Report Overview

Pet Food Market - Highlights

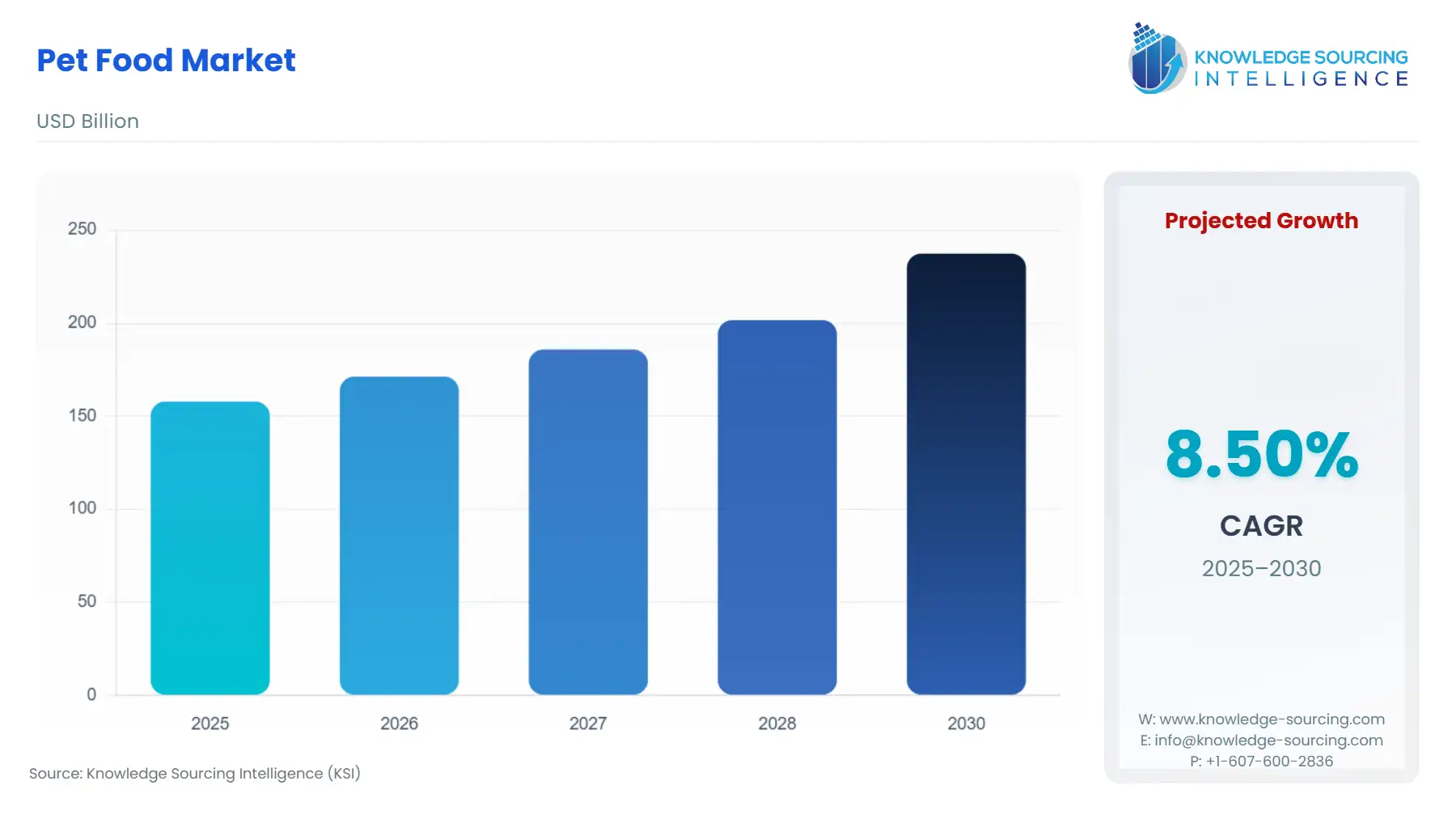

Pet Food Market Size:

The global pet food market is expected to grow at a CAGR of 8.48%, reaching a market size of US$237.376 billion in 2030 from US$157.873 billion in 2025.

The pet food market reflects a profound shift in how societies value animal companions, transforming basic sustenance into a cornerstone of household expenditure. Owners increasingly view pets not merely as animals but as integral family members deserving tailored nutrition, a perspective that has propelled consistent demand expansion. This evolution stems from broader socioeconomic changes, including delayed family formation and urban lifestyles that favor compact, low-maintenance bonds with dogs and cats. In regions like North America and Europe, where pet ownership rates exceed in households, this sentiment translates into higher per-pet spending on specialized diets addressing age, breed, and health specifics.

