Report Overview

Health Insurance Market - Highlights

Health Insurance Market Size:

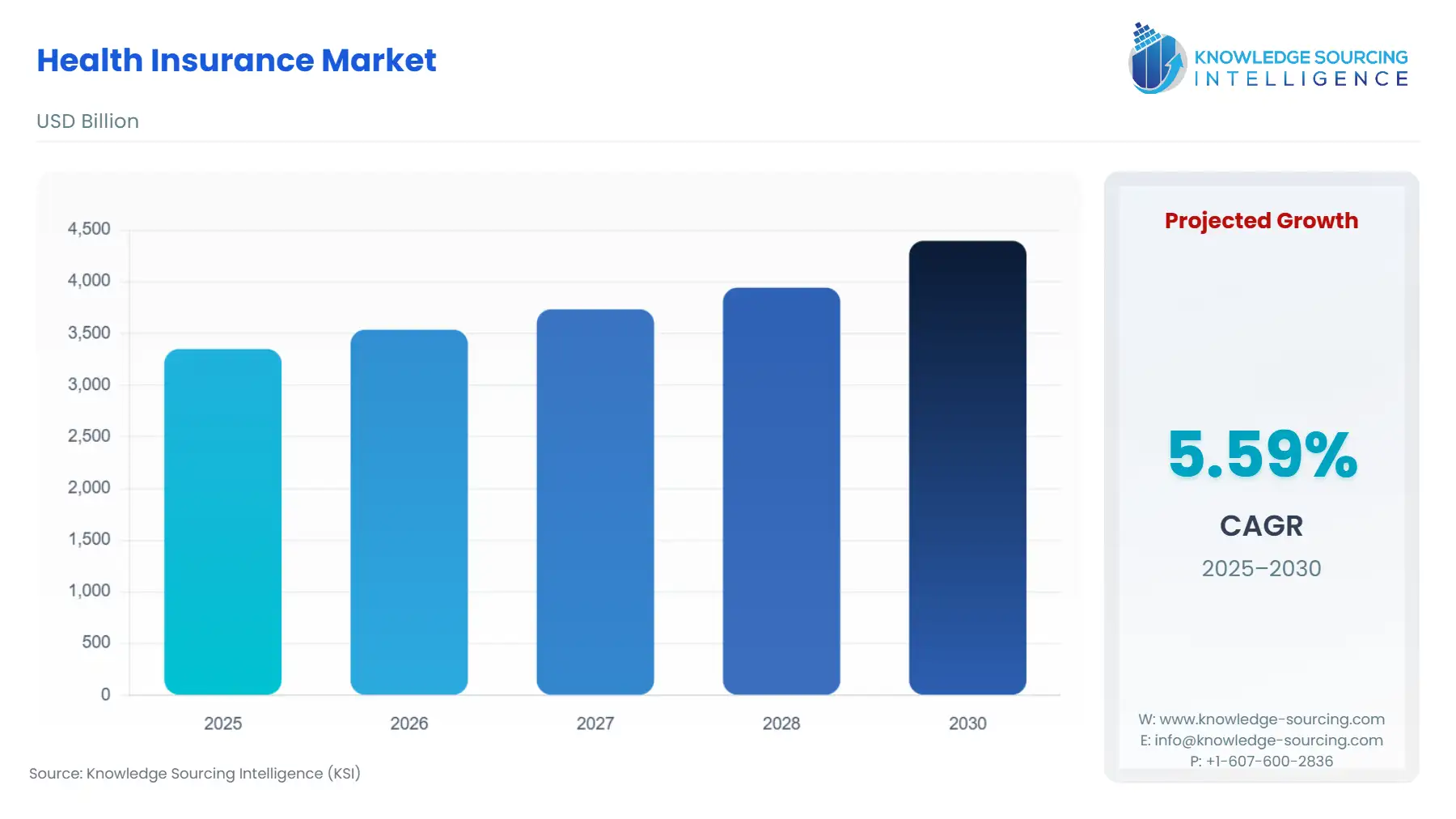

The Global health insurance market is predicted to expand at a CAGR of 5.59% to account for US$4,396.863 billion by 2030 from US$3,349.230 billion in 2025.

The global health insurance market is driven by multiple factors, such as regulatory developments that help ensure quality and compliance in the sector. Further, the COVID-19 pandemic has emphasized the critical role of health insurance in strengthening the healthcare ecosystem. The market is also aided by increased government health expenditure, providing maximum benefits to end users. Government schemes such as Ayushman Bharat (Pradhan Mantri Jan Arogya Yojana) (AB PMJAY) in India aim at providing a health cover of 5 lakh per family per year for secondary and tertiary care hospitalization.

In this regard, the number of beneficiaries for the Ayushman Card has been increasing on a year-on-year basis. The trend indicates that there were 15,116,631 cards created in March 2023, and it peaked at 22,045,246 in March 2024. These figures indicate the expanding healthcare benefits to the overall population in India.

A major factor for the increase in the global health insurance market is the increase in chronic disease ailments amongst different age demographics. The health insurance offers medical and surgical expenses for a person who has taken this policy. As the economy is expanding in the regions of Asia Pacific, the Middle East and Africa, people are becoming more aware of the medical insurance benefits and taking relevant schemes.

Health Insurance Market Drivers:

- Growing risk of chronic disease ailments

The global health burden has increased as the number of people suffering from different chronic diseases, such as cardiovascular disease, diabetes, asthma, etc., has increased. The primary causes for the increased cases of such diseases have been poor lifestyles, consumption of unhealthy food, and living in a polluted environment.

According to the IDF (International Diabetes Federation), the estimated number of people (20-79 y) suffering from diabetes in Europe will be 67,000.0 (in thousands) by 2030 and 69,000.0 by 2045. This figure indicates the severity of the increasing chronic disease ailments in the region.

