Report Overview

Global Disinfectants Market Size, Highlights

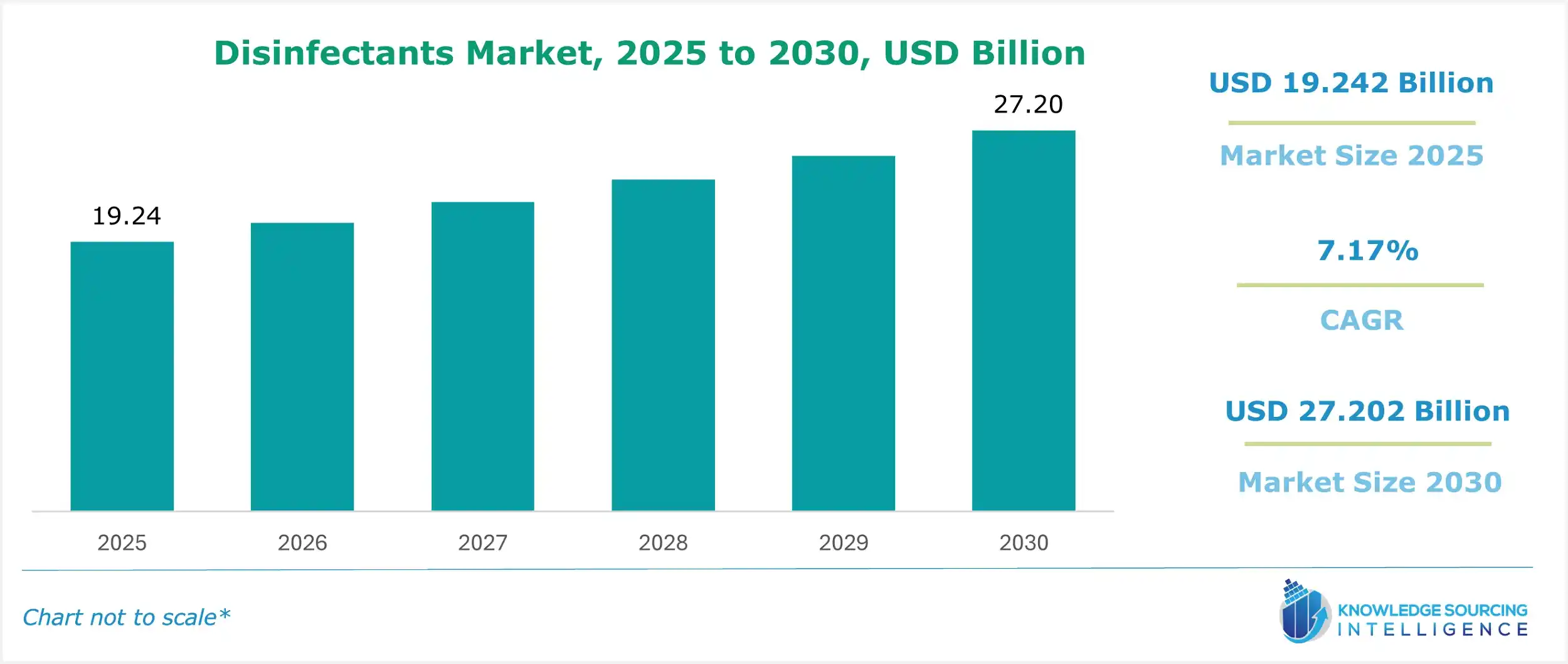

Disinfectants Market Size:

The global disinfectants market is projected to grow at a CAGR of 7.17% to attain $27.202 billion in 2030 from $19.242 billion in 2025.

Disinfectants are used to prevent microbial cross-contamination and transmission of microbial infections from surfaces in different industries, including healthcare and food processing. These disinfectants are also used in residential and commercial spaces to maintain cleanliness and hygiene. The global disinfectant market is being driven by the increasing prevalence of hospital-acquired Infections (HAIs) worldwide. Growing concerns regarding cleanliness and hygiene across various industries are significantly driving the demand for disinfectants worldwide. Stringent government regulations regarding hygiene at factories and workplaces are further boosting the use of disinfectants, thereby fueling the global disinfectants market growth.