Globally, the sector's growth hinges on these emotional investments, yet it also grapples with resource constraints. As pet populations swell particularly in Asia-Pacific, where urban singles adopt for companionship suppliers must balance nutritional innovation with environmental accountability. This tension sets the stage for analyzing drivers that directly amplify demand, from demographic shifts to regulatory frameworks ensuring safety and efficacy.

Pet Food Market Analysis

Growth Drivers

Demographic transformations propel the global pet food market by elevating the status of animals within households, thereby intensifying demand for advanced nutritional solutions. Millennials and Generation Z, representing a significant share pet owner respectively, prioritize wellness-oriented products that align with their own health-conscious lifestyles. According to the data provided by the American Pet Products Association (2025), millennials constituted for 30% of the US pet ownership while Gen-Z accounted for nearly 20%. This cohort's spending habits catalyze a surge in organic and sustainable formulations, as they allocate resources toward items like grain-free kibble or probiotic-infused treats that promise longevity and vitality for their companions.

Evidence from consumer surveys underscores this link: higher anthropomorphism scores among younger owners correlate with greater emphasis on freshness and variety, directly translating to increased purchase frequency and volume. In turn, manufacturers respond by reformulating recipes to incorporate superfoods such as millet or fava beans, which not only meet these expectations but also expand market penetration in urban centers where these demographics dominate.

Urbanization further amplifies this demand trajectory, particularly in Asia-Pacific economies where single households spending are growing in major economies. According to the “Statistical Handbook Japan 2025”, in 2024, the average monthly-consumption expenditure stood at 169,547 yen which marked 1.1% growth over preceding year expenditure. Likewise, the average expenditure for tow or more person household was 300,243 yen which experienced 2.1% growth. These environments foster pet adoption as a counter to isolation, with new owners seeking convenient, nutrient-dense feeds that accommodate busy schedules. Likewise, such shifts compel suppliers to innovate packaging—think resealable pouches for portion control—that sustains freshness, thereby encouraging repeat buys and reducing waste. This chain reaction underscores how urban density directly heightens reliance on processed pet nutrition, outpacing raw feeding alternatives in accessibility and consistency.

Income growth in emerging markets serves as another potent catalyst, unlocking affordability for mid-tier and premium segments that were previously out of reach. In Brazil and India, rising middle-class wages have correlated with an annual uptick in pet food expenditures, as families transition from homemade scraps to commercial blends enriched with essential fatty acids for coat health. This pivot not only stabilizes supply for livestock byproducts key ingredients like meat meal but also spurs investment in localized production hubs, mitigating import dependencies. Trade data reveals that higher disposable incomes reduce price sensitivity, with consumers favoring veterinary-endorsed lines that address breed-specific needs, such as joint support for larger dogs prevalent in Latin America. Consequently, this economic upliftment broadens the consumer base, injecting vitality into distribution networks and fostering category maturation beyond subsistence levels.

Health awareness among pet owners, fueled by veterinary endorsements, directly escalates demand for functional foods that mitigate common ailments like obesity or allergies. Hence, studies suggest most of U.S. household own pet emphasis on spending on specialized diets followed by advice on balanced nutrition. These imperative drives adoption of hydrolyzed proteins or omega-3 fortified meals, which command premium pricing yet yield higher loyalty through proven outcomes like improved digestion. In Europe, where regulatory scrutiny ensures label accuracy, such transparency builds trust, prompting a projected sales increase over six years as consumers gravitate toward evidence-based options. These preferences reshape portfolios, compelling firms to allocate R&D toward bioactive additives that extend pet lifespans, thereby perpetuating a virtuous cycle of investment and consumption.

Sustainability imperatives, while initially a headwind, now act as a demand accelerator by appealing to eco-aware demographics who shun high-carbon meat-heavy feeds. The trend toward plant-based and insect proteins such as black soldier fly larvae addresses environmental footprints equivalent to cars' emissions from U.S. pet diets alone. This realignment not only diversifies supply amid livestock shortages but also opens niches in markets like the EU, where cage-free sourcing boosts appeal. Ultimately, these drivers interlock to sustain momentum, with each reinforcing the others to elevate overall market volumes and value.

