Report Overview

Global Edge AI Market Highlights

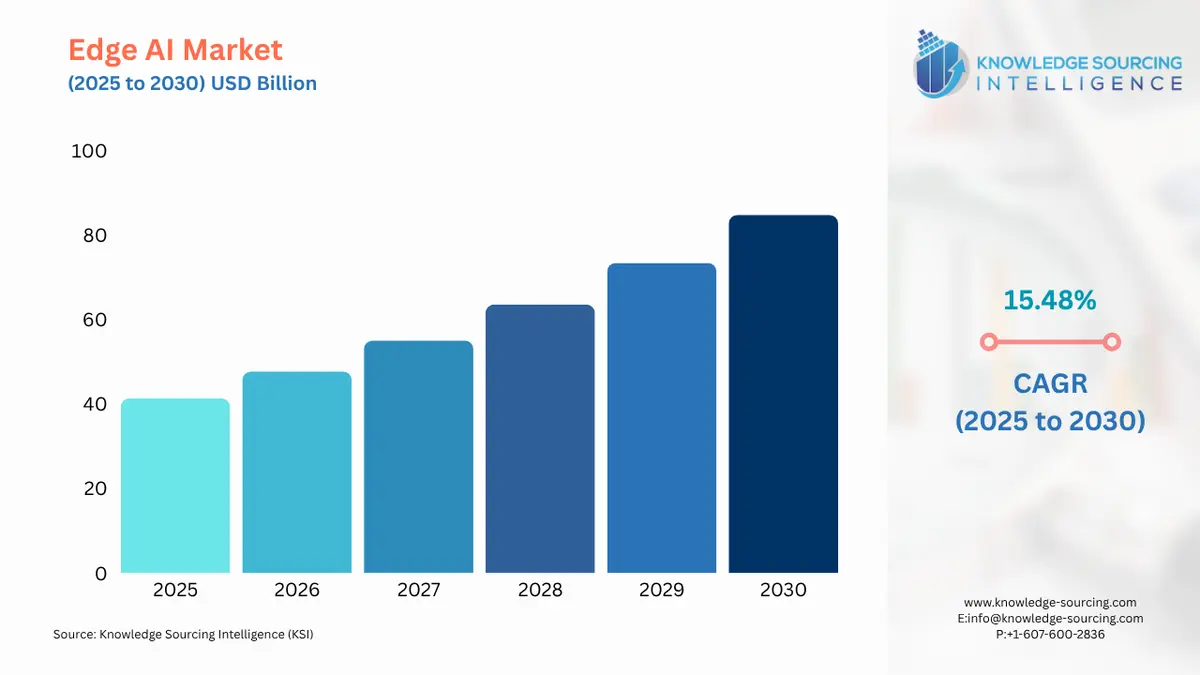

The global edge AI market is expected to grow at a CAGR of 15.48%, reaching a market size of US$84.765 billion in 2030 from US$41.268 billion in 2025.

Edge AI Market Highlights:

Edge computing and artificial intelligence (AI) technology are combined to create edge AI. With the help of this solution, several AI algorithms with edge computing capabilities can operate locally on devices for vital applications. This solution enables local devices to process data in real time without internet access. Company sectors such as automotive, manufacturing, healthcare, energy and utility, consumer goods, IT, and telecom are making use of these gadgets. Edge AI enables fast data processing, leading to real-time information processing on the Internet of Things (IoT) gadgets. Instead of being stored in the cloud, edge AI stores the data required to apply AI locally on the device or a nearby server.

Multi-Access Edge Computing architecture provides networking, storage, and processing capabilities at the edge of the network, near end users and end devices. Virtual devices, as opposed to actual edge computers, are utilized in MEC Edge AI use cases to process camera video streams over a 5G connection. For instance, in February 2023, Dublin City University in Europe and Cellnex Ireland, a European provider of wireless telecom infrastructure, worked together to develop a 5G-enabled smart campus. Cellnex installed a range of telecommunication infrastructure on the campuses as part of this partnership to enable Mobile Edge Computing (MEC) capabilities and guarantee 5G coverage throughout the main campus.

The market is expanding significantly due to the need for real-time data processing and intelligent decision-making at the edge of networks. The proliferation of IoT devices, the rise of 5G networks, and the need for low-latency applications are driving this demand.

According to the Ericsson Mobility Report, November 2024, by the end of 2024, 5G subscriptions in the region of India, Nepal, and Bhutan will reach above 27 crore, i.e., 23 percent of total mobile subscriptions. By 2030, this figure will grow to as high as 97 crore, with 74 percent of total mobile connections in the region.

Technological advancements in AI algorithms, hardware, and software are continuously being made, leading to the development of more powerful and efficient Edge AI solutions. More complex and sophisticated applications are enabled across various industries. Applications of Edge AI are rapidly expanding across industries, from smart homes and wearables to autonomous vehicles and industrial automation.

In this regard, in December 2024, Edge Impulse, the leading platform for building, deploying, and scaling edge machine learning models, and STMicroelectronics, a global semiconductor leader serving customers across the spectrum of electronics applications, announced support for the groundbreaking STM32N6 MCU.

In September 2024, SiMa.ai, the software-centric, embedded edge machine learning system-on-chip (MLSoC) company, launched MLSoC™ Modalix, the industry's first multi-modal edge AI product family.

Edge AI Market Growth Drivers:

- Increasing demand for edge AI in the healthcare industry is anticipated to propel the market growth

The healthcare industry is seeing a sharp rise in AI applications because these technologies yield accurate results. Applications include electroceuticals, robotics-assisted surgery, image analysis, and virtual diagnostics.

These instruments enable doctors to consult with patients remotely and assist healthcare organizations in analyzing health data. Additionally, edge-based cybersecurity is employed to protect private medical information.

The major market players are attempting to organize and create new technological advancements. Furthermore, the healthcare sector will benefit from the high performance and acceleration provided by the integration of this technology. For instance, Nvidia extended the use of its Edge Artificial Intelligence technology for robotics and healthcare in September 2022. The Nvidia IGX Platform aims to accelerate performance and extract real-time insights for use in both industrial and medical use cases.

- Rising demand for autonomous vehicles is anticipated to drive market growth

The decision-making processes of these automated systems are based on advanced machine learning and artificial intelligence techniques. The connection to the edge enhances productivity, reduces accident rates, increases safety, and mitigates traffic congestion for self-driving cars.

Additionally, such robotics applications are becoming popular owing to lessened latency and the need for bandwidth. Smart ports, AI-based robotic systems, or smart factories use high-tech robots like those found in WeRide and Lenovo Vehicle Computing. These two companies allied in March 2024 to create level 4 autonomous vehicle technology for commercial purposes. This partnership is to develop an advanced intelligent driving system based on Lenovo’s recently announced AD1 autonomous driving domain controller. This controller is powered by the NVIDIA DRIVE Thor platform that features next-gen Blackwell architecture optimized for transformer tasks and generative AI. The system is additionally trained using NVIDIA’s next-generation data center AI solutions.

- Expansion of 5G and Edge Computing Infrastructure

Advancements in AI-driven applications through 5G and edge computing expansion revolutionize the processing of low-latency, high-speed, and near-real-time processing near the data sources. This enables billions of edge devices and IoT systems to efficiently process vast amounts of data due to ultra-low latency, high bandwidth, and network slicing offered by 5G technology. This is changing autonomous vehicles, industrial automation, smart cities, healthcare, and telecom by evoking real-time decision-making and cloudless operations.

As per IBEF, by 2030, 5G will carry 80 percent of the world’s total mobile data traffic, highlighting its transformative role in the future of connectivity.

As per the Department for Science, Innovation and Technology, it is estimated that there are 9,600 active, VAT-registered data-driven companies (DDCs) in the UK, of which 5,500 offer specialized data infrastructure or software development services and 4,100 offer more diverse data consultancy or management services.

- High adoption of hardware devices is increasing the market share

The hardware market is expanding as a result of the growing use of 5G networks and the increased need for edge computing solutions based on the IoT to link telecom and IT. IoT devices heavily utilize dedicated AI processors for on-device image analytics. For example, in May 2022, the independent Intel company Habana Labs in Israel released its second-generation deep-learning processors. Habana Labs focuses on developing disruptive solutions for data center and cloud efficiency. These new processors aim to provide customers with efficient and high-performing options for deep-learning computing in the data center for inference deployments and training workloads.

Edge AI Market Restraints:

- Increased cases of security flaws are anticipated to impede market growth

Applications for edge devices are vulnerable to security risks because the data they secure and store is sensitive information. This is one of the newer developments, and all sectors lack experience and understanding in this area.

Furthermore, edge computing necessitates standardized units and is highly dependent on hardware. The prototype requires a lot of time to build and implement in production. It’s also quite an expensive process to train, requiring many resources and R&D efforts. Many other factors complicate applying this technology, such as processors, memory requirements, and power usage, hindering market growth.

Edge AI Market Segmentation Analysis

- By application, video surveillance is rising substantially

The use of cloud-based video surveillance systems has become popular for their scalability, remote access, and reduced costs of infrastructure over on-premises systems. With cloud-based solutions, a business can scale up video surveillance capabilities in a short time to support changing demands without large investments upfront in IT infrastructure and hardware.

Further, the use of surveillance cameras in private spaces has become increasingly common. Security cameras are being installed in an increasing number of homes. Security cameras were installed in 122.1 million homes worldwide as of 2024, and will increase to 180.7 million homes by 2027.

Furthermore, industry leaders are actively seeking expansion through a mix of market expansion programs, mergers and acquisitions, strategic alliances and agreements, product launches, and new product development.

For instance, in November 2024, i-PRO Co. Ltd. unveiled a new range of High Zoom Bullet cameras that combine cutting-edge AI capabilities with outstanding long-range coverage. The new cameras, which come with IR LED technology and a powerful zoom, provide unparalleled accuracy for long-distance surveillance in multiple settings, including stadiums, parking lots, bridges, ports, and highways.

- The healthcare segment is expected to grow significantly

The use of Internet of Things (IoT) devices for asset tracking, remote care, patient monitoring, and facility management is growing in the healthcare sector. Applications in the healthcare industry need quick decisions and reactions based on sensor readings, diagnostic pictures, patient data, and medical records.

Healthcare providers can make important decisions and analyze data locally with Edge AI hardware instead of depending entirely on centralized servers. Edge AI hardware can further support continuous monitoring of patients and personalized healthcare services through the processing of data from wearable technology, medical sensors, and home-based monitoring systems.

Further, rising investment in the healthcare industry has also raised the demand for edge AI in the healthcare industry. For instance, according to the Economic Survey 2022-23, India's public spending on healthcare increased to 2.1% of GDP in FY23 from 1.6% in FY21.

Furthermore, in October 2024, Microsoft Corp. introduced innovations in Microsoft Cloud for Healthcare that improve teamwork, empower healthcare professionals, link care experiences, and provide clinical and operational insights through Copilot Studio's healthcare agent service, Microsoft Fabric's healthcare data solutions capabilities, Azure AI Studio's new healthcare AI models, and an AI-powered nursing workflow solution.

Edge AI Market Geographical Outlook:

- North America is witnessing exponential growth during the forecast period

The rapid expansion of North American markets can be attributed to companies in the region adopting sophisticated technologies like AI and machine learning.

