Report Overview

Global Jam Market - Highlights

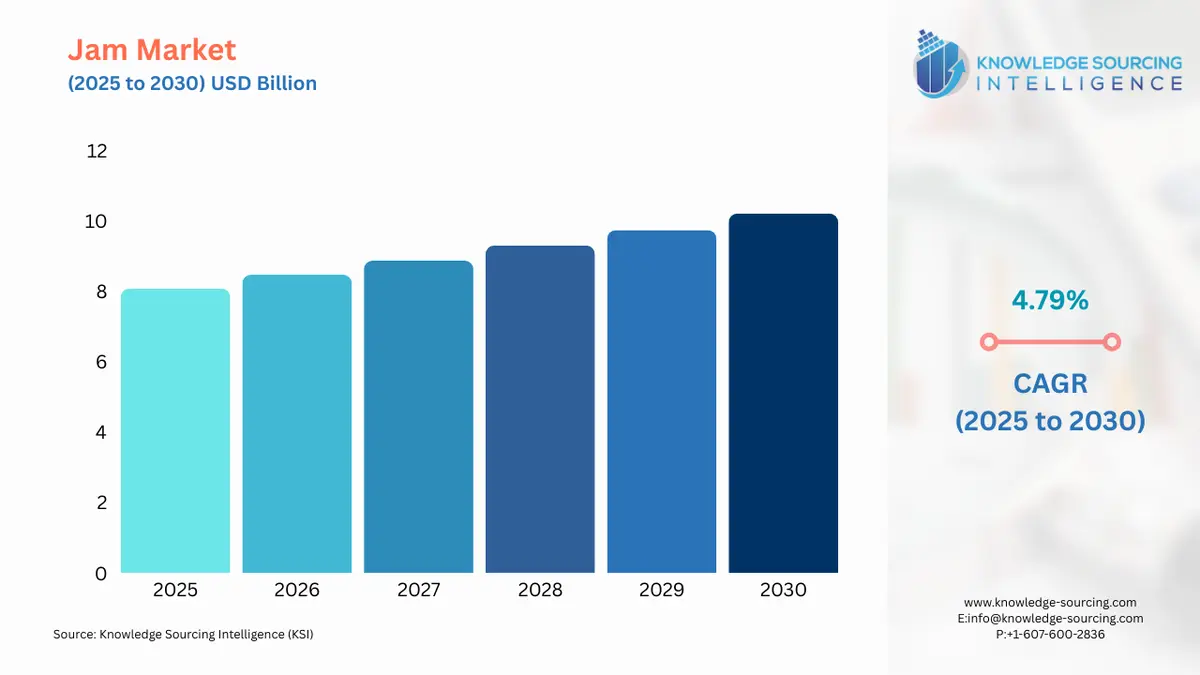

Global Jam Market Size:

The global jam market is expected to grow at a CAGR of 4.79% over the forecast period, increasing from US$8.081 billion in 2025 to US$10.213 billion by 2030.

Global Jam Market Overview

Report Metric

Details

Study Period

2021 to 2031

Historical Data

2021 to 2024

Base Year

2025

Forecast Period

2026 – 2031

:

Jams are commonly produced by crushing or chopping fruits and combining them with sugar, forming a semi-liquid product. Jam is less firm than jelly and is made from a mixture of fruits are commonly known as conserves, especially when citrus fruit, nuts, coconut, or raisins are involved in the production of conserves. They are prepared in two different methods, including standard methods, which do not involve the usage of pectin and only make use of fruits that already contain naturally high pectin content, and commercial liquid or powdered pectin, which involves the use of pectin and fruits.

Jam products are commonly stored in mason jars with a tight seal lid on top to prevent any kind of mould formation or loss of good flavour or colour. Jam offers a rich source of vitamins and minerals. Multiple research studies have stated that the consumption of jam can also enhance the body's immune system. Fruit Jams are known to contain a wide range of health benefits, which include:

- Boosts vitamin C intake, which acts as an antioxidant and helps protect the cells from damage from free radicals in the environment, such as cigarette smoke, air pollution, and many others.

