Report Overview

Global Medical Disposables Market Highlights

Medical Disposables Market Size:

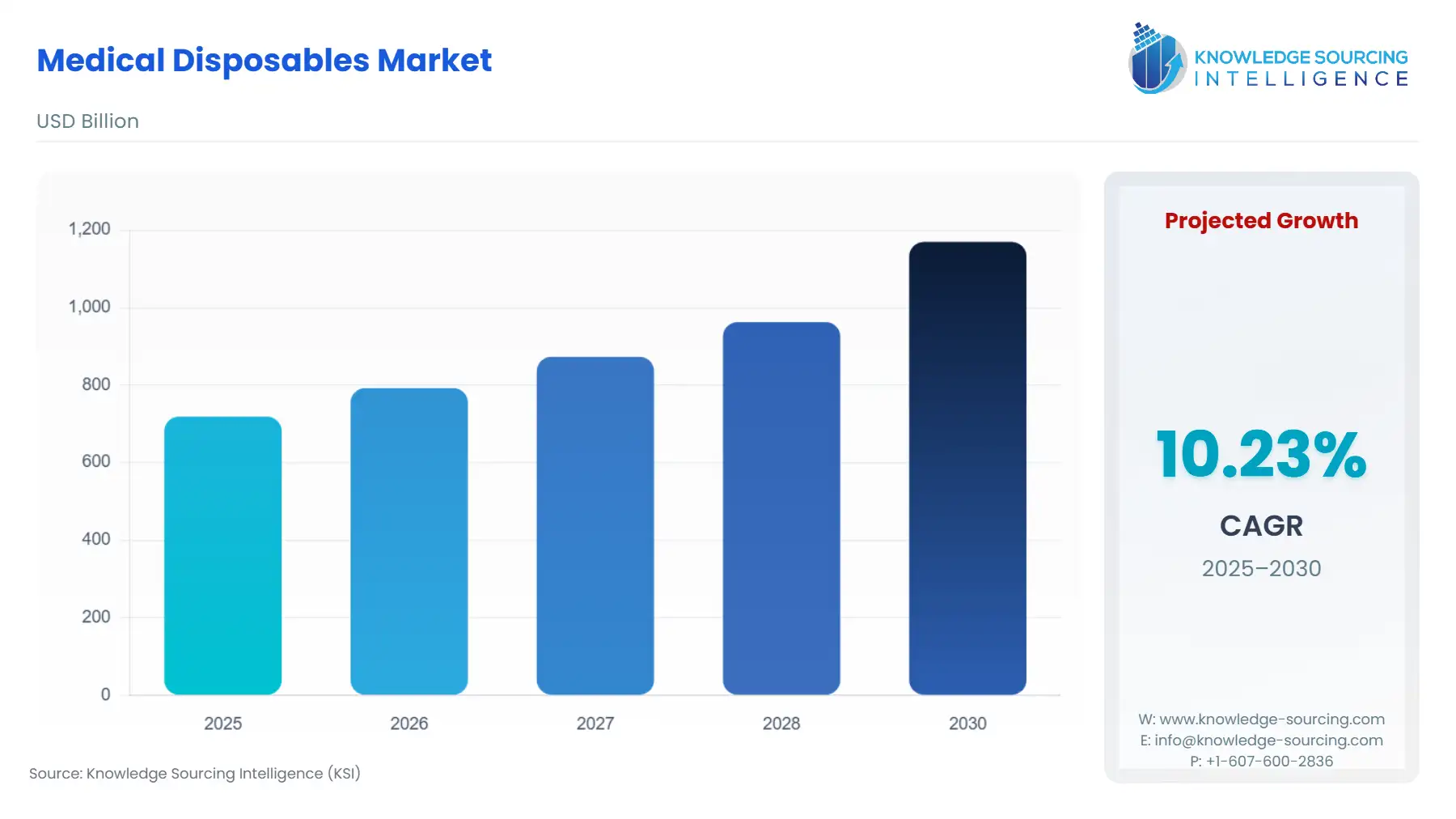

The global medical disposables market is projected to grow at a CAGR of 10.23% to reach a market size of US$1,169.584 billion by 2030, up from US$718.814 billion in 2025.

Medical disposables are single-use products meant for medical use and discarded once applied to prevent cross-contamination, reduce the risk of infection, and maintain hygiene standards. These products are integral to all healthcare facilities, such as hospitals, clinics, diagnostic centers, and home care settings.

The ongoing spread of the pneumonia-like virus is leading to skyrocketing demand for PPE to prevent the spread of the infection and restrict the rapidly rising number of confirmed cases and deaths globally. Personal Protective Equipment (PPE) is highly recommended by different healthcare organizations and government bodies, such as the Centers for Disease Prevention and Control (CDC) and the World Health Organization, among others.

