Report Overview

Global Laboratory Services Market Highlights

Laboratory Services Market Size

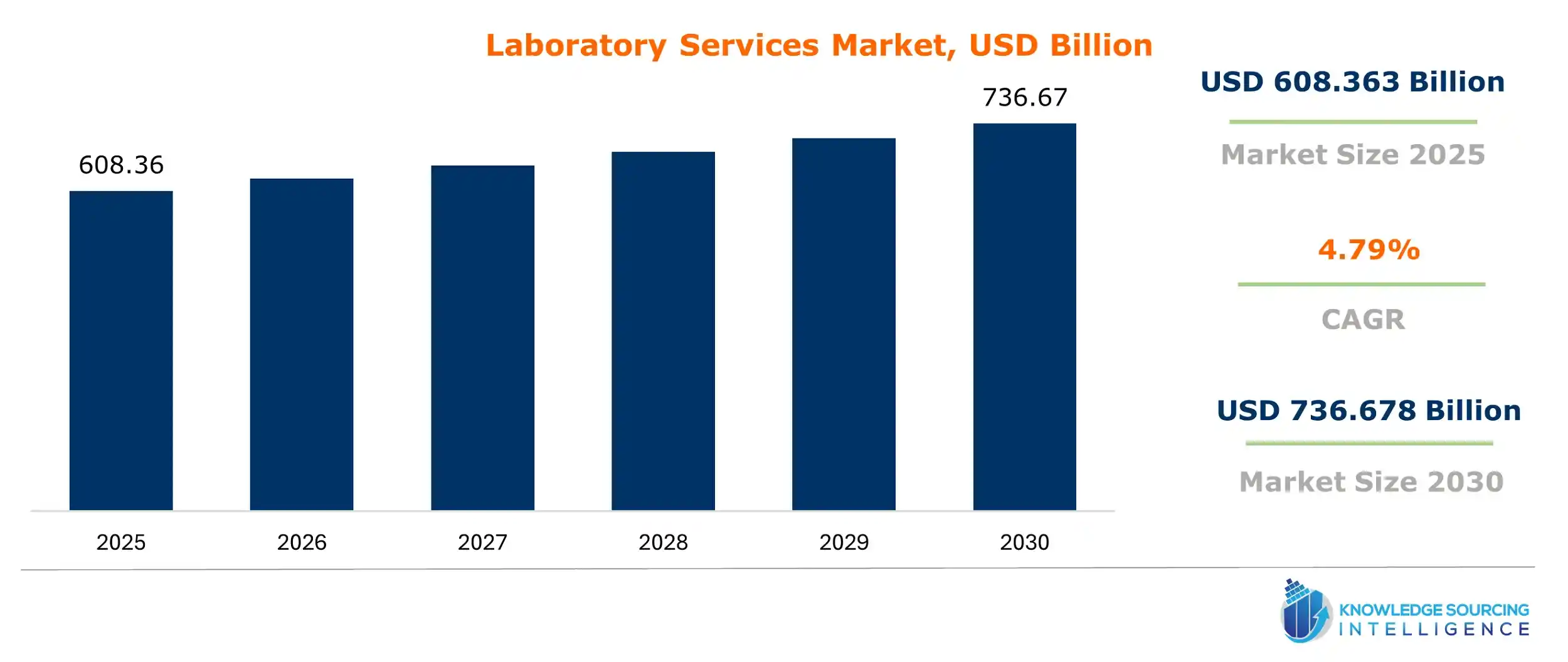

The Global Laboratory Services market is expected to grow at a compound annual growth rate of 4.79% over the forecast period to reach a market size of US$736.678 billion in 2030, up from US$608.363 billion in 2025.

Laboratory services are tests and services provided by a medical or testing lab that helps and aids in treating and diagnosing patients. There are many types of laboratory services, such as HIV tests, blood counts, liver function tests, and others, that are being provided. These tests help doctors, physicians, and other healthcare professionals to analyze the data and prepare appropriate evidence related to therapeutic and diagnostic decisions for the patients. Many countries have been investing a substantial sum of capital into healthcare, focusing on the development of clinical laboratory services. These services are beneficial, affordable, and give factual information.