Challenges and Opportunities

Supply chain vulnerabilities pose acute constraints on pet food demand, as disruptions in animal protein sourcing exacerbated by global livestock fluctuations elevate costs and limit availability. This bottleneck particularly hampers low-income segments in South America, where inconsistent harvests force reliance on imports, amplifying exposure to currency volatility and reducing purchase confidence. Owners facing these pressures often downsize to generic feeds, eroding premium demand and pressuring margins for specialized providers. The ongoing housing affordability crisis in major economies has also negatively impacted the frequency of pet adoption with owners aiming to limit their non-essential expenses. According to the National Association of Home Builder’s latest analysis for 2025, nearly 75% of US-household are unable to buy median-priced new home.

Regulatory hurdles further dampen expansion, with stringent safety standards in mature markets like the EU mandating extensive testing that delays product introductions. Hence, compliance with limits on additives, such as those under Regulation (EC) No 1831/2003, inflates operational expenses, thereby disproportionately affecting smaller innovators and stifling variety in functional categories. This rigidity curbs demand for novel ingredients like novel proteins, as hesitant consumers opt for familiar staples amid fears of recalls, evident in a dip in trial rates post-2020 enforcement waves. Such barriers entrench incumbents while sidelining agile entrants, constraining overall category diversification.

Opportunities emerge from digital distribution channels that democratize access, potentially lifting demand in underserved areas through e-commerce penetration. Platforms enable personalized recommendations based on pet profiles, fostering upsell to health-specific lines and capturing impulse buys among urban millennials. In Asia, where online sales surged at a massive rate post-pandemic, this conduit bridges rural-urban divides, allowing niche brands to scale without physical footprints and directly stimulating trial for sustainable variants.

Innovation in alternative proteins unlocks another avenue, mitigating supply risks while aligning with consumer ethics to boost uptake of eco-friendly feeds. Insect-based recipes, already approved in EU feed regulations, appeal the needs of owners prioritizing low-impact options, driving a projected positive segment growth as formulations match nutritional benchmarks of traditional meats. This shift not only stabilizes pricing amid protein scarcity but also attracts investment, enhancing affordability and broadening appeal in high-growth markets like India, where cultural acceptance grows alongside urbanization.

Raw Material and Pricing Analysis

Key raw materials in pet food production, primarily animal byproducts like meat meal and bone meal, dominate supply chains and dictate pricing volatility. These inputs, comprising majority of formulation costs, derive from livestock rendering processes. Sourcing concentrates in hubs such as the U.S. Midwest and Brazilian agribusiness zones, where integrated slaughterhouses process majority of byproducts into pet-grade meals. However, dependencies on corn and soy for binders sourced from U.S. and South American granaries expose the chain to weather-induced swings. Hence, the changing inflation has also impacted the pet food price volatility, for instance, according to the U.S Bureau of Labor Statistics, the pet food price has shown has risen significantly over the past five years.

Supply Chain Analysis

The global pet food supply chain orbits major production hubs in North America (U.S. rendering facilities handling most of byproducts) and South America (Brazil exporting high volume of protein meals), feeding formulation centers in Europe and Asia. Logistical complexities arise from perishable inputs, requiring cold-chain transport that contributes majorly to the costs, with dependencies on soy from Argentina exposing flows to trade frictions. Recent U.S. reciprocal tariffs, though minimal on pet food itself, indirectly hike input duties on Chinese additives, elevating landed costs and constraining demand in import-reliant markets like the EU. These measures, aimed at steel and electronics, ripple through packaging, prompting a shift to domestic sourcing and underscoring vulnerabilities in just-in-time models.

Government Regulations & Programs

Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

United States | FDA Center for Veterinary Medicine oversight under Federal Food, Drug, and Cosmetic Act | Enforces stringent labeling and contaminant limits, boosting consumer trust and premium demand through verified nutritional claims, though compliance delays innovation in novel ingredients. |

European Union |

Regulation (EC) No 1069/2009 and Regulation (EU) No 142/2011 by European Commission Food Safety | Mandates animal byproduct processing standards, enhancing safety perceptions that drive uptake in certified organic lines, yet raises production costs by tempering volume in cost-sensitive segments. |

Pet Food Market Segment Analysis

By Distribution Channel: Online

Online channels reshape pet food demand by offering unmatched convenience, capturing a considerable share of U.S. sales through algorithms that personalize recommendations based on pet age and health logs. This precision drives high conversion rate for trial packs, as platforms leverage data to upsell bundles dry food with toppers extending average order values. Post-pandemic, remote workers' reliance on home delivery has cemented this shift, with subscription models reducing churn and stabilizing volumes for volatile categories like fresh foods. Major economies are witnessing this digital shit in pet food buying, for instance, according to the USDA’s “Pet Food Market Update 2025” issued on May 2025, the online channel constituted for 50% of the total pet food retail in China with platform like Tmall constituting for 35% followed by Taobao accounting for 15%. Likewise, the same source also stated that prescription pet food sales experienced a significant 66% growth on online channels.

