Report Overview

Marine Paints Market - Highlights

Marine Paints Market Size:

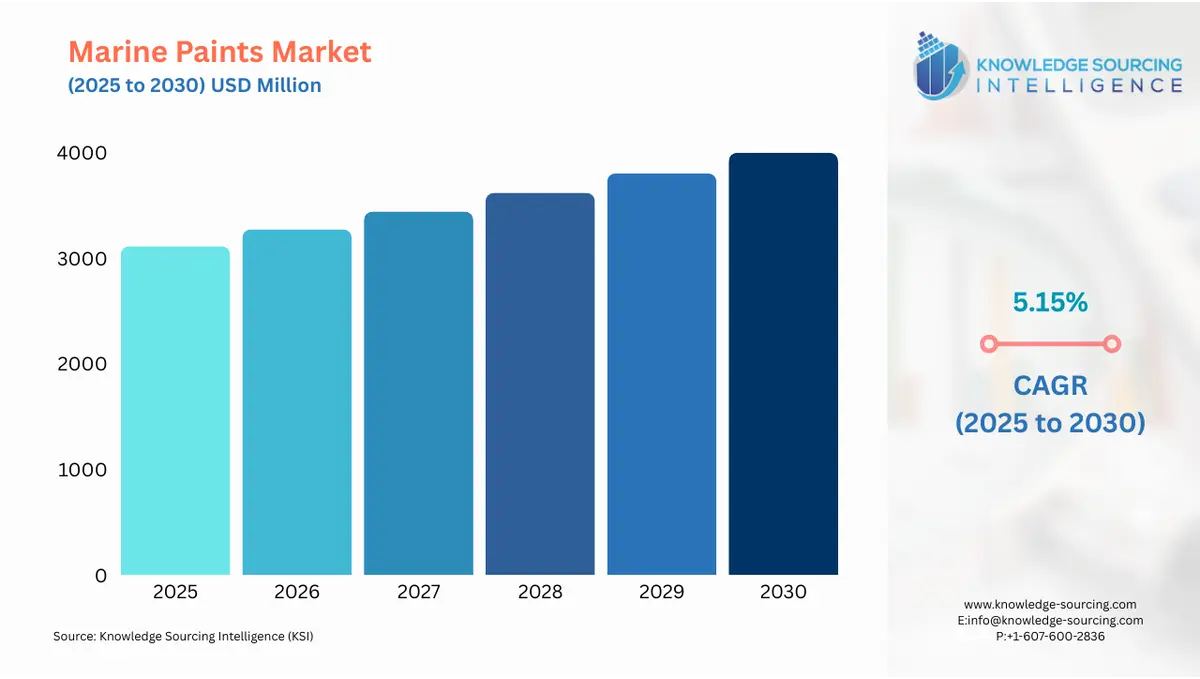

The global marine paints market is expected to grow at a CAGR of 5.15%, reaching a market size of US$3,999.90 million in 2030 from US$3,112.13 million in 2025.

Marine paints are the kind of paint for ships, boats, ferries, other watercraft, and buildings that are exposed regularly to water. These paints hold apart moisture, brackish water, and saltwater. They are painted on offshore oil rigs for preservation against iron corrosion and rusting. The demand for marine paints is high in general application, particularly as an easy-to-use product by ship operations in the shipping industry. It surrounds marine vessels from corrosive elements with the use of paints.

Moreover, a very important advantage of marine paints in the shipping industry is that they smoothen the ship hull, displacing frictional resistance from the seas and thus decreasing fuel consumption for the vessel’s operation. The primary advantage of marine paints on offshore structures is superior color and gloss retention so that the structure looks best under all conditions. At the same time, marine paints also avoid and protect the structure from weather damage, such as chalking and yellowing.

Marine Paints Market Growth Drivers:

- Enhanced application of anti-corrosion coatings is contributing to the global marine paints market growth

Anti-corrosion marine coatings are rapidly emerging as valuable solutions for vessels by shielding their metal parts from moisture, salt spray, and oxidation. The anti-corrosion segment accounts for nearly 40% of all sales for marine coatings. Moreover, with an impressive increase in demand, industry players are progressing with more innovative offers to effectively meet growing needs and attract a wider range of customers. For instance, Nippon Paint Marine offers new antifouling technology to enhance the level and consistency of antifouling performance. It also claims that the process thickens the film and reduces application time.

- The growing need for offshore vessels is anticipated to boost the global marine paints market.

The increased activities in offshore oil and gas exploration and production tremendously escalate the need for marine coatings. Protective coatings are essential to prevent the corrosion of various offshore vessels, including rigs, drill ships, pipe laying vessels, platform supply vessels, floating production storage and offloading vessels, and many others, due to different harsh underwater marine environments. Shields against chemicals, seawater, and other corrosive substances are extremely important to offshore vessels by coatings on decks and hulls. They lower repair and maintenance costs. Over time, these would increase the lifespan of offshore vessels.

New fields are still being developed in well-known offshore locations such as the North Sea and Gulf of Mexico. At the same time, massive capital investments are made into exploration infrastructure in emerging hydrocarbon basin countries such as Africa and Asia Pacific. Several national oil companies and international super majors have planned extensive deep-water and ultra-deep-water exploration programs for the coming decades. Many offshore vessels, which require corrosion-preventive coatings, are deployed on all these activities. As offshore exploration and production projects multiply worldwide in search of energy, high-performance marine coatings that coat these vessels will remain in high demand.

Marine Paints Market Restraints:

- Product wastage is anticipated to hamper the market growth

The market for marine coatings frequently faces the major obstacle of product waste during application on marine vehicles and the resulting environmental harm. According to the Epoxy Resin Committee, 20% of the epoxy used in marine coatings is likely to be lost during application. The development of biomarine coatings, which are environmentally benign even when discarded, can help address this issue.

Marine Paints Market Geographical Outlook:

- Asia Pacific is witnessing exponential growth during the forecast period.

The APAC marine coatings market will continue to rule globally, with rapid growth predicted over the next several years. China leads the APAC region and the world regarding marine coating consumption. The regional expansion of shipbuilding, maintenance, and dry-docking activities is mostly influencing this.

The Chinese market is followed by South Korea's marine coatings market. The marine coatings market in Japan ranks third in terms of market share. The growing number of ship owners in Singapore is expected to fuel the marine coatings market in the APAC region. The Indian market will also likely grow into a strong rival in the marine coatings sector over the forecast period.

Key Launches in the Marine Paints Market:

- In November 2024, CRX Coatings developed a graphene-infused bottom paint for the boating industry that improves hull protection and performance. The novel formula makes use of graphene's characteristics to increase durability and lower maintenance needs. Boat owners now have a new option for hull maintenance thanks to this development, which marks a significant advancement in marine coatings.

- In July 2024, Nippon Paint Marine, a leader in marine coatings, reported that its award-winning FASTAR product line has been successfully applied to more than 1000 vessels. Ship owners and operators are under tremendous pressure to take quick action to lower the greenhouse gas emissions of their vessels as the shipping sector adjusts to stricter regional and international emissions regulations to meet decarbonization targets. The fourth generation antifouling system from Nippon Paint Marine. FASTAR uses a new resin technology that reduces fuel consumption, related expenses, and emissions, resulting in improved hull performance and more sustainable and effective operations.

Marine Paints Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Marine Paints Market Size in 2025 | US$3,112.13 million |

| Marine Paints Market Size in 2030 | US$3,999.90 million |

| Growth Rate | CAGR of 5.15% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Marine Paints Market |

|

| Customization Scope | Free report customization with purchase |

The marine paints market is segmented and analyzed as follows:

- By Resin

- Epoxy

- Alkyd

- Polyurethane

- By Product Type

- Anticorrosion coatings

- Antifouling coatings

- By Application

- Cargo ships

- Passenger ships

- Boats

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Others

- North America

Our Best-Performing Industry Reports:

Navigation:

- Marine Paints Market Size:

- Marine Paints Market Key Highlights:

- Marine Paints Market Growth Drivers:

- Marine Paints Market Restraints:

- Marine Paints Market Geographical Outlook:

- Key Launches in the Marine Paints Market:

- Marine Paints Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 23, 2025