Laboratory Services Market Growth Drivers:

- The surge in the geriatric population will drive the market growth

According to the World Health Organization, people above 60 years would witness a growth of 12% to 22% between 2015 to 2050. Countries are facing significant challenges in ensuring that their social and health systems are ready to overcome this major demographic shift.

By 2050, many countries, such as China, Chile, Russia, and Iran, will share the same geriatric population percentage as Japan. Many health problems are associated with the aging older population, such as hearing loss, back and neck pain, depression, and others. Older people suffer from geriatric syndromes, and it is imperative to develop affordable, advanced, and convenient laboratory services. Automated and technological advancements will ease the burden and provide better capability and efficiency.

- HIV & AIDS are a major concern

According to the WHO’s 2022–2030 global health sector strategy on HIV, it aimed to reduce HIV infections from 1.5 million in 2020 to 335,000 by 2030 and deaths from 680,000 in 2020 to under 240,000 by 2030. There were around 1.3 million people who acquired HIV in 2023. More than 630,000 deaths occurred from AIDS-related diseases in the same year. Around 39.9 million people are living with AIDS in the world. HIV has been a major concern for women, too. According to the data, around 520,000 women from the age of 15 and above became infected with HIV in 2023.

Africa has been a major concern regarding the HIV problem. The continent has 640,000 people acquired HIV in 2023, way higher than any other continent. Governments worldwide have been investing a substantial sum of capital into developing laboratory services, which help in examining and analyzing this grave problem.

CDC has approved and given the guidelines regarding some of the tests related to HIV. Several tests are being approved by the FDA. Major companies have been investing significantly in developing novel and advanced capabilities and have also gotten FDA approval for some of the laboratory tests and services.

- Growing concern for chronic disease ailments

The global health burden has increased as the number of people suffering from different chronic diseases, such as cardiovascular disease, diabetes, asthma, etc., has been increasing. The primary causes for the increased cases of such diseases have been poor lifestyles, consumption of unhealthy food, and living in a polluted environment.

According to the IDF (International Diabetes Federation), the estimated number of people (20-79 y) suffering from diabetes would be 67,000.0 (in thousands) in 2030 and 69,000.0 in 2045 in Europe. This figure indicates the severity of the increasing chronic disease ailments in the region. Due to these rising cases of chronic diseases, the need for laboratory services will be boosted.

- A surge in health care expenditure to boost the growth

With the surge and growth in healthcare expenditure by countries, the laboratory services market will continue to grow significantly. According to data from the OECD, in 2019, before the pandemic, OECD countries spent, on average, 8.8% of GDP on healthcare, a figure relatively unchanged since 2013. By 2021, this proportion had jumped to 9.7%. However, 2022 estimates point to a significant fall to 9.2%, reflecting a reduced need for spending to tackle the pandemic but also the impact of inflation.

The overall increase in healthcare spending is necessary to achieve universal healthcare. The government and major players worldwide have been developing clinical and convenient laboratory services for its people. Digitalization and automation have played a critical role in expanding laboratory services. In recent years, regional governments have been boosting their overall health expenditure by developing laboratories, hospitals, and other essential infarct structures and services.

