Report Overview

Global Fortified Foods Market Highlights

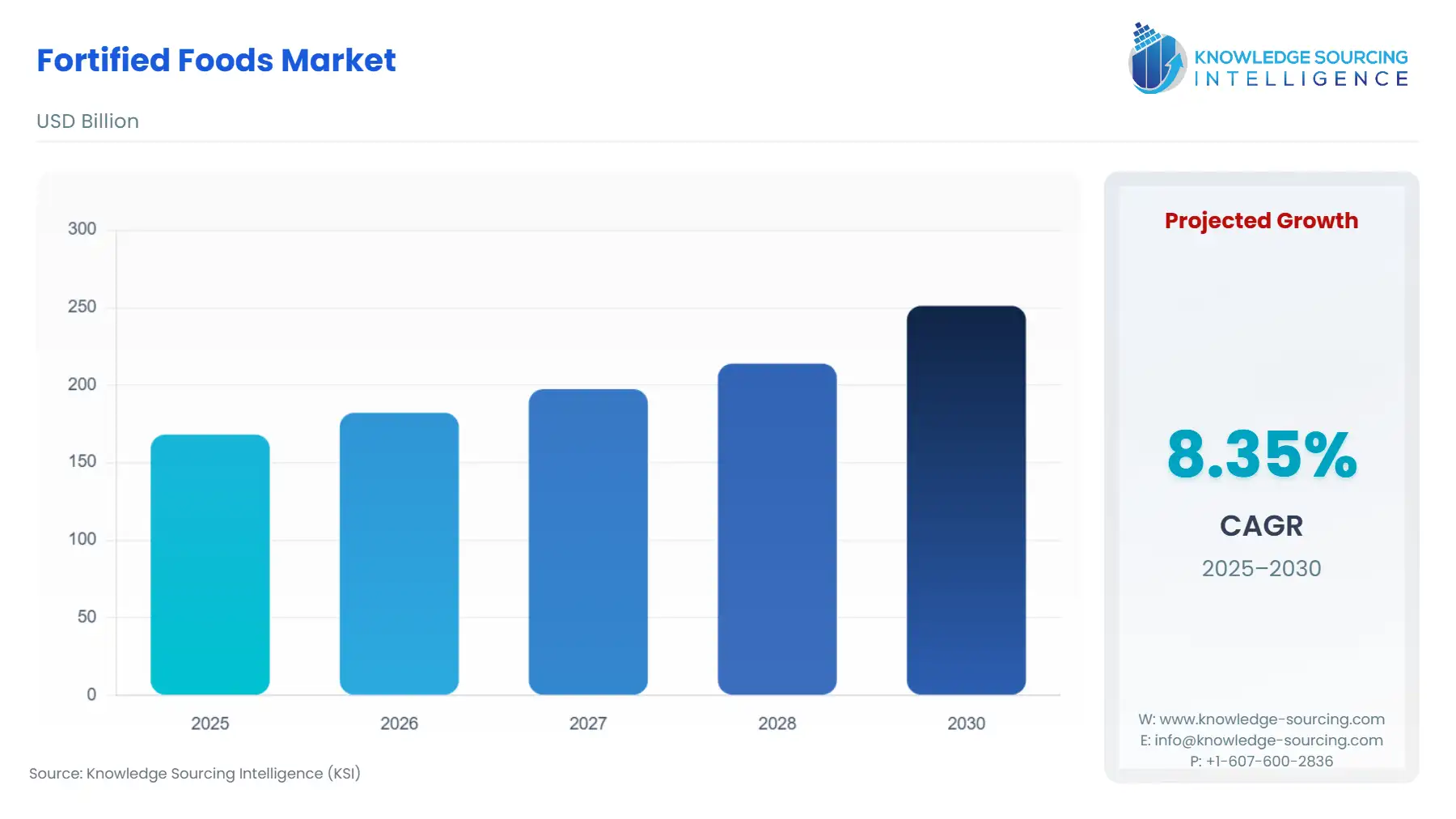

Fortified Foods Market Size:

The global fortified foods market is expected to grow at a CAGR of 8.36%, reaching a market size of US$251.144 billion in 2030 from US$168.148 billion in 2025.

Food fortification refers to foods that have extra nutrients and vitamins added. These foods aim to boost the body's nutritional capability and provide multiple additional health benefits. Food fortification is an effective solution that helps boost the nutritional status of the population. It is also widely adopted by governments worldwide.

The global prevalence of malnutrition among children, especially in underdeveloped and developing nations, is estimated to boost the market growth of fortified foods. Fortified foods, which offer additional nutrients and vitamins to the body, are generally recommended by governments and multiple health organizations to boost the health of malnutrition-affected children.

