Report Overview

Global Elastomer Market Report, Highlights

Elastomer Market Size:

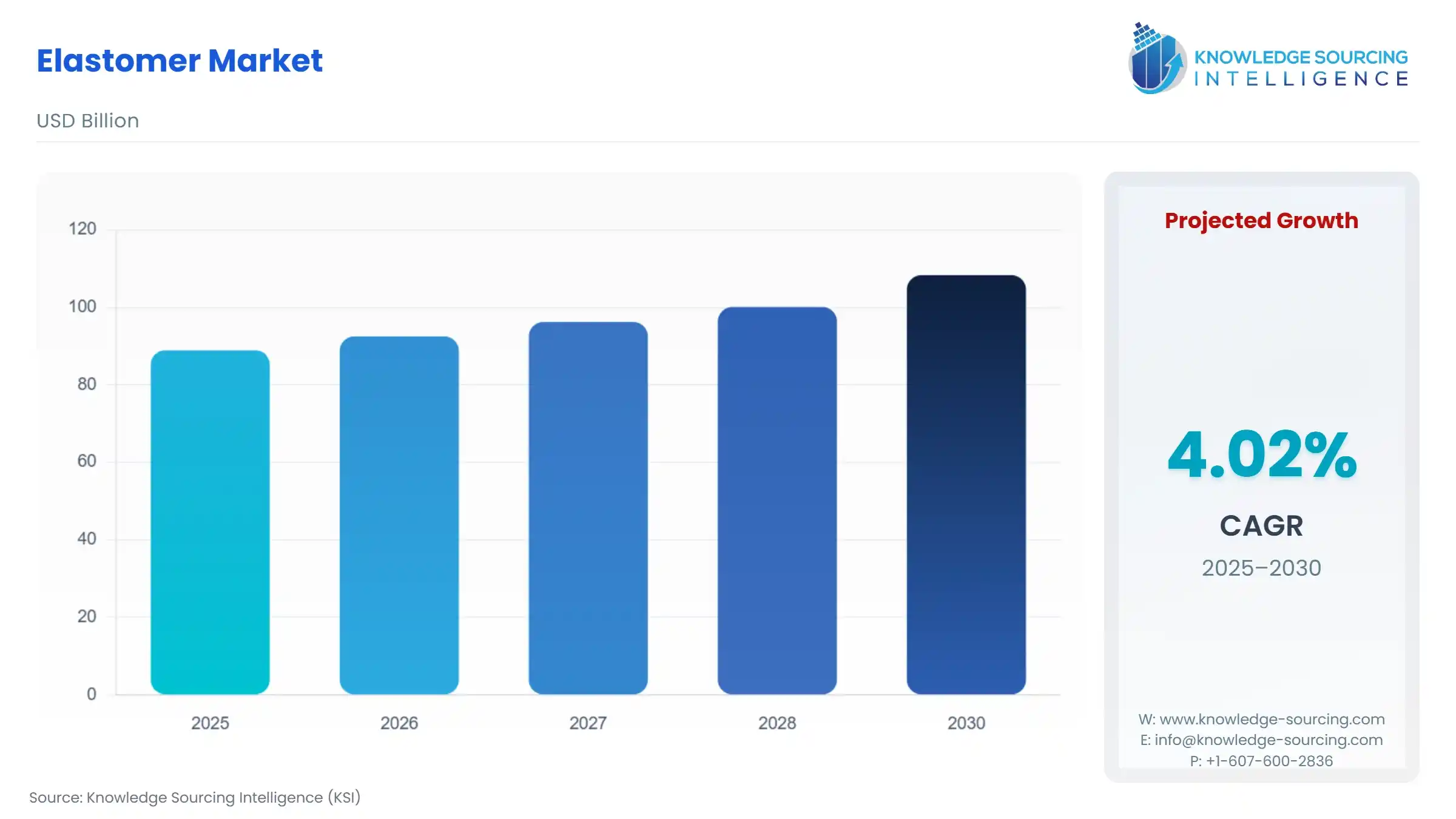

The global elastomer market is expected to grow at a CAGR of 3.82%, reaching a market size of US$108.351 billion in 2030 from US$88.964 billion in 2025.

An elastomer is a rubbery material composed of long chainlike molecules, or polymers, that are capable of recovering their original shape after being stretched. They are elastic and flexible in nature and amorphous in structure. Due to their prominent features, they play an essential and ubiquitous role in daily life. Some of their applications include automobiles, consumer products, construction, industrial products, wires and cables, and medical products.

By end-user, the automotive industry would likely hold a significant share, while consumer electronics will be another notable sector. By materials used, synthetic rubber is more popularly used because of its availability and cost. However, the shift to natural rubber has been observed as economies continue to make sustainable choices. By type, thermoplastic elastomers have a significant market share due to their properties and applications.

Elastomer Market Growth Drivers:

- Uses in the automobile industry.

