Report Overview

Global Corn Tortilla Market Highlights

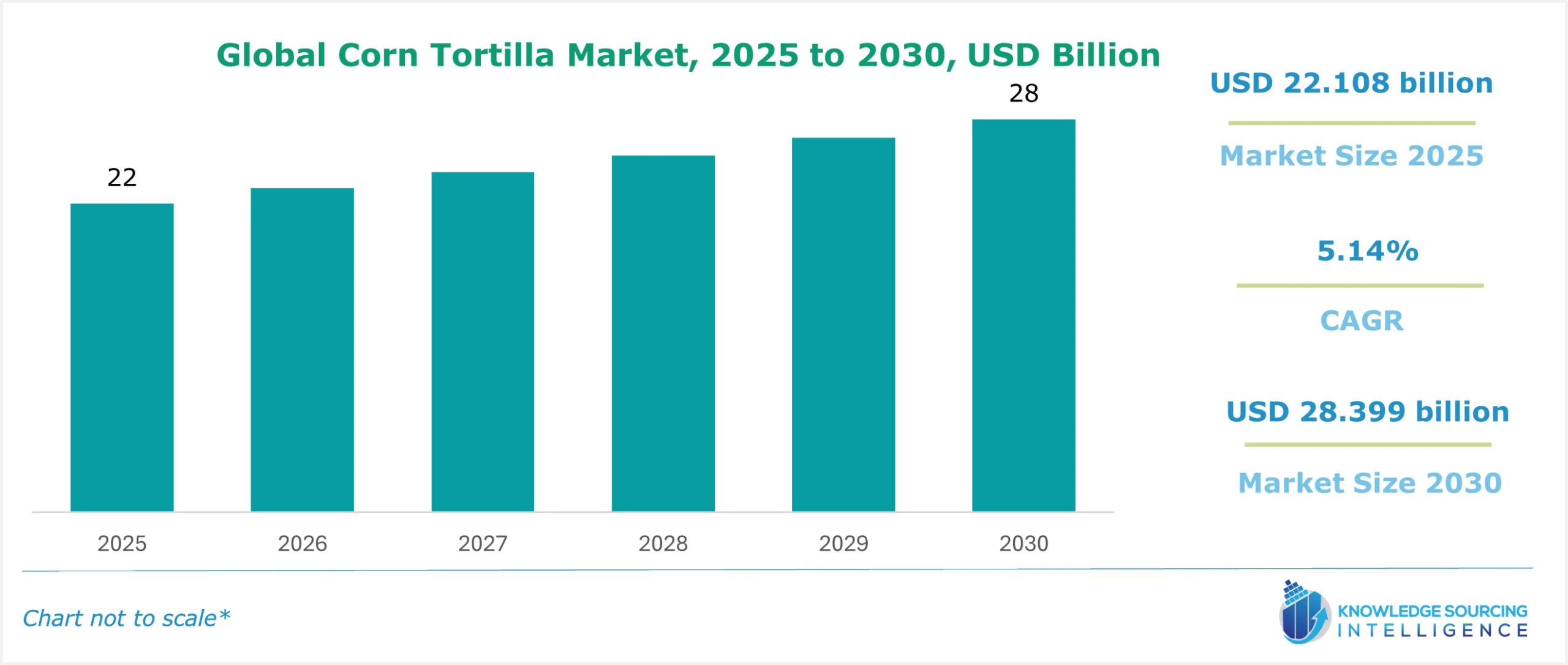

The Corn Tortilla Market is expected to grow at a CAGR of 5.14%, reaching a market size of US$28.399 billion in 2030 from US$22.108 billion in 2025.

Tortilla is a thin, circular flatbread generally made from wheat and corn and popularly eaten in America and Mexico. Traditionally, it is made up of wheat or corn with dried kernel. Presently, corn tortillas are made from corn cooked in a lime-based solution or by using a dough, forming a pancake, and baking it in the oven. Tortilla has widespread popularity in Mexicana and southwestern cuisine; thus, it has a huge market in America, Mexico, France, Spain, and Germany.