Medical Disposables Market Growth Drivers:

- Increasing prevalence of healthcare-acquired infections (HAI)

There is an increasing number of individuals who are leading sedentary lifestyles and consuming copious amounts of alcohol, nicotine, and other items such as fast food, which is putting them at risk of alcohol poisoning and lung cancer, thus leading to an increase in hospitalizations. However, their problems are being aggravated due to the unhygienic practices, unclean instruments, and surroundings in some of the healthcare centers.

According to the WHO, Healthcare-Acquired Infections (HAI) are increasingly common and are one of the major factors in the increased healthcare costs and prolonged hospital stays. Hence, these factors are encouraging healthcare professionals to adopt medical disposables such as face masks and medical gloves, among others, to prevent the spread of infection to themselves or other patients, further bolstering the market growth.

- Increase in geriatric population worldwide facilitated by increasing living standards

The increase in living standards, due to the rising disposable income of individuals, has increased life expectancy and led to a rise in the geriatric population in different regions of the world. As per the Population Reference Bureau, the number of Americans above 65 is projected to grow significantly from 58 billion in 2022 to 82.5 billion by 2050, a 47% increase. Additionally, the proportion of the population of people aged 65 or older will grow from 17% to 23% in the future.

The increase in the geriatric population has made them more prone to different infections and diseases due to their decreased immunity. Some of the diseases that plague aged individuals are urinary tract infections and cataract surgeries, among other viral infections. This is increasing the demand for medical disposables such as examination gloves, surgical gloves, and face masks, among others, contributing to the market growth over the forecast period.

- Rise in products offered by key market players

The offering of better and more advanced medical disposables with enhanced protection, quality, and durability, among other properties, by the existing and new players in different markets is estimated to lead to increased adoption and propel the market growth further over the forecast period.

Following this, Smith & Nephew, a company that provides different medical products and solutions to cater to different applications, offers a range of Wound Management solutions. It offers a product called “ACTICOAT,” which is used to create and act as an antimicrobial barrier and is used as a dressing for the wound.

Moreover, Cardinal Health, one of the leading medical products and solutions companies, offers a range of products under the infection control segment called the “Disposable Gowns and Capes”. These are specially designed by infusing 3 layers into a single layer of textile material that is non-woven and opaque to facilitate the provision of maximum protection.

Medical Disposables Market Geographical Outlook:

Geography-wise, the global medical disposables market is divided into North America, South America, Europe, the Middle East and Africa, and Asia Pacific. The

North American region is expected to hold a significant share over the forecast period since an increasing number of players are involved in providing advanced and enhanced varieties of medical disposables.

In addition, there is an increasing number of surgeries in countries such as the US, increasing the demand for essential medical disposables such as gowns, face masks, and medical gloves.

In addition, the Asia Pacific region is expected to witness a significant increase in its market share over the forecast period, which is attributable to the government taking initiatives to boost the healthcare sector. For instance, India has emerged as a significant success story in medical goods, with its production of generic medicines and cheaper vaccines leading it to become a net exporter of medical consumables and disposables. India has also overturned its previous reliance on foreign products, such as needles and catheters, in this domain. In addition, the cheap production and easy availability of medical disposables in countries such as Malaysia, India, and China, among others, are further adding to the regional market share.

Medical Disposables Market Key Developments:

- In September 2024, Embecta Corp., a global diabetes care company with a 100-year history of innovation in insulin delivery, announced that its proprietary disposable insulin delivery system has received 510(k) clearance from the U.S. Food and Drug Administration (FDA). The system is indicated for adults who require insulin to manage both type 1 (T1D) and type 2 (T2D) diabetes, and its tubeless patch pump design with a 300-unit insulin reservoir was informed by feedback from people with T2D and their healthcare providers.

- In January 2024, Inspira Technologies OXY B.H.N Ltd., a company pioneering life support technology with a mission to replace traditional mechanical ventilators, announced that it intends to launch the single-use disposable blood oxygenation kit for its INSPIRA ART medical device series. The Kit is also planned to be compatible with other life support machines.

List of Top Medical Disposables Companies:

- Intermed

- Narang Medical Limited

- Hindustan Syringes & Medical Devices Ltd.

- Smith & Nephew

- 3M

Global Medical Disposables Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Global Medical Disposables Market Size in 2025 | US$718.814 billion |

| Global Medical Disposables Market Size in 2030 | US$1,169.584 billion |

| Growth Rate | CAGR of 10.23% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Global Medical Disposables Market |

|

| Customization Scope | Free report customization with purchase |

Global Medical Disposables Market Segmentation:

- By Product Type

- Wound Management

- Applicators

- Bandages

- Dressings

- Gauze

- Apparel

- Coverall

- Exam Gowns

- Shoe Covers

- Gloves

- Lab Coats

- Face Masks

- Blood Collection

- Needles

- Lancets

- Tourniquets

- Swabs

- Others

- Wound Management

- By End-User

- Hospitals

- Homecare

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- UAE

- Rest of the Middle East and Africa

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America