Report Overview

Global Pet Care E-Commerce Highlights

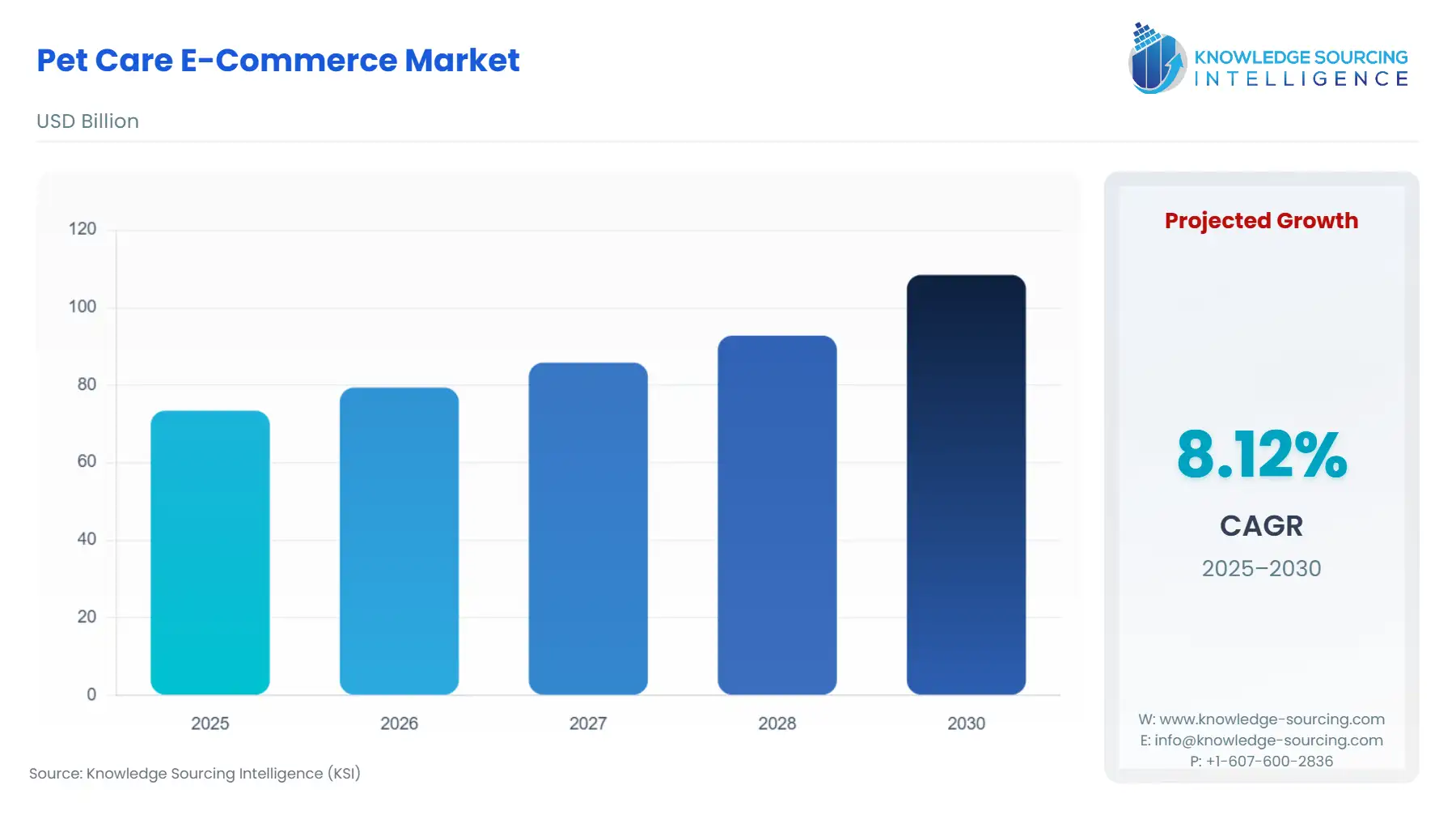

Pet Care E-Commerce Market Size

The Pet Care E-Commerce market is expected to grow at a CAGR of 8.12%, reaching a market size of US$108.461 billion in 2030 from US$73.414 billion in 2025.

The world is experiencing a significant rise in the adoption of pets. The growing adoption of pets is driven by rising disposable incomes and urban lifestyles that encourage companionship with animals. Many people now seek emotional support and comfort from their pets. This has led to an increase in demand for pet care products such as foods, supplements, shampoos & conditioners, brushes and combs, toys, and pet accessories, among many others. The rising e-commerce industry has significantly transformed the pet care market as it is easier for consumers to access a wide range of products online for their pets. The increasing internet penetration and proliferation of smartphones are further propelling the market growth of the e-commerce pet care market as it makes these products more accessible.

