Report Overview

Global Level Sensors Market Highlights

Level Sensors Market Size:

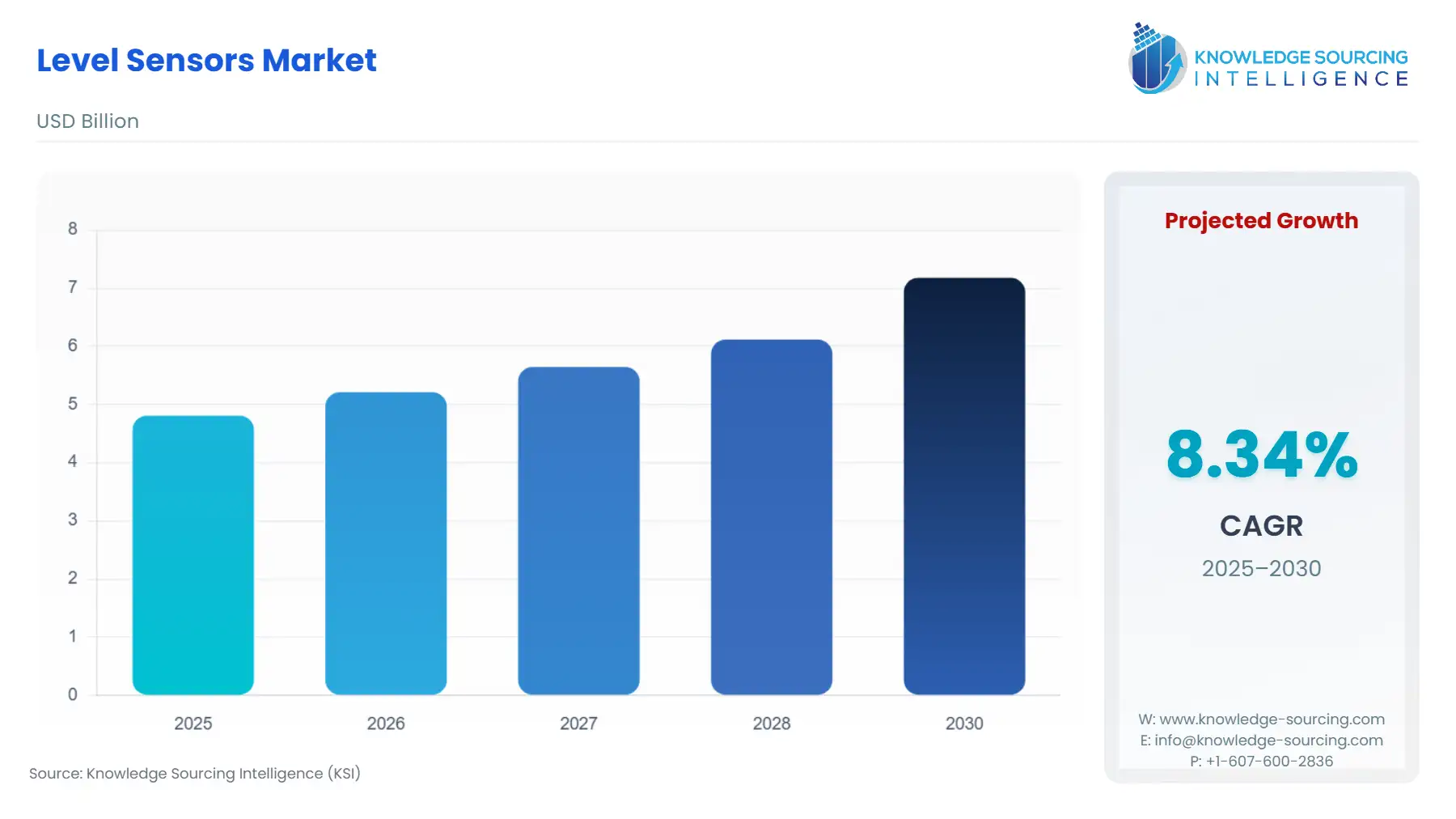

The level sensors market will grow from US$4.811 billion in 2025 to US$7.181 billion in 2030 at a CAGR of 8.32%.

The market is expected to surge in the coming years, because of the growth of level sensing applications in the oil & industry, power generation sector, food and beverage industry, pharmaceutical, and other sectors. The rise in artificial intelligence, Industry 4.0, and the Internet of Things is expected to play a major role in the overall market growth during the forecast period.

Major countries have been introducing several initiatives to propel market growth. The United States, the United Kingdom, and Germany launched initiatives such as the Leadership in Energy and Environmental Design, the Building Research Establishment’s Environmental Assessment Method, and Deutsche Gesellschaft fur Nachhaltiges Bauen to encourage the installation of point-level sensors and other types of level sensors worldwide.

Level Sensors Market Trends:

The need for accurate liquid and solid monitoring is driving the market for level sensors as a result of rising industrial automation in industries like manufacturing and oil and gas. Investments in sophisticated level sensing technology are driven by strict regulatory obligations addressing workplace standards and environmental safety to ensure compliance. By integrating smart sensors made possible by Industry 4.0 and the Internet of Things, remote monitoring and predictive maintenance techniques are made easier, improving operational effectiveness.