Similarly, fortified food offers multiple benefits for the global aging population, specifically those over 65. The increasing global population of people over 65 is estimated to further propel the global fortified foods market forward.

Fortified Foods Market Growth Drivers:

- Increasing prevalence of malnutrition among the global children population.

One of the major driving factors, which is estimated to boost the market demand for the global fortified food market, is the prevalence of malnutrition among the children's population. Malnutrition is a condition in which the body observes deficiencies or imbalances of nutrition and vitamins in the person's body. It can be treated using multiple therapeutic medications and increase the consumption of vitamin and nutritional-rich food products.

The Global Hunger Index, in its 2023 report, stated that the global population of undernourished people increased to 735 million in 2023. Furthermore, the World Health Organization, in its Joint Child Malnutrition Estimates (JME) of 2023, stated that globally, in 2022, an estimated 148.1 million children under the age of 5 were stunted. Meanwhile, about 45 million of these children were wasted, and about 37 million were overweight.

The ReliefWeb, a part of the United Nations Office for the Coordination of Humanitarian Affairs (UN OCHA), stated in its December 2023 report that in Africa, about 282 million people, about 20% of the total population of the region, are suffering from undernourishment. This population increased by almost 57 million since the occurrence of COVID-19. The agency further stated that about 30% of children below the age of 5 years suffer from stunting in 2022

- Benefits of fortified food for the older population.

Fortified foods offer multiple benefits to the aging population worldwide. They provide the body with the required nutrients, which it can not attain through regular meal consumption. The growing population above the age of 65 is estimated to push the market further forward.

As the human body ages, its ability to absorb nutrients depletes, increasing the chances or risk of malnutrition in the older population. Fortified foods offer the body essential nutrition, which can further help counteract malnutrition and help the body gain weight.

The globe has witnessed a constant growth in its total population above the age of 65. The World Bank, in its data, stated that the total population over 65 years was recorded at about 758 million in 2021, which grew significantly to about 779 million in 2022. The organization further stated that in 2023, this population was recorded at about 805 million. The organization also states that in 2023, the total population above 65 years in Canada was about 7.837 million, and in the USA and Germany, were recorded at 58.904 and 19.217 million, respectively, in 2023.

Fortified Foods Market Geographical Outlook:

- Asia Pacific is anticipated to hold a significant share of the Global Fortified Foods Market.

The Asia Pacific region is estimated to attain a greater global fortified food market share. As it is among the fastest developing regions, it offers a vast opportunity for the industry's companies to attract maximum market share. Similarly, the growing older population and prevalence of malnutrition are also estimated to boost the region’s fortified foods market.

Various developing countries in the region, like India, Bangladesh, Indonesia, and Thailand, among others, still have a higher incidence of malnutrition among their younger populations. The Ministry of Women and Child Development of the Indian Government, in its press release in December 2023, stated that although the nation witnessed a steady improvement in the indicators for malnutrition, it still has multiple cases of malnutrition. The National Health Family Survey conducted by the ministry on about 7.44 crore (74.4 million) children under the age of 6 years found that about 37.5% were stunted, and about 17.23% were underweight.

Fortified Foods Market Products Offered by Key Companies:

- BASF Group is a multinational corporation that offers products and services to multiple industries, including agriculture, automotive, coating, construction, and nutrition. In the food fortification market, the company offers its expertise, applications, and partnerships. The company offers oil fortification, sugar fortification, milk fortification, flour fortification, rice fortification, and seasoning and condiments.

- NESTLÉ is a multinational company that offers a wide range of products, especially in the food and beverage industry. The company's product catalog includes products in the dairy, foods, nutrition, and beverages categories. The company also offers fortified popular food products that contain additional micronutrients. In the food fortification market, the company offers Lactogrow, Nangrow, Caregrow, and Gerber, among others.

Fortified Foods Market Key Developments:

- In February 2024, PLANTSTRONG, a manufacturer of plant-based products, announced that it aims to launch its new plant-based dairy in the global market. The dairy is fortified with multiple essential nutrients, including B12, D3, and calcium.

Fortified Foods Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Fortified Foods Market Size in 2025 | US$168.148 billion |

| Fortified Foods Market Size in 2030 | US$251.144 billion |

| Growth Rate | CAGR of 8.36% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Fortified Foods Market |

|

| Customization Scope | Free report customization with purchase |

Fortified Foods Market Segmentation:

- By Method

- Bio-fortification

- Microbial- Enhanced

- Home Fortification

- By Micronutrient

- Iron

- Vitamin

- Iodine

- Calcium

- Zinc

- Others

- By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Retailers

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- Indonesia

- Taiwan

- Thailand

- Others