Disinfectants Market Overview & Scope:

The global disinfectants market is segmented by:

- Composition: By composite, the global disinfectant market is divided into alcohol, quaternary ammonium compounds, hydrogen peroxide, peracetic acid, and others. Peracetic acid has a significant market share in the global disinfectant market. Peracetic acid is used across the food industry as it is less toxic, cost-effective, and environment-friendly.

- Type: The type segment of the market is divided into liquid, wipes, and sprays. The emerging popularity of using wipes as a convenient solution will drive this segment’s growth as it provides several advantages, like lesser chances of cross-contamination compared to liquids, no water consumption, and ease of use.

- Application: By application, the global disinfectants market is categorized into in-house surfaces, instrument disinfection, and others. The growing prevalence of hospital-acquired infections is increasing the demand for disinfectant solutions on in-house surfaces.

- End-User: By end-user, the market is segmented into residential, commercial, industrial, food processing, chemical, healthcare, and others. The healthcare category is expected to attain greater market share, as the hospitals require a large amount of disinfectant due to the increasing prevalence of diseases causing an increase in hospital visits.

- Region: The Asia Pacific regional market is expected to experience a significant CAGR during the forecast period. This growth is attributed to the rising number of industries in the region and favorable government initiatives to focus on cleanliness and hygiene in residential and industrial spaces. The presence of major market players in the region also supports disinfectant market growth.

Top Trends Shaping the Disinfectants Market:

1. Sustainable disinfectant solution

- Growing demand for sustainable and environment-friendly disinfectant solutions is encouraging manufacturers to add eco-friendly products to their diverse portfolios to gain a larger market share while maintaining their position in the global disinfectant market.

Disinfectants Market Growth Drivers vs. Challenges:

Opportunities:

- Introduction of key governmental initiatives: Government initiatives to reduce hospital-acquired infections and raise awareness about maintaining hygiene in the home and surroundings are driving up demand for disinfectant solutions, positively impacting the overall market growth.

- Growing healthcare infrastructure: The growing global healthcare infrastructure is also among the key factors pushing market expansion. With the rising healthcare expenditure, the demand for sanitization solutions is expected to increase significantly.

Challenges:

- Environmental and health concerns: The major factors challenging the market's growth are the concerns related to the health and environmental side effects of the disinfectants.

Disinfectants Market Regional Analysis:

- North America: North America holds a noteworthy share in the global disinfectant market due to the presence of large pharmaceutical companies and high awareness regarding cleanliness and hygiene among people, which is boosting the use of disinfectants in homes. Strict regulations and guidelines regarding the cleanliness of the work area across industries in countries like the U.S. and Canada are also bolstering market growth.

Disinfectants Market Competitive Landscape:

The market is fragmented, with many notable players including 3M, Johnson & Johnson, Reckitt Benckiser Group PLC, Cantel Medical, Ecolab, Procter & Gamble, STERIS plc., The Clorox Company, Diversey, Inc, CarroLLClean, UPS Hygienes Pvt. Ltd., and PLZ Corp, among others:

- Product Launch: In January 2025, CloroxPro, a part of the Clorox Company, launched plant-based Clorox EcoClean Disinfecting Wipes. These ready-to-use and environment-friendly disinfectant wipes feature 100% plant-based substrate and naturally derived citric acid.

Disinfectants Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Disinfectants Market Size in 2025 | US$19.242 billion |

| Disinfectants Market Size in 2030 | US$27.202 billion |

| Growth Rate | CAGR of 7.17% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Disinfectants Market |

|

| Customization Scope | Free report customization with purchase |

Global Disinfectants Market is analyzed into the following segments:

By Composition

- Alcohol

- Quaternary Ammonium Compounds

- Hydrogen Peroxide

- Peracetic Acid

- Others

By Type

- Liquid

- Wipes

- Sprays

By Application

- In-House Surfaces

- Instrument Disinfection

- Others

By End-User

- Residential

- Commercial

- Industrial

- Food Processing

- Chemical

- Healthcare

- Others

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa