Report Overview

Global Low Calorie Food Highlights

Low Calorie Food Market Size:

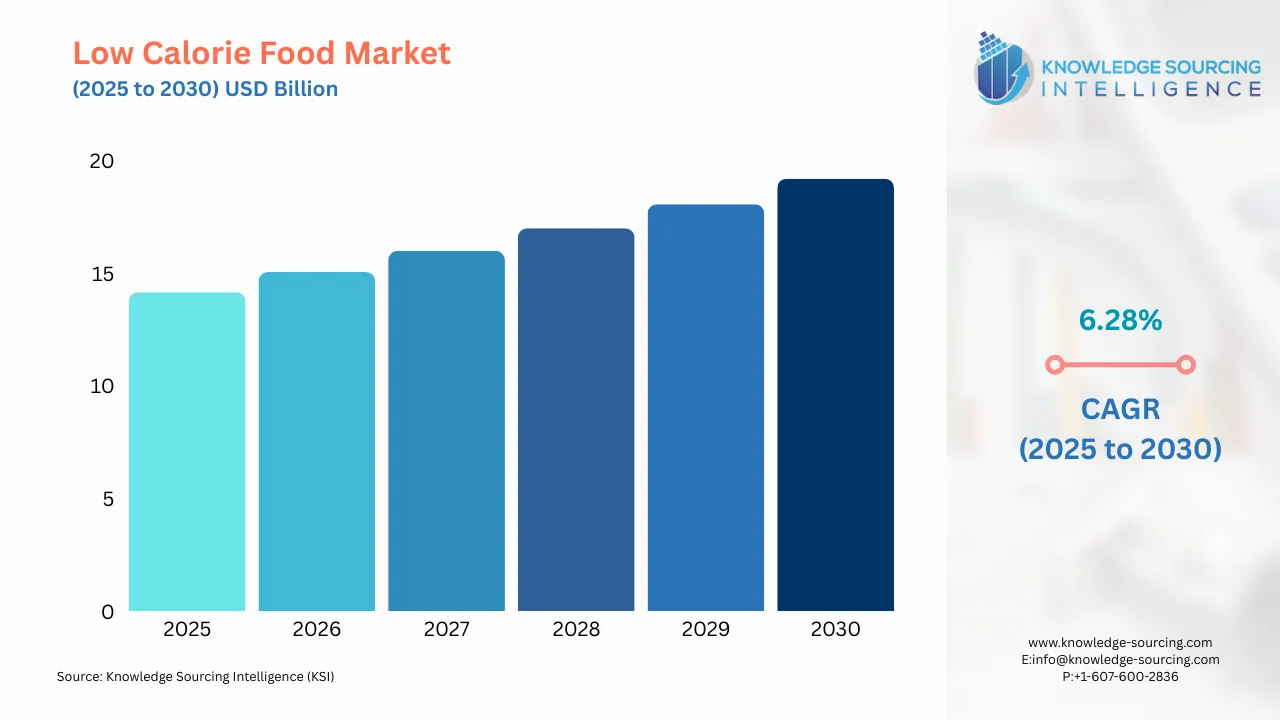

The global low calorie food market is estimated to attain a market size of US$19.198 billion by 2030, growing at a 6.28% CAGR from a valuation of US$14.157 billion in 2025 during the forecast period of 2025 to 2030.

The increase in adoption of healthy food products by consumer propelled by growing health concerns like obesity, diabetes and other lifestyle related disease is boosting the demand for low-calorie food products. Additionally, the growing urban population is leading to busy lifestyle and creating a shift towards healthier go to food options.

The consumers are looking for ready to eat meals and food products such as low-calorie snacks, cereals and sugar free beverages. According to Our World in Data, the global urban population was 4.61 billion in 2023 which witnessed an increase over 4.54 billion in 2022 . Moreover, as per the United Nations, the urban population is estimated to account for 68 percent of global population by 2050. Additionally, the innovations in food processing and new product launches to enhance the variety of low calories products is also promoting the market growth.

