Report Overview

Global Nectar Market Size, Highlights

Global Nectar Market Size

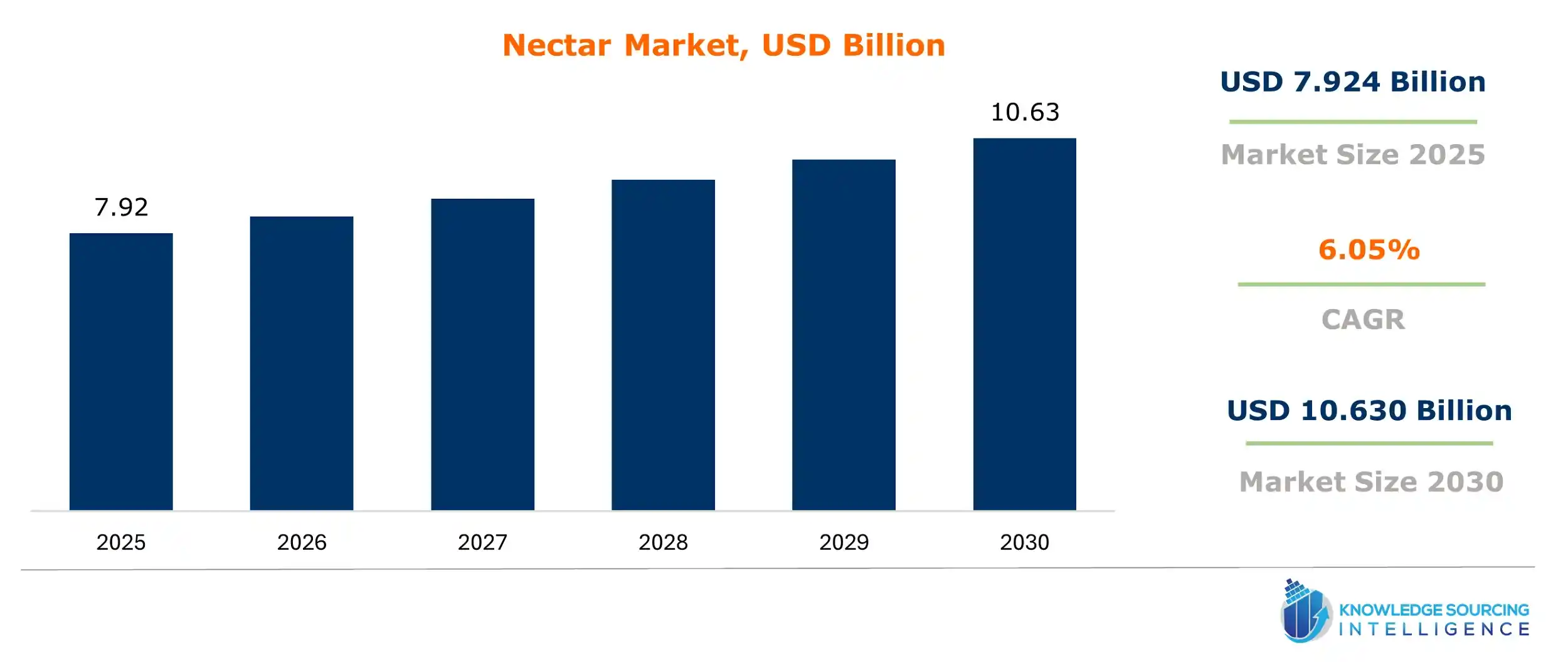

The global nectar market is expected to grow at a CAGR of 6.05%, reaching a market size of US$10.630 billion in 2030 from US$7.924 billion in 2025.

Nectar Market Key Highlights:

- Health-conscious consumers are increasingly preferring nectar over sugary carbonated drinks.

- Manufacturers are experimenting with innovative flavor combinations, including superfoods and exotic fruits.

- Rising disposable incomes and urbanization are boosting nectar demand in emerging markets.

