Report Overview

Lithium-Ion Battery Market - Highlights

Lithium-ion Battery Market Size:

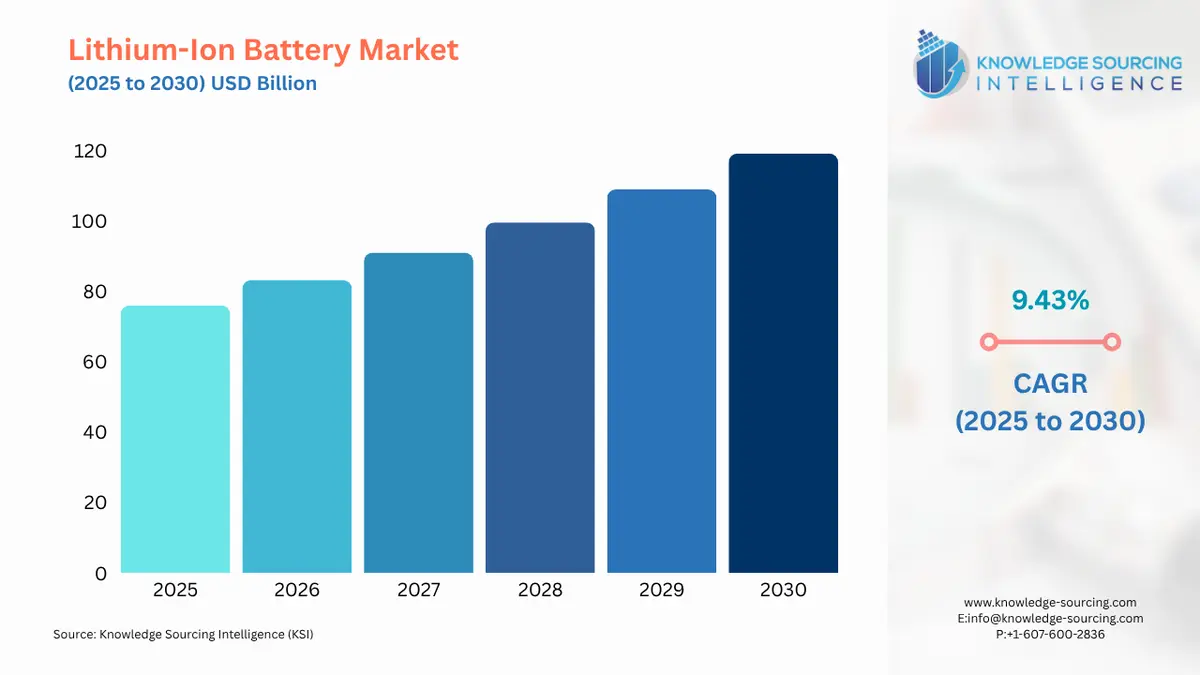

The lithium-ion battery market is expected to grow at a CAGR of 9.43%, reaching a market size of US$119.168 billion in 2030 from US$75.991 billion in 2025.

Lithium-ion Battery Market Trends:

The market for lithium-ion batteries is driven by the growing demand for electric vehicles, solar-powered rooftops, electronic devices, and the expansion of other energy-storing devices. The demand for electric vehicles would significantly increase the demand for Li-Ion Batteries.

These batteries are important for electronic devices and electric mobility and are gaining traction in grid-scale storage. Growth in sales of electric vehicles and energy storage increases the demand for lithium-ion batteries. The regions of Asia Pacific and Europe will have sufficient manufacturing capacity to meet demand.

The solar rooftop capacity expansion has created a significant demand for lithium-ion batteries to store excess solar energy generated for use during nighttime. This maximizes the use of solar power and provides homeowners with energy independence. In 2023, solar PV accounted for three-quarters of renewable capacity additions worldwide According to the International Energy Agency, Solar PV capacity additions would be 421.7 GW in 2025, 459.2 GW in 2026, and 493.9 GW in 2027.

With the growing demand for Lithium-Ion, companies are investing and making significant moves to meet it. For instance, in September 2024, Panasonic Energy Co., Ltd. announced preparations for mass production of the 4680 cylindrical automotive lithium-ion batteries. The company revamped its Wakayama factory in Western Japan, which would serve as the main factory for the new cells.

Lithium-ion Battery Market Growth Drivers:

- Rising demand for electric vehicles is contributing to the lithium-ion battery market expansion

The electric vehicle sales are driven in major regions of the United States, China, Europe, and India. The buying of electric vehicles (EVs) is driving the demand for EV batteries. According to the IEA (International Energy Agency), the demand for EV batteries will be 750 GWh in 2023, which is 40% up from 2022. This rising number of EV batteries has increased demand for critical rare earth minerals like lithium. The demand for lithium was 140 kt in 2023.

The observed trend in the production of lithium-ion batteries is that they are close to the production centre of EVs. The relative production of EVs in Europe was 2.5 million, and their EV battery production reached 110 GWh. Government policies in various countries promote the production of electric vehicles and lithium-ion battery manufacturing facilities for both countries. China registered a battery production capacity for electric vehicles of 417.97GW in 2023. With government backing in the United States, the manufacturing capacity would bypass Europe in upcoming years.