The use of level sensors to optimize production processes and reduce waste is driven by the need for cost-effectiveness, resource efficiency, and process optimization. The demand for effective resource monitoring is driving new development prospects in industries including water management, agriculture, and healthcare. Together, these elements encourage market growth and innovation in the level sensor sector.

Level Sensors Market Growth Drivers:

- Growth in the power generation sector is expected to influence the level sensors market growth.

The level sensors market is expected to surge in the coming years, due to the growth in the power generation sector globally. Electricity has been the fastest-growing source of energy demand, and according to the International Energy Agency, over the next 25 years, electricity’s growth will outpace energy consumption as a whole. The power sector has also been attracting more investments than the oil and gas industry. According to several major forecasts, such as those by the United States Energy Administration, the global electricity demand will surge by 56% by the year 2040. These trends are expected to have a positive effect on the level sensors market.

Many companies have been making significant developments in the advancement and innovation of novel-level sensing solutions in the past few years. For Instance, Gems Sensors & Controls, one of the major players in the market, provides the power generation industry with innovative and advanced sensors and control solutions for various applications. The company also provides reliable capacitive-level sensors. Other players are also making significant developments in the market. For Instance, Global Sustainable Solutions, one of the key players in the market, provides generator fuel level sensors, which have been designed to last inside a generator’s extreme environmental conditions.

- Rising utilization in water treatment systems is predicted to positively impact the level sensors market growth.

The level sensors market is expected to surge in the coming years because of the usage of level-sensing solutions in water treatment solutions and systems. Major companies have been providing novel and advanced-level sensing solutions for the water treatment management and processing sector. For Instance, Setra, one of the major players in the market, provides level pressure sensors for the wastewater processing industry. The company’s liquid-level sensors play a crucial and major role in effluent tanks, distribution tanks for clean water and wastewater, and pump stations for irrigation systems.

The sensors are also used in the measurement of pressure and confirm flow for liquids of various temperatures. Other companies are also providing innovative and advanced-level sensing solutions for water treatment plants and systems. Sapcon, one of the major players in the market, provides level sensors for the tanks to detect, maintain, and control proper level management.

Level Sensors Market Restraints:

The level sensors market is constrained by intricate designs and technical restrictions that impact accuracy and dependability. Cost considerations impede broad adoption, particularly for cutting-edge technology, which slows market penetration. Development expenses rise as a result of entrance obstacles imposed by regulatory standards and compliance requirements. Opportunities for smaller businesses and new entrants are restricted by market saturation and fierce rivalry.

Supply chains and demand dynamics are disrupted by events like geopolitical conflicts, and economic uncertainty, which affect investment choices further restraining the market.

Level Sensors Market Geographical Outlook:

- The Asia Pacific region is anticipated to hold a significant share of the market.

By geography, the market has been segmented into North America, South America, Europe, the Middle East, Africa, and the Asia Pacific. The Asia Pacific level sensors market is projected to grow owing to the presence of many market players in the region.

Major countries continue to invest in the water treatment and development sector to provide basic and freshwater facilities to their citizens. Developing nations, such as China, India, and others, have continued to invest a significant sum of capital over the last decade. In India, according to the country’s Jal Shakti Report for 2020-21, the Indian State of Madhya Pradesh provides around 1.98 million tap water connections and has been one of the major performers in the country’s water savings mission. The Indian Government collaborated with Tata Community Initiatives Trust to complete the pilot projects in several remote villages in various states. Various types of sensors, such as flow meters, groundwater level sensors, and others, were used in the projects.

Level Sensors Market Key Developments:

- October 2025: Emerson launched the Rosemount 3408 WirelessHART non-contacting radar level transmitter, claimed as the world’s first native WirelessHART radar level solution for simplified industrial automation.

- August 2025: Emerson’s Rosemount 3408 non-contacting radar level transmitter won a Best of Sensors Award at Sensors Converge 2025, recognizing its innovative Smart Echo Supervision and robust industrial performance.

- April 2025: SKE officially launched its “SK-E” series radar level transmitters, core members of its new radar sensor portfolio designed for industrial non-contact level measurement applications.

- March 2025: Shaanxi ShengKe Electronic Technology’s 80 GHz radar level sensors received FCC certification, marking international regulatory approval for its high-frequency radar level measurement products.

Global Level Sensors Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Level Sensors Market Size in 2025 | US$4.811 billion |

| Level Sensors Market Size in 2030 | US$7.181 billion |

| Growth Rate | CAGR of 8.32% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Level Sensors Market |

|

| Customization Scope | Free report customization with purchase |

Level Sensors Market Segmentation:

- By Type

- Continuous Level Measurement

- Point Level Measurement

- By End-User

- Oil and Gas

- Food & Beverage

- Pharmaceutical

- Power Generation

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

- North America