Report Overview

Global EV Battery Cooling Highlights

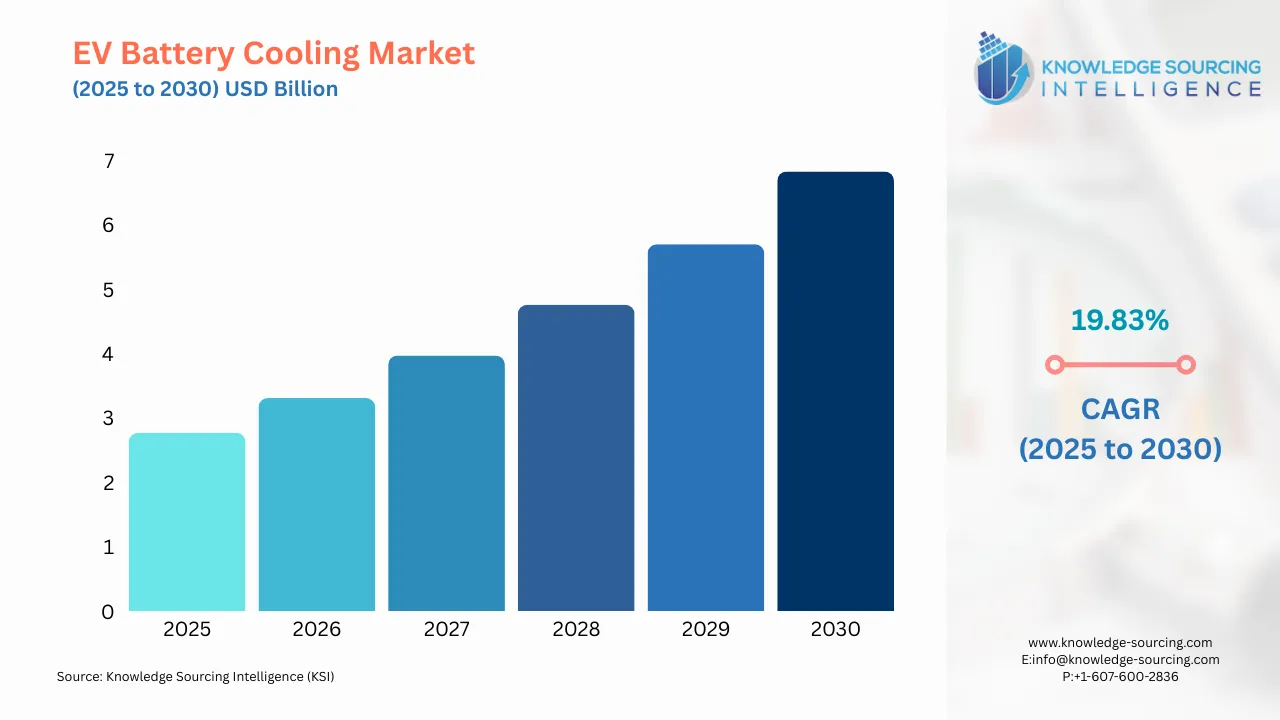

EV Battery Cooling Market Size:

The global EV battery cooling market will grow from US$2.766 billion in 2025 to US$6.834 billion in 2030 at a CAGR of 19.83%.

A battery cooling system is a procedure through which the temperature of an electric vehicle (EV) is maintained during operations or while charging. An efficient battery charging solution helps in improving the lifespan of the EV battery, simultaneously increasing its performance and ensuring a faster charge time. EV battery cooling is an important aspect of electric vehicle design and operation, as it is necessary to maintain a suitable temperature range for the battery cells to ensure optimal performance, longevity, and safety. Three main types of EV battery cooling systems are available across the industry: air, liquid, and fan. Different types of EV battery cooling systems are used across different types of vehicles, such as battery electric vehicles, hybrid electric vehicles, and plug-in hybrid electric vehicles.

EV Battery Cooling Market Trends:

The global EV battery cooling systems market is growing with the increasing demand for electric vehicles. With the increasing demand, the production volume of these vehicles is set to rise, leading to the global battery cooling market’s expansion. Furthermore, with the boost in the global EV battery technology research & development and the introduction of a new battery thermal management system, the market will also observe growth. An efficient battery cooling system ensures increased battery performance, increasing the vehicle's driving range and maintaining the optimum battery health.

EV Battery Cooling Market Growth Drivers:

- The increasing electric vehicle production and demand.

One of the major driving factors estimated to propel the global EV battery cooling market is the increasing global production of electric vehicles. With the demand for EVs across the world, the industry has observed an increasing production of electric vehicles in the past few years. The global market for electric vehicles witnessed a surge, mainly due to the increasing concern of consumers with the risk of air pollution and the improvement in EV technologies. Furthermore, various countries, like the USA, France, Spain, and India, among others, have introduced multiple policies and subsidy schemes to meet the demand for EVs.

