is a key segment of this market type, which incorporates single doses inside the card format. The fresh packaging design not only ensures improved product security but also stimulates patient respect through easy medication administration.

Unit dose placard wallets are designed to provide an easier patient experience, i.e., for those on significant polypharmacy. The individual drug dose is stored in one pocket (blister) made from moisture- and light-resistant material to protect the integrity of pharmaceuticals. The form of a wallet makes it easy for patients to pull out the prescribed amount, ensuring users are consistent with their medication every day.

Furthermore, these wallets include child-resistant measures to keep pharmaceuticals safe while enabling adult access. These wallets have been popular among pharmaceutical companies looking to increase patient compliance and engagement due to their emphasis on safety and convenience.

These wallets are in high demand owing to rising chronic disease rates and a shift towards patient-centric options. Furthermore, advances in sustainable materials resolve environmental problems connected with traditional plastic packaging, leading to a trend towards eco-friendly alternatives and fueling market growth.

- Material Insights

Based on material, the pharmaceutical blister packaging market is segmented into PVC, PVDC, PP, and Others. Polypropylene (PP) is becoming more recognized as an important material in the pharmaceutical blister packaging business, helping to drive overall growth and innovation. Blister packaging solutions are popular in the thriving pharmaceutical and healthcare industries for their numerous benefits, including product protection, tamper-evident features, and ease of delivery.

Pharmaceutical companies chose PP as a preferred raw material because of its characteristic properties. This is very important for the stability and activity of sensitive drug substances in such formulations; it ensures that there will be no change to drugs or excipients during storage. This is particularly true with medications, which can break down when they absorb moisture or humidity. In addition, despite being lightweight, polypropylene is tough and serves as an ideal packaging material for use where robustness needs to be combined with a low-weight product in transit. Being transparent allows consumers to go through the contents, boosting consumer satisfaction and happiness.

Polypropylene offers chemical resistance, perfect for preventing the product from being contaminated, thus ensuring that drugs hold their efficacy and remain effective over time. Including desiccants or moisture-absorbing chemicals allows for further extension of the shelf life of products with sensitivity to humidity by regulating their presence within the blister pack.

- Technology Insights

By technology, the pharmaceutical blister packaging market is bifurcated into cold-form and thermoforming. The anticipated growth will be observed in thermoforming to create packaging solutions that comply with the strictest safety and quality standards. Thermoforming is widely used in the pharmaceutical sector, specifically for blister packaging, as it provides more flexibility. This flexible packaging line can package many different types of products due to the diversity in shape and size.

It can produce large-scale packaging at a time with high efficiency. This efficiency is very important for mass production to keep costs down without compromising quality. The other main advantage is that they are also cost-effective. It has also been found that the molds required for this process are cheaper than those needed to use other production methods, such as injection molding.

The pharmaceutical industry focuses on the sustainability of thermoforming. In the wake of heightened environmental concerns, more eco-friendly packaging choices are a trend that is already gaining ground. This approach underlines recycled materials, which are accessible across the board in plastic sheets, while biodegradable options also serve sustainability. The continued advancement of thermoformed packaging and the industry's dedication to sustainability are greening this field with its innovations.

Thermoforming for pharmaceutical blister packaging: As customer preferences change towards sustainable options and tech developments, thermo-formed packaging is set to flourish in the future. The continued evolution of biodegradable polymers could potentially affect how legacy plastics like PVC are viewed in the industry.

Pharmaceutical Blister Packaging Market Geographical Outlook:

- Asia Pacific is projected to grow rapidly during the forecast period

The status of the Asia Pacific region in the global pharmaceutical blister packaging market is due to the increase in population and net income of individuals.

More than any other, big emerging markets such as China and India, with their huge populations coupled with a growing class of citizens able to afford medication, are trailblazing the trend towards greater medicine spending worldwide.

China is poised as one of the major players in the market due to its growing economy and improving pharmaceutical industry. It is the largest API manufacturer and is rapidly growing in the pharmaceutical sector. The prospects of blister packaging in these countries indicate a flourishing pharmaceutical industry. With the growing emphasis on sustainability, manufacturers opting for biodegradable materials, which results in less environmental pollution, and the development of smart materials with QR codes enabling the storage of information about the products are driving substantial growth. As such, the need for accurate dosing and improved patient compliance has also helped catalyze demand for unit dose material.

The pharmaceutical blister packaging market in India has shown iterative growth. It is expected to expand at a positive CAGR over the forecast period due to the flourishing pharmaceutical industry, increasing demand for drugs, rising health awareness among consumers, and its export potential. The nation has become one of the top three generic pharmaceutical producers worldwide regarding overall volume. Considering the scale and reach of Indian pharmaceutical companies, with 3000 Pharma manufacturing facilities having the highest approval from the US FDA, enough to cater to both domestic & global demand. Amidst this, the pharmaceutical packaging market is likely to grow as well; it is reportedly expected to touch USD 65 billion by 2024 and reach USD 130 billion in size by 2030 -Invest in India.

- The US market is also gaining substantial growth

The United States will hold a significant market share in the projected period, owing to the increasing aging population and the rise in chronic diseases, which will propel the pharmaceutical industry to demand effective packaging systems. According to the US Census Bureau’s “Vintage 2024 Population Estimates”, the strength of the population aged 65 years and above reached 61.2 million between 2023 and 2024, thereby witnessing a 3.1% growth, and the overall share of the older population stood at 18% of the total population.

Moreover, advancements in blister packaging innovation, incorporating improved barrier properties and user-friendly designs, with progress in product assurance and patient compliance, will contribute to the United States market expansion.

Additionally, the growing prevalence of disease in the country has also increased the overall healthcare expenditure of the people, with a considerable portion being spent on pharmaceutical products. According to the data provided by the U.S. Bureau of Economic Analysis, the nation’s total spending on pharmaceutical products in 2024 reached USD669.153 billion, representing a 6.7% growth over the expenditure incurred in the preceding year. Hence, such an expanded pharmaceutical budget is contributing to increased investment in advanced pharmaceutical blister solutions, which will contribute to the market growth in the United States in the coming years.

Furthermore, the ongoing innovations in blister packaging have encouraged the healthcare companies to offer their drugs in such innovative solutions in the US market. For instance, in February 2024, ViiV Healthcare, a worldwide HIV specialist, announced the availability of its Dovato (dolutegravir/lamivudine) in a blister pack within the U.S. The blister packs will enable the company to offer a discreet packaging solution to the HIV community, thereby seamlessly fitting in their daily routines.

Pharmaceutical Blister Packaging Market Recent Developments:

- In October 2024, Bayer collaborated with Swiss pharma Material business Liveo Research to launch a new revolutionary blister packaging that reduces the carbon footprint of typical blister packs by over 40%. The method replaces polyvinyl chloride (PVC) blisters with polyethylene terephthalate (PET), a recyclable plastic widely used in other sectors.

- In July 2024, Aluflexpack, a manufacturer of premium flexible Material solutions, launched its new product: the 4∞ Form. The blister pack is designed specifically for the pharmaceutical industry, entirely of lacquered aluminium, offering a sustainable and recyclable alternative to traditional multilateral material.

- In February 2024, Sanofi Consumer Healthcare partnered with PA Consulting and PulPac's Blister Pack Collective to create fiber-based blister packs that can be recycled in the paper waste stream while eliminating 'problem plastics' from pharmaceutical material.

- In August 2023, Amcor PLC launched its new AmSky blister system. The system utilizes high-density polyethylene (HDPE) as its primary material to replace standard PVC and aluminum foil blister packs with a more environmentally friendly, recyclable alternative. This transition is significant since numerous organizations, notably the United States Plastics Pact, have highlighted PVC as a problematic material and intend to eliminate its use by 2025.

Pharmaceutical Blister Packaging Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

|

Pharmaceutical Blister Packaging Market Size in 2025 |

US$7,297.836 million |

|

Pharmaceutical Blister Packaging Market Size in 2030 |

US$9,394.743 million |

| Growth Rate | CAGR of 5.18% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

|

List of Major Companies in Pharmaceutical Blister Packaging Market |

|

| Customization Scope | Free report customization with purchase |

Pharmaceutical Blister Packaging Market Segmentation:

- By Type

- Compartment

- Slide

- Wallet

- By Material

- PVC

- PVDC

- PP

- Others

- By Technology

- Cold-Form

- Thermoformed

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Taiwan

- Others

- North America