Report Overview

Electricity Transmission Poles Market Highlights

Electricity Transmission Poles Market Size:

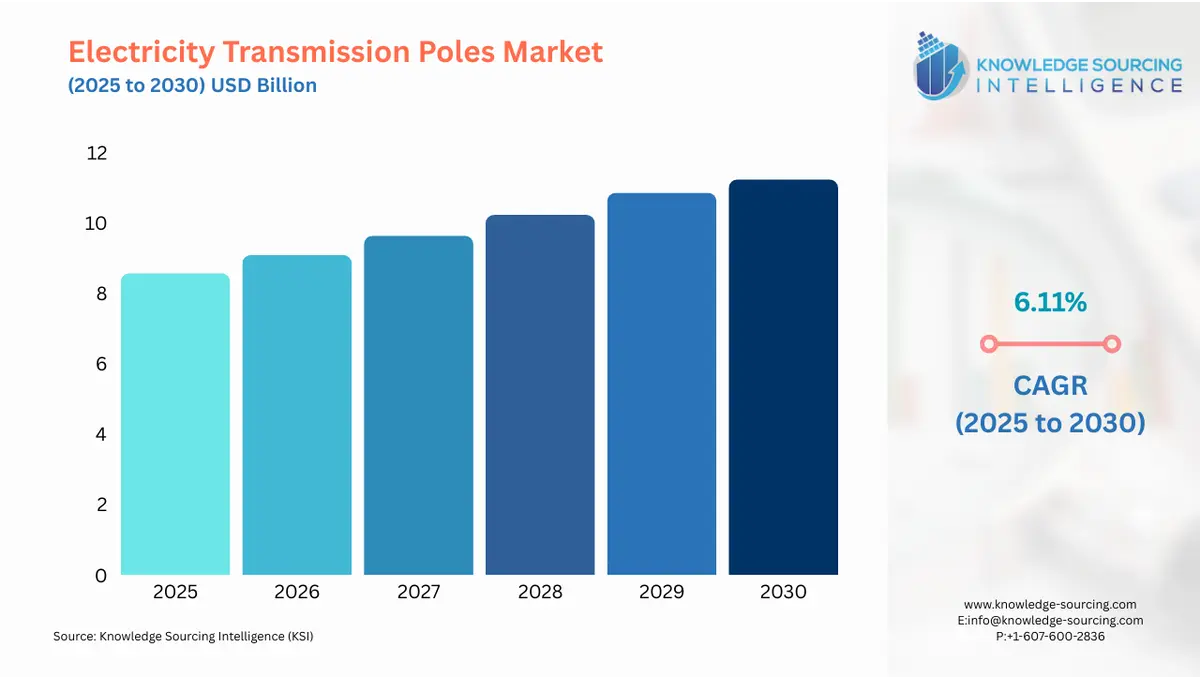

The global electricity transmission poles market is valued at US$8.565 billion in 2025 and is estimated to grow at a CAGR of 6.11% over the forecast period to reach US$11.240 billion in 2030.

Electricity poles, also called power poles, support wires and electric cables that carry electricity from power companies to end-users. Materials that are used in the production of electricity transmission poles include wood, steel, and composites. The choice of material depends on its use, which determines the life span of the electricity transmission pole. Electricity transmission poles are used to support and carry electrical lines, including distribution lines and sub-transmission lines.

The rising number of factories across various industries is also a factor contributing to the global electricity transmission pole market growth. Growing urban infrastructural development in developing economies has boosted the construction of residential and commercial buildings, driving the demand for electricity transmission poles, thus positively impacting its market.

The growing demand for reliable and efficient electricity transmission infrastructure is driving the global electricity transmission poles market as increasing energy needs are being met. Rapid urbanization and industrialization, mainly in emerging economies, have rapidly increased electricity consumption, hence the need to expand and upgrade the networks. A shift towards renewable energy sources such as wind and solar has created a demand for high-end transmission poles capable of carrying high voltage over long distances, thus boosting market expansion.

Electricity Transmission Poles Market Drivers:

- Growing technological advancements and government investments

Technological advancement and government investments in grid modernization drive the market further. The smart grid initiatives, which help increase energy efficiency and reduce transmission losses, are raising the demand for durable and lightweight transmission poles made from composite materials. Investment in smart grids needs to more than double through to 2030 to get on track with the Net Zero Emissions by 2050 (NZE) Scenario, especially in emerging market and developing economies (EMDEs).