The pet care e-commerce market refers to all those platforms offering specialized pet care products & services. This includes pet food, grooming products such as combs & brushes, shampoos and conditioners, etc., and health & wellness products such as supplements, probiotics, etc., among many other products. The market is segmented into product types, including pet grooming, pet food, medications, and others. It is also segmented based on pet type, including dog, cat, and others. It is segmented into five broad geographic areas: North America, South America, MEA, Europe, and Asia-Pacific.

Pet Care E-Commerce Market Growth Drivers:

- The increasing trend in pet adoption is propelling the growth of the pet care e-commerce market.

There is an increasing trend in the adoption of pets worldwide. The changing urban lifestyle characterized by smaller households and busier routines is encouraging people to seek companionship with animals. For instance, an estimated 78 million dogs and 85.8 million cat owners were in the USA, as per the American Pet Products Association 2015-2016. Additionally, the rising disposable income has enabled individuals to allocate more resources to the care and well-being of their pets. For example, the U.S. pet industry expenditure has increased from US$90.5 billion in 2018 to US$147 billion in 2023, showing the rapid expansion of the pet care products market. The expanding e-commerce market is further accelerating this growth by providing pet owners with easy accessibility and a wide variety of pet care products at their doorsteps. Together, this has accelerated the pet care e-commerce market expansion.

- The growth of e-commerce is driving the expansion of the pet care e-commerce market

The world is experiencing rapid growth in the e-commerce industry, transforming how people shop. People prefer purchasing over online medium as it provides them with convenience and a wide variety of options. As per the statistics of the European Council, 300 million people in the EU do e-commerce, i.e., every 3 out of 4 people buy online, showcasing the rapid expansion of the e-commerce market. The growing e-commerce market plays a very important role in transforming the pet care industry. It offers pet owners greater accessibility and a wide range of pet care products that may not be possible through offline stores as some places may not have a dedicated pet care products store. This ease of access, competitive pricing, and doorstep delivery are leading the pet care e-commerce market growth.

Pet Care E-Commerce Market Restraints:

- The high cost of pet care products may lead to restraining the market expansion

Though the pet care market has seen significant growth in recent years, and e-commerce has further aggravated it, many factors may restrict the market's expansion if not tackled well. The high price of pet care products is creating a barrier for many pet owners to enter the market, leading to a narrow customer base. Thus, the high cost of pet care products is acting as a market restraint.

Pet Care E-commerce Market Geographical Outlook:

- North America is anticipated to be the dominant market shareholder of the pet care e-commerce market during the forecast period

North America accounted for a significant global pet care e-commerce market share. As per the American Pet Products Association, the U.S. had a total net pet care product expenditure of US$147 billion in 2023. The market is projected to grow at a decent CAGR during the forecast period.

A rapidly growing number of pet owners in countries like the United States and Canada is the major driver of this regional market’s growth. The presence of a well-established e-commerce industry and major market players are contributing to this region's pet care e-commerce market expansion. With increasing spending on the well-being of pets due to rising awareness about their health among pet owners, the demand for pet care e-commerce services is growing rapidly, thus positively impacting the market growth.

Pet Care E-Commerce Market Key launches:

- In September 2024, Growel Group introduced its new brand, “Carniwel,” to enter the Indian pet nutrition market. The Growel Group is an Indian conglomerate specializing in aquaculture feeds, aqua healthcare, and seafood processing.

- In April 2024, Wilbur Ellis Nutrition LLC, a leading provider of innovative animal nutrition solutions, partnered with Bond Pet Foods Inc. to develop tailored ingredients for pet food applications. Bond Pet Foods Inc. is the Boulder-based leader in creating sustainable animal proteins via fermentation.

List of Top Pet Care E-Commerce Companies:

- PetSmart Inc.

- Amazon.com, Inc.

- Walmart Inc.

- Chewy, Inc.

- Petco Animal Supplies, Inc.

Pet Care E-Commerce Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Pet Care E-Commerce Market Size in 2025 | US$73.414 billion |

| Pet Care E-Commerce Market Size in 2030 | US$108.461 billion |

| Growth Rate | CAGR of 8.12% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Pet Care E-Commerce Market |

|

| Customization Scope | Free report customization with purchase |

Pet Care E-Commerce Market Segmentation:

- By Pet Type

- Dog

- Cat

- Others

- By Product

- Pet Grooming

- Pet Food

- Medications

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Others

- North America