Report Overview

Global Packaged Juice Market Highlights

Packaged Juice Market Size:

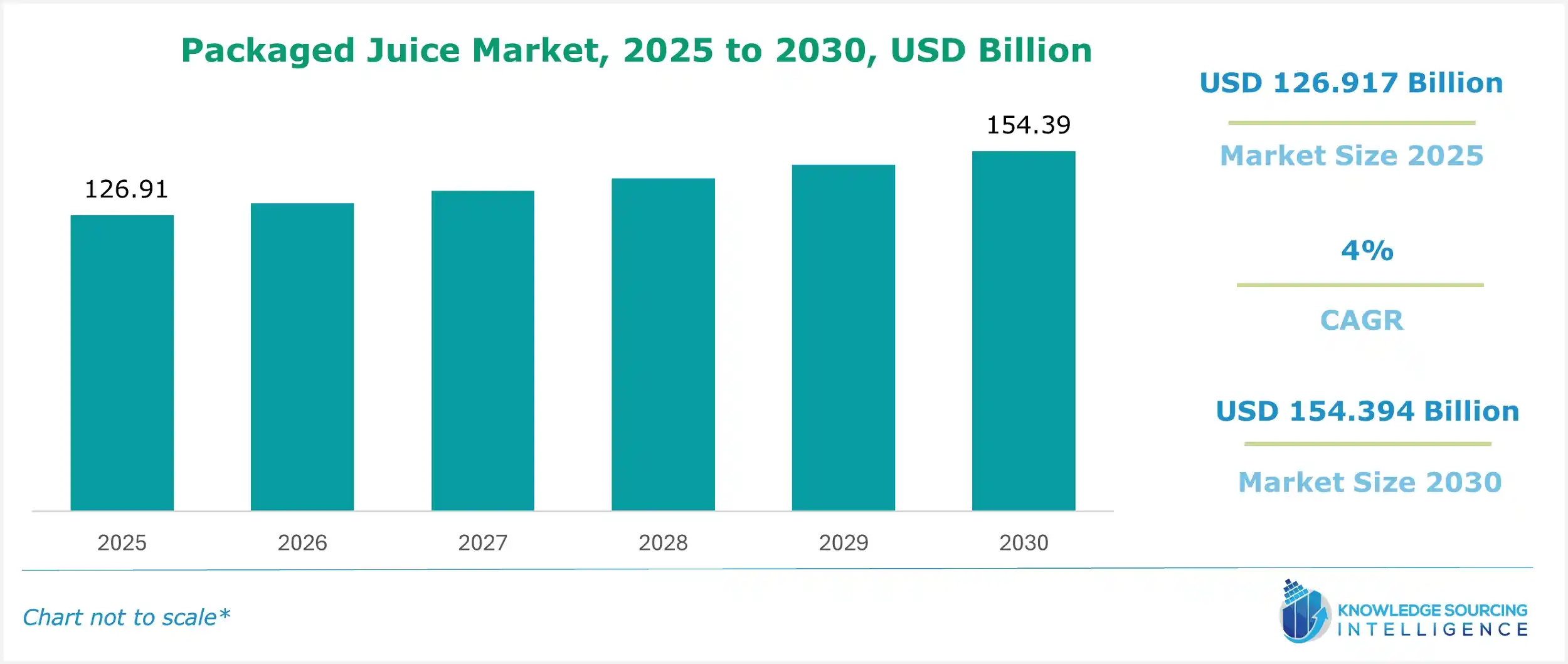

The global packaged juice market is expected to grow at a CAGR of 4% to attain US$154.394 billion in 2030, from US$126.917 billion in 2025.

Packaged juice is a type of juice that is packed or canned to maintain its nutritional value and taste for a longer time. The packaged juice provides the consumer with a rich source of vitamins, minerals, and other nutritional components. The global packaged juice market is estimated to grow significantly, primarily with the increasing consumer preferences towards healthy food products. Similarly, the expanding innovation in the juice production process is also among the key factors pushing the demand for packaged juice products in the global market.

Global Packaged Juice Market Overview & Scope:

The global packaged juice market is segmented by:

- Source: By source, the global packaged juice market is categorized into fruit juice and vegetable juice. The fruit juice category is expected to grow considerably.

- Pressing Method: By pressing method, the market is divided into hydraulic press (cold pressed juice) and centrifugal (normal juice). The centrifugal or normal juice category is estimated to attain a greater share of the global packaged juice market.

- Content: By content, the market is divided into sugar, sugar-free, with pulp, and without pulp. The sugar-free category of the content segment is growing significantly in the global packaged juice market. The increasing global cases of diabetes and the shift in consumer preferences towards healthier food products are among the key factors pushing demand for the sugar-free category’s growth.

- Product Type: By product type, the global packaged juice market is divided into normal and sparkling. The normal category is estimated to grow greatly.

- Packaging Method: By packaging method, the global packaged juice market is categorized into glass bottles, cans, tetra pak, and others. The tetra pak category is estimated to grow extensively, as it is used to package different types of food and beverages to increase their shelf life.

- Distribution Channel: By distribution channel, the market is divided into online and offline. The offline category is further divided into hypermarkets, convenience stores, and others. The online category is estimated to grow substantially due to the increasing utilization of e-commerce platforms worldwide.

- Region: The Asia Pacific region holds noteworthy growth prospects during the forecast period. This is attributed to different global market players, such as Tropicana, launching several new products. In addition, efforts are also being made by brands like RAW Pressery to make cold-pressed juices popular in countries such as India to cater to the population looking for no-sugar and healthy juices.

Top Trends Shaping the Global Packaged Juice Market:

1. Growing consumer convenience

With the increasing urbanization and changes in consumer lifestyle, the demand for convenient food products in the global market is estimated to grow significantly.

Global Packaged Juice Market Growth Drivers vs. Challenges:

Opportunities:

- Increasing demand for cold-pressed juice: Cold processed juices are prepared using a hydraulic press to extract the juices from other vegetables or fruits of choice. The hydraulic press is used after extracting pulp from the selected fruits or vegetables. In this way, these products can retain the fruits and vegetables' nutritional content. With the rising global demand for healthy food and beverage products, the demand for cold-pressed juices in the global market is estimated to grow, as cold-pressed juices have no added ingredients like sugar and preservatives.

- Introduction of fortified juice: The increasing introduction of healthier and fortified juice is also among the key factors propelling the global packaged juice market growth during the estimated timeline. With the change in consumer preferences towards healthier food and beverages, various companies worldwide introduced key innovations in the formulation and flavor of juice, like enriching the juice products with added minerals and vitamins.

Challenges:

- Growing preference for freshly squeezed juice: The packaged juices sold have very low fiber content, whereas they contain high amounts of fructose, increasing the body's insulin levels. On the other hand, fitness enthusiasts and health-conscious individuals prefer freshly squeezed juices to packed juices as they do not want to put a high amount of sugar in their bodies and lead a healthy lifestyle. This factor is leading to increased demand for fresh juice and restraining the packaged juices market’s growth.

Global Packaged Juice Market Regional Analysis:

- North America: The North American region is estimated to hold a considerable market share during the forecast period because consumers are becoming increasingly health-conscious and self-aware, due to which they are shifting to juices instead of aerated drinks. Moreover, certain market players, such as IZZE, are offering Nimoy sparkling juices that taste like aerated drinks and encouraging consumers to purchase their products.

Global Packaged Juice Market Competitive Landscape:

The market is fragmented, with many notable players, including Tropicana Products, Inc., Dabur India Limited, Sunkist Growers Inc., USA, B Natural (ITC), The Coca-Cola Company, IZZE, Snapple Beverage Corp., RawPressery, Dole Packaged Foods LLC, Hector Beverages Private Limited, Country Pure Foods, and Suntory Beverage & Food Oceania, among others.

- Product Launch: In December 2024, Ball Corporation, in partnership with Dabur India, launched 185ml aluminum cans for the Real Bites Juices brand of Dabur. The aluminum cans ensure longer shelf life and offer a sustainable packaging format.

Packaged Juice Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Packaged Juice Market Size in 2025 | US$126.917 billion |

| Packaged Juice Market Size in 2030 | US$154.394 billion |

| Growth Rate | CAGR of 4% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation | |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Packaged Juice Market |

|

| Customization Scope | Free report customization with purchase |

Global Packaged Juice Market is analyzed into the following segments:

By Source

- Fruit Juice

- Vegetable Juice

By Pressing Method

- Hydraulic Press (Cold Pressed Juice)

- Centrifugal (Normal Juice)

By Content

- Sugar

- Sugar-free

- With Pulp

- Without Pulp

By Product Type

- Normal

- Sparkling

By Packaging Method

- Glass Bottle

- Cans

- Tetra Pak

- Others

By Distribution Channel

- Online

- Offline

- Hypermarkets

- Convenience Stores

- Others

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa