Report Overview

Personal Care Chemicals Market Size

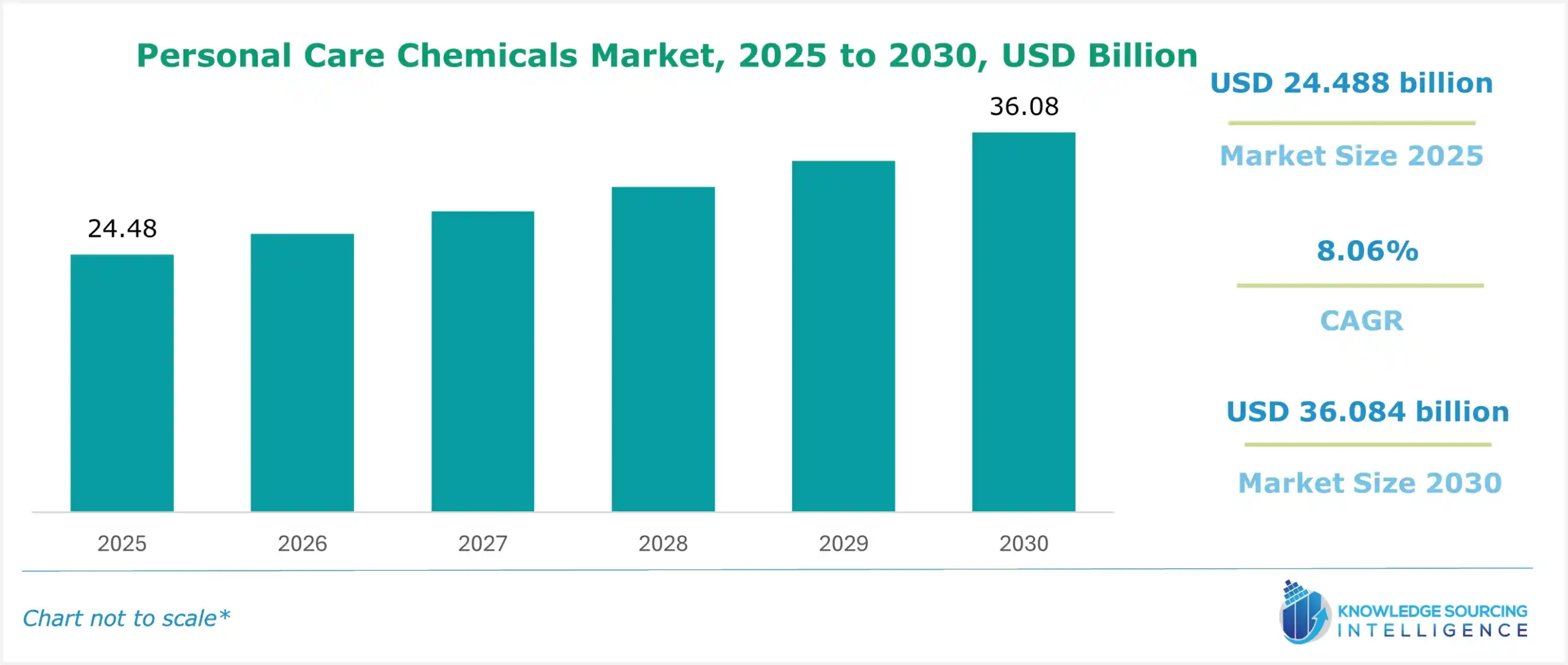

The global personal care chemicals market is expected to grow at a CAGR of 8.06%, reaching a market size of US$36.084 billion in 2030 from US$24.488 billion in 2025.

Personal care chemicals comprise several different chemicals used to keep skin healthy, in hair and cosmetics, and to prepare the body for cleansing, moisturizing, thickening, color, and perfume products or deliver active ingredients to target concerns. Examples include preservatives like parabens to preserve shelf life, surfactants like sodium lauryl sulfate to clean; emollients such as glycerin, which moisturize; and thickeners, such as xanthan gum, for aesthetic reasons; and active ingredients like retinol in anti-aging. Of course, regulations vary by country, but a consumer trend to prefer natural and transparent formulations is growing with increasing knowledge of the potential dangers of some chemicals in personal care products.