- Boosts the immune system, due to the rich content of immune-improving substances such as natural fibre, minerals, probiotics, and vitamin A.

- Improves digestion, due to great amounts of dietary fibre, potassium, and folate (folic acid),

- Reduces the risk of cardiovascular diseases due to the wide range of vitamins, minerals, antioxidants, and fibre in jam products.

In the bakery and bread products, jams offer key applications mainly as a bread spread and a decorative for bakery products. The increasing global consumption of bread and bakery products is among the major factors propelling the jam market’s expansion globally. The global bakery food products market witnessed major growth in its demand, majorly with the increasing disposable income. Agriculture Canada, in its report, stated that the sales of baked goods in the global market witnessed an increase from US$407,164.2 million in 2021 to US$425.676.4 million in 2022.

Some of the key market players are F. Duerr & Sons Ltd, The J.M. Smucker Company, Andros Group, Winland Foods, Inc., Morton Foods Limited, Kissan (Unilever), Natureland Organics, Tapi Fruit Processing Ltd., APIS India, The Nashville Jam Co., Bhuira Jams, Nectar Fresh, Histon Sweet Spreads Limited, and Dockyard Jam Factory, among others. The rising global demand for the food processing sector is among the major factors propelling the jam market. The growth of baked food products is also propelling this market’s expansion during the forecasted timeline.

Global Jam Market Drivers:

- Increasing consumption of bread products

Jams are popular for being used as spreads on several different baked goods, which include bread, cakes, and many others. Jam is also known to be used as a filling for products such as biscuits, cakes, and many others. The increase in consumption of bread products is expected to increase the consumption of jam products as well, due to the global usage of jams as spreads and fillings. The Institute of Food Technologies states that the global market for bread, which includes packaged and artisan products, is expected to display an increase of US$118 billion, with a CAGR of 7.3% from 2022-2027. It was also found that there was an increase in the growth of new bread and bread products from 2018 to 2022, with a CAGR of 1.5%. Since fruit jams are known for being used as a spread to enhance taste and also for the nutrients in the jam products, Bread products also provide a wide range of benefits, which include high fibre content, gluten-free, reduced sugar, organic, lactose-free, and digestive or immunity support. When combined with the several nutrients and benefits of fruit jams, the increase in consumption of jam sandwiches will provide the necessary boosts for the growth in demand for jam products. Therefore, the increase in consumption of bread and bread products is expected to increase growth, providing a necessary boost in the global jam market growth as well.

- Increasing demand from the food processing sector

The major factor propelling the demand for jams & jellies in the global market is the increasing demand for processed food and beverages. The global food processing sector witnessed major growth in developing economies, like India, Bangladesh, Vietnam, and South Africa. The India Brand Equity Foundation, in its report, specified that in India, the food processing sector is expected to witness significant growth in the coming years, with a major shift towards bakery and processed food items.

The US Department of Agriculture, in its report, stated that the global food processing sector witnessed major growth within the past few years. The agency stated that in China, the food processing sector was estimated at US$1,250 billion in 2023, whereas the sector in Japan and the UK was recorded at US$182 billion and US$168 billion, respectively. The food processing sector in Canada was recorded at US$156 billion in 2023.

Global Jam Market Segmentation Analysis:

- By application, the baking and pastries segment is expected to lead the market growth

The baking and pastry industry has significantly changed toward healthier and more natural ingredients. As more consumers seek products made with organic ingredients and free from artificial additives, they also desire health benefits, such as lower sodium content and added superfoods. It is with this background that manufacturers of better-for-you items have begun to create truly clean-label products that consumers will enjoy. Furthermore, the need for more exciting and ethnic tastes has been increasing. Bakers are creating fusion preparations influenced by several cuisines worldwide, e.g., matcha, spicy mango, and ube (a purple yam). The process will extend one’s food range and draw a wider customer base for freshness and surprising taste experiences.

Moreover, technological advances have also played an important part in market growth. The automated method has proven beneficial in streamlining processing to meet the raised demand for bakery products more efficiently. Progress in processing and packaging has helped to ensure the availability of a much longer shelf life and the best quality of bakery jams and fillings. It glazes from the point of production to consumption because consumer expectations were fresh and tasty.

Further, ready-to-eat (RTE) bakery products witnessed growth in 2024 as per quality statistics provided by the government. According to the Indian Ministry of Commerce and Industry, reports related to RTE food products, BOBs (Food and Simulated Beverages) show an increase of 24% since these items are more viable as RTE.

Furthermore, the baking and pastries business saw numerous major product debuts, particularly in the jams and fillings category, demonstrating the industry's commitment to innovation and matching changing consumer demands. "Bonne Maman" introduced a new pie filler series, especially geared toward holiday baking. The pie fillings' new range from its product line in three classic flavors: blueberry, cherry, and apple. It is easy to use, hardly requires any preparation, and fits well into many baking projects.

Angel Yeast, one of the top yeast product manufacturers, partnered with BakeMark to offer the name "BakeMark By Angel" to over 40 new products. These new products within Product Concentration Bakery Asia 2024 were launched in three categories: mixes and icings, custard and cheese fillings, and jams and fruit fillings. Jams and fruit fillings have options like apricot, raspberry, and strawberry in 55% to 70% fruit content, natural fruit fillings with clean labels, for the most part, indicating the healthy and open product developing consumer preferences.

- The online retail segment is anticipated to grow notably

The demand for jams in the online retail market has passed a benchmark, owing to several factors indicating contemporary customer preferences and technological advancements. Online retail is seeing record traffic due to the advent of e-commerce platforms, thus offering consumers access to various product ranges, including specialties and premium food items, like jams, which are nearly unattainable through regular shops. This access factor is supported by price comparison, reviews, and home delivery, making online trading for buying jams attractive.

Another reason driving the demand is the increased adoption of cell phones and internet access, particularly in emerging nations. Product offerings were perceived as prohibitive and were only accessible to people in Tier II and III cities. They can now purchase rare and imported jams with a click. These platforms also allowed them to see what local products are available. The global and regional brands working with these platforms pique consumer curiosity with novelty flavors and products.

For instance, according to National Telecommunications and Information Administration (NTIA) data, internet usage in the United States has increased significantly. From 2021 to 2023, the number of internet users increased by 13 million. The global e-commerce landscape has seen substantial expansion. The U.S. Census Bureau anticipated that e-commerce sales in the third quarter of 2024 would be $300.1 billion, accounting for 16.2% of total retail sales. This is a 7.4% rise from the same quarter in 2023, demonstrating the growing consumer preference for online purchasing.

Moreover, in 2024, India's e-commerce market was estimated to be worth $63.17 billion. The sector will likely continue its upward trend, fueled by rising internet penetration and a larger consumer base. These figures demonstrate the e-commerce industry's dynamic nature across geographies, reflecting shifting customer patterns and technology improvements.

Sales have been achieved due to the expansion of jam sales channels-huge, owing to digital marketing and company promotions with much focus. Many firms use social media and online marketing options very effectively to reach their target demographics. Influencers and bloggers are good for promoting new products and bringing them into the profile, or proposing new, creative uses of that jam, encouraging customers to try it. Discounts, free shipping, and subscription models offered by e-commerce companies have motivated consumers to buy jam online, making it a more cost-effective option.

Global Jam Market Regional Analysis:

- The North American region is expected to witness a significant increase in growth in the global jam market during the forecasted period.

The factors that affect the market growth in this region are the increasing consumption of breakfast cereals and processed foods like biscuits, cakes, and many others, since fruit jams are known to be used as fillings. The growth of consumption of breakfast cereals, which include bread products, cereals, oats, and many others, will help assist the jam market growth due to the increasing usage of jam with several breakfast cereal products in the market.

The Institute of Food Technology states that the United States dominated the global bread and bread products market between 2018 and 2022, with a CAGR of 16% when compared with the rest of the world. Also, as per the Agricultural and Processed Food Products Export Development Authority, the North American region had the largest share in sales for breakfast cereals in the world, expecting an increase of US$40 billion worldwide. The increase in consumption of breakfast cereals will, therefore, provide the necessary boost for the jam market growth during the forecasted period, with the wide use of jam as a spread and also the various health benefits that come with fruit jam products.

The growing adoption of improved lifestyles in the United States has been driving the need for organic food products with high nutritional value. With the improved numbers of the vegan population, followed by an ongoing shift towards convenience food items, the requirement for jams & jellies will witness an upward trajectory.

People are becoming much more aware of their fitness regime and diet intake, which has opened new possibilities for natural and organically-made jams as they form one of the key sources of protein and other minerals. Likewise, the major market players, J.M. Smucker Company and Andros Group, have well-established their businesses in the US market and are investing in new product development to optimize the growing opportunity for ultra-processed food items.

Being one of the major global economies, the United States is witnessing positive growth in its per capita food consumption, which positively impacts the demand for various day-to-day snacks and processed food items, including jams & jellies.

According to the United States Department of Agriculture, in 2023, the per capita food sales in the country stood at US$7,102. The same source also stated that per capita FAH (Food At Home) consumption was high in the Northwestern and Mountain West States, namely Washington, Utah, Oregon, and Colorado. Moreover, according to the “Consumer Expenditure 2023” data issued by the U.S. Bureau of Labor Statistics, food spending accounted for 12.9% of the total consumer expenditure, which experienced a 6.9% growth over 2022’s spending.

The World Bank states that the urban population constitutes 83% of the total population of the United States, which represents a significant upliftment in the living standards and level of improvement in consumer purchasing power. Additional factors, such as the booming bakery sector, have also paved the way for future market expansion.

Global Jam Market Developments:

- December 2024: The J.M. Smucker Co. opened a new 900,000-square-foot manufacturing facility in McCalla, Alabama, to produce its Uncrustables® brand, one of the fastest-expanding brands in the company. Company CEO Mark Smucker, together with the Alabama governor, Kay Ivey, came to the opening and said the plant was vital in meeting the rising demand for tasty frozen sandwiches.

- July 2022: Tata Consumer Products announced the release of their premium honey and preserves products under the Himalayan Brand. The products include handmade preserves that were made in small batches using Himalayan-originated fruits and were sourced from partners with a commitment to helping local communities. The various flavours of the preserves include strawberry, black cherry, apple cinnamon, and three fruit marmalade, and contain no added preservatives or flavouring to the jam products. Himalayan is a brand that is under the consumer products company Tata Consumer Products, providing various types of consumer products such as bottled mineral water, honey, and preserves. All their products are genuinely sourced from the Himalayas, creating value and loyalty to the brand name. The product portfolio was set to be available all over India in select premium outlets.

List of Top Jam Companies:

- The J.M. Smucker Company: Also known as Smuckers, a well-known food and beverage manufacturer who is known for the marketing of products such as consumer foods, pet foods, and coffee. They are also one of the leading producers and marketers of jams, jellies, and preservatives in the United States.

- Kissan: A well-known private label brand from India that is known for the production and marketing of jams, ketchup, and squash products. They are known for the production of jam in India, with various flavours such as apple, banana, mango, papaya, grape, pear, pineapple, and orange.

Jam Market Scope:

| Report Metric | Details |

| Jam Market Size in 2025 | US$8.081 billion |

| Jam Market Size in 2030 | US$10.213 billion |

| Growth Rate | CAGR of 4.79% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Jam Market |

|

| Customization Scope | Free report customization with purchase |

Global Jam Market Segmentation:

- BY TYPE

- Jams and Jellies

- Marmalades

- Others

- BY APPLICATION

- Bread Spreads

- Baking and Pastries

- Others

- BY DISTRIBUTION CHANNEL

- Hypermarkets and Supermarkets

- Convenience Stores

- Online Retail

- Specialty Stores

- Others

- By Geography:

-

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

- North America

Our Best-Performing Industry Reports:

Navigation

- Global Jam Market Size:

- Global Jam Market Highlights:

- Global Jam Market Overview:

- Global Jam Market Drivers:

- Global Jam Market Segmentation Analysis:

- Global Jam Market Regional Analysis:

- Global Jam Market Developments:

- List of Top Jam Companies:

- Jam Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 26, 2025