Report Overview

Electrical and Electronic Adhesive Highlights

Electrical And Electronic Adhesive Tape Market Size:

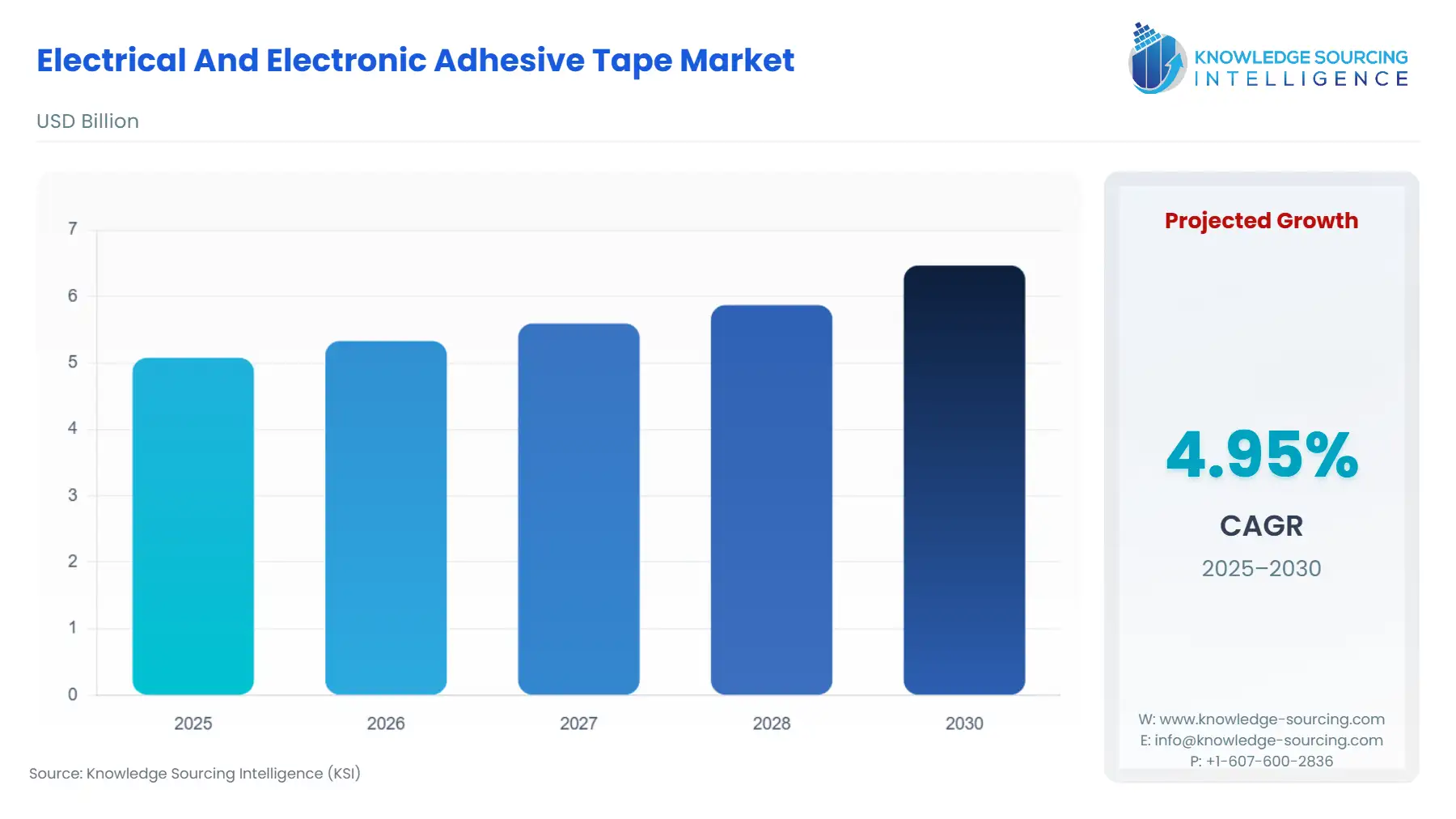

The Electrical And Electronic Adhesive Tape Market will reach US$6.468 billion in 2030 from US$5.079 billion in 2025 at a CAGR of 4.95% during the forecast period.

Electrical And Electronic Adhesive Tape Market Trends:

Electrical and Electronic adhesive tapes have unique properties that include conductivity and heat resistance which allows manufacturers to replace bolts and screws to reduce device size resulting in the extensive use of these tapes in tablets, smartphones, laptops, and other consumer electronic applications. They have extensive applications in a variety of electronic devices in their assembly operations to hold components in a fixed place while allowing current to pass through it. They are mainly used to attach radio frequency interference shields or electromagnetic interference shields to devices.

The electric and electronic adhesive tapes especially work when the conductive components come in contact with various substrates and a low current is allowed to flow between the two substrates and are in contact within the tape polymer matrix. These conductive components include nickel, silver, graphite, and copper. The extensive use of these tapes in consumer electronics and various industry sectors will drive the growth of the electrical and electronic adhesive tapes market in the forecast period.

North America emerged as one of the leading areas however, the Asia-Pacific region's market is expected to grow at a faster rate than other regions. North America is also expected to have the highest rate / CAGR. Factors like the increasing export of commercial goods and increasing infrastructure in the region have led to the growth of electric and electronic adhesive tapes. Electric and electronic adhesive tapes would produce moneymaking growth prospects for the growth of the market across the region.

The growth of the Asia-Pacific market is calculable to be fueled owing to the technological advancements the ever-growing manufacturing units associated with various industries such as automotive, electronics, construction and food and beverages have been a prominent reason for the increasing demand of electric and electronic adhesive tapes in these industry verticals. The ability of electric and electronic adhesive tapes to withstand harsh and high temperatures, elimination of the need for screws, fasteners or welding and high tensile strength have fueled its growth in the global market. Also, the increasing export of commercial goods from countries in the region like China, India, and Japan is leading to the increasing use of electric and electronic adhesive tapes in the region.

Electrical And Electronic Adhesive Tape Market Growth Factors:

- Increasing Investment in the electronics sector is fueling the market growth.

The increasing investments in the electronics sector due to its rapid growth as a result of surging demand of emerging market economies are fueled by the steady market growth of electric and electronic adhesive tapes market, The increasing electronic production by various countries and the growing investments in foreign production of electronics has led to the growing demand of electric and electronic adhesive tapes in the global market. The increasing spending power of consumers and the growing demand for electronics has led to the growth of the electronic sector, The electronics-producing countries have a strong consumer base that can invest in advanced technologies and buy new electronic products. The increasing competitiveness among end-users is leading to cheaper products in the market for individuals due to lower production costs.

Furthermore, the growing demand for consumer electronics due to the introduction of digital initiatives by governments of developing nations including China, India, and Brazil has further led to the increasing demand for consumer electronics like tablets, smartphones, and laptops led to the rising demand for electric and electronic adhesive tapes over the forecast period. China is one of the world's consumer electronics producers and is a major market for industrial and consumer electronics. Moreover, the increasing population around the globe has accounted for the use of consumer electronics owing to which the market for electric and electronic adhesive tapes is expected to bloom in the forecast period

Electrical And Electronic Adhesive Tape Market Restraints:

- The cyclic nature of the semiconductor and electronic industry proves to be a major restraint

However, the cyclic nature of the semiconductor and the electronic industry has proved to be a major restraint in the growth of electric and electronic adhesive tapes in the forecast period. The relatively shorter lifespan of semiconductor items where traditional technologies are dominated by new and advanced applications has been considered a major restraint of the electric and electronic adhesive tapes market. These advanced technologies take over these products and cause an upswing in the industry causing high demand and short supply of these products. Moreover, oversupply causes a downswing in the market and falling prices due to inventory build-up. Also, the worldwide economic growth has been a major reason for the restraining growth of the electrical and electronic adhesive tapes market.