By Pet Type: The dogs segment commands the largest share of global pet food demand, driven by their prevalence as family guardians and companions. Major economies are witnessing a considerable growth in dog ownership, for instance, according to the American Pet Products Association, in 2024, the total dog ownership reached 68 million that comprised of 51% of US pet owners. This dominance stems from breed diversity necessitating specialized nutrition large breeds like Labradors require joint-support formulas with glucosamine, propelling a premium sub-segment growth as aging populations seek longevity aids. Veterinary data links these formulations to reduced hip dysplasia incidences, fostering owner loyalty and repeat volumes that outpace cat feeds. Urban adoption trends further intensify this, as apartment-dwellers favor smaller breeds demanding calorie-dense, dental-health kibble to combat plaque, directly tying to a rise in functional treats.

Pet Food Market Geographical Analysis

The pet food market analyzes growth factor across following regions

North America: The major regional economies namely the United States and Canada holds high growth potential for pet food market which is attributable to the constant growth in the frequency of pet owners. For instance, the American Pet Products Association states, that in 2024, the total pet industry expenditure reached USD 152 billion showing a continued growth from preceding year, and moreover, the expenditure in 2025 is projected to reach USD 157 billion. Well-established presence of market players Mars Incorporated that through it subsidiary such as Champion Petfoods which provides an extensive portfolio in Canada has also positively impacted the regional market growth.

Europe: The dynamic change in the food preference by pet owners has provided a new market outlook. Hence, stringent regulation regarding ingredients usage and overall quality followed by the growing shift to sustainable sources is driving the developments in pet food production in major economies namely Germany, the United Kingdom, and France.

Asia Pacific: The constant progression in number of pet owners especially dogs and cats in major economies has propelled the overall market expansion. For instance, according to the “Pet Food Market Update 2025”, China’s dog and cat pet consumer market reached USD 41.9 billion which experienced a 7.5% growth over the preceding year.

South America & MEA: The growing middle-class frequency is accelerating demand for affordable protein-rich pet food which has positively impacted the market growth in South America, whereas the necessary mandates issued by governing authorities to regulate health-focused pet food products is expected to drive the MEA pet food market.

Pet Food Market Competitive Environment and Analysis

The competitive landscape features consolidation among leaders leveraging scale for innovation, with top firms controlling a considerable share through high R&D investments annually.

Nestlé through its subsidiaries like Purina positions as the innovation frontrunner, deploying scientists to advance nutrition for pets. Its omni-channel strategy involves blending e-commerce with retail which captures digital sessions, directly enhancing accessibility and demand for brands like Purina ONE which target muscles and heat health.

Colgate-Palmolive's Hill's Pet Nutrition anchors in therapeutic efficacy, with commitments across Europe underscoring welfare alignment. Its Small Paws center innovates for toy breeds, fortifying prescription diet lines that command most of vet endorsements.

Pet Food Market Developments

October 2025: General Mill’s Blue Buffalo announced the launch of its “Love Made Fresh” which marks the entry of company in fresh pet food category. The product is available in two forms, “Scoop & Serve Tub” and “Slice & Serve Rolls”.

May 2024: Nestlé Purina announced a CHF 200 million expansion of its Silao, Mexico facility, adding lines for wet and dry pet foods to meet Latin American demand. The expansion include addition of fourth line of dry pet food and third line of wet pet food.

Pet Food Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 157.873 billion |

| Total Market Size in 2030 | USD 237.376 billion |

| Forecast Unit | Billion |

| Growth Rate | 8.48% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Product, Source, Distribution Channel, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Pet Food Market Segmentation:

By Product

Dry Food

Frozen Food

Wet Food

By Source

Animal-Based

Plant-Based

By Distribution Channel

Online

Offline

Supermarket/ Hypermarket

Specialty Stores

By Pet Type

Dogs

Cats

Others

By Geography

North America

USA

Canada

Mexico

Others

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Italy

Others

Middle East and Africa

UAE

Israel

Saudi Arabia

Others

Asia Pacific

China

Japan

South Korea

Australia

India

Others