The automobile industry is one of the biggest consumers of the elastomers market. It is used in the vehicle's interior and exterior as a sealant, under the hood for gaskets, wires, and pipes, for decoration and protection, and most importantly, for manufacturing tires. It is one of the key raw materials of the industry. The demand is expected to surge with innovations and the burst of the electronic vehicles market. According to the OICA (International Organization of Motor Vehicle Manufacturers), the overall production of vehicles has expanded by 10% in 2023 compared to the previous year. This number of vehicles produced was 93,546,599, out of which 67,133,570 are cars and 26,413,029 are commercial vehicles.

Due to properties such as lightweight, ease-of-processing, greater design freedom, versatility, and ability to be recycled, they are predominantly used in the automotive industry. Their usage and versatility are fuelling high market growth.

- Other industrial applications.

Because of the viscosity and elasticity, elastomers have seeped into various applications. Synthetic elastomers made from petroleum products are used throughout the oil and gas industry, and they include seals, hoses, wipers, custom rubber products, etc. Depending on the specific plant, elastomers are used in a wide range of industrial applications, like conveyor belts, insulations, and coverings.

Elastomers are used in agriculture at every stage, from herd management to food production. For example, elastomers comprise the gaskets, seals, hoses, and dampeners used in tractors and other agricultural vehicles. Healthcare facilities use a huge variety of elastomers at every level. Elastomers are often chosen for sterility, biocompatibility, and low leaching levels. Gloves, implants and prosthetics, catheters, and tubes use elastomers. These applications help grow the elastomers market widely.

Elastomer Market Geographical Outlook:

- The global elastomer market is segmented into five regions worldwide

By geography, the market is segmented into North America, South America, Europe, the Middle East and Africa, and Asia Pacific. The major economies like China, Japan, India, and South Korea dominate the Asia-Pacific region. Some of the fastest-growing emerging economies are from this region, such as ASEAN countries.

The Asia Pacific region is expected to see the fastest growth in the global elastomer market due to increasing renewable energy applications such as offshore cable protection and silicon wafer cutting rollers of photovoltaic panels, among others. North America is expected to have a significant market share in the global elastomer market due to its major utilization in different industries.

Elastomer Market Restraints:

- The shift to environmentally conscious products which are biodegradable may hinder the market growth of elastomers. The synthetic elastomers are non-biodegradable, which detrimentally affects the soil and air quality, posing threats to animals, plants, and humans. This has led to a shift to alternative products, curbing market growth. Moreover, the high cost of manufacturing synthetic rubbers also limits the market growth.

Elastomer Market Key Developments:

The market leaders for the Global Elastomer Market are Saudi Armco, Mitsui Chemicals, Inc, Covestro, LyondellBasell Industries Holdings B.V., INEOS, ATP Elastomers, Braskem S.A., DuPont, and Grando. These key players implement growth strategies such as product launches, mergers, acquisitions, etc., to gain a competitive advantage. For Instance,

- In August 2024, Covestro started a new elastomers plant in Shanghai. The investment is in the double-digit million Euro range. The product could be used in offshore wind turbines and photovoltaic panels. Production has started at the new plant for polyurethane elastomer systems at its integrated site. The plant was announced in the summer of 2022. This new plant would help to meet the rising demand for the material in the Asia-Pacific region.

- In March 2024, Dow introduced a new polyolefin elastomer-based for the automotive market. It is a leather alternative for the automotive industry’s need to shift towards increasingly animal-free product alternatives to leather. Benefits included low-volatile organic compounds, 25% to 40% lighter weight than PVC leather, low-temperature resistance, better color stability, etc.

- In October 2023, Evonik launched a new INFINAM TPA elastomer powder material for SLS 3D printing. Evonik extended its portfolio of elastomeric materials for powder bed fusion 3D printing technologies. They launched INFINAM TPA 4006 P, a new powder grade that can be utilized in open-source SLS 3D printing machines.

- In May 2023, Borealis introduced the Bornewables line of Queo, a range of plastomers and elastomers. This line would enable Borealis to meet growing customer demand for sustainable solutions. It is produced with ISCC PLUS–certified renewable feedstock. By launching circular plastomers and elastomers, Borealis is trying to achieve its circular economy targets by 2025. It targets a four-fold increase in the share of circular products and solutions to 600 kilotonnes per annum.

List of Top Elastomer Companies:

- Saudi Aramco

- Mitsui Chemicals, Inc

- Covestro

- LyondellBasell Industries Holdings B.V.

- Braskem S.A.

Elastomer Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Elastomer Market Size in 2025 | US$88.964 billion |

| Elastomer Market Size in 2030 | US$108.351 billion |

| Growth Rate | CAGR of 3.82% |

| Study Period | 2020to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

|

List of Major Companies in the Elastomer Market |

|

| Customization Scope | Free report customization with purchase |

Elastomer Market Segmentation:

- By Type

- Thermoset

- Thermoplastic

- By Material

- Natural Rubber

- Synthetic Rubber

- By End-use Industry

- Consumer Electronics

- Automotive

- Construction

- Packaging

- Healthcare

- Others

- By Application

- Food

- Beverage

- Animal Feed

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- UAE

- Rest of the Middle East and Africa

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America