The global electrical and electronic adhesive tape market report provides an in-depth analysis of the industry landscape, delivering strategic and executive-level insights backed by data-driven forecasts and analysis. This regularly updated report equips decision-makers with actionable intelligence on current market trends, emerging opportunities, and competitive dynamics. It examines demand across various electrical and electronic adhesive tape coating technology, such as solvent-based and hot-melt-based coatings, while exploring end-user segments. The report also investigates technological advancements, key government policies, regulations, and macroeconomic factors, offering a comprehensive view of the market.

Electrical and Electronic Adhesive Tape Market Segmentations:

Electrical and Electronic Adhesive Tape Market Segmentation by material type

The market is analyzed by material type into the following:

- Vinyl

- Rubber

- Polyester

- Others

Electrical and Electronic Adhesive Tape Market Segmentation by coating technology

The report analyzes the market by coating technology as below:

- Solvent-based

- Hot-melt Based

- Water-based

Electrical and Electronic Adhesive Tape Market Segmentation by end-users industry

The report analyzes the market by end-users industry as below:

- Consumer Electronics

- Automotive

- Telecommunications

- Aerospace

- Others

Electrical And Electronic Adhesive Tape Market Segmentation by regions:

The study also analysed the Electrical And Electronic Adhesive Tape Market into the following regions, with country level forecasts and analysis as below:

Electrical And Electronic Adhesive Tape Market Competitive Landscape:

The Electrical and Electronic Adhesive Tape Market features key players such as 3M, Tesa SE, Avery Dennison Corporation, Henkel AG & Co. KGaA, Scapa Group plc, Intertape Polymer Group Inc., Gergonne, Shurtape Technologies, LLC, DIC Corporation, and Teraoka Seisakusho Co., Ltd., among others.

Electrical And Electronic Adhesive Tape Market Report Coverage:

This report provides extensive coverage as explained in the points below:

- Market size, forecasts, and trends by different material types, with historical revenue data and analysis focusing on key factors driving adoption, current challenges faced by key players, and major growth areas.

- Market size, forecasts, and trends by coating technology, with historical revenue data and analysis.

- Market size, forecasts, and trends by end-users industry, with historical revenue data and analysis across various segments.

- Electrical And Electronic Adhesive Tape Market is also analysed across different regions, with historical data, regional share, attractiveness, and opportunity of these solutions in different countries. The growth prospects and key players operating in these markets. The section also dwells on the macro factors, economic scenario and other complementing factors aiding in market growth.

- Market dynamics: The section details the market growth factors, restraints, and opportunities in the market. The segment also presents complete market scenario with the help of Porter’s five forces model.

- Competitive Intelligence: A thorough investigation on the competitive structure of the market presented through proprietary vendor matrix model, market share analysis of key players, insights on strategies of key players and recent major developments undertaken by the companies to gain competitive edge.

- Research methodology: The assumptions and sources which were considered to arrive at the final market estimates. Additionally, how our model is refined to ensure most significant factors are taken into consideration with the proper hypothesis and bottom-up and top-down approaches enhance the reliability of forecasts further strengthening the trustworthiness of the numbers being presented.

How this report is helpful to you and reasons for purchase?

- The report provides a strategic outlook of the electrical and electronic adhesive tape market to the decision-makers, analysts and other stakeholders in the easy-to-read format for taking informed decisions.

- The charts, tables and figures make it easy for the executives to gain valuable insights while skimming the report.

- Analyst support through calls and email for timely clarification and incorporating additional requests.

- Option of presentation or doc format with the estimates file to take care of diverse requirements.

- 15% FREE customization with all our reports help cater additional requirements with significant cost-savings.

- Option of purchasing specific segments of the study, including opting for summary reports or just the estimates file.

Electrical And Electronic Adhesive Tape Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Commodity Adhesive Tape Market Size in 2025 | US$56.934 billion |

| Commodity Adhesive Tape Market Size in 2030 | US$73.446 billion |

| Growth Rate | CAGR of 5.23% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Commodity Adhesive Tape Market |

|

| Customization Scope | Free report customization with purchase |