________________________________________

Low Calorie Food Market Overview & Scope:

The global low calorie food market is segmented by:

- Type: By type, the global low-calorie food market is segmented into sugar substitutes, sugar alcohol substitutes, and nutrient-based substitutes. The sugar substitutes segment is witnessed significant growth due to Improved consumer preference for convenience bakery products and ready-to-eat food and beverages products followed by growing healthier lifestyle adoption is driving the growth in this segment.

- Application: By crop type, the global low-calorie food market is segmented into bakery products, snacks, dairy products, dietary beverages, and others. The snacks segment is predicted to be the fastest-growing market share.

- Distribution Channel: By distribution channel, the global low-calorie food market is segmented into online and offline. The offline is further divided into supermarkets, convenience stores, and others. The offline preservation segment is expected to have a major share. The offline segment of global low-calorie food market is expanding due to rising health awareness and lifestyle-related health issues which is driving the retail sales of nutritious food items. Online platforms are seeing traction owing to convenience and access to a wider range of low-calorie products.

- Region: The Asia Pacific is poised to hold a prominent position in the global low calorie food market, particularly due to its rapid rise in urban population, with rise in disposable income is contributing to growth of regional market. The regional growth is also growing owing to the improved adoption of nutritious diets which has impacted the overall product availability in major regional economies such as China, Japan and South Korea.

________________________________________

Top Trends Shaping the Low Calorie Food Market:

1. Advancements Plant Based and Natural ingredients

- The growing trend in of consumers shifting towards plant based and vegan products which are low-calories is growing. The consumers are adopting to natural low calorie foods with clean labels and no added sugar and artificial preservatives.

________________________________________

Low Calorie Food Market Growth Drivers vs. Challenges:

Drivers:

- Growing Prevalence of Obesity and Diabetes: A The growing obesity rates globally is boosting the demand for low-calorie food products. According to Would Obesity Federation data reported that number of adults living with obesity stood at 0.81 billion in 2020 which is predicted to increase to 1.53 billion by 2035. Further, 79 percent overweight and obese adults and 88 percent of children who are overweight and obese is predicted to be living in low and middle economy counties by 2035.

Additionally, as per the data from World Health Organization (WHO), about 35 million children aged below 5 years were overweight in 2024. This rapid rise in obesity globally will contribute to consumer demanding for low-calories food products to assist them in weight management.

In addition, according to the International Diabetes Federation (IDF) data report, the diabetes rate is predicted to increase to 853 million for adults aged 20 to 79 years thereby showing a significant growth from 589 million adults in 2024. This increase in diabetes prevalence will also drive the low-calorie food demand especially, low sugar products to regulated blood sugar levels and reduce the chances of complication in their diabetes condition.

Moreover, healthcare professionals are also recommending consumption of low-calories product to patients suffering from this condition to maintain a healthy diet, management of their weight and control of blood sugar will also contribute to the market expansion in the years to come.

- Rise in Disposable Income: The growing disposable income enables the increase consumers purchasing power leading to them spend more on health-focused and premium low-calorie products such as bakery products and dietary beverages. The U.S. Energy Information Administration (EIA) data of October 2023, reported that global disposable income will to $14,368 per person by 2040 from predicted value of $10,677 per person in 2025 while $11,862 and $13,116 per capita in 2030 and 2035, respectively.

- Growth in online Channel: The demand for low-calorie food and beverages is seeing growth, especially as health awareness and fitness consciousness grows in more and more people. Hence, with internet access expanding rapidly and e-commerce platforms becoming more user-friendly the convenience level has increased thereby shifting the consumer interest on online purchase. This shift has made it far easier than before for health-conscious buyers to discover and buy a wide variety of low-calorie snacks, drinks, and meal options that suit their lifestyles.

- In the medical field, SLA is finding applications in creating customized dental models, surgical guides, prosthetics, and anatomical replicas due to its potential to provide biocompatible and patient-specific products with unmatched accuracy. In line with this, the nation’s government is investing in its healthcare development, for instance, the UAE Government invested a major portion of the federal budget in the healthcare sector every year to provide quality medical treatment.