Personal care chemicals comprise several different chemicals used to keep skin healthy, in hair and cosmetics, and to prepare the body for cleansing, moisturizing, thickening, color, and perfume products or deliver active ingredients to target concerns. Examples include preservatives like parabens to preserve shelf life, surfactants like sodium lauryl sulfate to clean; emollients such as glycerin, which moisturize; and thickeners, such as xanthan gum, for aesthetic reasons; and active ingredients like retinol in anti-aging. Of course, regulations vary by country, but a consumer trend to prefer natural and transparent formulations is growing with increasing knowledge of the potential dangers of some chemicals in personal care products.

What are the global personal care chemicals market drivers?

- Consumer awareness about personal hygiene drives the personal care chemicals market growth through increased demand for hygiene-related products such as hand sanitizers, soaps, and disinfectants. Their awareness of cleanliness, especially after global health events, has made consumers look for cleaning solutions that clean and provide additional benefits such as moisturizing or antimicrobial properties. This is a trend that manufacturers face, compelling them to innovate and extend their product lines in terms of advanced formulations and active ingredients that respond to the needs of consumers.

Eco- and chemical-friendly products are now gaining preference, thus making brands reformulate and invest in safer, effective personal care chemicals. Overall, emphasis on hygiene is a good demand stimulant and innovation, making this market grow very well.

- Expansion in e-commerce is one of the major driving factors for the personal care chemicals market, which has changed the buyer behaviors of consumers significantly. The Government e-marketplace achieved a Gross Merchandise Value of $2011 Bn. GeM has, since inception, achieved a cumulative GMV of over INR 9.82 Lakh Cr as of 30th July 2024. It brings accessibility to brands by reaching broader populations globally with a wider range of products than available in traditional retail. The whole experience seems to be better with convenience through 24/7 shopping and home delivery, while data-driven personalization and targeted marketing create tailor-made journeys for shopping. Online sites, for example, entertain consumers by providing reviews and linking social media for making purchasing decisions.

Subscriptions have also become popular because the customers are offered their favorite products, hence building loyalty. Such competitive advantage within the e-commerce sphere compels the brands to change and adopt different strategies within such a fast-changing environment, thereby making logistics and supply chain management crucial in satisfying the customers. Growth in e-commerce has become a factor reshaping consumers' discovery and consumption of personal care products, thus driving this sector.

Segment analysis of the global personal care chemicals market:

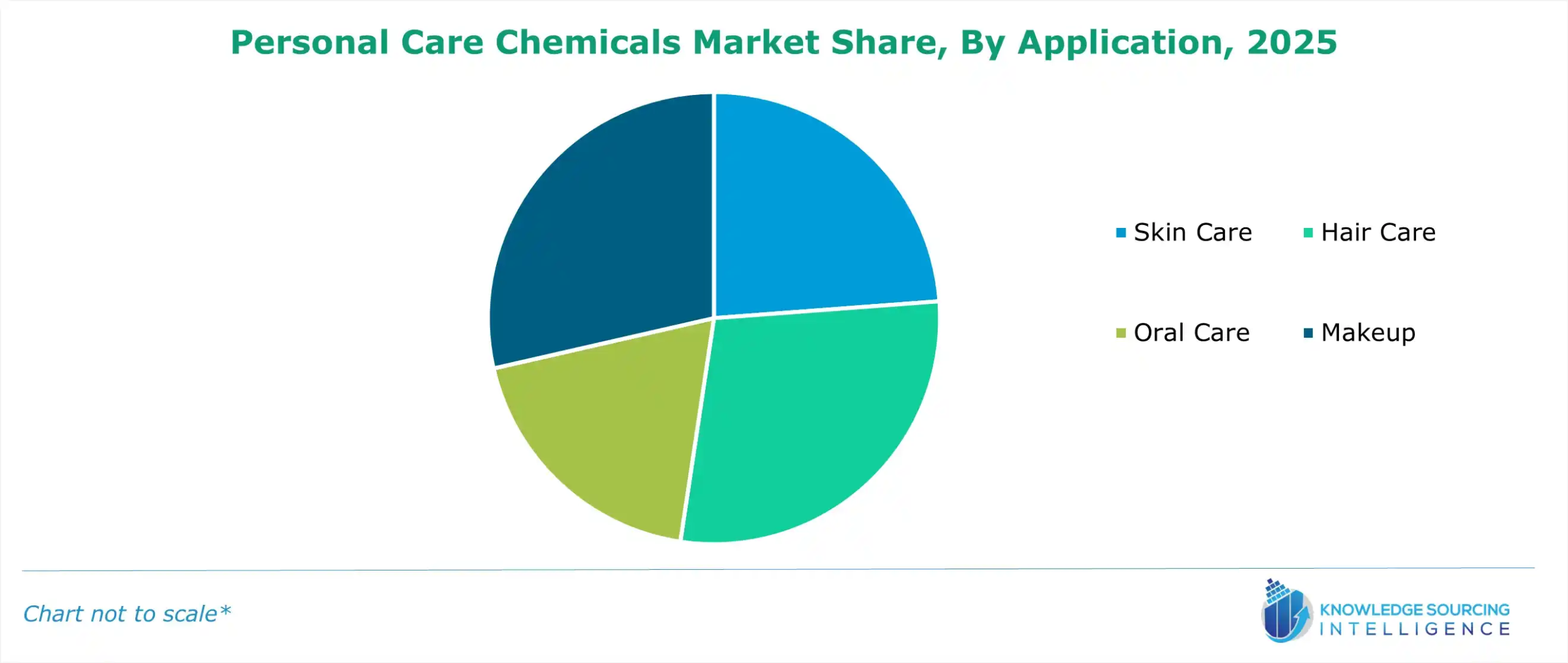

- By application, skin care is anticipated to be one of the fastest-growing segments in the personal care chemicals market.

Due to several driving factors, the skin care segment is said to be one of the high-growth segments of personal care chemicals. Moreover, there is a high investment in a large variety of skin care products due to the rising consumer awareness of skin health and beauty, influenced by social networks and beauty trends, in the form of moisturizers, serums, sunscreens, and anti-aging treatments. Furthermore, consumers' growing interest in the consumption of natural and organic-based products motivates brand companies to innovate and formulate the products according to their preferences.

Some consumers experience skin concerns such as acne, sensitivity, or hyper-pigmentation, fueling this segment’s growth. The increase in consumption of self-care and well-being products among consumers will spur the skin care segment significantly, forcing manufacturers to focus on advanced formulations and personalized offerings for catering to different consumer needs.

