Report Overview

Global Diodes Market Size, Highlights

Diodes Market Size:

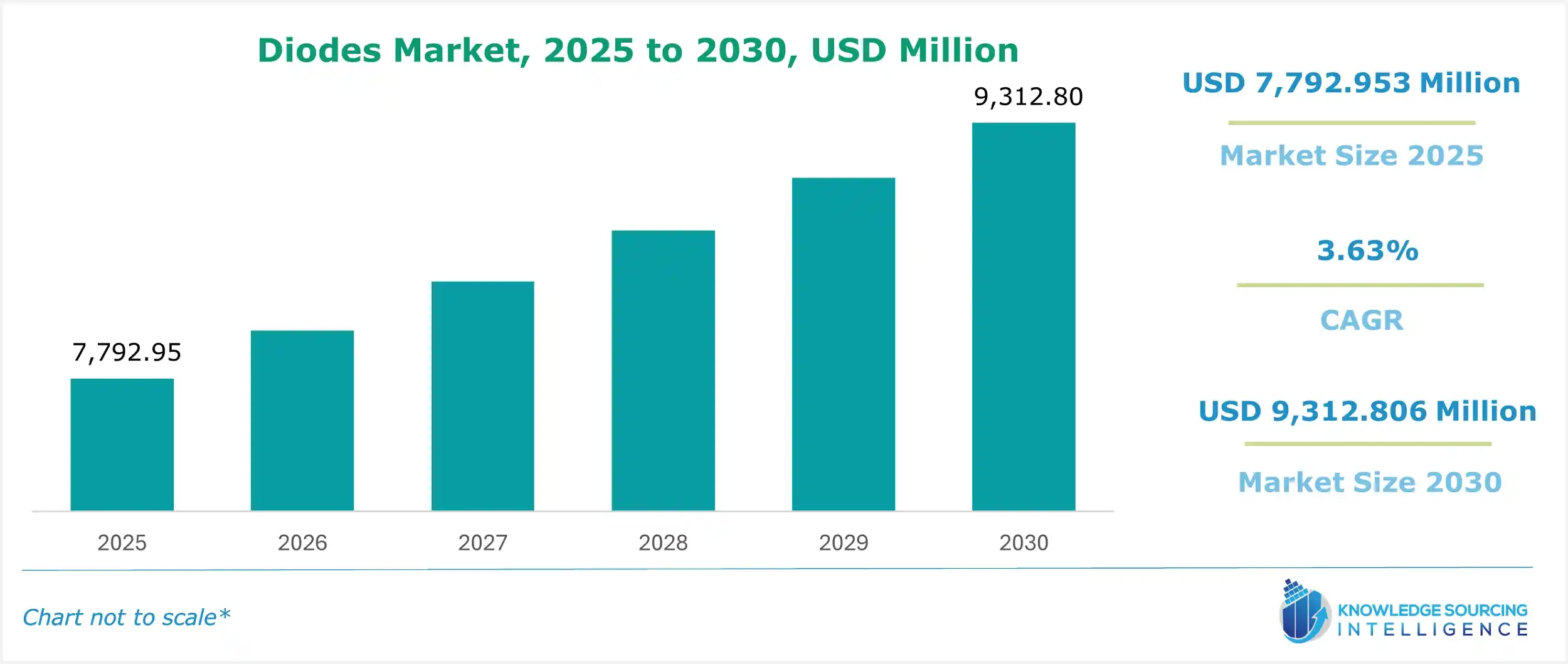

The global diodes market, valued at US$9,312.806 million in 2030 from US$7,792.953 million in 2025, is projected to grow at a CAGR of 3.63% through 2030.

An electrical diode is the semiconductor material component of two terminals, which, in theory, permits easy current flow in one direction but blocks it in the other way. One conceptual model for a diode might be that of an electric switch that controls the direction of electron flow through the circuit. Many cell phones now have multiple functions, such as FM radios, MP3 and MP4 players, portable TVs, note recorders, cameras, and projectors. Thus, the number of signals has increased, increasing the demand for signal routing solutions.

