Report Overview

Global Electronic Chemicals and Highlights

Electronic Chemicals and Materials Market Size:

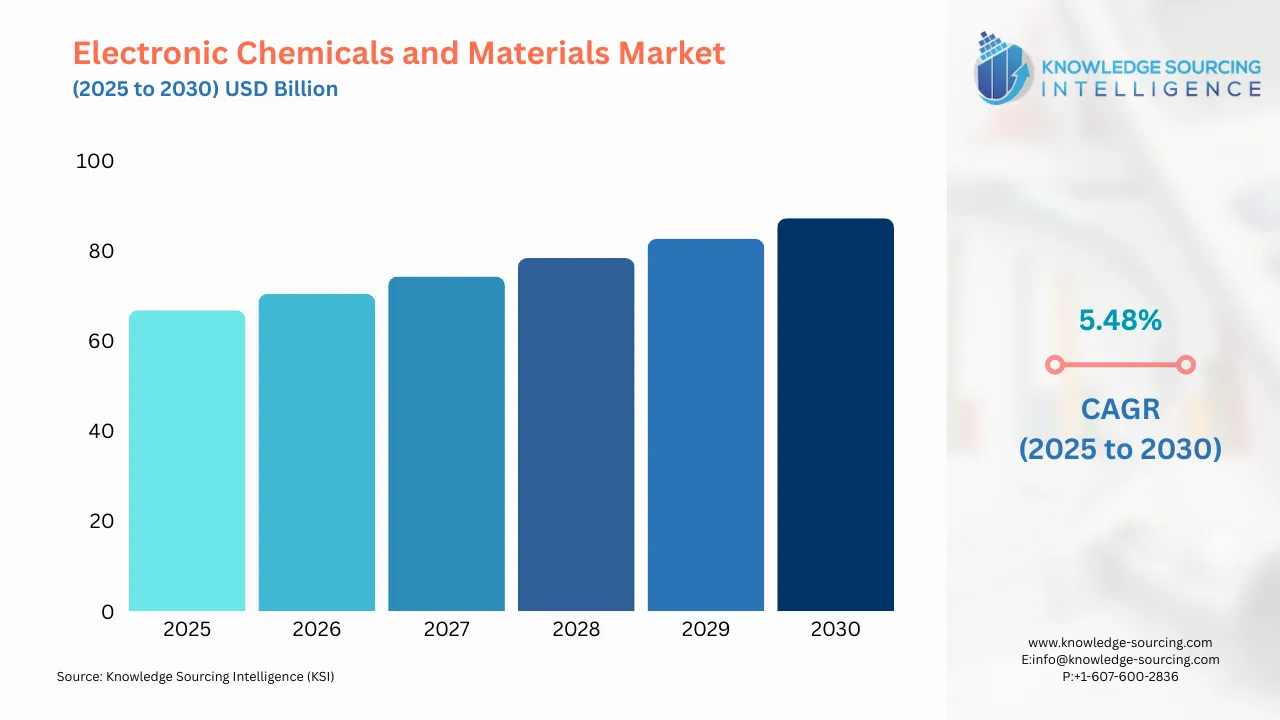

The global electronics chemicals and materials market is expected to grow at a CAGR of 5.48% over the forecast period, reaching a market size of US$87.183 billion by 2030, increasing from US$66.758 billion in 2025.

Electronic Chemicals and Materials Market Introduction:

The global electronics chemicals and materials market is a cornerstone of the modern electronics industry, providing the essential substances required to manufacture semiconductors, printed circuit boards (PCBs), integrated circuits (ICs), and advanced display technologies. These materials, ranging from high-purity gases and wet chemicals to silicon wafers and photoresists, enable the production of cutting-edge electronic devices that power consumer electronics, telecommunications, automotive systems, renewable energy technologies, and emerging applications like artificial intelligence (AI) and the Internet of Things (IoT). As the world continues its rapid digital transformation, the demand for specialized chemicals and materials has surged, driven by technological advancements, increasing device complexity, and the global proliferation of smart technologies.

Electronics chemicals and materials are specialized compounds and substrates used in the fabrication, cleaning, etching, doping, and packaging of electronic components. These include specialty gases (e.g., nitrogen, argon), wet chemicals (e.g., sulfuric acid, hydrogen peroxide), photoresist chemicals, chemical mechanical planarization (CMP) slurries, low-k dielectrics, silicon wafers, and PCB laminates. These materials are integral to processes like lithography, deposition, and etching, which are fundamental to semiconductor manufacturing. The market serves a broad range of applications, including consumer electronics (smartphones, laptops), automotive electronics (electric vehicles, autonomous driving systems), telecommunications (5G infrastructure), and renewable energy (solar panels, battery systems).

The market’s growth is closely tied to the semiconductor industry, which has seen exponential demand due to the global adoption of advanced technologies. This growth directly fuels the need for high-purity chemicals and materials to support advanced manufacturing processes, such as those for 7nm and smaller node technologies.

Electronic Chemicals and Materials Market Overview:

A variety of chemicals and materials are used in the processes and packaging of products and components, such as silicon wafers, printed circuit boards, integrated circuits, and semiconductors, in the electronics industry. These are collectively referred to as electronic chemicals and materials. Different chemicals are used in the electronics industry during and after the manufacture of electronic components for different devices. Some of these chemicals used for the manufacturing of silicon wafers include hydrochloric acid, ammonium chloride, and ammonia. Here, hydrogen chloride is used to remove any impurities, and ammonium chloride is used for the production of polysilicon crystals. Photoresists can also be applied on top of silicon wafers, enabling them to facilitate the photolithography process. For the manufacturing of semiconductors, various chemicals are used, including ammonium hydroxide, isopropyl alcohol, nitric acid, phosphoric acid, and sulfuric acid, among others.

