Report Overview

Global Electric Vehicle Battery Highlights

EV Battery Market Size:

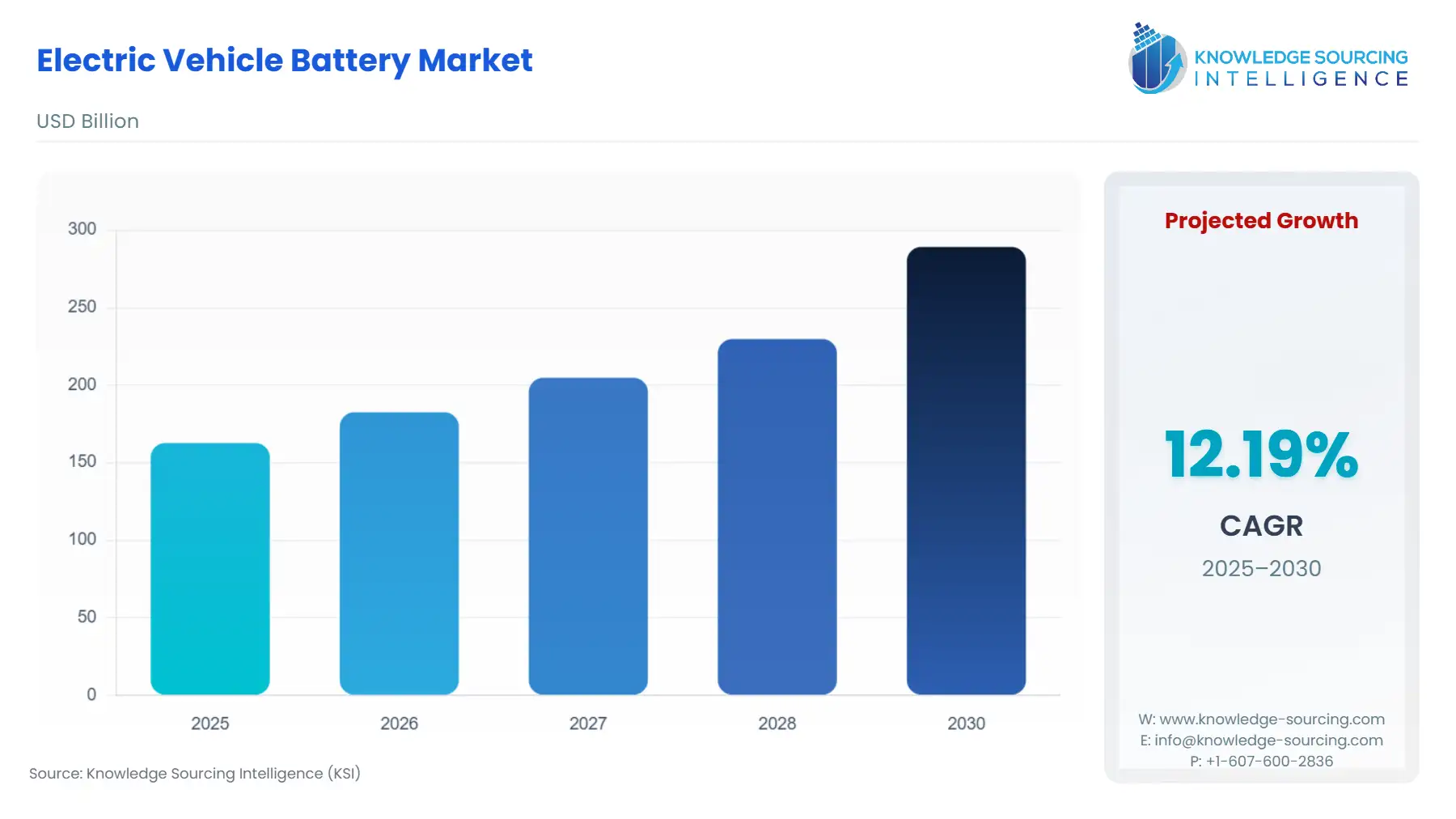

The electric vehicle battery market is projected to grow from USD 162.681 billion in 2025 to USD 289.194 billion in 2030 at a CAGR of 12.19%.

EV Battery Market Trends:

The electric vehicle (EV) batteries market is witnessing robust growth, driven by surging global demand for electric vehicles (EVs). These high-powered rechargeable batteries, primarily made from critical minerals like lithium-ion and, to a lesser extent, aluminum-ion, are engineered for superior energy density, current outflow, and temperature resistance. These qualities ensure efficient power delivery and durability in EV applications, supporting the global shift toward sustainable transportation.

Rising EV adoption, fueled by increasing fuel costs, heightened environmental awareness, and the need to reduce carbon emissions, is a primary market driver. Government subsidies and policies promoting clean energy and zero-emission vehicles further accelerate EV battery production. Countries like China, the U.S., and those in the European Union offer incentives for battery manufacturing, fostering innovation and market expansion. The Asia-Pacific region, particularly China, leads due to its dominant EV manufacturing ecosystem and supportive regulations.

Advancements in battery technology, such as improved lithium-ion batteries with enhanced energy efficiency and thermal management, are critical to extending EV range and safety. Research into alternative materials, like solid-state batteries, promises further growth. Despite challenges like mineral supply constraints, the EV batteries market is poised for expansion as sustainable mobility gains traction, supported by global investments in green technology and infrastructure development.

EV Battery Market Growth Drivers:

- The growing adoption of electric vehicles is driving global market growth.

The ongoing developments in sustainable fuel and alternatives for internal combustion engines have provided a major scope for the usage of electric transportation. With the establishment of zero-carbon emission policies and neutrality standards, the demand is expected to boom further in the future. Major nations, namely China, the United States, and Europe, have already taken a major leap toward green mobility adoption, thereby witnessing significant growth in their electric vehicle sales.