Based on an average serving size, a flour tortilla is a low-fat food containing iron and other vitamins, with 115 calories. A corn tortilla is also a low-fat, low-sodium food that contains calcium, potassium, and fiber and has 60 calories. Hence, the growing health awareness among consumers is increasing its market growth. For instance, Tortilla, while native to Mexico, its popularity has grown to the extent that U.S. consumers prefer tortillas above all their ethnic breads, such as bagels, English muffins, and pita bread, as per the Tortilla Industry Association.

The global tortilla market consists of producing and supplying wheat and corn tortillas. Along with its production and supply, this market also consists of processing tortillas into tortilla chips, tostadas, taco shells, and other processed forms like frozen tortillas.

What are the global corn tortilla market drivers?

- The global popularity of Mexican cuisine is boosting the demand for corn tortillas

Tortilla has been a fundamental part of Mexican and Latin American cuisine. The popularity of Mexican cuisine is rising worldwide. For example, dishes made of tortillas have become popular in Germany in the last few decades. According to the Tortilla Industry Association, the United States of America consumed around 85 billion tortillas in 2000. Processed tortillas in the form of tortilla chips are widely consumed in the USA.

Hence, the increasing popularity of Mexican foods worldwide has also raised the demand for tortilla wraps in restaurants or tortilla chips, tacos, etc., leading to a surge in growth for the global tortilla market.

- Growing health awareness among consumers is raising the demand for corn tortillas

Consumers are seeking healthier alternatives as health consciousness is taking the food industry by storm. They are looking for food items that have healthier and higher nutritional profiles, particularly for the younger generations.

Tortillas are a good option, as it has a much healthier nutritional profile. As per the U.S. Department of Agriculture, 100 g of corn tortilla has sodium of 45 mg, potassium of 186 mg, 6g of protein, Calcium, Vitamin C, Iron, Vitamin B6, magnesium, and 218 g of calories. At the same time, it does not contain gluten, making corn tortillas a great alternative to bread.

Hence, the growing demand for healthier alternatives to food is increasing the demand for tortillas, acting as a key market driver for the global tortilla market.

Segment analysis of the global corn tortilla market:

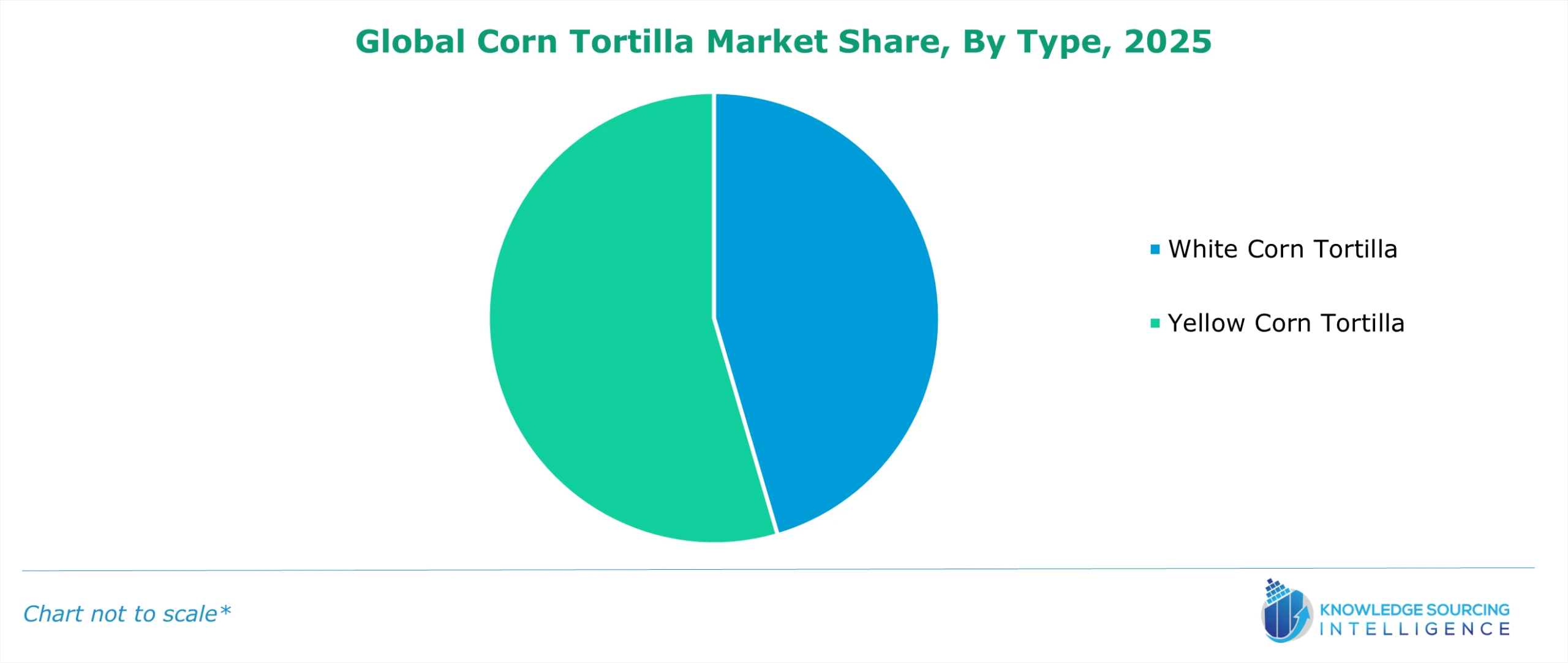

- White Corn tortillas would hold the largest share of the global corn tortilla market during the forecasted period

Corn tortillas are low-fat, low-sodium food containing calcium, potassium, and fiber with 1 g of fat based on average serving. Wheat tortilla is also a low-fat food containing iron and other vitamins. Still, corn tortillas do not contain gluten, thus making it a better alternative to bread for those who are gluten intolerant. In the corn tortilla, white corn tortilla would have the largest market share in the forecasted period.

According to a report published by Kemin Tortillas, white corn, both masa and cooked together, has a market share of $10,418 million in 2024 compared to the yellow corn tortilla, which only has $3,778 million.

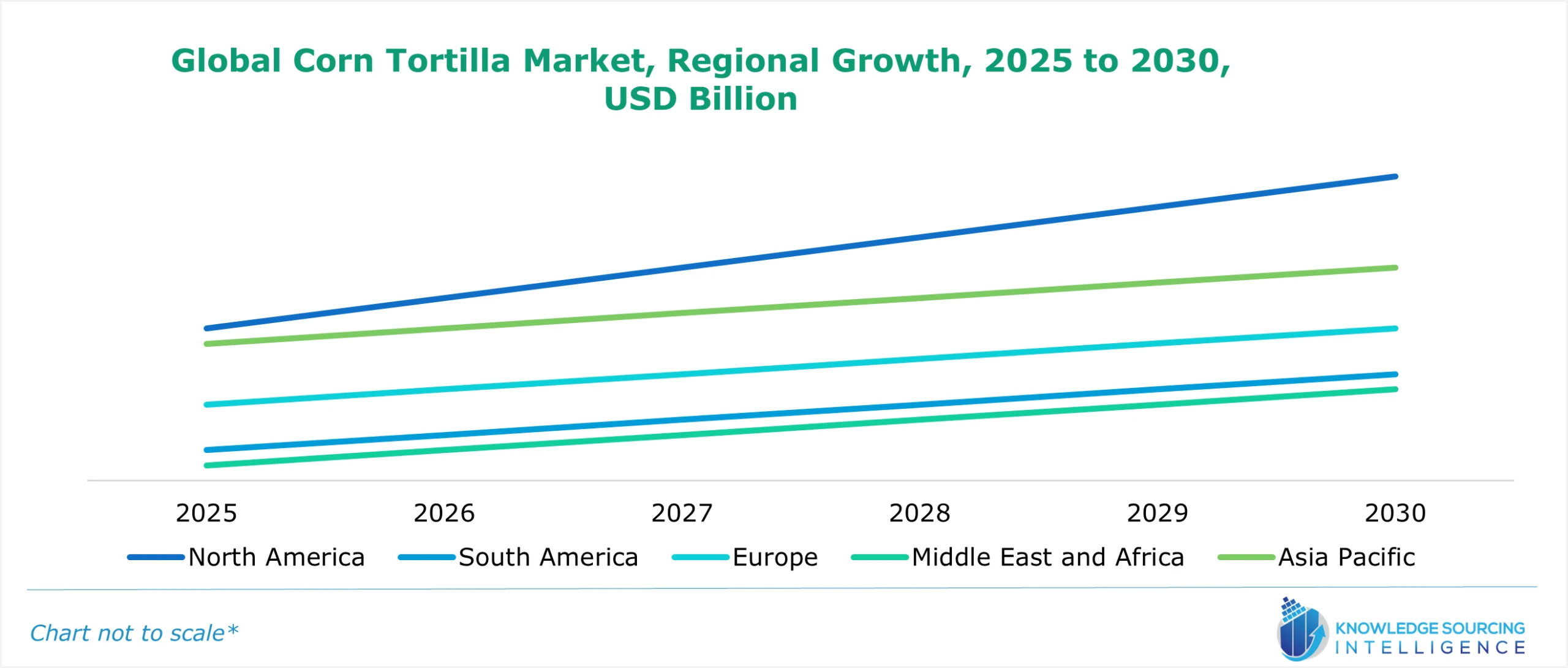

- North America would be the fastest-growing market for corn tortillas during the forecasted period

Region-wise, the global market is segmented into Asia-Pacific, North America, South America, Europe, Middle East and Africa. North America is the largest market shareholder of tortillas; it would be the fastest-growing market for tortillas, too.

This growth in North America in the global tortilla market is a huge consumer base for tortillas in the United States of America and Mexico. According to a report by the Tortilla Industry Association, tortillas are preferred in the USA more than their native breads. Americans consume more than 85 billion tortillas. 70% of global tortilla sales took place on the American continent, as per Kemin tortilla. Tortillas are now served as substitutes for traditional bread and are used in many recipes, such as hot dogs, lasagna, pitas, sandwiches, etc., in the American mainstream diet.

Major challenges hindering the global corn tortilla market:

- Other alternatives of bread are giving significant competition to the corn tortilla market

Though there is a growing demand for corn tortillas, it is experiencing significant competition from other breads like pita from the Middle East and roti from South Asia. Consumers have cultural preferences for their bread, and the nutritional contents of alternative bread are also good, especially suited to their environment. At the same time, the price of tortillas is rising. Thus, consumers have a preference for other bread. This would pose a challenge in the market growth for corn tortillas in the coming years.

Key developments in the global corn tortilla market:

- In October 2024, La Tortilla Factory, a brand of Insignia International, launched a new product line for tortillas: Tradicion tortillas. It would include fajitas, soft yellow corn tortillas, soft white corn tortillas, burrito flour tortillas, etc.

- In June 2024, Alpine Tortilla Company launched El Nacho tortilla chips. It would offer a new option for those who enjoy tortilla chips. The same technique would produce it as their Aztec ancestors.

- In June 2024, Tortilla Mexican Grill plc acquired Fresh Burritos Mexican restaurant for consideration of euro 3.95 million. While Tortilla Mexican Grill is the first largest fast-casual Mexican restaurant in Europe, Dresh Burritos is the second.

Corn Tortilla Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Corn Tortilla Market Size in 2025 | US$22.108 billion |

| Corn Tortilla Market Size in 2030 | US$28.399 billion |

| Growth Rate | CAGR of 5.14% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Corn Tortilla Market | |

| Customization Scope | Free report customization with purchase |

The global corn tortilla market is analyzed into the following segments:

- By Type

- White Corn Tortilla

- Yellow Corn Tortilla

- By End User

- Retailer

- Restaurants

- Processing Industry

- Others

- By Distribution Channel

- Online

- Offline

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

- North America