Report Overview

Global Ocular Implants Market Highlights

Ocular Implants Market Size:

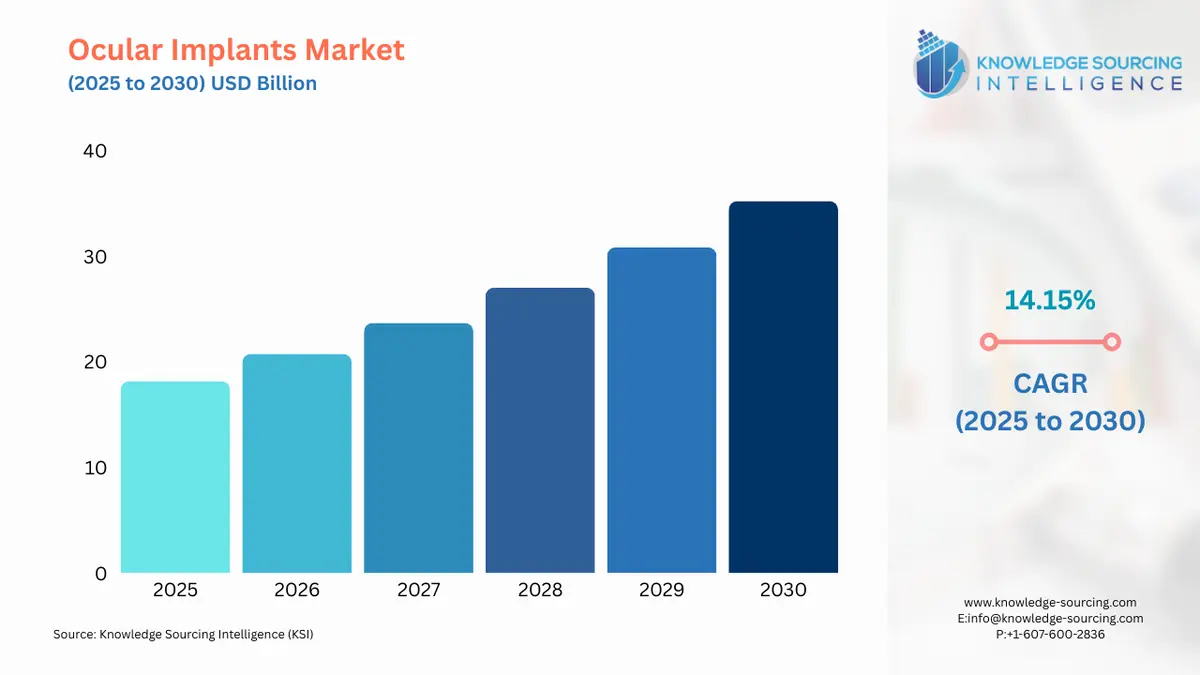

The Ocular Implants market will grow at a CAGR of 14.15% from USD 18.163 billion in 2025 to USD 35.208 billion in 2030.

Ocular Implants Market Trends:

The ocular implant market is driven by the rising prevalence of eye conditions such as cataracts, glaucoma, scleritis, and age-related macular degeneration (AMD). The World Health Organization estimates 2.2 billion people globally have vision impairment, with cataracts and AMD among the leading causes. This surge fuels demand for ocular implants, critical for surgical procedures like cataract surgery and glaucoma treatment. Advancements in ophthalmic diagnostic technology, including optical coherence tomography (OCT), enhance early detection, increasing the need for intraocular lenses, glaucoma drainage devices, and artificial eye devices.

Improved accessibility to online resources educates patients about eye treatment options, boosting market growth. Technological developments in ocular implants, such as premium intraocular lenses and minimally invasive glaucoma surgery (MIGS) devices, improve outcomes and drive adoption. North America leads due to advanced healthcare infrastructure, while Asia-Pacific grows rapidly, driven by aging populations and rising healthcare access in countries like India and China.

Challenges include high implant costs and limited access in developing regions, but government initiatives and NGO programs, like WHO’s Vision 2030, promote eye care. Innovations in biocompatible materials and smart implants with sensors enhance patient outcomes. The ocular implant market thrives on technological innovation, rising eye disease prevalence, and global healthcare advancements, ensuring sustained growth in addressing vision impairment.

Ocular Implants Market Growth Drivers:

- Rising demand for glaucoma implants

The market growth can be attributed to the fact that glaucoma is becoming more common and is one of the main causes of blindness. A Bright Focus Foundation study estimates that 20 million individuals worldwide suffered from glaucoma in 2020. By the end of 2040, this number is anticipated to surpass 111 million. The ocular implants market is divided into intraocular lenses, corneal implants, orbital implants, glaucoma implants, ocular prostheses, and other categories based on the product type.