- The increasing growth in the private sector is also acting as a growth driver

The market of private sector health insurance will experience a rise due to various factors. Primarily, the global cost of medical treatment and hospital accommodation is increasing, which contributes to the rising requirement for monetary protection for healthcare-related emergencies through insurance. Health insurance is also important for managing unforeseen spending on health, particularly for individuals suffering from a chronic disease and requiring constant care and medications.

Private insurance companies are contributing to the market expansion by promoting campaigns to increase awareness among people and launching new products utilizing technologies like AI. This is for easy usage and the convenience of consumers about coverage benefits and plan-related queries, as well as easy and fast access. For instance, in July 2024, ICICI Lombard, India's known private general insurer, introduced its progressive health insurance product, 'Elevate', fueled by AI. This first-of-its-kind item provides personalized systems for energetic lifestyles, unexpected health emergencies, and medical expansion, offering a comprehensive arrangement for the insurance industry.

Moreover, the private sector health insurance providers quick response and a more varied range of services that elevate the consumer base and also offer customized plans and policies for health treatments. Following this, the Australian Prudential Regulation Authority (APRA) report of quarterly private insurance statistics released in August 2024 reported that the average hospital benefits per individual grew from $1,397.44 in June 2023 to accounted at $1,471.85 in June 2024, with the biggest sum spent on medical services, hospital accommodation, and benefits related to prostheses. Moreover, there is also a rise in policies related to membership of hospital treatment from 5.86 million in June 2023 to 5.995 million in June 2024, which also contributed to the market growth.

Health Insurance Market Geographical Outlook:

- The United States in North America is expected to hold a significant share of the Global health insurance market.

In the United States, the rising penetration of chronic diseases among the population is a major factor expected to play a significant role in boosting the demand for Health Insurance in the coming years. For instance, according to the U.S. Centers for Disease and Control, Alzheimer's disease, which is known to be a major chronic neurodegenerative disease, accounts for around US$360 billion in terms of care-related costs. This is expected to rise to US$1000 by 2050 in the United States. Further, more than 98 million adults have prediabetes, which puts the majority at risk of type 2 diabetes. This highlights lucrative prospects for market growth with increasing medical care expenses.

Further, the rising elderly population of the country will provide additional impetus for market growth. For instance, as per the estimates of the Population Reference Bureau, the number of Americans aged 65 years or older is projected to increase from 58 million in 2022 to nearly 82 million by 2050. This will reduce the cost burden for multiple chronic conditions among the elderly and thereby promote insurance products to handle healthcare expenses.

Additionally, the growing awareness pertaining to health insurance benefits will boost the growth of different types of health insurance solutions till the forecast period. For instance, as per the American Journal of Managed Care (AJMC), private health insurance spending is anticipated to rise by 11.1% by 2023, compared to 5.9% in 2022. Moreover, the out-of-pocket expenditure also witnessed an upward trend with an increase of around 7.9% in 2023 from 6.6% in 2022. These factors reflect a favorable opportunity, boosting demand for health insurance in the country in the coming years.

Health Insurance Market Company Profiles:

- Zurich American Insurance Company offers hospital indemnity for critical illness, accidental death & dismemberment, accident medical expense, accident disability, and accident in-hospital, etc.

- United Healthcare Medicare insurance coverage included Dental benefits, over-the-counter (OTC) credit, hearing benefits, and vision benefits. United HealthCare Services Inc., founded in 1974, is a subsidiary of UnitedHealth Group, a leading American health insurance company. They provide various plans for individuals, families, and employers, making it one of the largest in the US. The company partners with over 1.3 million healthcare professionals and physicians and 6,700 hospitals and care centers across the nation to improve access to quality care when and where it's required. The company is endeavouring to set up an associated, aligned, and cost-effective framework that gives high-quality care, custom-fitted to a person's needs and the communities in which they work.

- Cigna International health insurance gives benefits according to the flexibility and package to suit the needs.

Health Insurance Market Key Developments:

- October 2025: Major insurers scaling back Medicare Advantage & Part D offerings: Companies such as CVS Health, Humana, and UnitedHealth Group announced they will reduce their MA and Part D plan offerings in certain regions for 2026, citing financial pressures, rising utilization, and lower profitability.

- June 2025: CMS finalizes the “Marketplace Integrity and Affordability” rule: The Centers for Medicare & Medicaid Services issued a final rule to tighten consumer protections in ACA Marketplaces — strengthening income verification, modifying redetermination processes, requiring pre-enrollment checks for special enrollment periods, and changing reenrollment and premium-payment rules (e.g., $5 monthly premium for automatic reenrollees who don’t reconfirm eligibility).

- April 2025: Medicare Advantage payments revised upward: Final 2026 Medicare Advantage rates came in better than expected — CMS’s final rate is expected to increase more than 5%, driving a rally in major insurer stocks.

- January 2025: Proposed 2026 Medicare Advantage payment boost: The U.S. government proposed a 2.2% increase in Medicare Advantage reimbursement rates, plus a 2.1% risk score adjustment — totalling an estimated 4.3% uplift, amounting to ~$21 billion.

Health Insurance Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Health Insurance Market Size in 2025 | US$3,349.230 billion |

| Health Insurance Market Size in 2030 | US$4,396.863 billion |

| Growth Rate | CAGR of 5.59% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Health Insurance Market |

|

| Customization Scope | Free report customization with purchase |

Health Insurance Market Segmentation:

- By Type

- Health Maintenance Organization (HMO) plans

- Preferred Provider Organization (PPO) plans

- Exclusive Provider Organization (EPO) plans

- Others

- By Service Provider

- Public Sector

- Private Sector

- Stand-alone Providers

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- North America