Global Diodes Market Overview & Scope:

The global diodes market is segmented by:

- Type: The global diodes market is segmented by type into Schottky, zener, rectifier, ESD, and others. The Schottky diode has high-efficiency rectification and switching capabilities. It is thus in high demand in power electronics, battery management, and charging systems. As such, during the forecast period, the growth of the segmental automotive diode market will be driven by the use of the Schottky diode in high-speed applications.

- Industry Vertical: The industry vertical is segmented into consumer electronics, communication, automotive, and manufacturing. The automotive industry has embraced diodes due to their high accuracy, energy efficiency, and adaptability. The rise in electric vehicle production likely fuels the global diode market. Additionally, middle-class consumers' growing disposable income and their necessity to spend a lot of money on self-driving cars have shaped the market's development.

- Region: North American region is witnessing substantial growth due to rising demand for consumer electronics.

Top Trends Shaping the Global Diodes Market:

1. Rising Smartphone Adoption

- The increasing number of signals has increased the demand for signal-routing solutions. These concepts, which require diodes with smaller sizes and better functionality, may allow mobile phone designers to demand smaller form factors while incorporating better functions in their designs. This technological necessity is driving up demand for diodes.

2. Increasing Demand for Miniature Diodes

- The market is expanding largely due to the growing need for smaller diodes. Smaller and more compact diodes that can be incorporated into various gadgets and applications are becoming increasingly necessary as technology develops. As diodes are becoming smaller, they can be used in wearable technology, portable electronics, and smaller electronic devices without sacrificing effectiveness or performance.

Global Diodes Market Growth Drivers vs. Challenges:

Opportunities:

- LED Technology Adoption: The growth of LED technology remains one of the largest factors fuelling the diode market expansion. Because of their longevity and efficient energy use, light-emitting diodes have become the lighting and display solutions of choice. The switchover from conventional incandescent and fluorescent lighting to LEDs in homes and businesses has significantly supported the diode market. Its demand has further increased because of diodes' critical role in the functioning of LED screens, which are now common in computers, smartphones, and televisions.

- Greater utilization in different industries: Manufacturers in the automotive, electrical, and communication industries use integrated circuits (ICs) with discrete diodes instead of digital circuits. Since smaller components have fewer parasitic resistors, capacitances, and inductances, condensed discrete components with sizes in micrometers and millimeters lead to improvements in speed and power consumption.

Challenges:

- High Costs: The market for laser diodes as a whole is significantly constrained by the fact that they require a higher initial investment than other light-emitting diodes. Various systems, procedures, and applications require laser power ranging from a few hundred to thousands of watts. Installing laser products is rather costly, even though using them would lower labour costs in the automotive and industrial sectors.

Global Diodes Market Regional Analysis:

- Asia Pacific: The region is witnessing growth in smartphone usage and industrial processes' digitization. With an increasing need for diodes in all electrical products coupled with the recent spurt in demand for smartphones and related electronic devices, the Asia-Pacific region stands to witness growth in the diodes market. High demand for consumer electronics has also prompted many manufacturers to set up production plants in this region.

Global Diodes Market Competitive Landscape:

The market is fragmented, with many notable players, including Semiconductor Components Industries, LLC, Vishay Intertechnology, Inc., Infineon Technologies AG, and STMicroelectronics, among others:

- Launch: ROHM created surface mount SiC Schottky barrier diodes (SBDs) in November 2024. By extending the creepage distance between terminals, SBDs increase insulation resistance.

- Expansion: In November 2024, Shindengen Electric Manufacturing increased the number of products in its SLSBD series. This product helps to reduce loss and miniaturize automotive ECUs by suppressing thermal runaway and reducing leakage current by about 99%?1 compared to the conventional products.

Global Diodes Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Diodes Market Size in 2025 | US$7,792.953 million |

| Diodes Market Size in 2030 | US$9,312.806 million |

| Growth Rate | CAGR of 3.63% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Diodes Market | |

| Customization Scope | Free report customization with purchase |

The Global Diodes Market is analyzed into the following segments:

By Type

- Schottky

- Zener

- Rectifier

- ESD

- Others

By Industry Vertical

- Consumer Electronics

- Communication

- Automotive

- Manufacturing

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa