Report Overview

Graphene Composites Market Size, Highlights

Graphene Composites Market Size:

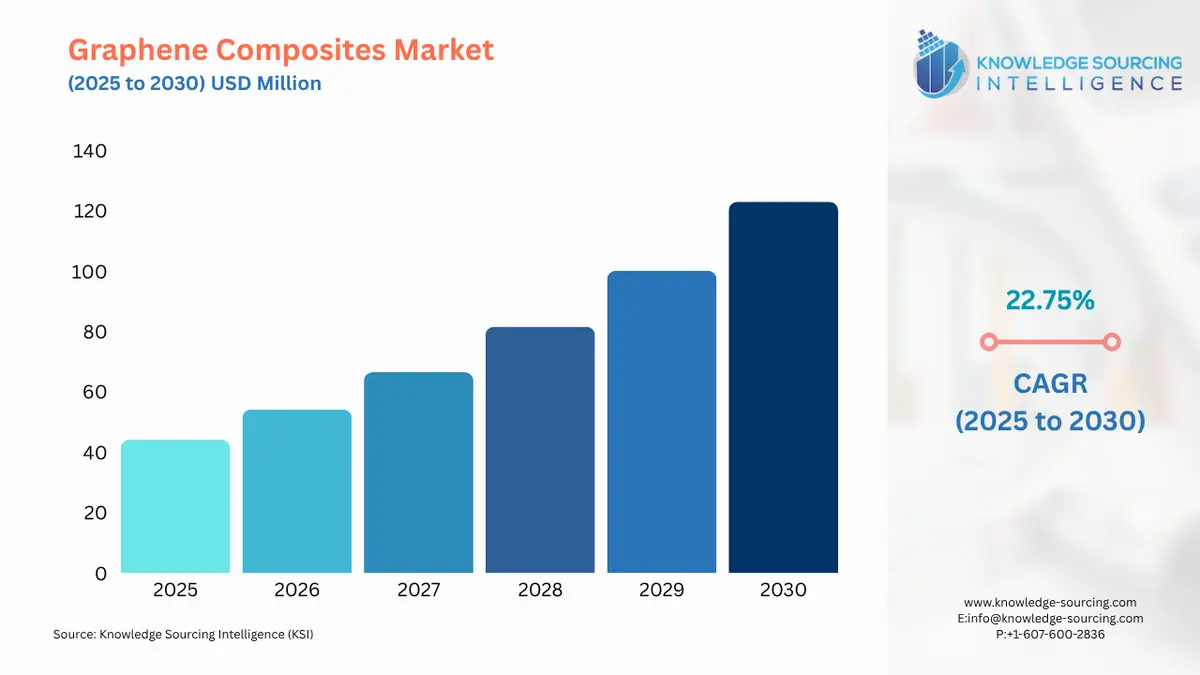

The global graphene composites market is expected to grow at a CAGR of 22.75%, reaching a market size of US$123.010 million in 2030 from US$44.137 million in 2025.

Graphene Composites Market Trends:

Graphene composites offer exceptional fire, impact, temperature stability, mechanical, electrical, optical, and dimensional properties. Furthermore, graphene can be combined with metals, polymers, and other substances to form composites that are conductive, temperature-resistant, and other properties. For example, adding graphene to rubber improves its strength, impermeability, and conduction.

The demand for graphene composites could rise sharply in the upcoming years. This is because graphene composites are increasingly being used in aircraft, automobiles, and energy storage components. With the increasing number of clients in developing nations as the aerospace industry has been growing, the demand for graphene composite materials is also projected to increase during the assessment period.

Graphene Composites Market Growth Drivers:

- Increased demand in electronics and energy storage is contributing to the global graphene composites market growth

The advancement of batteries, supercapacitors, and electronic devices of course of which graphene is a fundamental component is gaining more and more importance because of the extraordinary electrical conductivity, high flexibility, and light weight of the material known as graphene. Materials that can provide superior efficiency and reliability are required as consumer electronics move toward miniaturization and improved performance.

Additionally, the demand for high-capacity energy storage systems is being driven by the growing popularity of electric vehicles (EVs) and renewable energy sources, where graphene composites can offer significant advantages over conventional materials. For instance, Mito Material Solutions revealed two significant graphene-based EV energy storage projects in 2024. One project involves working with Avery Dennison to create a multipurpose adhesive that will increase the safety and longevity of EV batteries. The other seeks to address obstacles in EV adoption by improving battery cell capacity and charging performance through the ChargeUp program. As a result, the market for graphene composites is growing due to developments in energy storage technologies and increased demand from sectors like consumer electronics and electric vehicles.

