Report Overview

Global Immunosuppressant Drugs Market Highlights

Immunosuppressant Drugs Market Size

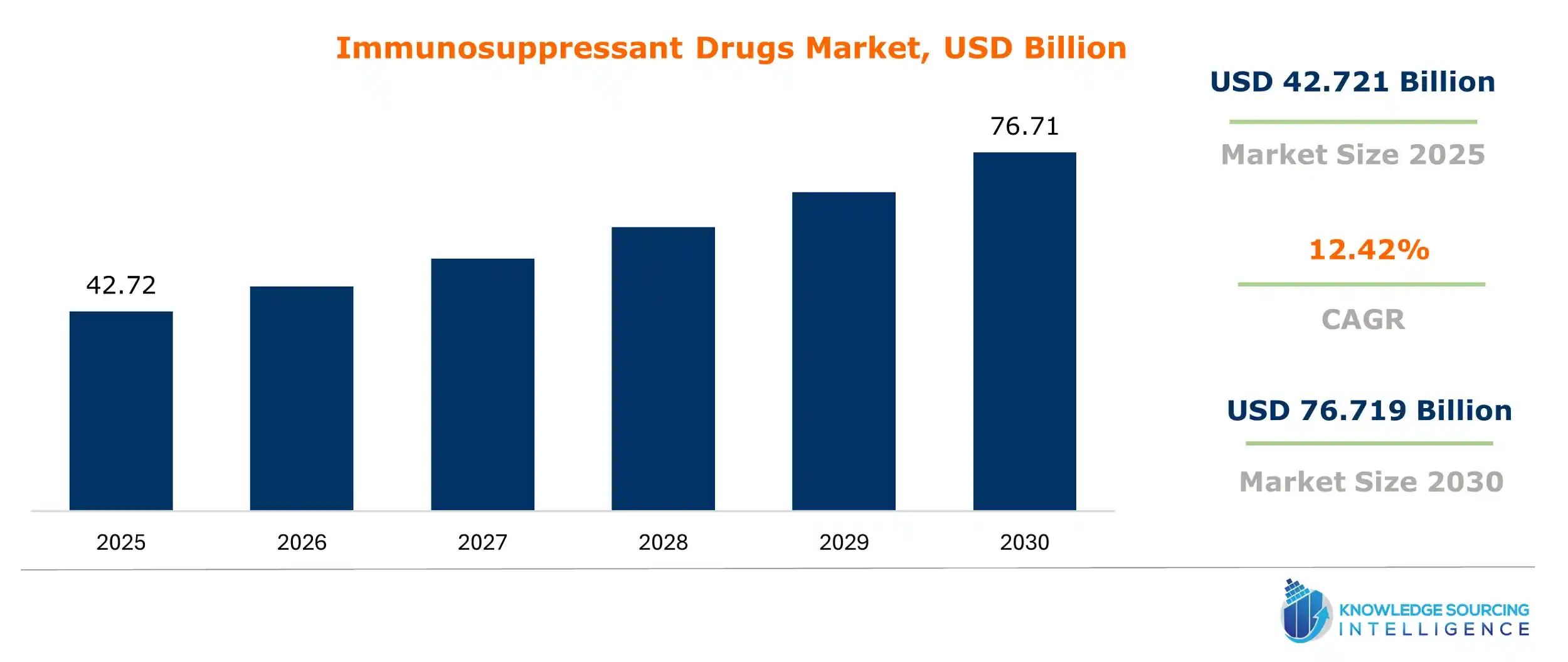

The global Immunosuppressant Drugs market is expected to grow at a CAGR of 12.42%, reaching a market size of US$76.719 billion in 2030 from US$42.721 billion in 2025.

Immunosuppressive drugs find their clinical utility in managing autoimmune diseases such as skin disorders, multiple sclerosis, and rheumatoid arthritis. These medications, which are also known as anti-rejection medications, prevent our body from rejecting transplanted organs. The need to support populations with chronic ailments, particularly those requiring organ transplants and technological advancements that enhance the transplant process, would significantly increase market growth.

According to the World Health Organization report in September 2023, about 41 million die per year from noncommunicable diseases (NCDs), which equals about 74% of all deaths in the world. It would cover respiratory, cancer, kidney, cardiovascular diseases, etc. Improving immunosuppressive medications and the development of organ transplantation would hence reduce some of the mortalities caused by these diseases and boost market expansion.

Immunosuppressant Drugs Market Growth Drivers:

- Rising chronic health diseases are contributing to the global Immunosuppressant Drugs market growth

Stem cell transplant requirements are rising for acute leukemia, refractory anemia, and osteopetrosis, while there is an increase in chronic renal diseases that cause kidney transplants. The organ transplant burden has thus led to a colossal rise in the demand for immunosuppressants and has further contributed to the global market. Increasing clinical trials, growing mergers and acquisitions, and the fast-growing CDMOs and CROs supporting drug discovery and development are additional factors fostering market expansion.

- High demand for Calcineurin Inhibitors is anticipated to increase the global market share

Over the forecast period, the growing demand for calcineurin inhibitors is driven by the treatment of various autoimmune diseases, including lupus nephritis, atopic dermatitis, idiopathic inflammatory myositis, interstitial lung disease, and solid organ transplantation. For instance, cyclosporine has been approved by the U.S. Food and Drug Administration (FDA) to prevent the rejection of allogeneic organ transplants in conjunction with glucocorticoids.

Azathioprine and mycophenolic acid are the two main antiproliferative agents that offer the mainstay therapy of maintenance antirejection for solid organ transplants. Due to their action in cellular replication interference, these drugs are also useful for research studies in autoimmune diseases and cancers, which inclines the higher potential toward a rise in market demand.

- Technological advancement is anticipated to boost the global Immunosuppressant drugs market.

Factors promoting this global market’s growth include rising healthcare costs and increased healthcare infrastructure development in developing countries. The technologies enhance understanding of molecular processes, paving the way for discovering new immunosuppressive medicines and opening many avenues for global market expansion during the forecast period. However, stringent guidelines regarding quality, clinical, and nonclinical aspects for approval of immunosuppressive medicines might curb this worldwide immunosuppressant market’s growth.

- Increasing cases of Systemic Autoimmune Disease is anticipated to increase the demand

Autoantigens and such DNA or protein complexes are present in nearly every kind of cell of an entity, underlying the pathology of almost every systemic autoimmune disease. So, the pathology manifests widespread damage within an organ system. Hence, the growing market is attributed to the increasing incidence of systemic autoimmune diseases, such as rheumatoid arthritis, systemic lupus erythematosus, scleroderma, psoriasis, and dermatomyositis.

According to an article published in July 2022 by the MDPI, the number of rheumatoid arthritis patients in India is around 10 million and is 0.7% prevalent among the population. Most days, people with rheumatoid arthritis feel exhausted, a feature that is evident in more than 70% of them showing symptomatology similar to chronic fatigue syndrome.

The launch of new products by the major market players is also expected to propel market growth. One such product is Aurinia Pharmaceuticals' oral Lupkynis (voclosporin), which the FDA approved for use in adult patients suffering from active lupus nephritis. This drug is a new, modified form of calcineurin inhibitor that both binds and inhibits calcineurin while also providing immunosuppressive effects.

Immunosuppressant Drugs Market Restraints:

- Side Effects caused by drugs are anticipated to hamper the market growth

The combined impact of multiple factors is constraining the market expansion of immunosuppressive medications. The most significant of those factors are the adverse effects of these medications. Immunosuppressive medications reduce immunity, which leaves our bodies vulnerable to other deadly illnesses. Furthermore, these medications must pass strict laws and regulations in several nations to reach consumers. As a result, these regulations are also impeding market expansion.

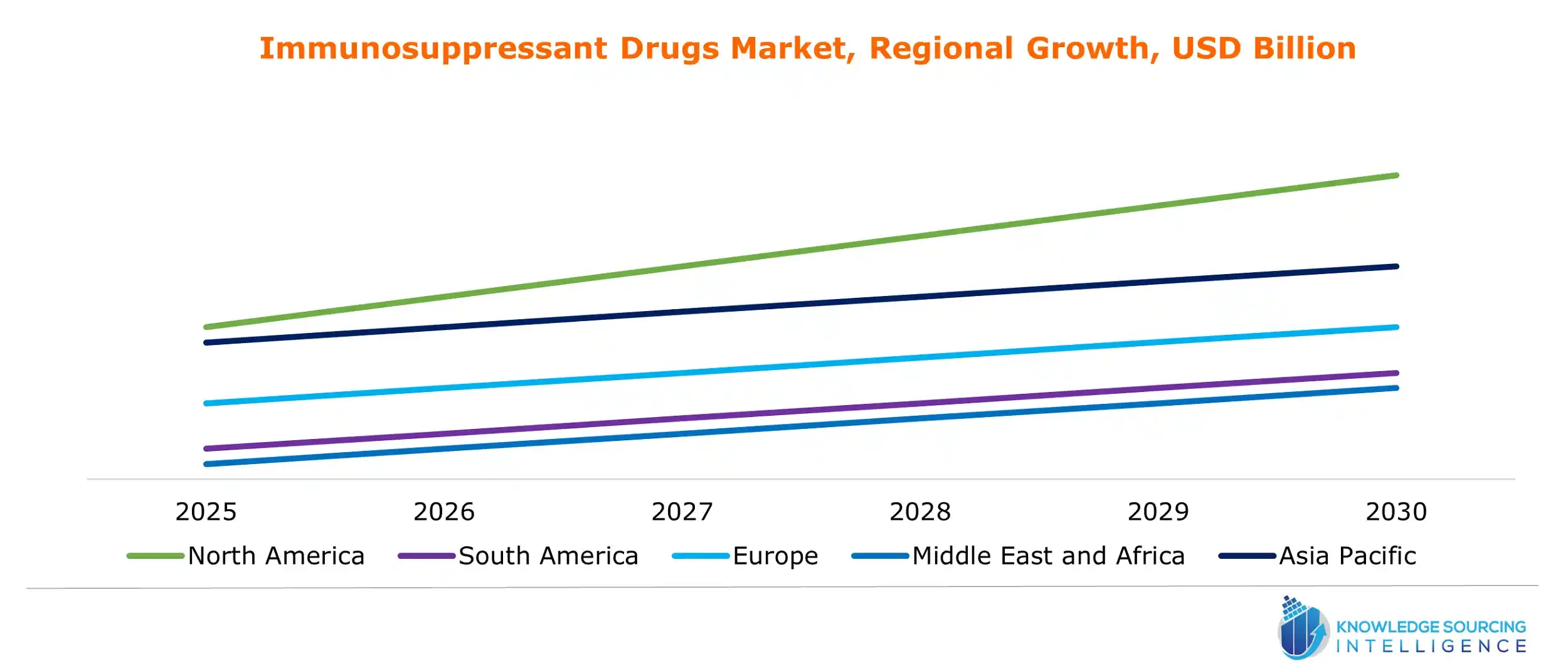

Immunosuppressant Drugs Market Geographical Outlook:

- North America is witnessing exponential growth during the forecast period.

Technological advancements and the presence of significant market participants aid the development of this regional market. In nations like the US and Canada, rising demand for organ transplants and related procedures increases demand for immunosuppressive medications, propelling market expansion. Growing public awareness of organ donation is also opening the door for more transplant procedures, which will accelerate the immunosuppressive medication market’s growth over the next five years. In the United States, 90% of adults favor organ donation. The market for immunosuppressive medications is expanding due to the region's increasing prevalence of autoimmune disease and R&D spending.

Immunosuppressant Drugs Market Key Launches:

- In November 2023, Kynviq® (ledipasvir/sofosbuvir), Novartis's novel oral immunosuppressant, was approved by the FDA to treat chronic HCV infection in adults with compensated liver disease who have not previously received antiviral therapy. Kynviq® is a combination of the NS5A inhibitor ledipasvir and the NS5B inhibitor sofosbuvir. The FDA has received a New Drug Application (NDA) from GlaxoSmithKline (GSK) for Benlysta® (belimumab), an investigational medication used to treat systemic lupus erythematosus (SLE).

- In June 2023, Dr Reddy's Laboratories Ltd. declared that the Phase I study of its suggested immunosuppressive medication biosimilar was successfully finished. All primary and secondary endpoints were met by the Phase I study, "A Phase I, Double-Blind, Randomized, Parallel-group, Single dose, Three-arm, Comparative Pharmacokinetic and Pharmacodynamic Study of Dr. Reddy's Tocilizumab (DRL_TC), USA sourced Reference Tocilizumab (Actemra), and EU sourced Reference Tocilizumab (RoActemra) Administered by the Intravenous Route to Normal Healthy Male Volunteers."

List of Top Immunosuppressant Drugs Companies:

- Astellas Pharma Inc.

- Sanofi

- AbbVie Inc.

- Veloxis Pharmaceuticals Inc.

- GlaxoSmithKline plc

Immunosuppressant Drugs Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Immunosuppressant Drugs Market Size in 2025 | US$42.721 billion |

| Immunosuppressant Drugs Market Size in 2030 | US$76.719 billion |

| Growth Rate | CAGR of 12.42% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Immunosuppressant Drugs Market |

|

| Customization Scope | Free report customization with purchase |

The global Immunosuppressant Drugs market is segmented and analyzed as follows:

- By Drug Class

- Calcineurin Inhibitors

- mTOR inhibitor

- Antibodies

- Others

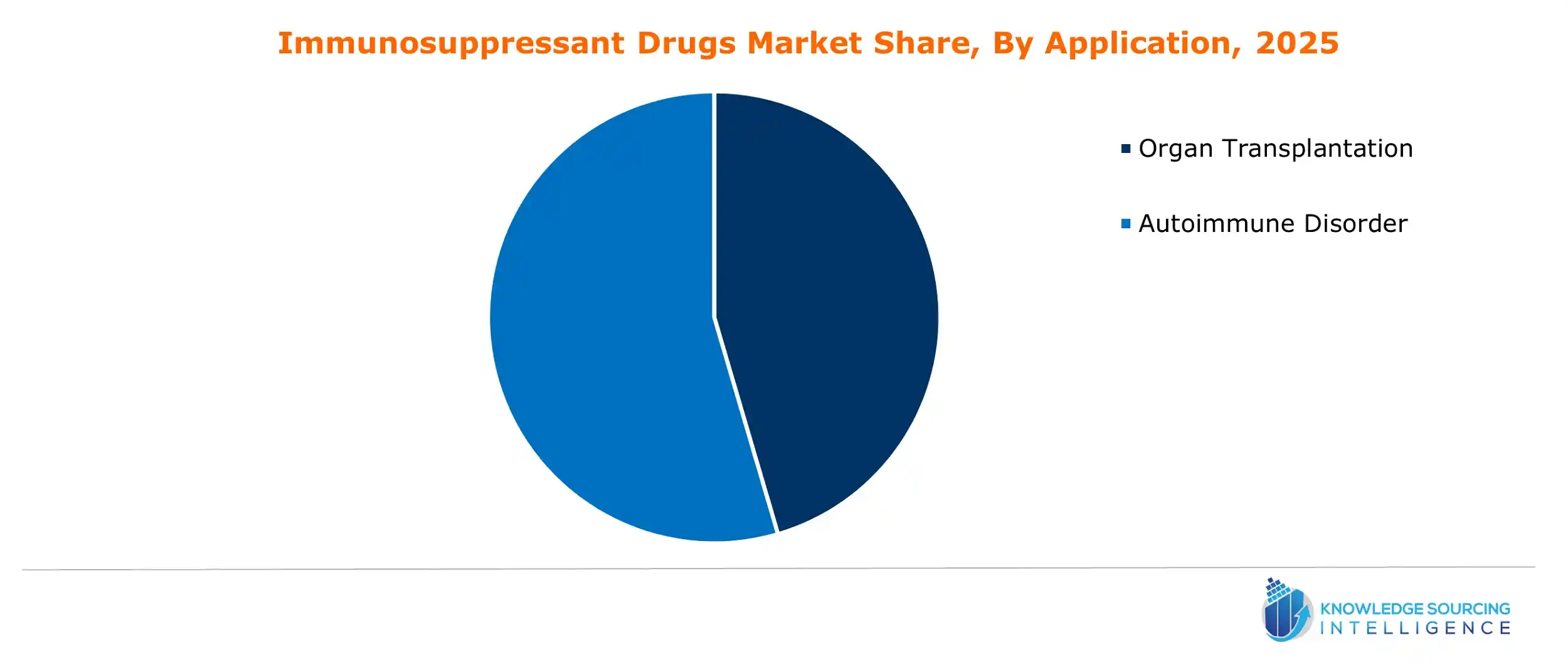

- By Application

- Organ Transplantation

- Autoimmune Disorder

- By Distribution Channel

- Online

- Offline

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Others

- North America

Our Best-Performing Industry Reports

Navigation

- Immunosuppressant Drugs Market Size

- Immunosuppressant Drugs Market Key Highlights:

- Immunosuppressant Drugs Market Growth Drivers:

- Immunosuppressant Drugs Market Restraints:

- Immunosuppressant Drugs Market Geographical Outlook:

- Immunosuppressant Drugs Market Key Launches:

- List of Top Immunosuppressant Drugs Companies:

- Immunosuppressant Drugs Market Scope:

- Our Best-Performing Industry Reports