Report Overview

Hospital Supplies Market Report Highlights

Hospital Supplies Market Size:

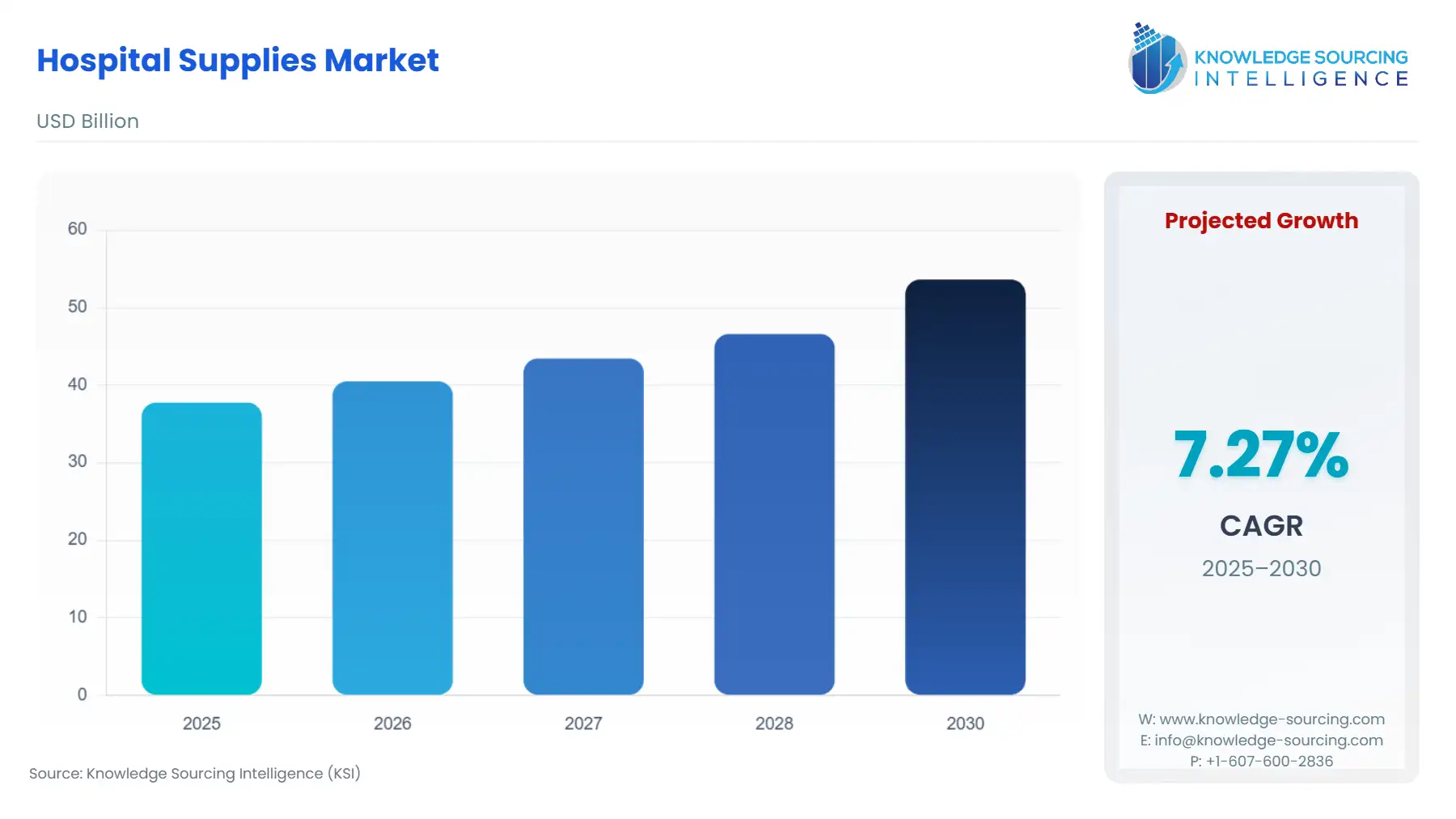

The Hospital Supplies Market is expected to grow from USD 37.752 billion in 2025 to USD 53.626 billion in 2030, at a CAGR of 7.27%.

The hospital supplies market represents a vast and essential component of the global healthcare ecosystem, encompassing a wide array of products from simple disposable gloves to complex operating room equipment. This market's stability is underpinned by the non-discretionary nature of healthcare, but its growth and dynamics are being profoundly shaped by powerful macroeconomic and epidemiological trends. The convergence of an aging global population with a rising incidence of chronic conditions is fundamentally expanding the volume of healthcare services required, which in turn drives the foundational demand for the supplies needed to deliver that care.

However, the industry is also navigating a period of significant operational and regulatory complexity. The vulnerabilities of the global supply chain, starkly exposed in recent years, continue to present challenges in procurement and cost management for healthcare providers. Simultaneously, an increasingly stringent regulatory environment demands greater investment in product development, clinical validation, and post-market surveillance. This report provides an in-depth, expert-level analysis of the forces impacting the demand for hospital supplies, the challenges facing the industry, and the strategic opportunities emerging from this complex and evolving landscape.

Hospital Supplies Market Analysis

- Growth Drivers

The most significant and enduring factor driving demand for hospital supplies is the demographic shift towards an older global population. As the baby boomer generation ages, particularly in developed regions like North America, Europe, and Japan, the incidence of age-related conditions requiring medical intervention is increasing substantially. This directly translates into a higher volume of surgical procedures, more frequent hospitalizations, and more intensive long-term care, all of which are primary consumers of a broad range of hospital supplies, from wound care products to mobility aids.

This demographic trend is coupled with a global rise in the prevalence of chronic diseases such as diabetes, cardiovascular disease, and chronic respiratory conditions. The management of these long-term illnesses requires continuous medical monitoring and frequent use of disposable supplies like glucose test strips, infusion sets, and catheters. This creates a predictable, recurring demand stream that is less susceptible to economic cycles than capital equipment purchases.

Furthermore, the continuous expansion and modernization of healthcare infrastructure, especially in emerging economies across Asia-Pacific and Latin America, is a powerful growth driver. As governments in these regions increase healthcare spending to improve access and quality of care, new hospitals and clinics are being built and existing ones are being upgraded. This creates a direct, large-scale demand for a full spectrum of hospital supplies, from basic patient examination devices to sophisticated operating room equipment, to outfit these new facilities.

- Challenges and Opportunities

The primary challenge confronting the hospital supplies market is the persistent pressure on pricing and margins. Healthcare systems globally, both public and private, are under intense pressure to control costs. This has led to the rise of powerful Group Purchasing Organizations (GPOs) and centralized procurement departments that leverage their immense purchasing volume to negotiate significant price reductions from suppliers. This dynamic compresses profit margins for manufacturers and creates a highly competitive environment where cost-efficiency is paramount.

This pricing pressure is exacerbated by the ongoing volatility and inflationary trends in the global supply chain. Many hospital supplies, particularly disposables, are made from petroleum-based polymers, the prices of which are linked to the volatile energy markets. Similarly, advanced medical equipment relies on specialty metals and electronic components that have experienced significant price increases and supply disruptions. These rising input costs are difficult for manufacturers to pass on fully in a cost-conscious healthcare environment, further challenging profitability.

However, these challenges also create significant market opportunities. The intense focus on infection control and the prevention of Hospital-Acquired Infections (HAIs) is a major opportunity. This is driving strong, sustained demand for single-use disposable products, advanced sterilization equipment, and disinfectants. Companies with strong product portfolios in infection prevention are exceptionally well-positioned for growth.

Another major opportunity lies in the decentralization of care and the growth of the home healthcare market. As more care shifts from the hospital to the home to reduce costs and improve patient comfort, there is a growing demand for a new category of hospital supplies that are designed for use by patients or non-professional caregivers. This includes easy-to-use wound care dressings, portable patient monitoring devices, and simplified infusion systems. This trend is creating an entirely new channel and set of product requirements, representing a significant growth avenue for innovative companies.

- Raw Material and Pricing Analysis

The pricing and availability of raw materials have a direct and significant impact on the cost structure and supply stability of the hospital supplies market. For the vast and critical segment of disposable supplies, the primary raw materials are petroleum-based polymers such as polypropylene, polyethylene, and PVC. The prices of these resins are directly linked to the price of crude oil and natural gas, exposing manufacturers to the volatility of global energy markets. A sharp increase in oil prices leads directly to higher costs for everything from disposable gowns and drapes to IV bags and tubing.

For more complex medical devices and equipment, the raw material landscape includes specialty metals like stainless steel and titanium, which are used in surgical instruments and orthopedic implants. The prices of these metals are influenced by global mining output and industrial demand. Furthermore, an increasing number of hospital supplies, from patient monitors to infusion pumps, incorporate sophisticated electronic components like microprocessors and sensors. The global semiconductor shortage has highlighted the vulnerability of the supply chain for these critical components, leading to production delays and significant price increases for advanced medical equipment. The ability of manufacturers to manage these diverse and volatile raw material supply chains is a key determinant of their profitability and market competitiveness.

- Supply Chain Analysis

The supply chain for hospital supplies is a highly complex, global network designed to deliver a vast number of products to thousands of healthcare facilities. The chain begins with the sourcing of raw materials, which are then converted into finished goods by manufacturers located around the world, with a significant concentration of high-volume disposable product manufacturing in Asia-Pacific, particularly China and Southeast Asia. A critical and often overlooked step in the supply chain for many products is sterilization. Whether through ethylene oxide (EtO), gamma irradiation, or other methods, this step is essential for ensuring product safety and is often performed at specialized facilities before final distribution.

From the manufacturer, products typically flow to large national or regional distributors. These distributors, such as Cardinal Health and McKesson, play a crucial role in the supply chain. They aggregate products from thousands of manufacturers, manage vast warehouse inventories, and handle the complex logistics of delivering supplies to individual hospitals, clinics, and other care facilities. Hospitals rely on these distributors for "just-in-time" delivery systems to minimize their own inventory holding costs. This highly efficient but lean supply chain structure has proven vulnerable to disruptions, as seen during the COVID-19 pandemic, prompting a renewed focus on building greater resilience through strategies like geographic diversification of manufacturing and increased safety stock levels.

Hospital Supplies Market Government Regulations

The hospital supplies market is one of the most highly regulated sectors of the economy. Government agencies in every major market exert strict control over product safety, efficacy, and quality, which directly impacts market access, R&D costs, and the competitive landscape.

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

| United States | FDA (Center for Devices and Radiological Health - CDRH) | Implements a risk-based classification system (Class I, II, III). Higher-risk devices require a rigorous and costly Premarket Approval (PMA) process, which directly impacts R&D timelines and creates high barriers to entry, shaping demand for approved products. |

| European Union | Competent Authorities under the Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR) | The MDR has significantly increased the requirements for clinical evidence and post-market surveillance. This has increased compliance costs for all manufacturers and has led to some older products being withdrawn, impacting product availability and demand. |

| China | National Medical Products Administration (NMPA) | Manages a stringent product registration and approval process. The NMPA's evolving standards and emphasis on local clinical data can create challenges for foreign manufacturers, influencing market access and shaping demand for locally approved supplies. |

Hospital Supplies Market Segment Analysis

- Analysis by Product Type: Disposable Hospital Supplies

The disposable hospital supplies segment is the largest and one of the most critical components of the entire market. This category includes a vast range of high-volume, single-use products such as examination gloves, face masks, surgical gowns and drapes, syringes, catheters, and IV supplies. The primary and overwhelming demand driver for this segment is the imperative of infection control. The global healthcare community's focus on preventing hospital-acquired infections (HAIs), which are a major cause of patient morbidity and increased healthcare costs, has led to the widespread adoption of single-use products over reusable alternatives. This trend significantly reduces the risk of cross-contamination between patients and healthcare workers, creating a massive, non-negotiable, and recurring demand stream for these supplies.

The demand within this segment was fundamentally and permanently reshaped by the COVID-19 pandemic. The pandemic led to an unprecedented surge in demand for personal protective equipment (PPE) like N95 respirators, surgical masks, and isolation gowns, and has created a new, elevated baseline of demand as healthcare systems maintain strategic stockpiles and heightened infection control protocols. Furthermore, the increasing volume of surgical procedures and routine medical care globally ensures a steady and growing consumption of these essential supplies. The demand dynamic in this segment is characterized by high volume and intense price competition, with healthcare providers constantly seeking cost-effective solutions that meet clinical and safety standards.

- Analysis by Application: Infection Control

The application of hospital supplies for infection control is a foundational and pervasive theme across the entire market, rather than a siloed category. The demand here is driven by the universal need to minimize the transmission of pathogens within healthcare settings. This creates a direct and powerful demand for a specific basket of products. The most visible of these are disposable items and PPE, as discussed above. However, the demand for infection control extends much further. It drives the market for sterilization and disinfectant equipment, including autoclaves for sterilizing surgical instruments and chemical disinfectants for cleaning surfaces and medical equipment.

Furthermore, the need for infection control shapes the demand for product design and material science. For example, there is growing demand for medical devices and surfaces that are coated with antimicrobial agents to inhibit the growth of bacteria. The demand for advanced wound care dressings is also driven by infection control, as these products are designed to create a sterile barrier that protects wounds from infection and promotes healing. The significant financial burden of treating HAIs, which are often not reimbursed by payers, creates a powerful economic incentive for hospitals to invest in supplies that can reduce infection rates. This makes infection control a primary and enduring driver of demand across multiple product categories within the hospital supplies market.

Hospital Supplies Market Geographical Analysis

- US Market Analysis

The United States is the largest single market for hospital supplies globally. This dominance is driven by several factors: the country's high level of per capita healthcare spending, the prevalence of advanced and high-cost surgical procedures, and a large, aging population with a high incidence of chronic diseases. The demand is further shaped by the country's stringent regulatory environment, with the FDA's rigorous approval process creating a market that favors well-established companies with the resources to conduct extensive clinical trials and navigate the complex regulatory pathway.

- Brazil Market Analysis

In Brazil, demand for hospital supplies is driven by ongoing efforts to expand and modernize its public healthcare system (Sistema Único de Saúde - SUS), which serves the majority of the population. Government tenders for large volumes of essential supplies, particularly disposables, represent a significant portion of the market. The growth of the private healthcare sector, catering to the middle and upper classes, is also creating demand for more advanced medical devices and equipment.

- Germany Market Analysis

As the largest economy in Europe, Germany represents a major market for hospital supplies. Demand is characterized by a strong emphasis on quality, high-performance products, and adherence to rigorous safety standards. The country's universal healthcare system and large, aging population ensure a high and stable volume of medical procedures. The market is heavily influenced by the EU's Medical Device Regulation (MDR), which has increased the clinical evidence requirements for all products sold in the country, creating a demand for supplies with robust clinical data and post-market surveillance programs.

- Saudi Arabia Market Analysis

The hospital supplies market in Saudi Arabia is driven by significant government investment in healthcare infrastructure as part of its "Vision 2030" economic diversification plan. This involves the construction of new hospitals and medical cities, creating large-scale demand for a full range of medical equipment and supplies to outfit these new facilities. The demand is predominantly for high-quality, internationally recognized brands, making it an attractive market for major multinational corporations.

- China Market Analysis

China represents both the largest market in Asia and a dominant global manufacturing hub for hospital supplies. Domestic demand is immense, driven by its massive population, a rapidly aging society, and ongoing government-led healthcare reforms aimed at expanding insurance coverage and improving the quality of care. The "Healthy China 2030" initiative is fueling significant investment in hospital infrastructure. Simultaneously, China is a major global exporter of many high-volume disposable supplies, which has a significant impact on global pricing and availability.

Hospital Supplies Market Competitive Environment and Analysis

- Medtronic:

As one of the world's largest medical technology companies, Medtronic holds a commanding position, particularly in the operating room equipment and advanced surgical supplies segments. Their strategy is focused on innovation in high-value, technology-driven products that improve clinical outcomes and procedural efficiency. They leverage their extensive global sales force and deep relationships with surgeons and hospital administrators to drive demand for their portfolio of surgical staplers, energy-based devices, patient monitoring systems, and ventilators.

- Becton, Dickinson and Company (BD):

BD is a global leader in the high-volume disposable and hypodermic products segment. Their competitive strategy is built on their immense manufacturing scale, extensive distribution network, and a brand that is synonymous with safety and quality in products like syringes, needles, catheters, and blood collection devices. They capture demand by being a core supplier for the everyday essential products that are fundamental to nearly every aspect of patient care.

- Johnson & Johnson:

Through its MedTech segment, Johnson & Johnson is a major force in the market, with leading positions in areas such as orthopedics (DePuy Synthes), surgical instruments (Ethicon), and vision care. Their strategy combines a focus on category leadership with continuous innovation. They drive demand for their products through extensive clinical research, professional education for surgeons, and the development of comprehensive procedural solutions that bundle implants, instruments, and disposable supplies.

Hospital Supplies Market Developments

- July 2025: TEAM Medical Acquires Duke Empirical to Enhance Minimally Invasive Device Capabilities TEAM Medical, a contract manufacturer specializing in medical device components for hospital use (including catheters and delivery systems), acquired Duke Empirical, a designer of advanced catheters for cardiology and interventional procedures.

- April 2024: 3M announced the successful completion of the spin-off of its Health Care business, which officially launched as the independent company, Solventum. This major strategic restructuring allows Solventum to focus exclusively on capturing demand in its core markets, including wound care, oral care, and healthcare IT, as detailed in the company's public statements.

- November 2023: Stryker announced it had entered into a definitive agreement to acquire SERF SAS, a France-based joint replacement company. This strategic acquisition is intended to strengthen Stryker's global orthopedic portfolio and capture greater demand in the European hip implant market.

- October 2023: Baxter International Inc. announced the U.S. launch of its Hillrom Progressa+ next-generation ICU bed. The company's press release highlighted new features designed to support patient mobility and reduce the risk of pressure injuries, aiming to meet hospital demand for technology that can improve patient outcomes and reduce lengths of stay.

Hospital Supplies Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 37.752 billion |

| Total Market Size in 2031 | USD 53.626 billion |

| Growth Rate | 7.27% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Product Type, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Hospital Supplies Market Segmentation

- By Product Type:

- Patient Examination Devices

- Operating Room Equipment

- Mobility Aids & Transportation Equipment

- Sterilization & Disinfectant Equipment

- Disposable Hospital Supplies

- Hypodermic and Radiology Products

- Others

- By Application:

- Respiratory

- Infection Control

- Wound Care

- Radiology

- Orthopaedics

- Cardiology

- Others

- By Geography:

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Spain

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- Australia

- Others

- North America