Report Overview

Global Fruit Jellies Market Highlights

Fruit Jellies Market Size:

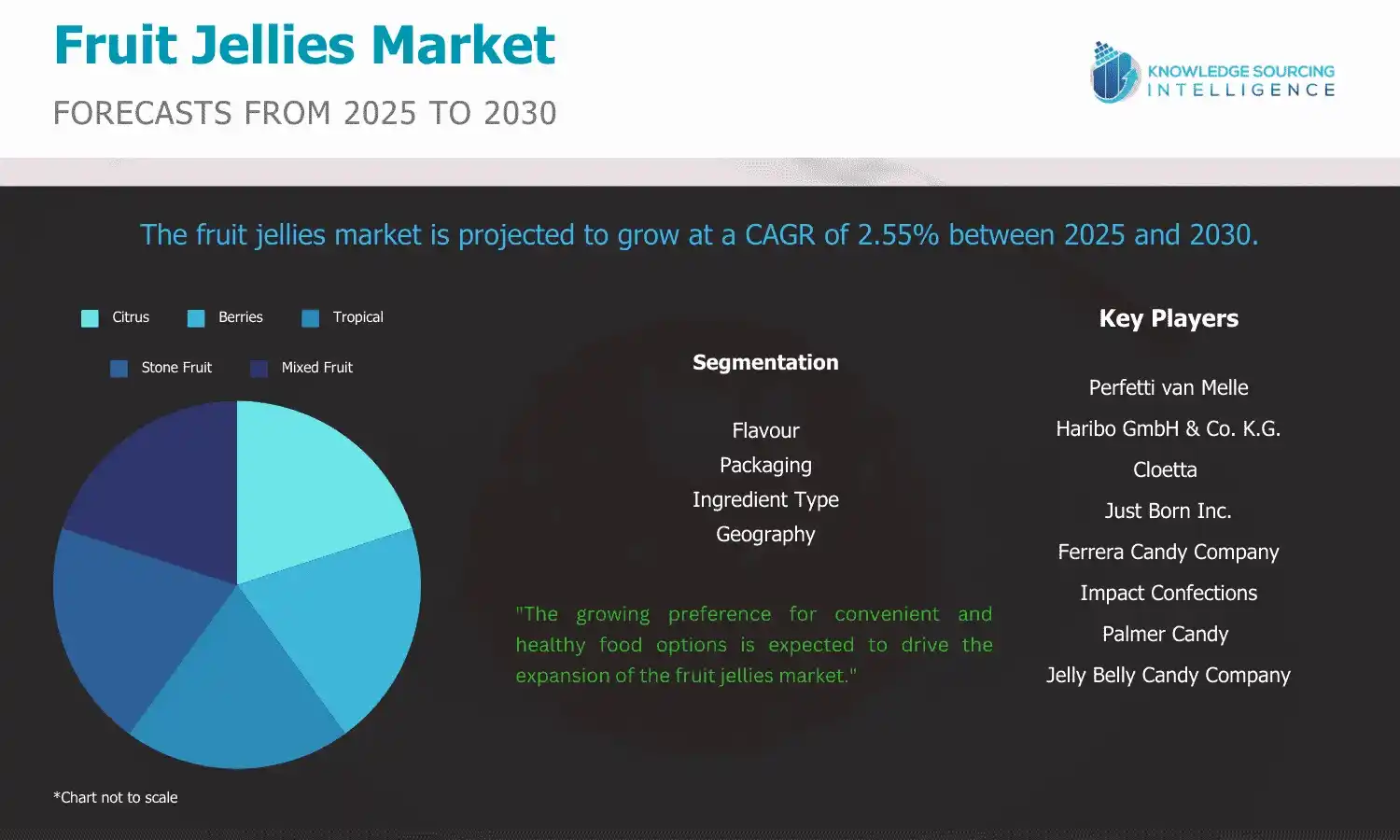

The fruit jellies market is projected to grow at a CAGR of 2.55% over the forecast period, increasing from US$1,080.808 million in 2025 to US$1,225.679 million by 2030.

Fruit jellies are typical popular candies that resemble fruits in shape and flavor. They are created by mixing gelatin, sugar, and fruit flavorings. They come in various shapes, sizes, and colors, with or sometimes without sugar or other coatings. Globally, it has a wide range of products appealing to consumers, including popular brands such as Haribo Goldbears is a gummy bear and is available in many colors and flavors. Some of its components include the juices of fruits from apples, strawberries, raspberries, oranges, lemons, pineapple, citric acid, fruit and plant concentrates, elderberry extract, and a coating of beeswax and carnauba wax. Besides that, fruit jellies are popular snack food for all age groups, relishable as sweets, combined with meals, cereal, etc., and as an ingredient for dessert items, including cakes and pies.