- Sustainable packaging and eco-friendly sourcing are driving brand loyalty among consumers.

Nectar juice, also called pulp juice or nectar drink, is a drink that contains fruit pulps and flesh. Nectar fruit juice is made out of natural fruit pulp or concentrated pulps and contains fibrous fruit materials as well as pectins. This juice generally represents a more original taste of fruits, reserving some solid content of fruit. The increased consumption of carbonated soft drinks, including flavored sodas and colas, is steadily declining worldwide due to increased health concerns from the masses, especially in developed economies. Soft drinks include ingredients such as sugar in high amounts, phosphoric acid, artificial coloring, artificial sweeteners, and caffeine that harm the human body and human health.

A major reason for the global nectar market development is the awareness of the adverse effects of soft drinks on human health. Consumers now prefer healthier alternatives to carbonated drinks, such as soft drinks and sodas. As a result, demand for nectar is shooting up gradually and positively influencing the global nectar market growth. People are becoming aware of their lifestyle and dietary habits for healthy living. Besides, growing disposable income, living standards, and increasing urbanization in emerging countries have collateral influences on the world nectar market.

Nectar Market Growth Drivers:

- Rising health consciousness is contributing to the global nectar market growth

The increasing focus on sustainability has led to a growing preference among consumers for products that integrate environment-friendly practices. These form some very strong audiences showing brand loyalty towards those eco-friendly package-related and sustainable ingredient source messages. The producers are also attempting new flavor combinations and profiles rather than sticking to the regular and conventional nectars and juices that might even include some superfoods or exotic fruit blends. This makes it more interesting to try out new products with the myriad of palates that it could cater to.

Further, natural sugar-rich carbonated drinks are declining in popularity. Natural nectars are predominantly preferred as they are increasingly regarded as a premium, nutritious addition to the general diet. This has come about mainly because of young consumers whose health concerns lean toward products labeled as clean and devoid of artificial ingredients.

- The increasing popularity of fruit nectar is anticipated to boost the global nectar market.

Fruit juices take all the juiciness from the fruits, completely extracting the fruit juices. These fruit juices do not have any additional sugars, preservatives, or artificial flavors. It appeals to health-conscious consumers searching for an all-natural, fresh alternative, because they're usually defined according to the fruit whose juice they contain, such as orange juice, apple juice, and various mixed fruit juices. Nectars, by contrast, are beverages produced by mixing with water, fruit juice, or fruit puree and are typically further sweetened with sugars or sweeteners. Despite having a lower percentage of pure fruit juice than fruit juices, it pleases most consumers, especially children and even adults, who are looking for a more welcoming fruit drink.

Global Nectar Market Restraints:

- High sugar content is anticipated to hamper the market growth

High sugar content in many fruit juices and nectars can lead to diabetes, obesity, and other health issues. Customers are choosing low-sugar beverages or substitutes like coconut water, sparkling water, and herbal teas as they grow more health conscious. Fresh, whole fruits are becoming increasingly popular as an alternative to processed juices. Consumers are seeking products with more natural nutritional benefits and less processing. Governments and regulatory agencies are strengthening laws governing fruit beverage labeling and advertising globally. This may limit juice producers' marketing strategies and raise compliance costs.