- Increased research and development is anticipated for the growth of the global nanometals market.

There is an extensive increase of activities on graphene research and its associated practices in China, America, and other countries. The surge in R&D has been linked to many factors such as the provision of government support and other policies. Many producing countries are stepping up the research and innovation to improve the technology to make and use graphene and its by-products.

Additionally, graphene composites suppliers from developing states are also technologically backward. Moreover, China has invested heavily in composite materials and graphene. China hopes to increase the importance of cutting-edge materials in manufacturing sectors.

- Advancements in material science will increase the market demand.

Manufacturing process innovations like liquid-phase exfoliation and chemical vapour deposition are increasing the scalability and affordability of creating high-quality graphene. As these techniques advance, they enable producers to incorporate graphene into a greater range of composite materials, improving their characteristics and enabling a variety of uses in sectors such as healthcare, construction, and aerospace.

Additionally, new applications and performance advantages are being unlocked by continuous research into graphene's synergistic effects when combined with other materials. In addition to lowering costs, these technological advancements increase the market potential for graphene composites, opening them up to a wider range of industries searching for cutting-edge material solutions.

- The increasing use of polymer-based graphene composites is anticipated to increase the market demand.

When graphene is added to polymers, a material with improved mechanical, thermal, and electrical qualities is created that can be used in a variety of products, such as wind turbines, plastic containers, sports equipment, medical implants, and gas tanks. The automotive and aerospace industries are the main users of polymer-based graphene composites because of their lightweight nature and ease of processing. Sixth Element (Changzhou) Materials Technology consistently makes R&D investments to create innovative formulations that enhance the mechanical, thermal, and electrical characteristics of different plastic polymer composites.

Graphene Composites Market Restraints:

- The high cost of graphene composites is anticipated to hamper the market growth

While the multi-functionality of graphene composites makes them desirable in various applications spanning different industries, their escalating cost is hampering the global growth of the existing market for graphene composites. Graphene composites depend on the price, production and quality of the available graphene. It is, however, important to note that graphene is not a one-size-fits-all, as different applications require various grades of this compound, at net discriminating costs.

Graphene Composites Market Geographical Outlook:

- North America is witnessing exponential growth during the forecast period.

Graphene composites' well-established customer bases in the automotive and aerospace industries are driving market expansion in North America. The market for graphene composites is also driven by significant energy, sensor, coating, and biomedical applications.

Moreover, the United States and Canada are the primary drivers of the regional market's expansion. The market value is expected to increase the number of universities and research institutes as well as the number of product manufacturers working together to create next-generation graphene for the electronic aerospace and military industries. The market leaders for all kinds of graphene products have their headquarters in the United States.

Global Graphene Composites Market Key Launches

- In November 2024, A novel line of polymer-graphene composites was introduced by Nordic deep-tech startup Graphmatech. Applications for hydrogen storage and transportation could be completely transformed by AROS Polyamide-Graphene. Additionally, the Swedish Energy Agency awarded the company a 10 million SEK grant to support this innovation, which is expected to drastically cut down on dangerous hydrogen leakage into the atmosphere.

- In June 2024, Black Swan Graphene Inc., a global leader in the manufacturing and marketing of patented high-performance and affordable graphene products, and Graphene Composites (GC), a prominent advanced materials engineering company, announced a successful collaboration for the supply of Black Swan's graphene for use in GC Shield®, a patented ballistic protection technology.

Graphene Composites Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Graphene Composites Market Size in 2025 | US$44.137 million |

| Graphene Composites Market Size in 2030 | US$123.010 million |

| Growth Rate | CAGR of 22.75% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Graphene Composites Market | |

| Customization Scope | Free report customization with purchase |

The global graphene composites market is segmented and analyzed as follows:

- By Product Type

- Polymer-based Graphene Composites

- Metal-based Graphene Composites

- Ceramic-based Graphene Composites

- Others

- By End-User

- Aerospace

- Buildings and Construction

- Electronics

- Energy Storage and Generation

- Automotive

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Others

- North America