Report Overview

Global Drilling Fluid Additives Highlights

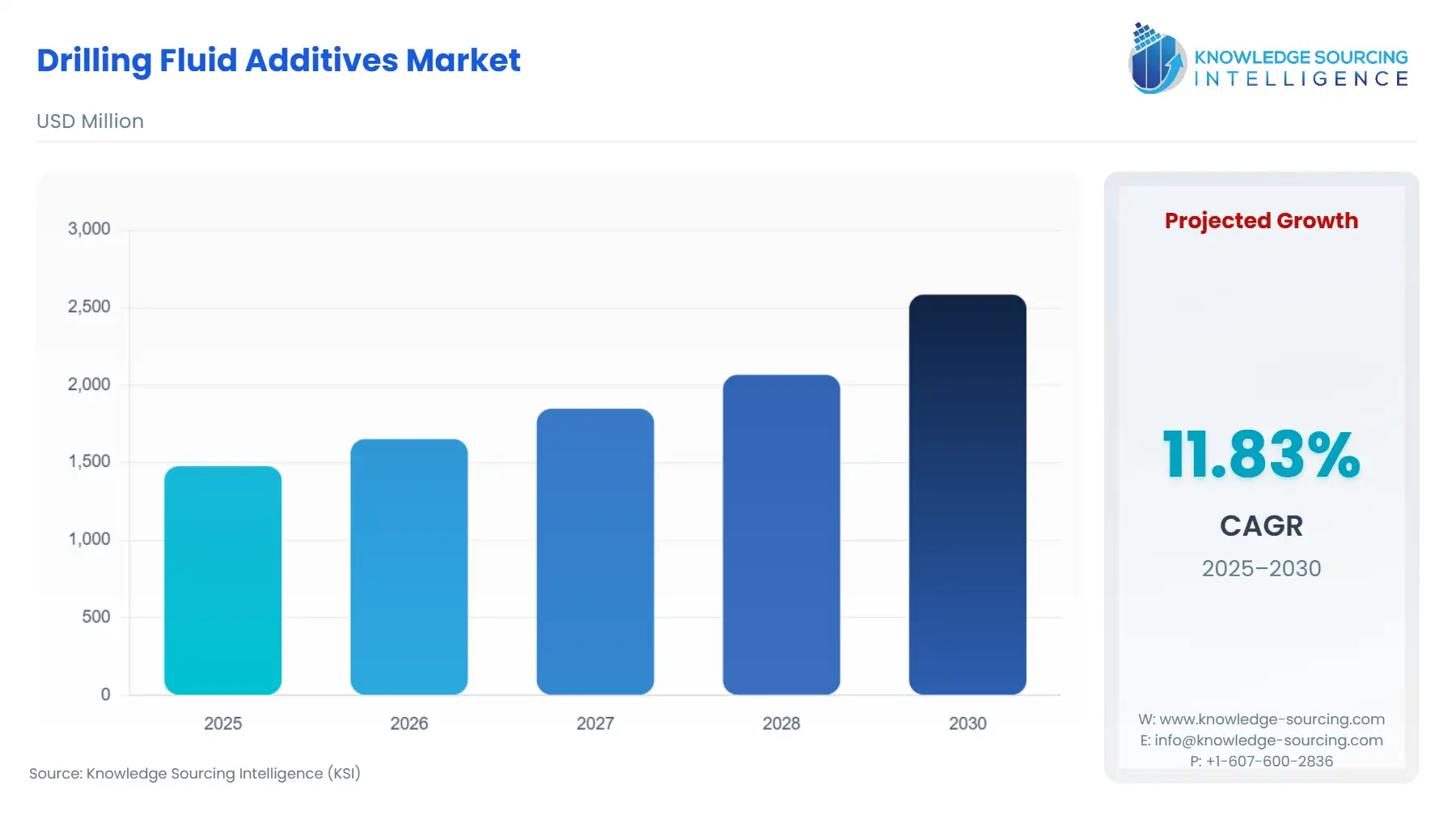

Drilling Fluid Additives Market Size:

The global drilling fluid additives market is expected to grow at a CAGR of 11.83%, reaching a market size of US$2,584.426 million in 2030 from US$1,477.630 million in 2025.

Drilling fluids serve as indispensable components in various applications, facilitating the excavation of boreholes into the earth. Their utility extends beyond intricate operations like oil and natural gas drilling to simpler endeavors such as water well drilling. Various types of drilling fluids, including water-based mud, non-aqueous mud, and gaseous drilling fluid, are deployed based on specific project requirements.

The global market for drilling fluid additives is witnessing steady growth, propelled by several key factors underscoring their significance in ensuring the efficiency and success of drilling operations. Certain additives, such as Lubrication and Friction Reduction, contribute to maintaining wellbore stability by preventing formation collapse and facilitating a smooth drilling path.