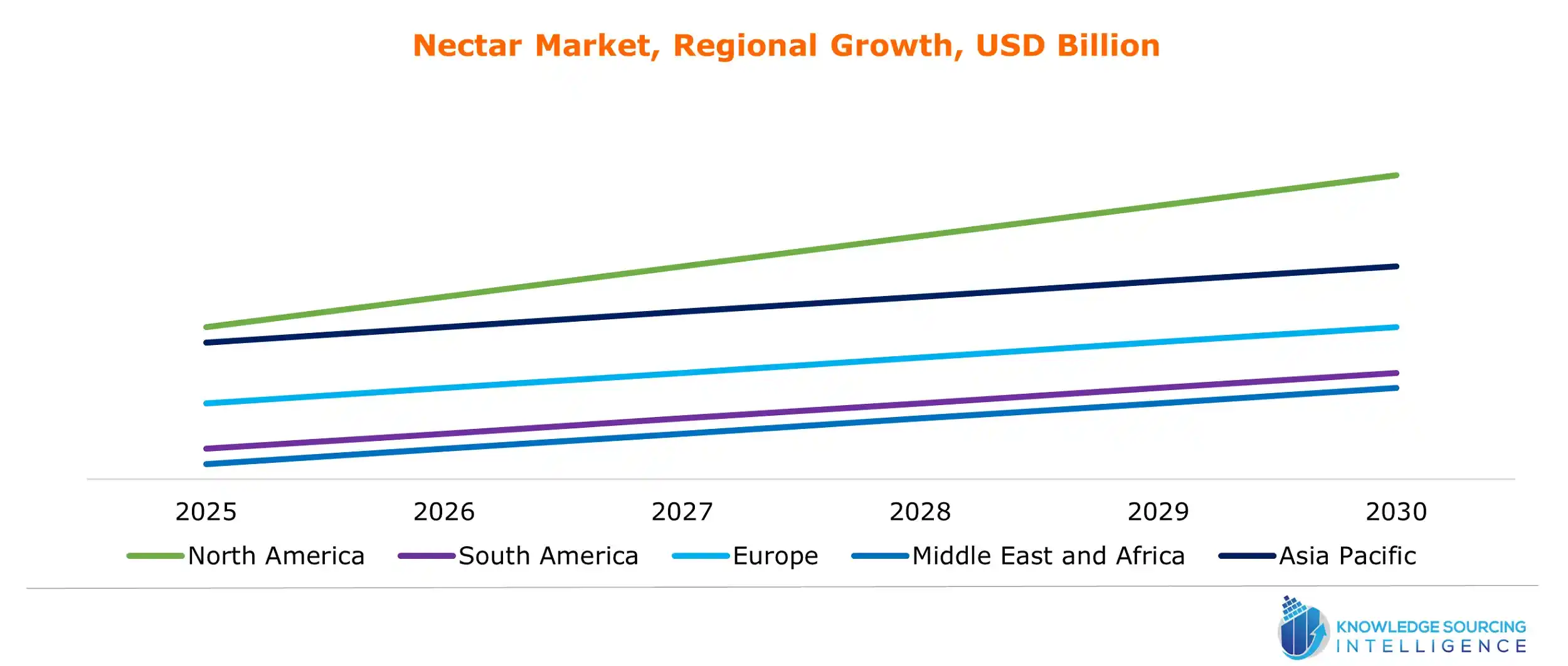

Nectar Market Geographical Outlook:

- North America is witnessing exponential growth during the forecast period.

The market is expanding steadily due to rising consumer demand for natural and minimally processed products and healthier beverage options.

As North American consumers have become increasingly health and wellness conscious, higher volumes of consumption of nectars are recorded for such beverages, which are generally perceived to be healthier options than sugar-laden carbonated drinks. To satisfy the diverse expectations of various consumers, manufacturers now experiment with unique combinations of fruits and flavors, including concoctions that feature functional ingredients and superfoods.

Nectar Market Key Launches:

- In June 2024, RFG entered the fruit nectar juice market in response to the Rhodes brand's success in the 100% fruit juice market. The 200ml, 1L, and 2L pack sizes of the Rhodes fruit nectar juice line have been introduced. It comes in five different flavors: apple, guava, tropical, Mediterranean, and red grape.

- In April 2024, PeakSpan Capital partnered with Nectar, a culture platform that emphasizes employee rewards and recognition, to expand its platform and product offerings more quickly. Well-known growth equity firm PeakSpan Capital makes calculated bets on high-potential tech companies.

List of Top Nectar Companies:

- Döhler

- Kanegrade

- The Tierra Group

- Malt Products Corporation

- ciranda, inc.