- Rising demand for electronic devices is anticipated to increase the market demand

Rising demand for electronic devices is another major driving factor for the rise in the lithium-ion battery. Devices such as digital cameras, personal digital assistants, smartphones, laptops, watches, portable power packs, emergency power backup, surveillance, and alarm systems are the main devices that use lithium-ion batteries for their usage. Mobiles and smartphones have become an indispensable part of our lives as we are living in the age of digitalization and data consumption. Mobile phones are the most common internet access device and use lithium-ion batteries. The percentage of individuals owning a mobile phone in Asia Pacific was 75%, 82% in Arab States, and 93% high in Europe in 2023.

The companies are advancing in improving battery technologies and increasing their capacity for better performance. Additionally, cost, life cycle, and better production facilities have been major concerns for the manufacturers.

Lithium-ion Battery Market Segment Analysis:

- By industry, automotive is anticipated to grow during the forecast period

The demand for automotive Li-ion batteries grew by almost 65% to 550 GWh in 2022 from around 330 GWh in 2021, mostly due to a rise in the sales of electric passenger cars, with new registrations rising by 55% in 2022 compared to 2021 as stated by IEA. In addition, consumer preference is gradually turning towards the ownership of EVs owing to the drive towards e-mobility initiated by the Government of India (GOI) and its incentive initiatives such as the Faster Adoption and Manufacturing of Electric and Hybrid Vehicles (FAME). The market is anticipated to grow at a compound annual growth rate of 22.4% to reach $118bn by 2032. The market for materials of EV battery technology, BMS, and BESS are set to grow drastically owing to the rising EV demand.

- High demand for medical devices is increasing the market growth

Due to its extended lifespan and minimal drain, lithium batteries are increasingly being used in pacemakers. Li-ion batteries for pacemakers may weigh very little and last for seven to eight years. Due to their ease of recharging, they are also utilized in hearing aids. A lithium-ion battery is also used by the infusion pump to transport fluids into the body in precisely the right amounts.

As chronic disease rates rise globally and healthcare spending rises to find a cure, this expanding use will also grow. Both developed and emerging economies are very concerned about chronic illness conditions because they have the potential to cause financial losses for their countries. Medical equipment that uses lithium-ion batteries would be more innovative, developed, and portable for improved use.

Lithium-ion Battery Market Geographical Outlook:

- Europe is witnessing exponential growth during the forecast period.

Germany’s lithium-ion battery market will witness substantial growth owing to several factors, such as the country’s commitment to technological advancement and sustainability.

The market growth within the European region reflects its broader trend where the demand for these lithium-ion batteries is increasing due to their efficient role in electric mobility and energy storage systems.

Electric cars (EVs) so far have also been one of the main engines of this development. The demand for lithium-ion batteries has increased as Germany has been switching to more environment-friendly forms of transport. According to the report published by the OECD Environmental Performance Review, Germany 2023, between 2020 and 2021, Germany witnessed a double growth in its EV sales, reaching 24% of newly purchased vehicles by the end of 2021. Similarly, according to the study published by Clean Technica, the month of August 2024 saw EVs take a 20.6% share in Germany, which is an increase from a 19.3% share in EVs in February 2024.

Lithium-ion Battery Market Recent Developments:

- In September 2025, the Indian Union Minister of Electronics & IT inaugurated an advanced lithium-ion battery manufacturing plant of TDK Corporation located in Sohna, Haryana. The plant is predicted to manufacture 20 crore battery packs per year and provide cells for wearables, mobile phones, hearables, and laptops, and is under the Government’s Electronics Manufacturing Cluster (EMC) scheme.

- In July 2025, Panasonic Energy inaugurated a very large factory for cylindrical 2170-cell EV batteries in De Soto, Kansas. The total area of the factory is around 300 acres, and it is estimated to produce about 32 GWh/year of batteries by 2030. The battery production will have the following advantages: first, more than 20% productivity compared to the Nevada plant, and second, higher-capacity cell materials will be introduced.

- In July 2025, Kalmar presented a new lithium-ion battery technology for its electric counterbalanced such as reachstackers, empty-container handlers, and forklifts product range. This technology provides more energy capacity, improved thermal stability, and a more predictable performance curve; it is a globally available standard now for Europe (US/China versions expected in 2026). The Gen-2 chemical composition helps prolong the lifespan and energy throughput of the cycle.

List of Top Lithium-ion Battery Companies:

- Samsung SDI

- Panasonic Corporation

- Automotive Energy Supply Corporation

- LG Chem

- Toshiba Corporation

Lithium-ion Battery Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 75.991 billion |

| Total Market Size in 2031 | USD 119.168 billion |

| Growth Rate | 9.43% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Power Capacity, End-User Industry, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Lithium-ion Battery Market Segmentation:

- By Power Capacity

- 0 to 3000 mAh

- 3000 mAh to 10000 mAh

- 10000 mAh to 60000 mAh

- More than 60000 mAh

- By End-User Industry

- Automotive

- Consumer Electronics

- Energy Storage Systems

- Aerospace And Defense

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- Japan

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

- North America