Global EV sales grew massively, mainly with the introduction of new and improved technologies in this sector. The International Energy Agency, in its global electric vehicle report, stated that the sales of EVs witnessed a massive increase, especially in Europe and the USA. The agency stated that in 2021, 2.3 million units of EVs were sold in Europe, which increased to about 2.7 million in 2022 and 3.2 million in 2023. Similarly, in the USA, the total EV sales in 2021 were recorded at about 0.6 million, which increased to 1 million in 2022. In 2023, a total of about 1.4 million units of electric vehicles were sold in the nation.

Similarly, the production of EVs has grown across the globe in the past few years. The International Energy Agency stated that in 2021, the total stock of BEV battery electric vehicles in Europe was about 2.9 million, and 1.5 million units of EV stock were recorded in the USA. The EV stock grew in 2022 when a total of 4.4 million in Europe and 2.1 million in the USA were recorded. In 2023, the total EV stock in Europe doubled from 2021, reaching 6.7 million units of BEV stock, whereas in the USA, a total of 3.5 million units of BEV stock were recorded.

EV Battery Cooling Market Geographical Outlook:

- Asia Pacific is forecasted to hold a major share of the Global EV Battery Cooling Market.

The Asian Pacific region is estimated to attain a greater market share in the global EV battery cooling market, as it is among the fastest-growing regions in the EV sector and the technological leader in the global EV landscape.

Asian Pacific countries like China, Japan, and Taiwan are among the biggest producers of EVs and EV-related technologies. Furthermore, the Asian Pacific region has also witnessed increasing governmental and private investments from across the globe, especially in countries like India, China, and Vietnam, to develop EVs and their technology.

The Asia Pacific region is also among the biggest producers of electric vehicles, especially China. The International Energy Agency, in its report, stated that in 2021, the total stock of BEVs in China was recorded at about 6.2 million units, which increased to about 10.7 million in 2022. The total stock of BEVs in China was recorded at about 16.1 million units in 2023, nearly half of the global stock. Similarly, the nation’s EV sales also witnessed a massive increase, from about 3.3 million units sold in 2021 to about 6 million in 2022. In 2023, the total number of EVs sold in China was recorded at about 8.1 million.

The demand for electric vehicles is also increasing in other nations of the Asian Pacific region, like India. The India Brand Equity Foundation, in its report, stated that in 2021, a total of 3.31 million EVs were registered in the nation, which increased to about 10.2 million in 2022. In 2023, this figure was recorded at about 15.29 million, observing a growth of more than five times compared to 2021.

Major Companies in the EV Battery Cooling Market:

- Boyd is among the world's leading innovators, offering engineered materials and thermal solutions. The company provides its products and services across multiple industries like eMobility, cloud, medical, semiconductor, 5G, and aerospace. The company also offers material science products, including foam, adhesives, metal alloys, fluids, rubber, and plastics. The company's thermal solution includes liquid cooling, two-phase cooling, extreme air cooling, conduction cooling, and sockets. The company's EV battery cooling system offers an increased battery range and improved battery life.

- Hanon Systems is a multinational corporation that offers thermal management solutions for conventional and EVs. For EV/HEV battery management systems, the company offers a battery thermal management system, a heat pump system, and a high-voltage cooling fan motor.

EV Battery Cooling Market Key Developments:

- In August 2023, MAHLE GmbH, a global EV-based solution provider, introduced its new bionic battery cooling plates. These plates are being developed to offer better thermal cooling using nature's technology. They use the bionic structure for the cooling channels, which significantly improves the thermal management performance and has structural-mechanical properties. According to the company, the new thermal plate offers 10% more cooling capacity and 20% less pressure loss. The company also claims that the new thermal plate will ensure faster charging and more durable battery performance.

List of Top EV Battery Cooling Companies:

- 3M

- Boyd

- Hanon Systems

- MAHLE GmbH

- Modine Manufacturing Company

EV Battery Cooling Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

|

EV Battery Cooling Market Size in 2025 |

US$2.766 billion |

|

EV Battery Cooling Market Size in 2030 |

US$6.834 billion |

| Growth Rate | CAGR of 19.83% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2025 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

|

List of Major Companies in EV Battery Cooling Market |

|

| Customization Scope | Free report customization with purchase |

Global EV Battery Cooling Market Segmentation:

- By Cooling Type

- Air Cooling

- Liquid Cooling

- Fan Cooling

- By Battery Type

- Lead Acid

- Lithium Ion

- Others

- By Vehicle Type

- Battery Electric Vehicles

- Hybrid Electric Vehicles

- Plug-In Hybrid Electric Vehicle

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Other

- North America