Report Overview

Global Hybrid Adhesives And Highlights

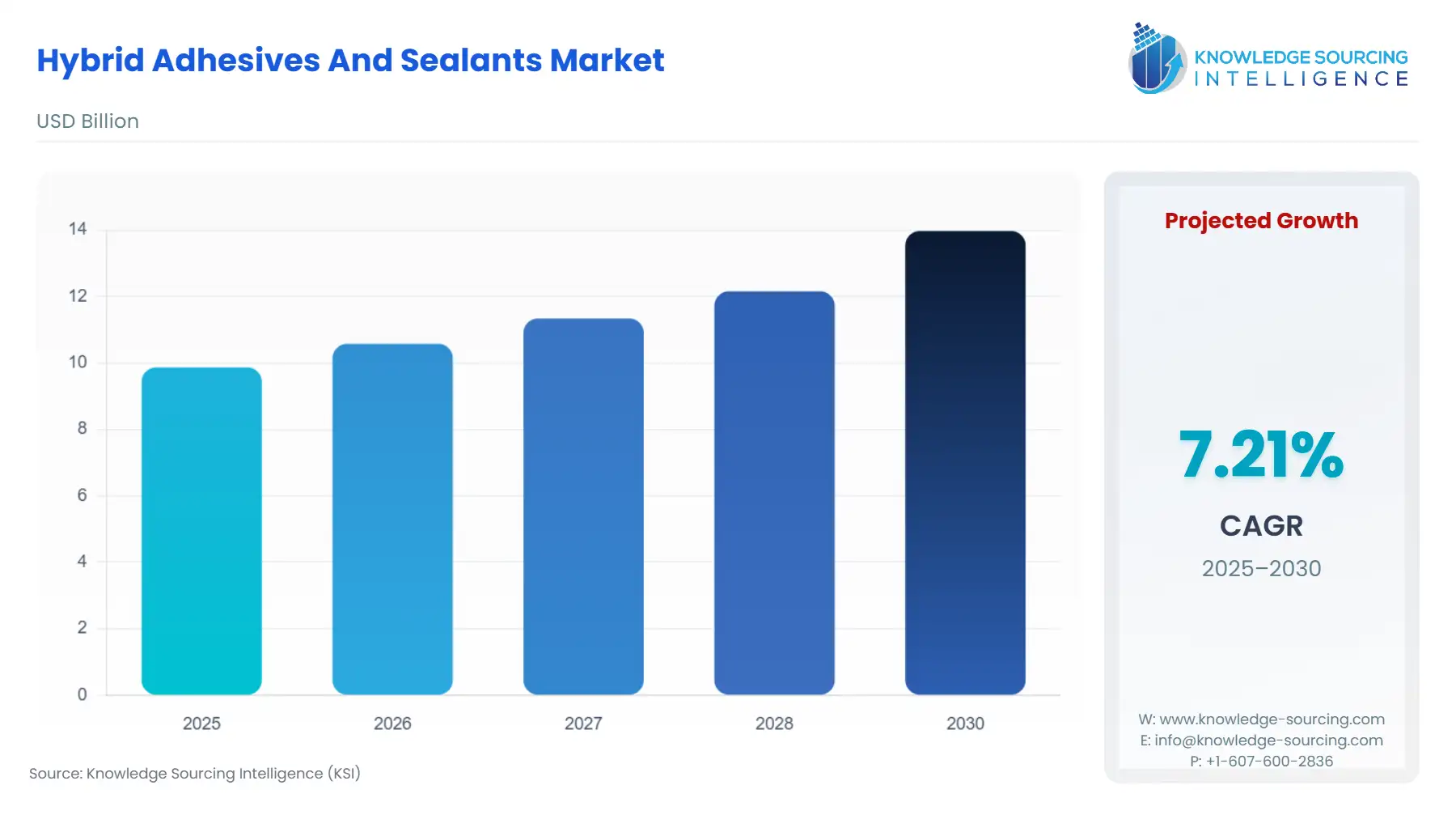

Hybrid Adhesives and Sealants Market Size:

The Global Hybrid Adhesives And Sealants Market is expected to grow from US$9.868 billion in 2025 to US$13.975 billion in 2030, at a CAGR of 7.21%.

Hybrid adhesives and sealants are chemically hardening adhesives that are developed by combining two or more polymer resins. These materials are suitable for both sealing and bonding applications. Also, hybrid adhesives and sealants are versatile due to their solvent-free and isocyanate-free nature. This makes it popular for use in various industries. It has high applicability in the construction industry, automotive, and assembly operations in various industries like electronics equipment, appliances, and households, amongst others.

Hybrid sealants provide long-lasting flexibility, comfort, and tidiness for users and have the protection attributes of silicone. Hybrid adhesives and sealants comprise no VOCs, are water-resistant, do no longer degrade when flashed by UV light, and are free from isocyanates, solvents, silicone, and PVC. The environment-pleasing nature of hybrid adhesives and sealants assists in growing their call for use in the improvement and automobile industries.

Hybrid Adhesives and Sealants Market Trends:

The global hybrid adhesives and sealants market is growing rapidly with increasing application of these adhesives and sealants in building & construction, automotive, industrial assembly, and other sectors. Hybrid adhesives and sealants have gained popularity as they are versatile and can be used for multiple purposes. This reduces the need for multiple products for various applications, reduces cost, saves time, and streamlines processes. Key market players are investing in R&D to develop advanced products that can overcome the inadequacies of conventional adhesives and sealants.

Furthermore, sustainable adhesives and technological development a ways to similarly increase numerous possibilities as a way to cause the boom of the hybrid adhesives and hybrid sealants marketplace within the forecast period.

Hybrid Adhesives and Sealants Market Analysis:

Growth Drivers

- The acceleration of vehicle lightweighting in the automotive industry is a primary growth driver.

OEMs replace heavier steel components with multi-material assemblies of aluminum, carbon fiber, and engineering plastics to enhance fuel efficiency and battery range in EVs. Traditional fastening methods cannot reliably join these dissimilar substrates, directly increasing the demand for two-component epoxy-polyurethane or MS polymer hybrid adhesives that offer strong, stress-distributing bonds. Concurrently, government-mandated Green Building initiatives worldwide, such as the EU’s Nearly Zero-Energy Building (nZEB) standards, necessitate high-performance sealants for façade and window systems. This regulatory pressure directly increases the demand for low-VOC hybrid sealants, essential for achieving the required air-tightness, thermal insulation, and long-term joint durability in modern, energy-efficient structures.

- Growth in the Construction Industry

The growth of the global hybrid adhesives and sealants market can be attributed to the increasing construction activities around the world and more specifically in developing countries like China and India. Countries like China, the United States, and India are major contributors to the growth of the construction industry. China has observed a drastic increase in urban construction in the last decade. According to the UN-Habitat UN-DESA’s World Urbanization Prospects 2025 reveals that 81% of the people live in urban areas. . India’s construction industry is also growing. Govt. initiatives such as the Pradhan Mantri Awas Yojana aim to build 20 million urban homes and 30 million rural houses by 2022, which is expected to massively boost the country’s construction industry as per the report published by the International Journal of Engineering Research & Technology (IJERT). Furthermore, as per India’s National Investment Promotion and Facilitation Agency, India’s construction industry has reached $1.4 Tn by 2025. With exceptional growth in the country’s construction industry, the demand for hybrid adhesives and sealants is also expected to increase exponentially in the upcoming years.

- Growth in the Automotive Industry

The growth of the global hybrid adhesives and sealants market can be attributed to the automotive industry. Despite the downfall in the automotive industry due to COVID-19, the industry is expected to grow owing to the increasing adoption of autonomous and electric vehicles. Not only the private players but also the governments of various countries are switching to electric vehicles. Governments are making it mandatory in a few countries to use electric vehicles. For instance, in the United States, the federal government fleet is being converted into EVs.

Also, states like California and Massachusetts have committed to phasing out the sales of new gas-powered vehicles by 2035. The European Union proposed a ban on sales of new petrol and diesel cars as of 2035, which would accelerate the switch towards electric vehicles to reduce carbon emissions. With various countries worried about the amount of carbon emissions produced due to fossil-fuel-based vehicles, those countries are switching to an alternative source, i.e., electric vehicles. With increasing production to meet the demand, the demand for hybrid adhesives and sealants is also expected to increase. Due to the various uses of adhesives and sealants in the manufacturing process of the automotive industry.

- Challenges and Opportunities

A critical challenge is the volatility and upward pressure on key raw material costs, specifically silane-functional polymers and polyurethane intermediates like MDI and TDI. This cost instability constrains formulator margins and complicates long-term pricing strategies, posing a direct obstacle to market accessibility and price competitiveness against conventional, lower-cost chemistries. Conversely, a significant opportunity lies in the burgeoning electronic assembly market. The proliferation of industrial IoT devices, advanced displays, and automotive electronics requires hybrid adhesives that offer not only structural bonding but also specialized functionalities like thermal conductivity and electromagnetic shielding. Developing hybrid systems tailored for these high-value, high-specification applications creates a new, profitable demand vector outside of the cyclical construction and automotive sectors.

- Supply Chain Analysis

The global hybrid adhesives and sealants supply chain is a multi-tiered structure beginning with large chemical producers (e.g., Dow, Evonik) who manufacture the specialty silane-functional polymers and isocyanates. The next tier consists of major formulators and integrators (e.g., Henkel, Sika, 3M) who blend and customize these raw materials into finished adhesive and sealant products. Production hubs are heavily concentrated in Western Europe (Germany, Switzerland), driven by strong R&D infrastructure and proximity to major automotive and high-value manufacturing centers, and Asia-Pacific (China, South Korea), driven by high construction and electronics manufacturing demand. A significant logistical complexity is the handling and transport of moisture-sensitive isocyanates and the specialized storage required for reactive hybrid systems, which necessitates a highly controlled, sophisticated regional distribution network for timely delivery to end-users in the construction and manufacturing segments.

Hybrid Adhesives And Sealants Market Segment Analysis:

- By Sealant Type: Silyl-modified polyethers (MS polymers)

Silyl-modified polyethers (MS polymers) stand as a critical segment, capitalizing on their superior performance profile and exceptional environmental characteristics. MS polymers, which are isocyanate-free and solvent-free, directly address the tightening global regulatory constraints on VOCs and hazardous air pollutants (HAPs), making them the preferred technology for compliance-driven markets like the European Union and California. The core demand driver is the construction sector's need for high-specification façade and fenestration sealing. MS polymer sealants offer exceptional UV resistance, non-yellowing characteristics, and the ability to adhere without priming to complex substrates like glass, aluminum, and concrete, all while maintaining long-term elasticity. This combination of attributes ensures a durable, aesthetically consistent, and energy-efficient building envelope, a non-negotiable requirement for modern, high-rise commercial and residential projects globally. The ease of application and paintability further enhances their demand over traditional silicones, which are often non-paintable and susceptible to staining.

- By End-User: Automotive

The Automotive end-user segment is fundamentally restructuring the demand profile for hybrid adhesives. The most significant catalyst is the global transition to Electric Vehicles (EVs). EV battery packs require extensive sealing and bonding for structural integrity, vibration dampening, and thermal management. High-performance hybrid structural adhesives, such as epoxy-polyurethane combinations, are uniquely capable of bonding the diverse materials used in battery enclosures, including aluminum casings, plastic cooling components, and battery cells. Beyond battery systems, hybrid formulations are essential for Body-in-White (BIW) assembly to achieve weight reduction. By replacing heavy mechanical fasteners and welding in critical joints, these adhesives reduce the vehicle's mass while simultaneously enhancing overall stiffness, crash safety, and noise/vibration/harshness (NVH) characteristics. This critical functionality, which directly enables vehicle lightweighting and improves EV performance metrics (e.g., range and safety), locks in robust and escalating demand for specialized hybrid adhesive systems.

Hybrid Adhesives And Sealants Market Geographical Analysis:

- US Market Analysis (North America)

The US market for hybrid adhesives and sealants is heavily influenced by the rebounding commercial construction sector and large-scale, government-backed infrastructure projects. Specifically, federal initiatives like the Infrastructure Investment and Jobs Act (IIJA) drive demand for durable, high-performance sealants in critical applications such as bridge joint expansion, highway rehabilitation, and public building construction. Demand is further intensified by stringent state-level regulations, most notably in California, which mandate the use of ultra-low-VOC and isocyanate-free products for all new construction and remodeling. This dual pressure—of high-specification performance requirements and environmental compliance—compels construction contractors to adopt SMP-based hybrid sealants as the standard, fundamentally shifting market dynamics away from traditional chemistries.

- Germany Market Analysis (Europe)

The German market is characterized by exceptionally high technical standards and a rigid regulatory environment. Demand is driven by two powerful forces: the premium automotive manufacturing sector and the EU's comprehensive energy efficiency mandates. German auto OEMs are global leaders in vehicle lightweighting, demanding custom, high-strength epoxy-hybrid and polyurethane-hybrid systems for structural bonding in advanced platforms and electric battery assemblies. Simultaneously, the EU’s Renovation Wave and nZEB standards force the construction sector to adopt hybrid sealants for External Thermal Insulation Composite Systems (ETICS) and high-performance window installation, directly linking product demand to the imperative of reducing the national building energy footprint. Germany acts as a technological bellwether, with a strong preference for innovative, sustainable, and highly engineered hybrid solutions.

- China Market Analysis (Asia-Pacific)

China is the single largest consumption market, propelled by the sheer scale and pace of its urbanization and infrastructure build-out. The primary demand vector is the residential and commercial construction sector, which requires vast volumes of sealants for joint filling, pre-fabricated construction, and window installation. While cost is a factor, the escalating focus on domestic environmental quality, driven by the government’s Green Building Action Plan, is creating a rapid transition from high-VOC solvent-based products to low-VOC hybrid alternatives. Furthermore, China's dominant position as the world's largest EV manufacturer ensures a persistent and aggressive demand for high-specification hybrid adhesives for bonding, potting, and encapsulation applications within the electric vehicle and battery manufacturing supply chains.

Hybrid Adhesives And Sealants Market Competitive Environment and Analysis:

The Global Hybrid Adhesives and Sealants Market is dominated by a few multinational chemical conglomerates that leverage their deep R&D capabilities, extensive product portfolios, and formidable global distribution networks. The competitive dynamic is characterized by strategic acquisitions aimed at consolidating niche technologies and expanding geographic reach, particularly in the high-growth Asia-Pacific and South American regions. Differentiation centers on compliance, with a strong market premium placed on isocyanate-free, low-VOC, and specialized functional hybrid products (e.g., thermally conductive).

Hybrid Adhesives And Sealants Market Company Profiles:

- Henkel AG & Co. KGaA

Henkel is a market leader, strategically positioned across both the industrial and consumer segments through its Adhesive Technologies business. The company maintains its competitive edge by focusing on application-specific hybrid solutions, particularly in the automotive and aerospace industries. A key strategic pillar is sustainovation, driving collaborations with raw material suppliers like Dow and Synthomer, as highlighted in its 2025 Supplier Awards, to develop formulations with a reduced Product Carbon Footprint (PCF). Henkel's LOCTITE and TEROSON brands feature advanced hybrid products, including specialized polyurethane-silane hybrids engineered for superior performance in EV battery assembly and multi-substrate structural bonding.

- 3M

3M capitalizes on its core competence in advanced materials science and its comprehensive industrial product suite. Its strategy is to offer a powerful, high-performance alternative to traditional mechanical fasteners. The company's 3M™ Polyurethane and Hybrid Adhesives & Sealants (the POWER Line) are a testament to this, with products like the $3\text{M}^{\text{TM}}$ 525 and 550 Polyurethane Adhesive Sealants, which are widely used in marine OEM, trailer assembly, and heavy construction. 3M's hybrid offerings are strategically positioned for applications where Environmental Health and Safety (EHS) is critical, emphasizing formulations with no isocyanates or solvents and enhanced UV resistance, broadening their appeal in high-end construction and specialty vehicle bonding.

Hybrid Adhesives And Sealants Market Developments:

- October 2024: APPLIED Adhesives Acquires AutomationSupply365

APPLIED Adhesives, a specialized North American adhesive solutions provider, completed the acquisition of AutomationSupply365. This strategic move directly enhances APPLIED Adhesives’ capability to provide integrated dispensing and application systems alongside its core adhesive products, thereby improving service delivery and expanding its reach into high-volume, automated industrial assembly operations, which are key users of hybrid adhesive solutions.

- May 2024: H.B. Fuller Acquires ND Industries

H.B. Fuller Company, a leading global adhesives manufacturer, announced the acquisition of ND Industries, Inc. This transaction, which added approximately $70 million in revenue for fiscal year 2023, immediately enhanced H.B. Fuller's portfolio in the high-margin, high-growth industrial assembly and maintenance, repair, and overhaul (MRO) segments. The acquisition strengthens H.B. Fuller's position in specialized chemical solutions, including those relevant to hybrid adhesive applications where specialized dispensing is required.

Hybrid Adhesives and Sealants Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Hybrid Adhesives and Sealants Market Size in 2025 | US$9.868 billion |

| Hybrid Adhesives and Sealants Market Size in 2030 | US$13.975 billion |

| Growth Rate | CAGR of 7.21% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Hybrid Adhesives and Sealants Market |

|

| Customization Scope | Free report customization with purchase |

Hybrid Adhesives and Sealants Market Segmentation:

- By Adhesives type

- Reactive Hybrids

- Dispersed Phase Hybrids

- By Sealant Type

- Silyl-modified polyethers (MS polymers)

- Silyl-modified polyurethanes (SPUR polymers)

- By End-User Industry

- Aerospace and Defense

- Automotive

- Construction

- Manufacturing

- Aerospace

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- Italy

- Spain

- Others

- Middle East and Africa

- Israel

- Saudi Arabia

- Others

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

- North America