Report Overview

Hydrocolloids Market - Strategic Highlights

Hydrocolloids Market Size:

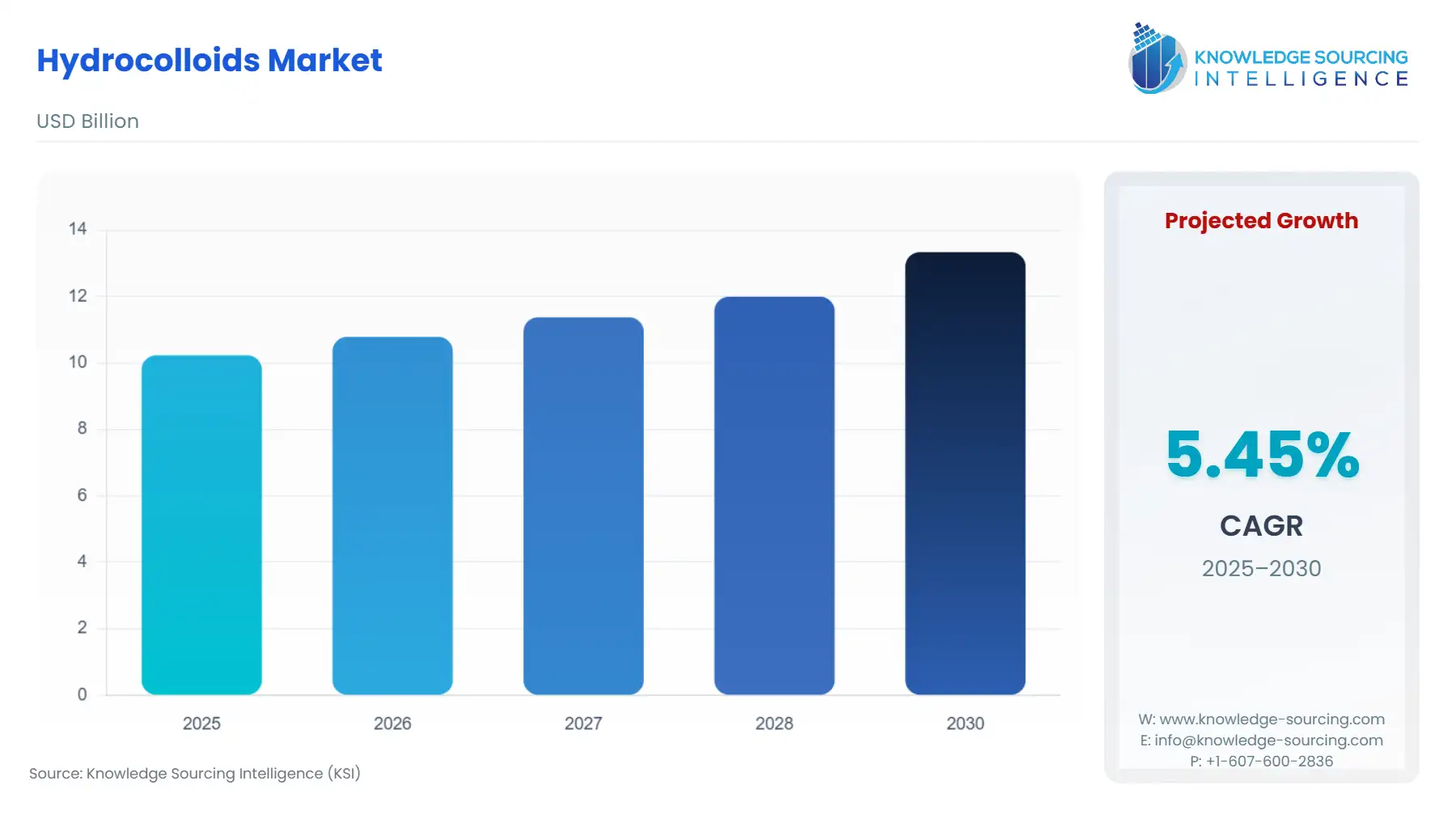

The hydrocolloids market is projected to grow at a CAGR of 5.45% to be valued at US$13.338 billion in 2030 from US$10.232 billion in 2025.

Hydrocolloids Market Introduction:

The global hydrocolloids market is a complex and vital sector of the food, pharmaceutical, and cosmetic industries, driven by the unique functional properties of these natural and synthetic polymers. Hydrocolloids are hydrophilic substances that, when dispersed in water, form gels, thickeners, or stabilizers. Their ability to manage viscosity, texture, and stability makes them indispensable ingredients in a vast array of products, from everyday food items to advanced medical formulations. The market's growth is fundamentally linked to a confluence of consumer trends and technological advancements, including the rising demand for clean-label products, the expansion of plant-based and vegan diets, and the need for new solutions in drug delivery and personal care.

Hydrocolloids are a diverse group of high-molecular-weight polysaccharides and proteins derived from various sources, including plants, seaweed, animals, and microbial fermentation. This diversity is a key strength of the market, as it allows formulators to choose the right hydrocolloid for a specific application, based on its gelling, thickening, or emulsifying properties. For instance, gelatin, derived from animal collagen, is a well-established gelling agent, while xanthan gum, produced through microbial fermentation, is widely used as a stabilizer in sauces and dressings. The rising consumer awareness about the health and environmental impact of food has led to a significant shift in preference towards plant-based and natural hydrocolloids. This trend has spurred innovation and investment in the development of new hydrocolloids from botanical and seaweed sources, such as pectin, guar gum, and carrageenan.

Beyond the food and beverage industry, hydrocolloids are playing an increasingly crucial role in pharmaceuticals and cosmetics. In pharmaceuticals, they are used as binders, disintegrants, and coating agents for tablets and as gelling agents in wound dressings. Their biocompatibility and ability to form controlled-release matrices make them ideal for advanced drug delivery systems. In cosmetics and personal care, hydrocolloids function as thickeners and stabilizers in creams, lotions, and gels, providing a desirable texture and feel. The market's expansion into these non-food applications is a testament to the versatility of hydrocolloid technology.

However, the hydrocolloids market is not without its challenges. The industry faces significant headwinds from fluctuating raw material prices, which are often subject to agricultural yields, climate change, and geopolitical events. The supply of natural hydrocolloids, such as those derived from seaweed or plants, can be inconsistent, leading to price volatility and supply chain disruptions. Additionally, the industry is subject to stringent and complex regulatory frameworks that vary by region and application. These regulations govern the maximum permissible levels of hydrocolloids in food and pharmaceutical products, adding to the cost and complexity of product development. Despite these challenges, the market's trajectory remains positive. The ongoing innovation in sourcing, processing, and application of hydrocolloids, combined with the strong and growing consumer demand for functional and natural ingredients, positions this market for continued growth and expansion into new and exciting application areas.

Hydrocolloids Market Overview:

Hydrocolloids are used extensively in a wide variety of food products as gelling and thickening agents for improving the shelf-life and quality of food products. Hydrocolloids are colloids (particles) mixed in water (hydro). These particles are what provide the right viscosity, texture, or structure to many foods you likely consume daily.

Increasing worldwide demand for processed and ready-to-eat food and beverage products is driving the need for hydrocolloids in the food and beverage industry. The expanding use of hydrocolloids in various sectors, including textiles and the pulp and paper industry, is further accelerating the global hydrocolloids market’s expansion.

Regionally, North America dominates the global market, holding the largest share due to the presence of key industry players and significant investments in research and development. Meanwhile, the Asia-Pacific region is experiencing the most rapid growth during the forecast period, fueled by a rising preference for processed and convenient food options. Additionally, growing consumer awareness of medications is increasing demand for over-the-counter (OTC) drugs in countries like China and India, which in turn is enhancing the need for hydrocolloids in the region’s pharmaceutical sector.

Some of the major players covered in this report include Cargill Incorporated, DSM (Koninklijke DSM N.V.), Kerry Group plc., Archer-Daniels-Midland Company (ADM), Ashland Inc., Jungbunzlauer Suisse AG, Ingredion Incorporated, CP Kelco U.S., Inc., and Tate & Lyle plc, among others.

Hydrocolloids Market Drivers:

Rising Demand for Clean-Label and Plant-Based Ingredients: The hydrocolloids market is significantly driven by a growing consumer preference for clean-label and plant-based products. Consumers are increasingly seeking natural, simple ingredients, leading food manufacturers to reformulate products using natural hydrocolloids from botanical and seaweed sources. This trend extends to cosmetics and pharmaceuticals, and the industry is responding by developing new hydrocolloid solutions that offer high performance while maintaining a natural and sustainable profile.