In addition, the replacement of aging infrastructure in developed countries and the extension of rural electrification projects in underdeveloped regions are further contributing to the electricity transmission poles market growth.

Advancements in the global energy sector are also contributing to this global market’s expansion. The growing demand for energy-efficient and resilient power grids is another factor bolstering the market. Rapidly growing demand for unhindered electricity supply across various sectors has also fuelled the revenues of market players in the global electricity transmission market. Increasing public and private investments in smart grids in both developed and developing economies will continue to pave the way for new distribution lines and poles as replacements for older infrastructure, thereby driving the overall market growth of electricity transmission poles.

India and the United States of America agreed to expand the Indo-US Joint Clean Energy Research and Development Centre (JCERDC) by funding new research in two areas critical to improving the reliability, flexibility, and efficiency of the electricity delivery system i.e. Smart Energy Grids and Energy Storage. The program is being administered in India by the bilateral Indo-U.S. Science and Technology Forum (IUSSTF) and in the US by the Department of Energy (DoE).

- The growing popularity of cement electricity transmission poles

The cement electricity transmission poles are anticipated to account for the major market share in 2030 since it is the pioneering material for making electricity transmission poles. In North America, there are an estimated 130 million wood poles, according to the Woodpoles organization.

The application of cement (concrete) poles as overhead electrical transmission lines has increased because of their properties, such as higher strength, longer life, and the potential to span longer distances than steel poles. Moreover, concrete electricity transmission poles have relatively low maintenance costs and high electrical resistance. The drawbacks of cement electricity transmission poles include vulnerability to damage and high self-weight.

Electricity Transmission Poles Market Geographical Outlook:

- The electricity transmission poles market is segmented into five regions worldwide

The global electricity transmission poles market is segmented into five regions: North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. By geography, the global electricity transmission pole market has been segmented into five major regional markets- North America, South America, Europe, the Middle East and Africa (MEA), and Asia Pacific (APAC).

The North American electricity transmission poles market is anticipated to account for a significant share in 2030. High electricity consumption in countries like the United States and Canada is driving this market’s expansion. The electricity sector in these countries is witnessing major investments in new electricity distribution and transmission infrastructure as the existing infrastructure is aging and needs to be refurbished. Electric power transmission and distribution in the United States need expansion and upgrading since increasing loads and aging equipment and infrastructure are putting pressure on more investments.

In August 2022, the United States Congress passed the Inflation Reduction Act (IRA), a law intended to accelerate U.S. decarbonization, clean energy manufacturing, and deployment of new power and end-use technologies. This scenario includes representations of the main electricity sector provisions from IRA and the potential impact on electricity demand.

The growing focus on green energy solutions in both North America and the European regions will continue to augment the demand for new electricity transmission poles during the next five years, thus fuelling regional market growth. Government policies and regulations that promote greener technologies and new energy sources are increasing the demand for advanced distribution and transmission infrastructure. This trend is expected to positively influence the overall growth of the global electricity transmission poles market during the forecast period.

Electricity Transmission Poles Market Key Developments:

- In December 2024, SWEPCO launched a system-wide pole replacement project to enhance the distribution system's strength and resilience against extreme weather conditions and other disruptive events in its service territory.

- In October 2024, Larsen & Toubro's Power Transmission & Distribution vertical won new orders in the Middle East and Africa for expansion and strengthening electricity grids at high voltage levels. Orders include the implementation of an Energy Management System for a country-wide electricity network.

Electricity Transmission Poles Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Electricity Transmission Poles Market Size in 2025 | US$8.565 billion |

| Electricity Transmission Poles Market Size in 2030 | US$11.240 billion |

| Growth Rate | CAGR of 6.11% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Electricity Transmission Poles Market |

|

| Customization Scope | Free report customization with purchase |

The Electricity Transmission Poles Market is analyzed into the following segments:

- By Material

- Wood

- Cement

- Steel

- By Area

- Rural

- Urban

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

- North America

Our Best-Performing Industry Reports:

Navigation:

- Electricity Transmission Poles Market Size:

- Electricity Transmission Poles Market Key Highlights:

- Electricity Transmission Poles Market Drivers:

- Electricity Transmission Poles Market Geographical Outlook:

- Electricity Transmission Poles Market Key Developments:

- Electricity Transmission Poles Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 23, 2025