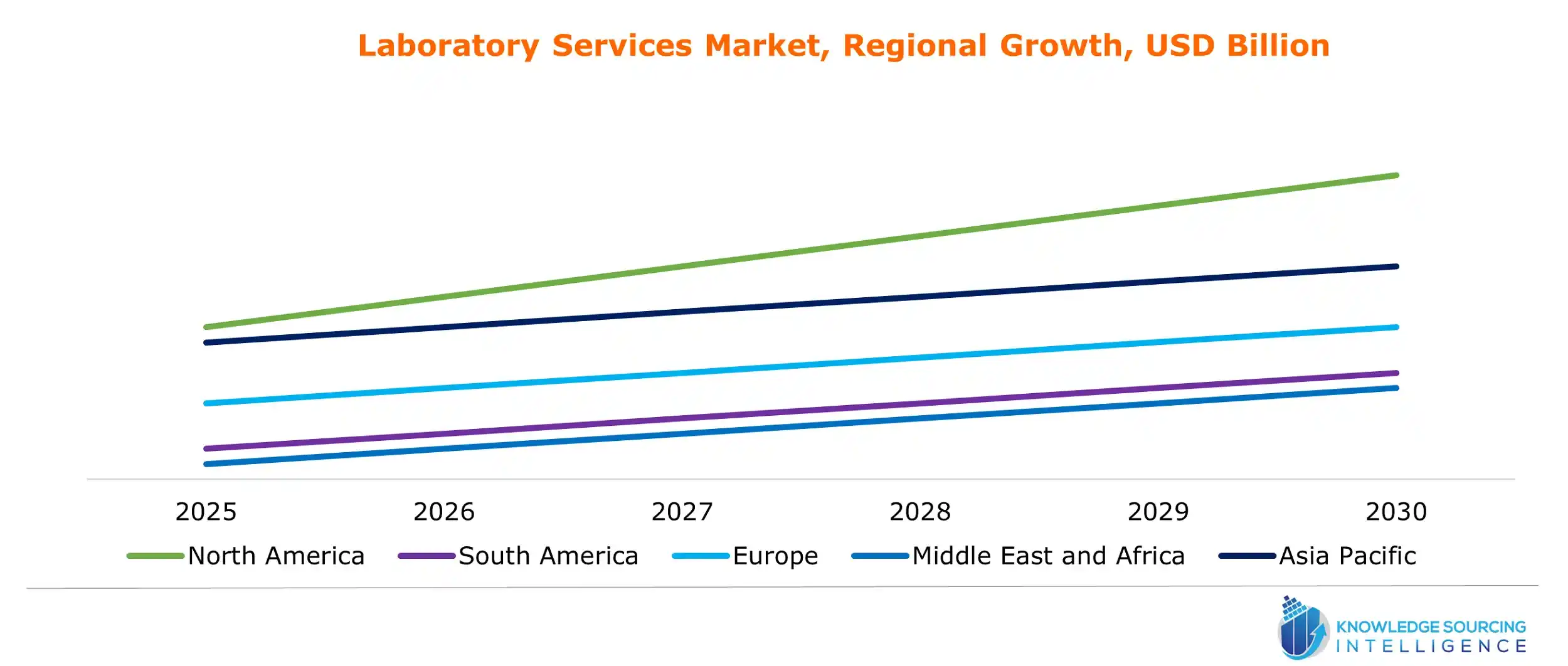

Laboratory Services Market Geographical Outlook:

By geography, the laboratory services market is segmented into North America, South America, Europe, the Middle East and Africa, and Asia Pacific. The major economies like China, Japan, India, and South Korea dominate the Asia-Pacific region. Some of the fastest-growing emerging economies are from this region, such as ASEAN countries.

The Asia Pacific region is expected to see notable growth. The Indian Healthcare industry displayed significant growth in 2023 and reached a value of US$372 billion, driven by both the private sector and the government. In May 2023, Temasek invested US$2 billion in Manipal Health Enterprises, a leading healthcare provider in India. Indian medical tourism market was valued at US$7.69 billion in 2024.

Laboratory Services Market Key Developments:

The major Global Laboratory Services market leaders are Quest Diagnostics, Abbott Laboratories, Spectra Laboratories, Sanofi Genzyme, ARUP Laboratories, and Bio-Reference Laboratories. These key players implement growth strategies such as product launches, mergers, acquisitions, etc., to gain a competitive advantage. For Instance,

- In October 2024, IQVIA Laboratories announced the expansion and relocation of its Central Laboratory and Biorepository operations in Valencia, California, into a new 134,000-square-foot state-of-the-art facility. Relocating to this site allowed laboratory and biorepository operations to be co-located in a single facility, helping to streamline operations and increase efficiencies. The facility was designed with the latest California Title 24 green building code.

- In September 2024, The PPD clinical research business of Thermo Fisher Scientific announced the expansion of its global laboratory services with a new bioanalytical lab in GoCo Health Innovation City in Gothenburg, Sweden. It would serve pharmaceutical and biotech customers with advanced laboratory services and leading instrumentation.

- In June 2024, QPS announced new laboratory services. The central laboratory, leukoplakia cell therapy facility, and enhanced PBMC capabilities would complement existing bioanalysis, translational medicine, and peripheral blood mononuclear cell (PMBC) laboratories. This extends the current QPS full-service global CRO offerings.

List of Top Laboratory Services Companies:

- Quest Diagnostics

- LabCorp

- Sanofi Genzyme

- Abbott Laboratories

- Charles River Laboratories, Inc.