Additionally, another key driver is the increasing preference for convenience; people can easily access products that support their wellness goals, and online shopping meets that need as a result, brands are increasing their online presence and offering more low-calorie options to keep up with demand. For instance, according to the data provided by the Census Bureau of the Department of Commerce, the e-commerce sales for the year 2024 totalled US$1192.6 billion, which was approximately an 8.1% increase from 2023’s total e-commerce sales.

- Increase in Innovative Health Solutions: The major market players such as Cargill Incorporated, Ingredion Incorporated, and Nestle S.A have established their presence globally majorly in high income countries like United States, and Germany, through their extensive portfolio, and the companies through their strategic tie-ups with local distributors and retailers have been enabled to garner a major customer base promoting the market during the projected period.

The players are also driving innovation in their products that meet current health-related trends. For instance, in May 2024, Nestle launched its food line “Vital Pursuit” in the US which offers products rich in protein and fiber and will be ideal for consumers following GLP-1 weight loss medication.

Challenges:

- High Production Cost: The low-calorie foods production requires natural ingredients and appealing in appearance and taste profile which requires significant cost. Additionally, the research, development and sourcing of this ingredient and food product is also expansive which can limit the market growth due to reduced profitability and adoption.

________________________________________

Low Calorie Food Market Regional Analysis:

- North America: The region is expected to hold the major market share due to growing health consciousness in the United States and with rapid urbanization and improvement in lifestyle the consumer transition towards protein-rich diets adoption is witnessing an upward trajectory. According to the “2024 Food & Health Survey” conducted by the International Food Information Council on 3,000 Americans, it was stated that 71% of consumers are trying to consume fresher and protein-rich food.

- Moreover, the same survey also specified that 20% of Americans follow high-protein diets and 12% follow a calorie-counting pattern. Low-calorie food provides health benefits by stabilizing blood sugar, cholesterol, and blood pressure owing to which they form an integral part of protein protein-rich diet. Hence, with the high adoption of such a diet pattern in the USA the demand for low-calorie food will increase.

________________________________________

Low Calorie Food Market Competitive Landscape:

The market is fragmented, with many notable players, including Cargill, Incorporated, Zydus Lifesciences Limited, Bernard Food Industries. Ajinomoto Co., Inc., Beneo Group, Ingredion Incorporated, Galam Ltd., Nestle S.A., General Mills, Unilever, Kraft Heinz, Herbalife, ConAgra FoodsFoods., among others.

- Nestle S.A.- The company aims to meet the consumer’s health-related goals through its product offerings such as “Optifast” which assists in weight management and improving the overall nutrition content in the body. The company is emphasizing the provision of food products that meet the desired customer requirements for calorie intake, for which it has been actively participating in new product offerings. It is also targeting other regional markets such as India where a growing fitness culture has shifted consumer food choices towards less-fat-oriented items.

________________________________________

Low Calorie Food Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Low Calorie Food Market Size in 2025 | US$14.157 billion |

| Low Calorie Food Market Size in 2030 | US$19.198 billion |

| Growth Rate | CAGR of 6.28% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Low Calorie Food Market |

|

| Customization Scope | Free report customization with purchase |

Low Calorie Food Market Segmentation:

By Type

- Sugar Substitutes

- Stevia

- Saccharin

- Aspartame

- Others

- Sugar Alcohol Substitutes

- Erythritol

- Sorbitol

- Others

- Nutrient Based Substitutes

- Fat Based

- Protein Based

- Carbohydrate Based

By Application

- Snacks

- Dairy Products

- Dietary Beverages

- Others

By Distribution Channel

- Offline

- Supermarkets

- Convenience Stores

- Others

- Online

By Region

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Others

Our Best-Performing Industry Reports:

Navigation:

- Low Calorie Food Market Size:

- Low Calorie Food Market Overview & Scope:

- Top Trends Shaping the Global Low Calorie Food Market:

- Low Calorie Food Market Growth Drivers vs. Challenges:

- Low Calorie Food Market Regional Analysis:

- Low Calorie Food Market Competitive Landscape:

- Low Calorie Food Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 30, 2025