Growth in Convenience and Processed Food Consumption: The global rise in convenience and processed food consumption is another key driver for the hydrocolloids market. These ingredients are crucial for improving texture, extending shelf life, and maintaining product stability in ready-to-eat meals, sauces, dressings, and baked goods. Hydrocolloids are also used as fat replacers in low-fat and low-sugar formulations, and ongoing innovation in the processed food industry ensures a sustained demand for them.

Expansion of the Personal Care & Cosmetics Industry: The rapid expansion of the personal care and cosmetics industry is a major driver, with hydrocolloids serving as thickeners, stabilizers, and emulsifiers in products like creams, lotions, and shampoos. The trend towards natural beauty products has boosted demand for plant-based hydrocolloids like carrageenan and alginates. New applications, such as hydrocolloid patches for acne and wound care, are also contributing to market growth in the dermocosmetics sector.

Hydrocolloids Market Restraints:

Price Volatility of Raw Materials: A primary restraint is the significant price volatility of raw materials, as many hydrocolloids are sourced from natural products whose supply is subject to agricultural yields, climate conditions, and geopolitical events. This instability makes it difficult for manufacturers to forecast costs and can lead to thin profit margins, potentially hindering investment in new products.

Stringent and Varied Regulatory Landscape: The market is subject to a complex and stringent regulatory landscape that varies significantly by country and region. Regulations on permissible levels, purity standards, and labeling requirements add to the cost and complexity of product development. The time-consuming and expensive approval process for new hydrocolloids can slow down innovation and create trade barriers.

Hydrocolloids Market Segmentation:

By Type, Gelatin is anticipated to lead the market expansion: Gelatin holds the largest market share due to its versatile properties as a thermoreversible gelling agent, which is highly valued in confectionery, desserts, and dairy products. It is also extensively used in pharmaceuticals and nutraceuticals for capsules and wound dressings. The long history of safe use and reliable functionality make it a leading choice for formulators.

By Source, Botanical Sources is expected to gain traction: The Botanical Sources segment is dominant, driven by consumer demand for natural and plant-based ingredients. This segment includes hydrocolloids like guar gum and pectin, which align with clean-label trends and cater to vegan diets. The sustainability of botanical sourcing is also a key advantage, bolstering its dominance.

By Application, the Food & Beverages sector is rising notably: The Food & Beverages industry is the largest application segment, where hydrocolloids are indispensable for improving texture, stability, and shelf life. They are used as gelling agents in jams, thickeners in soups, and stabilizers in ice cream. Growth in convenience foods and functional food sectors ensures that this industry remains the primary market for hydrocolloids.

Hydrocolloids Market Key Developments:

In April 2025, Ingredion introduced a new range of plant-based texturizers and stabilizers to address challenges in the dairy-free and meat-substitute markets.

In November 2024, Marine Hydrocolloids showcased its Spreadable Agar Agar Wondergel, a vegan alternative to gelatin, and Agar Instant, an agar product designed for fast solubilization, at Gulfood Manufacturing.

In July 2024, Sunita Hydrocolloids participated in the IFT FIRST 2024 event to highlight the use of its guar gum in gluten-free and low-fat products.

List of Top Hydrocolloids Companies:

Archer Daniels Midland Company

Cargill, Incorporated

IFF (International Flavors & Fragrances Inc.)

Tate & Lyle

CP Kelco

Hydrocolloids Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD10.232 billion |

| Total Market Size in 2030 | USD 13.338 billion |

| Forecast Unit | Billion |

| Growth Rate | 5.45% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Type, Source, Function, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Hydrocolloids Market Segmentations:

By Type

Gelatin

Pectin

Xanthan Gum

Gum Arabic

Alginates

Guar Gum

Others

By Source

Botanical Sources

Microbial Sources

Animal Sources

Seaweed Sources

Synthetic Sources

By Function

Thickening Agents

Gelling Agents

Stabilizers

Emulsifiers

Fat Replacers

Others

By Application

Food & Beverages

Pharmaceuticals

Cosmetics & Personal Care

Other Applications

By Regions

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

UK

France

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

Japan

China

India

South Korea

Thailand

Indonesia

Others