The increasing demand for convenient and portable snacks due to busy lifestyles and an increase in snacking habits is the primary driving force of the fruit jellies market. Urbanization further enlarges the market for fruit jellies with frequent snacking, portability, and distribution across various retail outlets. According to

Our World in Data, there has been a continuous increase in urban population, with a count comprising 4.454 billion people living in urban areas worldwide in 2021 and raising the figure to 4.523 billion in 2022, which is greater than half of the entire population of the planet.

With quick-paced living in cities, they have minimized time for properly prepared meals, resulting in the adoption of fruit jellies. These are very portable and good for on-the-go consumption and they can be easily carried as required in urban settings. Moreover, their availability is also easy due to the multitude of retail outlets in cities. Urbanization is very likely to increase consumer diversity which would instantly lead to even more fruity jellies varieties and brands leading to the promotion of the market in the coming years.

Fruit Jellies Market Growth Drivers:

- The rising demand for convenience and healthy foods is predicted to promote the fruit jellies market expansion.

The market for fruit jellies worldwide is generating quite an upsurge owing to changing preferences among consumers. Convenience forms a part of the modern age and is leading to demand for fruit jellies convenient for travel. They come in small sizes, are transportable, and fit perfectly into snacking products for the go-lifestyle. Along with convenience, healthy foods also raise demand as people look for healthier meals and drinks that can be included in busy schedules. Fruit jellies offer easy access to quick bites between meetings or while on a road trip or just as a treat for the consumer.

Fruit jellies are versatile snacks, that can be applied in many culinary uses such as toppings over baked goods such as cakes, cupcakes, and ice cream and add a sweet and tangy flavor to plain yogurt or even a cereal bowl and can also be added to create infused water to enjoy as refreshing beverages.

In addition, chefs who create savory-infused recipes can use them in glazing meat or sauces for salads. This utilization act demonstrates the wide demand for fruit jellies which can serve many functions in different culinary settings, thus making them appealing.

There is a symbiotic relationship formed between baked goods and fruit jellies. The baked goods bring up a platform for enhanced consumption of fruit jellies while the fruit jellies enhance the taste, texture, and even visual appeal of the baked products. The baked goods exports, as stated by OEC between 2021 and 2022, observed an increase of 11.4% to $48.4 billion from $43.5 billion in 2021. Top baked goods-exporting countries include Germany, Canada, Italy, France, and Poland valued at $4.92B, $4.75B, $3.5B, $2.93B, and $2.67B, respectively.

The type of baked goods highly influences the market for fruit jelly because they are an important category in content and complement products. Fruit jellies improve flavor, texture, and moisture in baked products like cakes, cupcakes, muffins, and breads. Baked items also use these fruit jellies in different ways, such as fillings, toppings, or glazes, thus creating an increased consumption.

In addition, bakers and pastry chefs experiment with new flavor combinations, boosting demand for fruit jellies. These jellies also add aesthetics to baked goods and attract consumers. The baking applications of fruit jellies include fruit tarts, jelly rolls, muffins, and quick breads. Decorative features are also used to create elaborate designs in icing cakes and cupcakes.

- The increase in disposable income is anticipated to boost the fruit jellies market expansion.

The rise in disposable income has made convenience one of the major priorities of consumers. The growing disposable incomes in developing economies drive increased consumption of processed foods and snacks, particularly fruit jellies. These ready-to-consume treats, unlike fresh fruits that require preparation, save consumers valuable time by eliminating the need for cutting, peeling, or washing, making them a popular choice for snacking.

The International Energy Outlook reported in 2023 source-wide overall disposable income data that accounted for US$ 10,136 per capita for 2022. The number will increase to US$10,677 by 2025 to further attain US$11,862 by 2030. Meanwhile, Asia Pacific will account for US$11,152 per capita, while the Americas region will be expected to be valued at US$23,240 per capita in 2030, whereas Europe and Eurasia will account for US$21,974 per capita by 2030, thus fuelling market growth.