Moreover, AI technology is getting national attention from the U.S. government as its main goal. For example, in March 2024, the AI solutions provider Innodisk demonstrated its expertise in integrating edge AI at NVIDIA GTC in the United States. With a focus on delivering customizable AI solutions available to various industries, Innodisk actively shares its research and real-world edge AI implementations globally. The company highlights useful applications across industries by showcasing how its camera modules seamlessly integrate with NVIDIA's specialized AI visual technology.

The United States AI in the edge AI market is growing significantly. This growth is driven by the proliferation of IoT and smart devices that work with increasing demands of real-time, on-device data processing1. Edge AI software allows these devices to work on data locally, reducing the requirement for periodic cloud communications that bring along crucial issues like latency, bandwidth limitation, and data privacy issues.

The rollout of the 5G network is one of the major growth drivers in the U.S. With higher speeds, lower latency, and better capacity, 5G fundamentally improves the ability of edge devices to manage real-time AI workloads. The main applications are in smart cities and autonomous systems, where relatively quick data processing is seen as vital. The U.S. is the leading country in developing autonomous systems, ranging from self-driving cars to drones and robotics that heavily rely on Edge AI to process data locally for safety as well as operational efficiency.

More than that, there are supportive government initiatives that boost the adoption of AI in different verticals of industry. The growth of the North American edge AI market is therefore fueled by the existence of some major edge AI companies, like IBM, Nvidia, and Amazon, within this region. More availability of novel edge AI solutions, as well as a high rate of adoption of automation in several sectors, is opening up new avenues for growth. Edge AI technologies are increasingly being deployed in various sectors within the U.S., ranging from healthcare, manufacturing to smart cities.

Edge AI can monitor and diagnose in real time, predict maintenance, and enhance operational efficiency and safety by processing data locally and responding faster to changing conditions. Additionally, the convergence of edge computing and cloud services allows for better resource utilization and scalability. Data privacy and security concerns are also driving the adoption of Edge AI, as it enables localized data processing and reduces reliance on cloud services. Generative AI is significantly impacting the edge AI software market, making devices more intelligent by generating and processing data. This enhances the capability of edge devices to do more complex tasks independently, without necessarily relying on cloud systems.

Edge AI Market Recent Developments:

- In July 2024, a leading provider of IT infrastructure and services, NTT DATA, unveiled its new Edge AI platform, which pushes AI processing to the edge to speed up IT/OT convergence. With the help of this special, fully managed solution, advanced Industry 4.0 technologies can be driven across industries with real-time decision-making, improved operational efficiencies, and secure AI application deployment. It does this by processing data when and where it is generated and unifying diverse IoT devices, systems, and data.

- In June 2024, Advantech presented a cutting-edge Edge AI server solution for generative AI that leverages aiDAPTIV+, a patented technology from Phison. Utilizing an AMD EPYC 7003 series processor, the AIR-520 Edge AI Server combines NVIDIA RTX GPU cards, SQ ai100 AI SSDs, an Edge AI SDK, and NVIDIA AI Enterprise to offer a solution that is ready for immediate deployment.

- In June 2024, STMicroelectronics made the ST Edge AI Suite available, which combines information, software, and tools to make developing edge-AI applications easier and faster. This integrated set of software tools facilitates the creation and implementation of embedded AI applications.

Global Edge AI Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

|

Global Edge AI Market Size in 2025 |

US$40.987 billion |

|

Global Edge AI Market Size in 2030 |

US$83.915 billion |

| Growth Rate | CAGR of 15.42% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

|

List of Major Companies in Global Edge AI Market |

|

| Customization Scope | Free report customization with purchase |

The global Edge AI market is analyzed into the following segments:

- By Component

- Services

- Solutions

- By Data Sources

- Mobile Data

- Sensor Data

- Biometric Data

- Speech, Video, and Image Recognition

- By Application

- Video Surveillance

- Access Management

- Autonomous Vehicles

- Energy Management

- Others

- By Industry

- Manufacturing

- Healthcare

- Automotive

- Retail

- Telecommunications

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Others

- North America