Nectar Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Nectar Market Size in 2025 | US$14.157 billion |

| Nectar Market Size in 2030 | US$19.198 billion |

| Growth Rate | CAGR of 6.05% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Nectar Market |

|

| Customization Scope | Free report customization with purchase |

The global nectar market is segmented and analyzed as follows:

- By Type

- Orange

- Guava

- Papaya

- Mango

- Apricot

- Agave

- Others

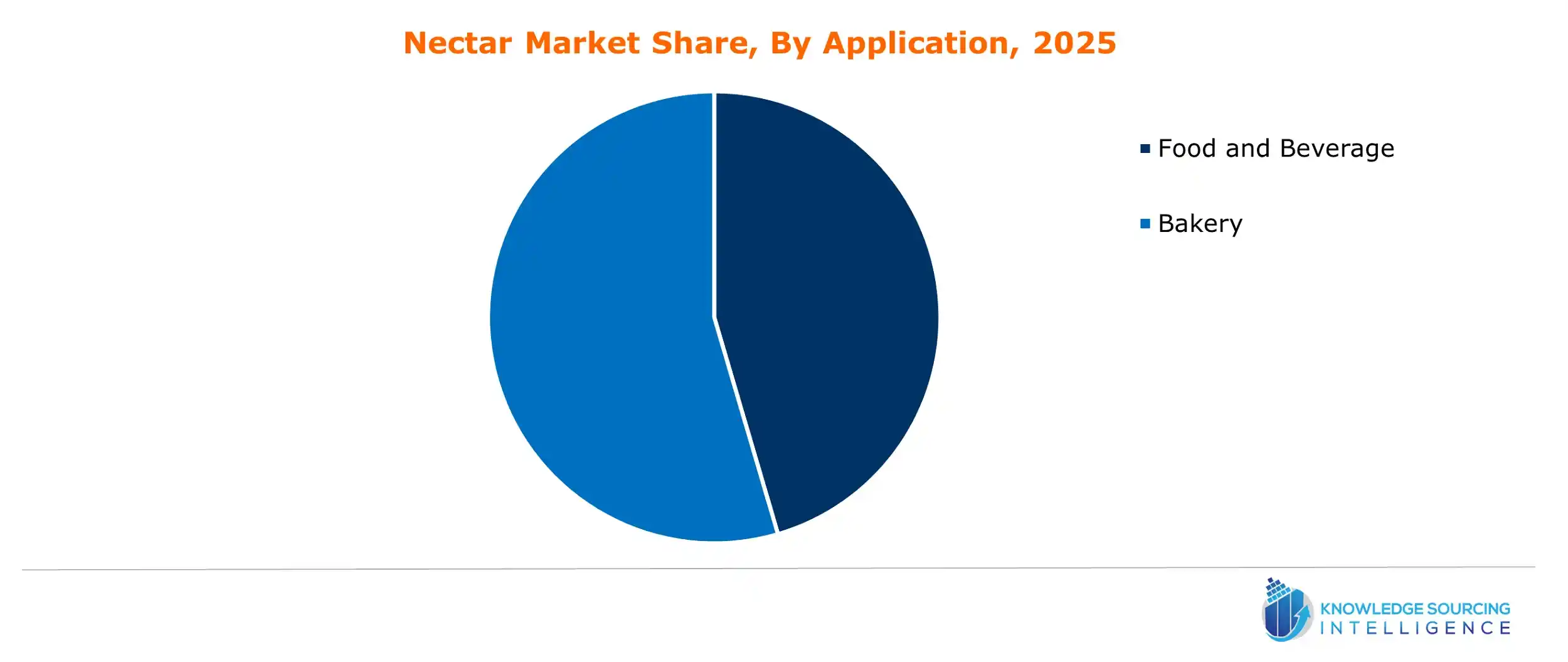

- By Application

- Food and Beverage

- Bakery

- By Distribution Channel

- Online

- Offline

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Others

- North America