During the forecast period, glaucoma implants are expected to continue to increase the market demand. This is because governmental and non-governmental organizations have raised awareness of glaucoma. For example, to raise awareness about glaucoma, the World Glaucoma Association[1] has launched an initiative called "World Glaucoma Week," scheduled for March 6–12, 2022. Moreover, they have been used for so long to treat nearsightedness, farsightedness, and presbyopia that intraocular lenses have become increasingly popular.

- The increasing importance of aesthetic value has led to a rise in the adoption of ocular prosthesis

For those who have experienced eye trauma, the ocular prosthesis adds aesthetic value to their faces. The market offers a wide range of implantable ocular prostheses composed of a scleral shell, acrylic, and glass. The use of cryolite glass ocular prostheses is becoming more and more popular. This is because the glass provides a reflection that resembles the human eye. Furthermore, the development of digital technology has made it possible to quickly and accurately construct an ocular prosthesis of this kind. In developed nations like the United States, Germany, and Japan, the acceptance of glass ocular prostheses has shifted due to these factors.

- Increasing prevalence of eye disorders like cataracts and glaucoma

The two most common ocular conditions affecting the world's elderly population are cataracts and glaucoma. The World Health Organization (WHO) estimates that cataracts cause blindness in about 20 million people globally. Furthermore, it is estimated that only 17% of people with cataract-related vision impairment and 36% of people with refractive error-related distance vision impairment worldwide have access to the proper interventions. Glaucoma devices and intraocular lenses have become more popular due to this increase. In conjunction with the aforementioned factors, the population's growing awareness of various treatment options is expected to support the ocular implant market growth in the foreseeable future.

- Rising technological advancements

There have been many technological developments in the market. For example, the PRIMA System, a bionic or artificial eye technology that partially replaces the physiological function of the eye's photoreceptors, was recently introduced by PIXIUM VISION. A wireless sub-retinal implant that sends visual data to the brain's optical nerve makes this possible. The gadget also includes a digital projector, a pair of glasses with a camera integrated into them, and a pocket processor. A feasibility study for this technology is presently being conducted in the United States and France for people with age-related macular degeneration (dry atopic form), which causes severe vision loss.

Furthermore, developing microinvasive glaucoma devices for patients is anticipated to propel the market. Advanced intraocular lenses and corneal implants that solve issues with currently available implantable devices are two more examples of such innovations. During the projected years, the market sales of these cutting-edge technologies for treating ocular disorders and diseases are anticipated to soar.

- High demand for ocular implants in hospitals

This is because more patients choose to have eye surgeries in hospitals than in clinics or other settings. Two factors driving the growth of the hospital segment are the rising prevalence of cataract and glaucoma surgeries in hospitals and the growing number of people undergoing ocular surgeries. The need for ocular implants in hospitals is expected to be fueled by other significant factors, such as the developing healthcare infrastructure in developing nations and the rise in sophisticated healthcare facilities. By the end of the forecast period, it is anticipated that this market trend will be followed.

Ocular Implants Market Geographical Outlook:

- North America is witnessing exponential growth during the forecast period

North America is anticipated to grow at a high rate because of the rising incidence of eye problems, sedentary lifestyles, and rising knowledge of important factors.

The factor that is primarily driving the market boom in North America is Trelease products. Additionally, the region's access to technologically advanced products and a favourable pay environment make it likely for the company to maintain its lead over the course of the forecast period.

Ocular Implants Market Key Launches:

- In February 2024, Johnson & Johnson MedTech*, a leading global provider of eye health care, announced that the TECNIS PureSee purely refractive presbyopia-correcting lens is now offered in Europe. Similar to a monofocal IOL, the TECNIS PureSee IOL has a proprietary purely refractive design and provides continuous, high-quality vision with high best-in-category contrast and low-light performance.

- In December 2023, the FDA approved Glaukos Corp.'s New Drug Application (NDA) for travoprost intracameral implant (iDose TR) 75 mcg, a prostaglandin analogue indicated for reducing intraocular pressure (IOP) in patients with open-angle glaucoma (OAG) or ocular hypertension (OHT). According to Glaukos Corp.1, the travoprost intracameral implant is a long-duration intracameral pharmaceutical therapy intended to provide therapeutic levels of a unique formulation of travoprost inside the eye for prolonged periods.

List of Top Ocular Implants Companies:

- SMR Ophthalmic Pvt. Ltd.

- iSTAR Medical

- Johnson & Johnson

- STAAR Surgical

- Alcon

Ocular Implants Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Ocular Implants Market Size in 2025 | US$18.163 billion |

| Ocular Implants Market Size in 2030 | US$35.208 billion |

| Growth Rate | CAGR of 14.15% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Ocular Implants Market |

|

| Customization Scope | Free report customization with purchase |

Ocular Implants Market Segmentation:

- By Type

- Intraocular lenses

- Ocular Prostheses

- Others

- By End-User

- Eye Hospitals

- Ophthalmic Clinics

- Eye Institutes

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- South Africa

- Others

- Asia Pacific

- Japan

- China

- India

- Australia

- Others

- North America