According to the International Energy Agency, in 2024, the global electric registration reached 15.2 million units, representing a 10.9% growth over 13.8 million units sold globally in 2023.

Moreover, the same source also stated that electric vehicle adoption in China witnessed 24.6% growth, 6.2% in Europe, and 21.4% in the United States.

Additionally, the economies are setting targets till 2030 to increase the percent share of electric vehicles in overall automotive sales. Hence, such developments and booming EV adoption are expected to positively impact the demand and supply of EV batteries, thereby augmenting their overall industry expansion in the forecast period.

EV Battery Market Restraints:

- Raw material price volatility is posing a challenge to the market expansion

Electric vehicle batteries are made mainly from critical minerals such as lithium, aluminum, and nickel, among others. With the ongoing trade wars between the USA and China, following restrictions on mining operations in economies, the supply chain tends to get disrupted for such minerals. This is causing fluctuations in their overall supply to the battery manufacturers, resulting in price volatility and restraining the overall market expansion.

EV Battery Market Segment Analysis:

- Battery electric vehicles, based on vehicle type, will account for a considerable market share

By vehicle type, the battery electric vehicle is estimated to constitute a significant market share. It is poised for a positive expansion owing to the high applicability of lithium-ion and hybrid-nickel metal batteries in fully electric vehicles, both commercial and passenger.

As the economies are exploring new ways of improving sustainable fuel adoption, the demand for battery electric vehicles is anticipated to show positive growth.

According to the “Global EV Outlook 2024” by the International Energy Agency, the battery electric vehicle accounted for 70% of electric vehicle stock in 2023, and major regions, namely China, experienced 15% growth in BEV registration in Q1 2024. The same source further specified that in economies such as the United States, the demand for medium and small fully electric vehicles is high, which is expected to augment the segment growth further for battery electric vehicles. The plug-in hybrid electric vehicles, on the other hand, are anticipated to show constant growth in the coming years.

EV Battery Market Geographical Outlook:

- Asia Pacific will continue to hold a remarkable market share during the forecast period

Geographically, the electric vehicle battery market has been segmented into North America, South America, Europe, the Middle East, Africa, and the Asia Pacific.

The Asia Pacific market is expected to constitute a considerable market share during the forecast period. It is poised for a positive expansion as major regional economies, namely China, account for a major portion of global electric vehicles and EV battery production. For instance, as per the International Energy Agency, in 2023, China accounted for nearly 60% of new electric vehicle registrations occurring globally. Hence, the country recorded 8.1 million EV registrations in the same year, representing a growth of 35% over 2022’s registration figure.

Likewise, the same source also specified that the demand for electric vehicles in China is also witnessing significant growth, positively driving the country’s production capacity. In 2023, electric vehicle battery demand in China stood at 417 GWh/Year, which showcased a 32.8% growth over demand as reported in the preceding year.

Additionally, major market players' ongoing investment in establishing battery manufacturing plants in regional economies is further propelling the market expansion. For instance, in April 2024, Panasonic announced the completion of its new battery manufacturing plant in Japan to bolster the company’s competitiveness in producing next-generation EV batteries.

North America and Europe are projected to show positive growth fueled by ongoing government schemes and policies to bolster domestic battery capacity. Moreover, the rapid progression of green mobility adoption in such regions and growing efforts to optimize the energy storage solution for EV applications have stimulated regional market expansion.

EV Battery Market Key Developments:

- In December 2024, LG Energy Solutions and General Motors extended their 14-year battery technology partnership, which involved leveraging multiple advanced battery chemistries and exploring new approaches to reducing their weight and component usage and improving overall performance. The collaboration will enable General Motors to use LG’s Ultium cell plants in Tennessee, Ohio, and Warren that produce pouch battery cells.

- In October 2024, Stellantis N.V. formed a strategic collaboration with Factorial Inc., which aimed to accelerate the development of deployment of next-generation EVs powered by Factorial’s “Solid-State Battery Technology. This marks Stellantis's next step in commercializing such battery technology in its electric vehicles, thereby assessing the real-time demand for new EV battery technology.

- In September 2024, Panasonic collaborated with Subaru Corporation to establish an automotive battery plant in Japan to supply next-generation cylindrical lithium-ion batteries for BEVs. The collaboration marks Subaru’s commitment to selling nearly 1.2 million battery-electric vehicles globally by 2030.

- In April 2024, Kia Corporation and Hyundai Motor formed a memorandum of understanding (MOU) with Indian battery manufacturer Exide Energy Solution Ltd. to localize their electric vehicle battery production in the Indian market. The company will especially emphasize manufacturing lithium-iron phosphate batteries.

List of Top EV Battery Companies:

- Contemporary Amperex Technology Co., Limited

- LG Energy Solution

- BYD Company Limited

- Panasonic

- Samsung SDI Co., Ltd

EV Battery Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Electric Vehicle Battery Market Size in 2025 | USD 162.681 billion |

| Electric Vehicle Battery Market Size in 2030 | USD 289.194 billion |

| Growth Rate | CAGR of 12.19% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Electric Vehicle Battery Market |

|

| Customization Scope | Free report customization with purchase |

Electric Vehicle Battery Market Segmentation:

- By Battery Type

- Lithium Ion

- Aluminum Ion

- Hybrid Nickel Metal

- Others

- By Vehicle Type

- Battery Electric Vehicle

- Plug-In Hybrid Electric Vehicle

- Hybrid Electric Vehicle

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Others

- North America

Our Best-Performing Industry Reports:

- EV Battery Recycling Market Size

- EV Powertrain Market

- Ultra-Fast EV Batteries Market

- Electric Vehicle Infotainment Market