Increasing disposable income has spurred a growing demand for consumer electronics, such as entertainment systems, mobile phones, and laptops, thereby driving the need for related chemicals and materials.

Additionally, as advanced circuits evolve, the demand for high-purity processing chemicals used in the production of integrated circuits, silicon wafers, and ICs will intensify due to their increasing complexity. This trend, fueled by the ongoing technological sophistication of devices, is expected to further accelerate market growth.

From a geographical perspective, the Asia Pacific and North American regions are projected to command a substantial share of the market. This is largely attributed to the robust, high-output electronics industry in countries like China within Asia Pacific, alongside the well-established chemical sector in the United States in North America.

Some of the major players covered in this report include BASF SE, KMG Chemicals Inc., Dow Inc., Eastman Chemical Company, Honeywell International Inc., and Avantor Inc., among others.

Electronic Chemicals and Materials Market Growth Drivers:

Technological Advancements and Miniaturization: The rapid evolution of semiconductor technology, particularly the transition to smaller process nodes (e.g., 5nm, 3nm, and below), drives significant demand for advanced electronic chemicals and materials.

Proliferation of 5G, AI, and IoT: The global rollout of 5G networks, coupled with the widespread adoption of AI and IoT devices, significantly boosts the demand for high-performance semiconductors and PCBs, which rely heavily on electronic chemicals and materials.

Growth in Electric Vehicles (EVs) and Renewable Energy: The shift toward electric vehicles (EVs) and renewable energy systems is a major driver for the electronics chemicals and materials market.

Electronic Chemicals and Materials Market Segmentation Analysis:

Electronic Chemicals and Materials Market Segmentation Analysis by Product Type:

Electronic Chemicals: Includes photoresists and etchants, wet chemicals, chemical mechanical planarization slurries, and specialty gases, crucial for semiconductor fabrication processes.

Electronic Materials: Comprises silicon wafers, conductive polymers, ceramic substrates, and dielectric materials, essential for chip and PCB production.

Others: Includes additional materials like PCB laminates and other niche compounds used in specialized applications.

Electronic Chemicals and Materials Market Segmentation Analysis by Application:

Semiconductor and IC Manufacturing: The dominant segment, driven by the critical role of chemicals and materials in producing advanced chips for various technologies.

Photovoltaic: Involves materials for solar cell production, driven by the growing renewable energy sector.

Displays: Includes materials for manufacturing advanced displays in consumer electronics.

Others: Covers niche applications like sensors and other electronic components.

Electronic Chemicals and Materials Market Segmentation Analysis by End-User Industry:

Consumer Electronics: The leading segment, driven by the demand for smartphones, laptops, and IoT devices requiring advanced semiconductors and PCBs.

Automotive: Fueled by the rise in electric vehicles and autonomous driving systems needing sophisticated electronics.

Healthcare and Medical: Involves materials for medical devices and diagnostic equipment.

Telecommunications: Driven by 5G infrastructure and related communication technologies.

Others: Includes industrial automation and other specialized applications.

Electronic Chemicals and Materials Market Geographical Outlook:

The Global Electronic Chemicals and Materials market report analyzes growth factors across the following regions:

Americas: Significant growth driven by the well-established chemical sector and increasing semiconductor demand in the US.

Europe, Middle East & Africa: Growth in Europe is propelled by demand for consumer electronics and automotive applications, with slower growth in the Middle East and Africa due to limited manufacturing infrastructure.

Asia Pacific: Dominates the market due to its robust electronics manufacturing ecosystem, particularly in China, Japan, Taiwan, and South Korea.

Electronic Chemicals and Materials Market Competitive Landscape:

BASF SE: Offers a wide range of electronic chemicals and materials, focusing on high-purity solutions for semiconductor manufacturing.

Dow Inc.: Provides advanced materials like CMP slurries and dielectric materials for cutting-edge chip production.

Shin-Etsu Chemical Co., Ltd.: A key supplier of silicon wafers and photoresists, supporting global semiconductor foundries.

These companies are among the global leaders in electronic chemicals and materials, driving innovation through extensive research and strategic collaborations.

Electronic Chemicals and Materials Market Latest Developments:

January 2025: Sumitomo Chemical announced collaborations with leading semiconductor manufacturers to develop advanced materials for semiconductor manufacturing processes, focusing on materials for advanced lithography, deposition, and etching.

September 2023 (Operational in 2024): Solvay, in collaboration with Shinkong, launched a new facility in Taiwan to produce 35,000 tons of electronic-grade hydrogen peroxide annually, with operations commencing in 2024.

June 2023 (Effective in 2024): Covestro entered into an agreement with Encina to supply circular raw materials, such as methylene diphenyl diisocyanate (MDI), polycarbonate, and toluene diisocyanate (TDI), with implementation in 2024.

Electronic Chemicals and Materials Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 66.758 billion |

| Total Market Size in 2030 | USD 87.183 billion |

| Forecast Unit | Billion |

| Growth Rate | 5.48% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Product Type, Application, End-User Industry, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Electronic Chemicals and Materials Market Segmentation:

By Product Type

Electronic Chemicals

Photoresists and Etchants

Wet Chemicals

Chemical Mechanical Planarization Slurries

Specialty Gases

Electronic Materials

Silicon Wafers

Conductive Polymers

Ceramic Substrates

Dielectric Materials

Others

By Application

Semiconductor and IC Manufacturing

Photovoltaic

Displays

Others

By End-User Industry

Consumer Electronics

Automotive

Healthcare and Medical

Telecommunications

Others

By Region

Americas

US

Europe, Middle East and Africa

Germany

Netherlands

Others

Asia Pacific

China

Japan

Taiwan

South Korea

Others