Report Overview

Crop Protection Chemicals Market Highlights

Crop Protection Chemicals Market Size:

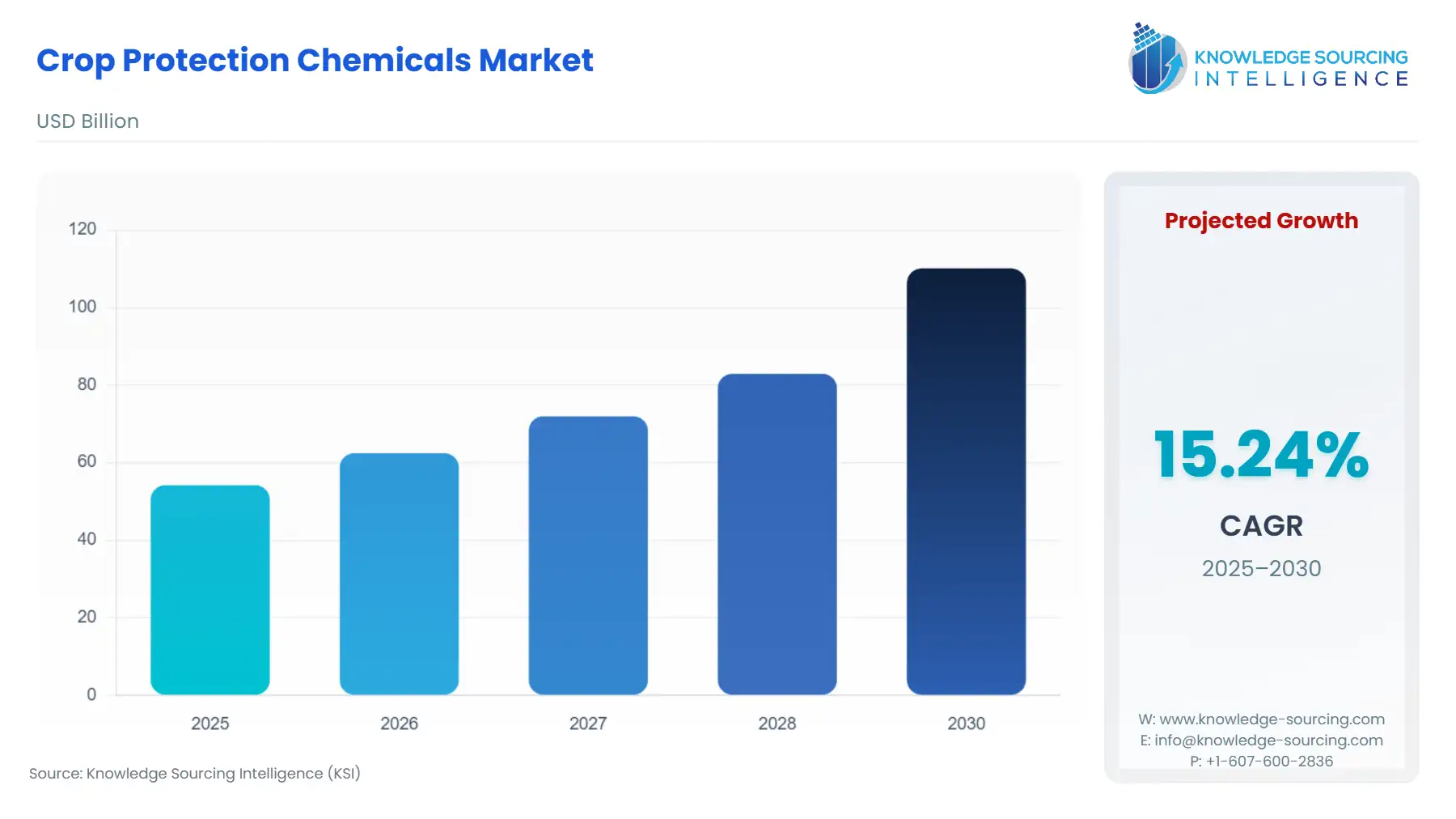

The crop protection chemicals market will grow from US$54.192 billion in 2025 to US$110.124 billion in 2030 at a CAGR of 15.24%.

Various chemicals prevent pests in crops worldwide and form an essential part of agriculture; these pesticides eliminate fungi, weeds, or insects that would otherwise threaten crop productivity or health. Furthermore, herbicides are used to eliminate unwanted plants, while insecticides are used to manage pest insects that can destroy crops. Fungicides mitigate fungal infections, which is crucial in preventing crop diseases that spread widely. In addition, nematicides handle nematode infestations, molluscicides combat slugs and snails, and rodenticides manage the rodent population.

Furthermore, pathogens that are viral or bacterial are the focus of virucides and bactericides, respectively. Agricultural productivity is maintained when crop protection chemicals are applied correctly, and the recommended guidelines are followed. It is commonly used to reduce any possible harm to non-target animals, the environment, and human health. Implementing integrated pest management strategies that combine various pest control techniques is essential to promoting moral and environmentally friendly farming practices.

Crop Protection Chemicals Market Growth Drivers:

- Increasing global population

There is an increasing need for food to feed the expanding population. Chemicals used to protect crops from weeds, pests, and diseases are essential to maintaining increased agricultural productivity. By preventing or minimizing yield losses, these chemicals assist farmers in producing enough food to meet the growing demands of a larger population.

- Expanding agricultural practices

The need for crop protection chemicals is rising due to the spread of agricultural practices like intensive cropping systems and commercial farming. The trend toward larger-scale farming operations has increased the need to control weeds, pests, and diseases that can result in large yield losses. In these intensive agricultural systems, crop protection chemicals offer farmers practical ways to protect their crops and maximize yield. Farmers can maximize their yields and financial returns by using these chemicals to suppress weed growth, fight diseases, and control pests.

- Rising need for higher crop yields

By shielding crops from numerous dangers that could lower yields, crop protection chemicals are essential to increasing crop productivity. These chemicals offer efficient ways to manage and control the persistent problems that farmers encounter, such as weeds, diseases, and pests. Farmers can protect their crops, reduce yield losses, and boost overall productivity by strategically applying these chemicals and adhering to recommended practices. In addition to providing ample food for the expanding population, higher crop yields benefit farmers economically and contribute to global food security. The least possible risk to the health of people and animals is supporting market expansion.

- Rising use of herbicides

Due to their competition with crops for vital resources like sunlight, water, and nutrients, weeds are a common and enduring issue in agriculture. Farmers need to use herbicides because they provide an efficient way to control weeds. Herbicides help farmers maintain crop quality and productivity by specifically targeting, suppressing, or eliminating weeds. Furthermore, herbicides make controlling weeds easy and effective. Herbicides are a faster and more economical solution to weed removal than mechanical or manual techniques. Large-scale application of these herbicides enables effective weed control in expansive farming operations.

Many farmers, especially in commercial agriculture, prefer herbicides because of their time-saving properties and ease of application. Aside from this, the increased demand for herbicides has been attributed to developing herbicide-resistant crops, such as genetically modified herbicide-tolerant varieties. Certain herbicides can be applied to these crops without damaging them because they are engineered to withstand them. Herbicide usage has significantly increased due to the adoption of herbicide-resistant crops, which has further fueled the growth of the herbicides segment.

- High demand for cereals and grains

Throughout the world, cereals and grains are staple foods consumed and are the basis of many diets. These crops are in constant demand due to several factors, including population growth, shifting dietary preferences, and rising urbanization. Consequently, farmers attach great importance to the production and safeguarding of cereals and grains, which raises the need for crop protection agents. Cereals and grains can also be severely impacted by various pests, illnesses, and weeds that can negatively affect their quality and yield. These crops are constantly threatened by weed competition, fungi, and insects, so appropriate crop protection strategies are required.

Moreover, chemicals used for crop protection, such as herbicides, fungicides, and insecticides, are essential for handling these problems and preserving the yield of grains and cereals. Cereals and grains are also amenable to intensive and mechanized farming methods since they are frequently grown over wide areas. These methods call for effective and efficient weed and pest management crop protection chemicals to provide workable answers to pest management and high-yield assurance.

Crop Protection Chemicals Market Geographical Outlook:

- North America is witnessing exponential growth during the forecast period

The large agricultural industry in North America is characterized by extensive farms and a wide range of crops grown throughout the continent. The United States is among the leading countries in agricultural production worldwide and is known for many important crops grown on its soil. In addition to increasing crop yields and productivity, these practices call for implementing efficient crop protection techniques.

The region's strong focus on increasing agricultural productivity fuels the need for crop protection chemicals even more. A strong regulatory framework that controls the use and registration of crop protection chemicals is also present in North America. Farmers and consumers can feel confident knowing that these products are safe and effective thanks to the strict regulations. Various crop protection chemicals are available and can be used in the North American market thanks to adherence to these regulations.

Crop Protection Chemicals Market Key Launches:

- In November 2023, Godrej Agrovet Limited (GAVL), one of India's largest and most diversified agribusiness companies, announced that the innovative pest management product Rashinban would be available nationwide. In collaboration with GAVL, Rashinban, a patented chemical developed by Nissan Chemical Corporation in Japan, is being introduced in India to protect chilli crops during blooming.

- In September 2023, ADAMA Ltd., a renowned global crop protection company, announced the launch of Cosayr® and Lapidos® in India, their first insecticides containing the active ingredient chlorantraniliprole (CTPR). This announcement was made possible by the company's new in-house manufacturing.

Crop Protection Chemicals Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Crop Protection Chemicals Market Size in 2025 | US$54.192 billion |

| Crop Protection Chemicals Market Size in 2030 | US$110.124 billion |

| Growth Rate | CAGR of 15.24% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Crop Protection Chemicals Market |

|

| Customization Scope | Free report customization with purchase |

Crop Protection Chemicals Market Segmentation:

- By Origin

- Synthetic

- Biopesticides

- By Type

- Herbicides

- Insecticides

- Fungicides

- Others

- By Application

- Fruit and Vegetables

- Oilseeds and Pulses

- Cereals and Grains

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others