Laboratory services market scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Laboratory Services Market Size in 2025 | US$608.363 billion |

| Laboratory Services Market Size in 2030 | US$736.678 billion |

| Growth Rate | CAGR of 4.79% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Laboratory Services Market |

|

| Customization Scope | Free report customization with purchase |

The Global Laboratory Services market is segmented and analyzed as below:

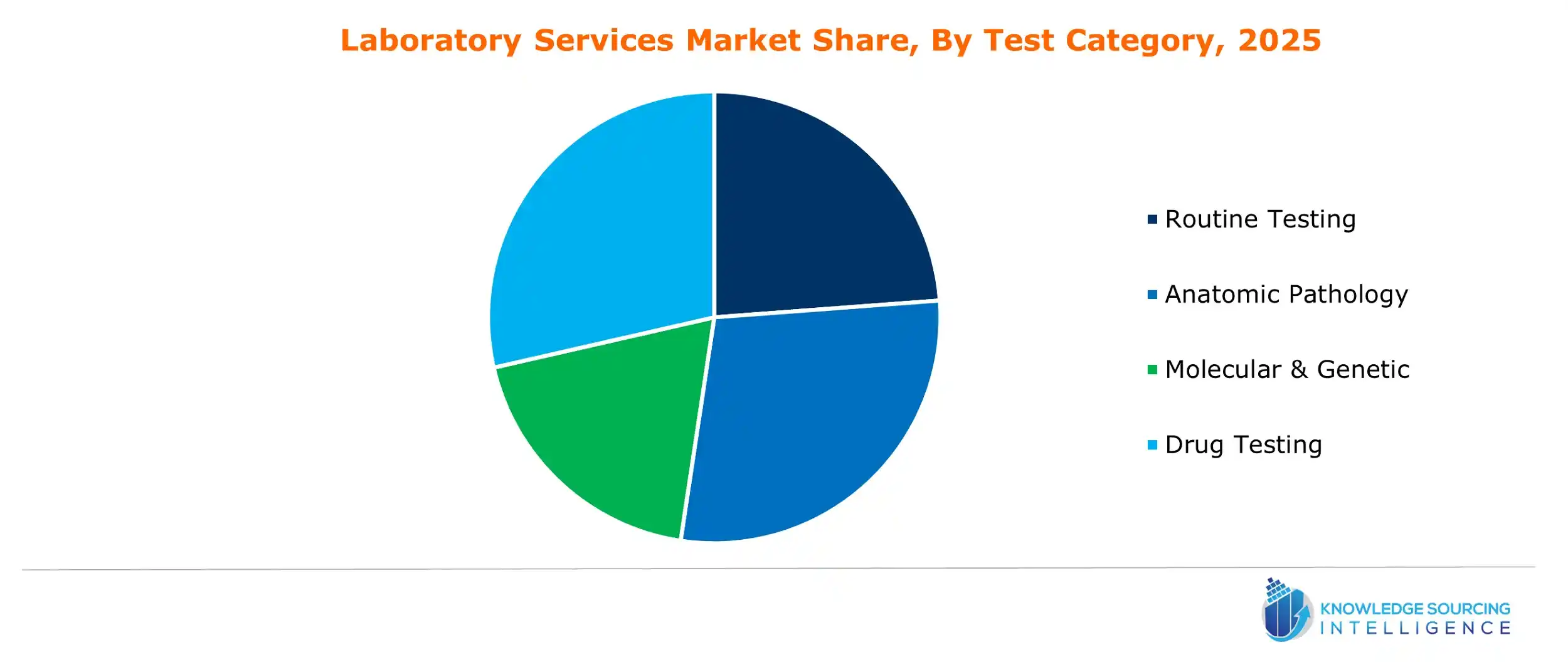

- By Test Category

- Routine testing

- Anatomic pathology

- Molecular & genetic

- Drug testing

- Pap & HPV testing

- By End-User

- Mobile/ Home-based sample collection

- Laboratories visiting centers

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- UAE

- Rest of the Middle East and Africa

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America

Our Best-Performing Industry Reports:

Navigation

- Laboratory Services Market Size

- Laboratory Services Market Key Highlights:

- Laboratory Services Market Growth Drivers:

- Laboratory Services Market Geographical Outlook:

- Laboratory Services Market Key Developments:

- List of Top Laboratory Services Companies:

- Laboratory services market scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 12, 2025