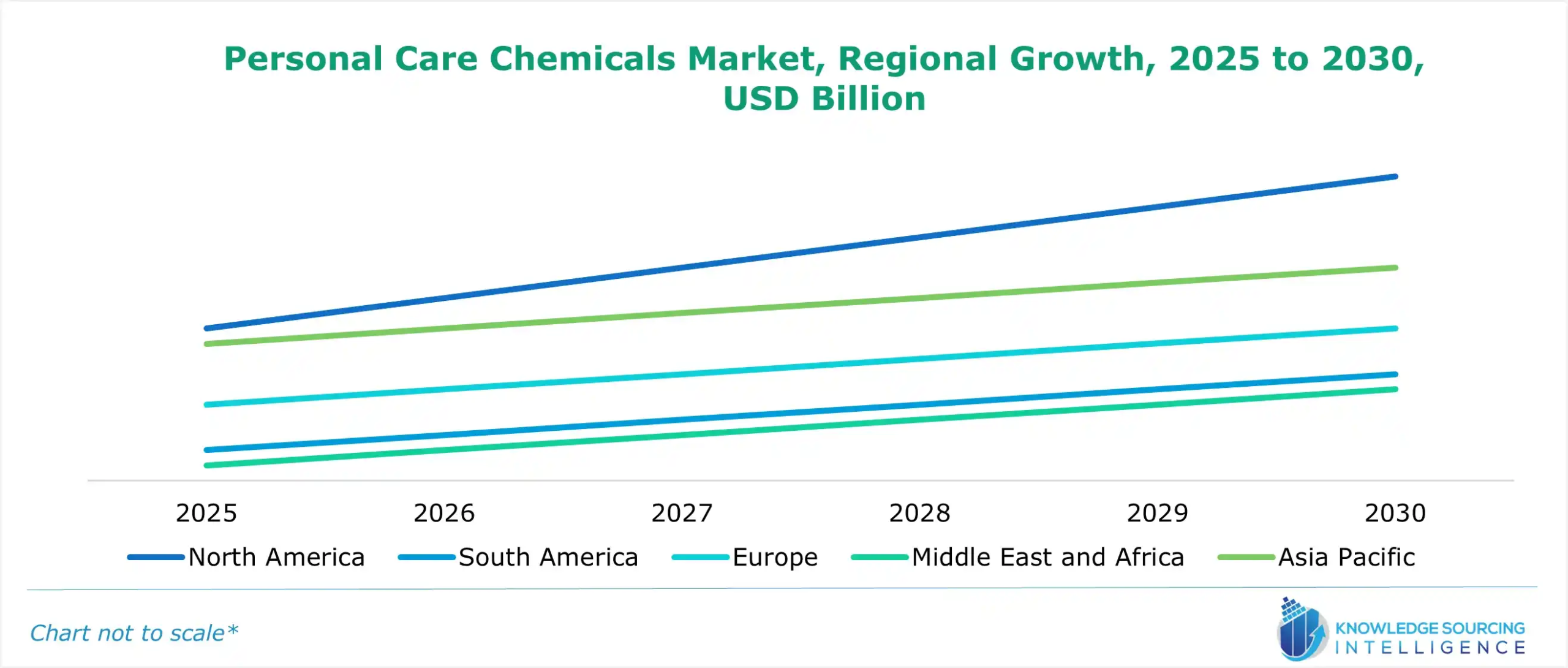

- Asia Pacific’s personal care chemicals market is anticipated to grow significantly.

The personal care chemicals market in Asia Pacific is expected to expand at a significant rate through various key drivers. Rapid urbanization and increasing disposable incomes of people in countries like China and India emerge as key factors driving consumer spending toward personal care products. China is the world's second-largest personal care products market and is set to reach nearly $80 billion by 2025.

At the same time, the growing middle-class population in the region is increasingly becoming aware of health and beauty trends, pushing demand for new premium personal care products. The region's diverse cultural influence also makes accepting a wide range of products easier, such as traditional remedies or more modern formulations. Moreover, interest in natural and organic ingredients further fosters demand for safer, cleaner, and more ecologically friendly options. Regional e-commerce growth is improving product accessibility and enabling consumers to explore and purchase a more extensive range of personal care products. The e-commerce industry in India is growing owing to increased penetration of smartphones, increased affluence, and low data prices. With over 950 Mn users, India is the 2nd largest internet market in the world with 131.16 Lakh Cr UPI transactions in FY 2023-24. All these factors position Asia Pacific as a dynamic and rapidly growing market for personal care chemicals.

Key launches in the global personal care chemicals market:

- In April 2024, Nouryon revealed its Structure® M3 co-surfactant as a new biodegradable personal care technology at the 2024 in-cosmetics Global event in Paris, France. This innovation increases the value and performance of various personal care formulations and results from consumers’ demand for more natural and less aggressive ingredients.

- In April 2024, Advancion Corporation unveiled a new green-sourced multifunctional amino alcohol designed primarily for the cosmetics and personal care industries. A newly introduced ingredient unique to Advancion, thereby giving it a competitive edge, is 50% bio-based and delivers optimum performance, such as efficiency in neutralization, emulsion, and pigment stabilization.

- In October 2023, Dow’s latest innovative ingredients were showcased in in-cosmetics Asia 2023 at booth K30 from 7-9 November in Bangkok, Thailand. The new product launches mark one of the largest portfolios in the field of the Personal Care industry that offers Sustainable & High-Performance Solutions.

- In January 2023, Ashland introduced the Natural Line for personal care products. This line is more dedicated to the promotion of natural items that people can easily identify by their name, INCI description, and known composition.

Personal care chemicals market scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Personal Care Chemicals Market Size in 2025 | US$24.488 billion |

| Personal Care Chemicals Market Size in 2030 | US$36.084 billion |

| Growth Rate | CAGR of 8.06% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Personal Care Chemicals Market |

|

| Customization Scope | Free report customization with purchase |

The global personal care chemicals market is analyzed into the following segments:

- By Product Type

- Surfactants

- Emollients

- Preservatives

- Thickeners

- Colorants

- By Application

- Skin Care

- Hair Care

- Oral Care

- Makeup

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Rest of the Middle East and Africa

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America