Moreover, Fluid Loss Control, addressing fluid loss to the formation presents a significant challenge. Additives aid in forming a filter cake on the wellbore wall, thereby minimizing fluid loss and sustaining wellbore pressure.

Additionally, in temperature regulation, drilling fluids encounter high temperatures downhole. Additives play a crucial role in regulating fluid viscosity and preventing excessive temperature rises, which could potentially damage equipment or jeopardize wellbore stability.

The primary functions of drilling fluids include maintaining hydrostatic pressure to prevent infiltration of formation liquids into the wellbore, ensuring optimal cooling and cleanliness of the drill bit during operations, transporting drill cuttings, and suspending bore cuttings during drilling interruptions.

In essence, the global market for drilling fluid additives is driven by the imperative for efficient, cost-effective, and environmentally conscious drilling operations.

Drilling Fluid Additives Market Drivers:

- Booming global oil & gas production propels the market.

The global drilling fluids additives market is predicted to grow at a steady rate fueled by the bolstering growth in oil & gas production and investment in new exploration projects. In addition, technological innovation and R&D investments in new product innovations have further caused an upward market trajectory. Furthermore, in India, India’s consumption of petroleum products stood at almost 4.44 million barrels per day (BPD) in FY23, up from 4.05 million BPD in FY22, highlighting the continued need for drilling fluids in production capacity.

Furthermore, established players in the industry collaborate with local companies in emerging markets to facilitate technology transfer and knowledge sharing. Other factors driving market growth include the application of nanomaterials in drilling fluid additives for enhanced performance and sustainability and the exploration of deepwater and ultra-deepwater drilling.

These combined factors are anticipated to drive significant market expansion for global drilling fluid additives. By capitalizing on these drivers and addressing emerging challenges, the drilling industry can become more efficient, sustainable, and successful.

- Cost optimization

Cost optimization and efficiency play crucial roles in drilling operations. Additives are instrumental in optimizing drilling performance by enhancing lubrication and stabilizing the borehole, ultimately leading to reduced drilling time and associated expenses. Instances of wellbore instability or other fluid-related challenges can result in Non-Productive Time (NPT).

However, the integration of effective additives can mitigate these issues, thereby minimizing downtime and the resultant costs. Additionally, the utilization of lubricating additives aids in diminishing wear and tear on drilling equipment, thereby prolonging its lifespan and mitigating replacement costs.

- Environmental Regulations

As environmental regulations grow stricter, there's a heightened push for sustainability in drilling operations. This has spurred the advancement of eco-conscious drilling fluid additives aimed at reducing environmental impact. Utilizing biodegradable and non-toxic additives helps minimize the ecological footprint of drilling activities.

A notable trend in the industry is the transition towards water-based drilling fluids, which are typically more environmentally benign than their oil-based counterparts. To ensure the effectiveness of these water-based fluids, the inclusion of specific additives is paramount.

Drilling Fluid Additives Market Segmentation Analysis:

- The global drilling fluid additives market is segmented By Fluid Formation into Synthetic Based, Water Based, and Oil Based.

The global drilling fluid additives market is categorized by fluid formation into three segments: Synthetic-Based, Water-Based, and Oil-Based. Water-based fluids (WBFs) are generally regarded as more environmentally friendly than oil-based fluids (OBF) due to their lower toxicity levels and ease of disposal.

Synthetic-based fluids (SBFs) boast superior performance characteristics compared to WBFs, particularly in High-Pressure and High-Temperature (HPHT) wells and deepwater environments. OBFs are known for their exceptional lubrication properties and ability to maintain wellbore stability, making them well-suited for challenging drilling conditions where WBFs may prove less effective.

Drilling Fluid Additives Market Geographical Outlook:

- The market is projected to grow in the North American region.

The market for drilling fluids is propelled by various factors, including the focus on shale oil and gas extraction due to the depletion of conventional reserves, necessitating specialized drilling fluids with advanced additives. Additionally, the development of unconventional resources and the persistent demand for oil and gas contribute significantly to market growth.

In 2022, the United States witnessed a record average natural gas consumption of 88.5 billion cubic feet per day (Bcf/d), marking a notable 5% increase (4.5 Bcf/d) from the previous year, with consumption totaling 83.5 billion cubic feet per day in 2021.

Drilling Fluid Additives Market Key Players:

Global Drilling Fluid Additives Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Drilling Fluid Additives Market Size in 2025 | US$1,477.630 million |

| Drilling Fluid Additives Market Size in 2030 | US$2,584.426 million |

| Growth Rate | CAGR of 6.91% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2025 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies Covered |

|

| Customization Scope | Free report customization with purchase |

The Drilling Fluid Additives Market is analyzed into the following segments:

- By Type

- Surface Modifiers

- Dispersants

- Corrosion Inhibitors

- Fluid Viscosifiers

- Biocides

- Defoamers

- Others

- By Fluid Formation

- Synthetic Based

- Water Based

- Oil Based

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- UK

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Taiwan

- Others

- North America