Besides, consumers with a higher income are mostly inclined towards preferring premium and healthy fruit jelly made up of ingredients of the highest quality, exotic flavors, and great packaging. This will lead manufacturers to produce artisanal or gourmet fruit jellies made from organic or fair-trade ingredients. Further, manufacturers now switch fruit jellies into healthier versions by lowering sugar levels and manipulating the taste with natural sweeteners to have that sweetness and flavor in comparison.

Citrus fruit jellies are seeing significant growth primarily because of a synergism of factors. For instance, consumer preferences for the healthy and convenient are constantly evolving. Citrus fruit jellies happen to be an excellent product containing Vitamin C and antioxidants; such a product would fit this changing pattern very well. This implies a healthier alternative than simple sugar-laden products typically associated with snacks and diets. Additionally, the nostalgic appeal and comfort food factor associated with these jellies contribute to their popularity, particularly among older generations.

Following this, Turkey's mandarin/tangerine production for 2023/24 is estimated to increase by 55 percent to a record 2.9 million tons, due to higher area and favorable weather during the bloom. With the increase in production, exports are estimated up 17 percent to 1.0 million tons.

Global orange production for 2023/24 is expected to increase by 1 percent to 47.4 million tons as lower Production in Brazil and the European Union is outweighed by larger crops in Egypt, the United States, and Turkey. Consumption and fruit for processing are both up with production while exports are flat.

The second factor is product innovation, which drives market growth. Manufacturers are constantly experimenting with new and exciting flavors, such as blood orange, yuzu, and lemon-lime, to cater to evolving consumer tastes. For instance, in October 2022, TCP or the consumer products company bringing the Tata Group's leading food and beverage interests under a single banner has extended its portfolio in ready-to-drink through Tata Fruski Juice N Jelly, which, inspired by the flavors of local India, stands as one-of-a-kind juice-based drink infused with an element of surprise- in Jelly form. The new offering aligns with TCP's thrust to innovate and expand its subsidiary, NourishCo's existing portfolio that comprises Himalayan Natural Mineral Water, Tata Gluco Plus, Tata Copper+ Water, Tata Fruski, and the recently launched premium Himalayan Honey and Preserves range.

Fruit Jellies Market Geographical Outlook:

Based on geography, the fruit jellies market is segmented into the Americas, Europe Middle East and Africa, and the Asia Pacific. The fruit jellies market in India is experiencing significant growth, driven by several key factors that reflect changing consumer preferences and lifestyle trends. One of the primary growth drivers is the rising demand for convenience foods, which is closely linked to the fast-paced lifestyle of urban consumers. As more individuals lead busy lives, the need for ready-to-eat and easy-to-prepare products has surged, making fruit jellies an attractive option for quick snacks or additions to meals.

Furthermore, there is a growing health consciousness among consumers, leading to an increased preference for products that are perceived as healthier. This trend has spurred interest in organic and low-sugar fruit jellies, which cater to health-oriented consumers looking for guilt-free indulgences.

Another significant factor contributing to the growth of the fruit jellies market is the rise in disposable income among Indian consumers. As economic conditions improve, more people are willing to spend on premium and artisanal products, including gourmet fruit jellies that offer unique flavors and high-quality ingredients. The growing popularity of online shopping has also played a crucial role in expanding market reach. E-commerce platforms provide consumers with easy access to a wider variety of fruit jelly products, enhancing visibility and availability. In this regard, according to IBEF, the Indian e-commerce platform achieved a significant milestone, hitting a GMV of US$ 60 billion in fiscal year 2023, marking a 22% increase from the previous year.? This growth in e-commerce is expected to drive the market growth.

Fruit Jellies Market Recent Developments:

- In May 2024, Clever Mama which is a renowned pudding maker in China, launched a new sub-brand known as "Serious Jelly" focusing on healthy jelly and advanced products like Vegetable and Fruit Jelly as an extension of its good dessert heritage. This natural and authentic vegetable and fruit jelly meets up with consumer demand for healthy foods.

Fruit Jellies Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Fruit Jellies Market Size in 2025 | US$1,080.808 million |

| Fruit Jellies Market Size in 2030 | US$1,225.679 million |

| Growth Rate | CAGR of 2.55% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Fruit Jellies Market |

|

| Customization Scope | Free report customization with purchase |

Fruit Jellies Market Segmentation:

- By Flavour

- Citrus

- Berries

- Tropical

- Stone Fruit

- Mixed Fruit

- By Packaging

- Jar

- Pouches

- Cups

- By Ingredient Type

- High Methoxyl Pectin (HMP)

- Low Methoxyl Pectin (LMP)

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Thailand

- Taiwan

- Others

- North America